Free Quitclaim Deed Template for Florida State

The Florida Quitclaim Deed form serves as a crucial instrument in the realm of real estate transactions, allowing property owners to transfer their interest in a property to another party without guaranteeing the title's validity. This form is particularly useful in situations where the transferor is unsure of the property's title status or when the transfer occurs between family members or in divorce settlements. Unlike other deed types, such as warranty deeds, the quitclaim deed does not provide any warranties or covenants regarding the title, making it a straightforward yet limited option for transferring ownership. It is essential for both parties involved to understand that the quitclaim deed merely conveys whatever interest the grantor possesses, which may be none at all. Additionally, the form must be executed with proper signatures and notarization to ensure its legal effectiveness, and it should be recorded in the appropriate county office to provide public notice of the change in ownership. Understanding these key aspects is vital for anyone considering using a quitclaim deed in Florida, as it can significantly impact property rights and future transactions.

Common mistakes

-

Incorrect Names: One common mistake is failing to accurately write the names of the parties involved. All names should match the names on the official identification documents.

-

Missing Signatures: Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must sign the form. Omitting one of these signatures can invalidate the deed.

-

Not Notarizing: In Florida, a quitclaim deed must be notarized. Skipping this step can lead to issues with the deed’s acceptance in legal proceedings.

-

Improper Description of Property: The property description must be accurate and detailed. Failing to provide a correct legal description can create confusion and complications in the future.

-

Incorrect Execution Date: The date on which the deed is signed should be clearly noted. An incorrect or missing date may lead to disputes over the timing of the transfer.

-

Failure to Record the Deed: After completing the quitclaim deed, it must be recorded with the county clerk’s office. Neglecting this step can result in the deed not being recognized in public records.

-

Inadequate Consideration: While a quitclaim deed does not require a specific amount of money to be valid, stating "for love and affection" without proper context may lead to questions about the legitimacy of the transfer.

-

Ignoring Local Requirements: Different counties may have specific requirements for quitclaim deeds. Not checking local regulations can lead to rejection of the document.

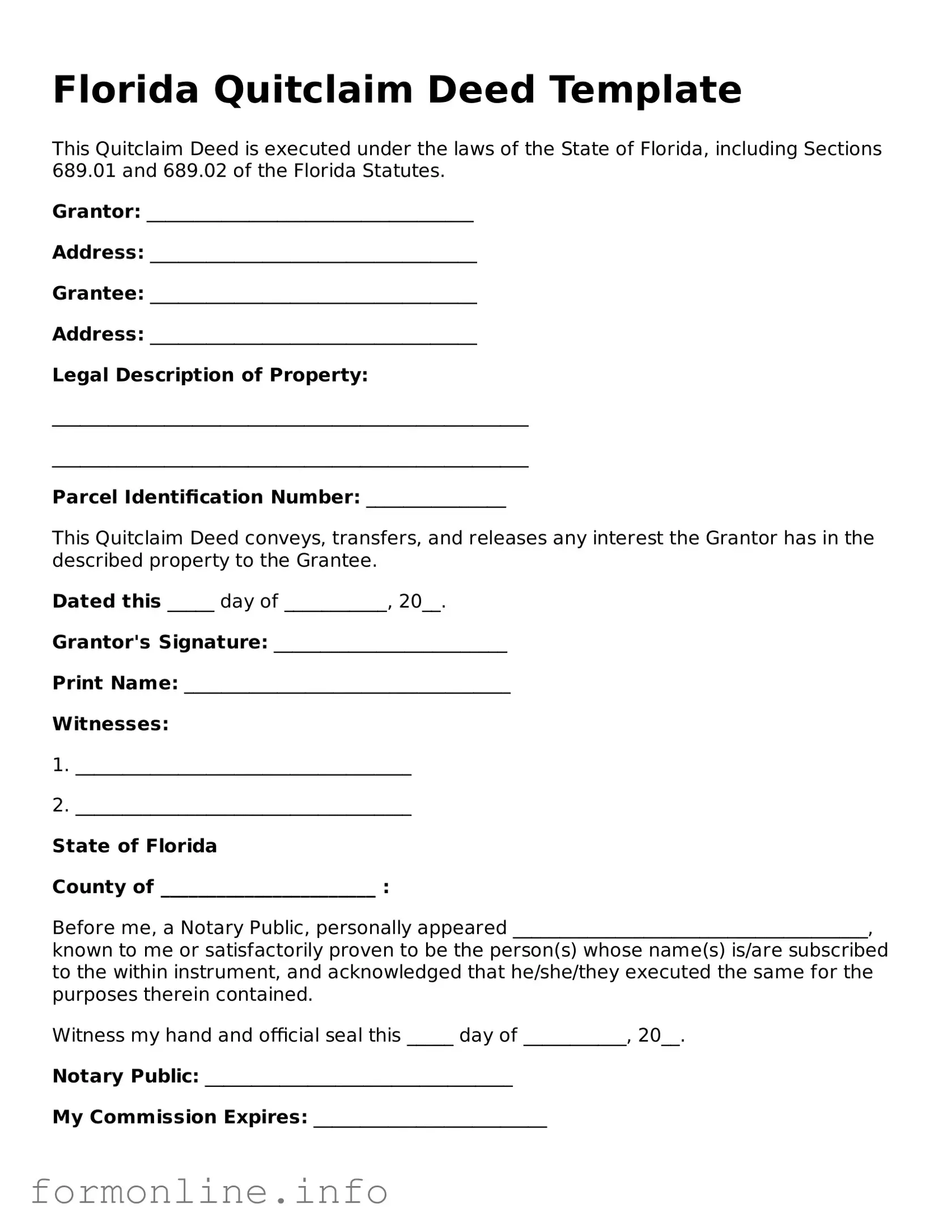

Preview - Florida Quitclaim Deed Form

Florida Quitclaim Deed Template

This Quitclaim Deed is executed under the laws of the State of Florida, including Sections 689.01 and 689.02 of the Florida Statutes.

Grantor: ___________________________________

Address: ___________________________________

Grantee: ___________________________________

Address: ___________________________________

Legal Description of Property:

___________________________________________________

___________________________________________________

Parcel Identification Number: _______________

This Quitclaim Deed conveys, transfers, and releases any interest the Grantor has in the described property to the Grantee.

Dated this _____ day of ___________, 20__.

Grantor's Signature: _________________________

Print Name: ___________________________________

Witnesses:

1. ____________________________________

2. ____________________________________

State of Florida

County of _______________________ :

Before me, a Notary Public, personally appeared ______________________________________, known to me or satisfactorily proven to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

Witness my hand and official seal this _____ day of ___________, 20__.

Notary Public: _________________________________

My Commission Expires: _________________________

Popular Quitclaim Deed State Templates

How Much Is a Quitclaim Deed - The document can facilitate the division of inherited property.

To streamline the process of purchasing a motorcycle, it is crucial to utilize the appropriate documentation, such as the Bill of Sale for Motorcycles, which ensures that the transaction is officially recorded and both buyer and seller have a clear understanding of the terms of sale.

Documents used along the form

When transferring property in Florida, the Quitclaim Deed is a common choice. However, it is often accompanied by several other important forms and documents that help clarify the transaction and ensure everything is legally sound. Below are some of the essential documents you might encounter alongside the Quitclaim Deed.

- Property Appraisal: This document provides an estimate of the property's value, which can be crucial for determining fair market price and for tax purposes.

- Mobile Home Bill of Sale: This form is essential for the transfer of ownership of a mobile home, providing proof of the transaction while detailing key information such as the buyer, seller, and specifics of the mobile home. For more information, refer to the Mobile Home Bill of Sale.

- Title Search Report: A title search reveals the legal ownership of the property and any liens or encumbrances that may affect the sale. This ensures the buyer receives clear title.

- Affidavit of Title: This sworn statement confirms the seller's ownership and asserts that there are no undisclosed claims against the property, providing peace of mind to the buyer.

- Closing Statement: This document summarizes the financial aspects of the transaction, including the purchase price, closing costs, and any adjustments, ensuring transparency for both parties.

- Transfer Tax Form: In Florida, a transfer tax may apply when property changes hands. This form helps report the transaction to the state and calculate any taxes owed.

- Warranty Deed (if applicable): Unlike a Quitclaim Deed, a Warranty Deed provides a guarantee from the seller regarding the title. It may be used in conjunction with a Quitclaim Deed in certain situations for added security.

Having these documents prepared and reviewed can streamline the property transfer process and help avoid potential disputes down the line. Always consider consulting a legal professional to ensure all necessary paperwork is completed accurately and in accordance with Florida law.

Similar forms

The Warranty Deed is a document that, like the Quitclaim Deed, transfers ownership of property. However, it provides a guarantee that the seller holds clear title to the property and has the right to sell it. This means that if any issues arise regarding ownership, the seller is responsible for resolving them. In contrast, a Quitclaim Deed offers no such guarantees, making it a riskier option for buyers.

The Bargain and Sale Deed is another similar document. It conveys ownership of property but does not include warranties against encumbrances. While it suggests that the seller has an interest in the property, it does not guarantee that the title is clear. This is similar to a Quitclaim Deed, where the seller essentially "quits" any claim to the property without providing assurances about its title.

The Special Warranty Deed is distinct yet shares similarities with the Quitclaim Deed. This document transfers property ownership but only guarantees that the seller has not caused any title issues during their ownership. Unlike the Quitclaim Deed, which offers no guarantees, the Special Warranty Deed provides some level of protection for the buyer, but only for the time the seller owned the property.

The General Warranty Deed offers the most protection among deed types. It guarantees that the seller holds clear title to the property and is responsible for any claims against it, regardless of when they arose. While it is more secure than a Quitclaim Deed, both documents serve the purpose of transferring ownership, but the General Warranty Deed provides peace of mind for the buyer.

For those looking to document the sale of a trailer, a widely used option is the official Florida Trailer Bill of Sale document. This form ensures that both parties are protected by providing a record of the transaction details.

A Deed of Trust is similar in that it is a legal document used in real estate transactions. However, it serves a different purpose. It secures a loan by transferring the property to a trustee until the borrower pays off the debt. While it does not transfer ownership in the same way a Quitclaim Deed does, both documents are essential in real estate dealings and involve the transfer of property interests.

The Transfer on Death Deed allows property owners to pass their property to beneficiaries upon their death without going through probate. While it operates differently from a Quitclaim Deed, both documents facilitate the transfer of property. The key difference is that the Quitclaim Deed is used during the owner's lifetime, whereas the Transfer on Death Deed is effective only after death.

A Lease Agreement can also be compared to a Quitclaim Deed in that both involve property rights. A Lease Agreement grants a tenant the right to use a property for a specified time, while a Quitclaim Deed transfers ownership. Though they serve different purposes, both documents are vital in defining and transferring property rights.

Finally, the Affidavit of Heirship is a document that helps establish the rightful heirs to a property when the owner passes away without a will. It is similar to a Quitclaim Deed in that it deals with the transfer of property ownership, but it does so in a context where the original owner is deceased. Both documents play crucial roles in clarifying property ownership, but they operate under different circumstances.

Dos and Don'ts

When filling out the Florida Quitclaim Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do include the full names of both the grantor and grantee.

- Do provide a complete legal description of the property.

- Do sign the document in front of a notary public.

- Do check for any outstanding liens or mortgages on the property.

- Don’t leave any sections blank; fill in all required information.

- Don’t forget to record the deed with the county clerk after signing.

By adhering to these guidelines, you can help ensure that the Quitclaim Deed is valid and properly executed.

Key takeaways

When dealing with a Florida Quitclaim Deed form, it is important to understand the key aspects involved in its completion and use. Here are some essential takeaways:

- Understanding the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property from one party to another without guaranteeing that the title is clear. This means that the grantor is not making any promises about the property’s title.

- Identifying Parties: Clearly identify both the grantor (the person transferring the property) and the grantee (the person receiving the property). Accurate names and addresses are crucial for legal validity.

- Property Description: Provide a detailed description of the property being transferred. This should include the legal description, which can often be found in previous deeds or property tax documents.

- Signatures and Notarization: The deed must be signed by the grantor in the presence of a notary public. This step is vital, as a notarized signature helps to validate the document.

- Recording the Deed: After completing the Quitclaim Deed, it should be filed with the county clerk’s office where the property is located. Recording the deed provides public notice of the transfer and protects the grantee’s rights.

- Tax Implications: Be aware of any potential tax consequences that may arise from the transfer of property. Consulting with a tax professional can help clarify any obligations that may be incurred.

By keeping these points in mind, individuals can navigate the process of using a Quitclaim Deed more effectively.

How to Use Florida Quitclaim Deed

Once you have the Florida Quitclaim Deed form ready, it's important to complete it accurately to ensure the transfer of property is processed smoothly. Follow these steps to fill out the form correctly.

- Obtain the form: Get the Florida Quitclaim Deed form from a reliable source, such as a legal website or local county clerk's office.

- Fill in the grantor's information: Enter the full name and address of the person transferring the property. Ensure this information is accurate.

- Provide grantee details: Write the full name and address of the person receiving the property. Double-check for any spelling errors.

- Describe the property: Include a legal description of the property being transferred. This can often be found in previous deeds or property tax records.

- Include the consideration: State the amount of money or value exchanged for the property, if applicable. If no money is exchanged, indicate that it is a gift.

- Sign the document: The grantor must sign the deed in the presence of a notary public. Ensure the signature is clear and matches the name provided.

- Notarization: Have the notary public complete their section, verifying the identity of the grantor and witnessing the signature.

- File the deed: Submit the completed Quitclaim Deed to the appropriate county clerk's office for recording. There may be a filing fee.

After filling out the form and submitting it, keep a copy for your records. The county clerk will process the deed and return a recorded copy, which serves as proof of the property transfer.