Free Transfer-on-Death Deed Template for Florida State

In the state of Florida, the Transfer-on-Death Deed (TOD) serves as a valuable estate planning tool that allows property owners to designate beneficiaries who will receive their real estate assets upon their death, bypassing the often lengthy and costly probate process. This form enables individuals to maintain full control over their property during their lifetime, as the transfer of ownership does not occur until the property owner passes away. By completing a TOD Deed, one can specify who will inherit the property, whether it be family members, friends, or other entities, thereby ensuring that their wishes are honored without the complications that can arise from traditional wills. Importantly, the form must be properly executed and recorded with the county clerk to be legally binding, and it can be revoked or modified at any time before the owner’s death. Understanding the nuances of the Transfer-on-Death Deed is essential for anyone looking to simplify their estate planning process while providing peace of mind to their loved ones.

Common mistakes

-

Not including the legal description of the property: Many people forget to provide a complete legal description of the property they wish to transfer. This description is crucial as it identifies the specific parcel of land and ensures that there is no confusion about what is being transferred.

-

Failing to sign the deed properly: A common mistake is not signing the deed in the presence of a notary. Florida law requires that the Transfer-on-Death Deed be signed by the property owner and notarized to be valid.

-

Not naming the beneficiaries correctly: People sometimes make errors in spelling or naming the beneficiaries. This can lead to complications when the time comes to transfer the property, so it’s essential to ensure that names are accurate and match official documents.

-

Overlooking the need for witnesses: In Florida, the deed must also be witnessed by two individuals who are not beneficiaries. Failing to include these witnesses can invalidate the deed.

-

Not recording the deed: After completing the form, it’s important to record the deed with the county clerk’s office. If the deed is not recorded, it may not be recognized, and the intended transfer may not take place.

-

Ignoring existing liens or mortgages: If there are outstanding debts tied to the property, such as mortgages or liens, these must be addressed. Not acknowledging these can create issues for beneficiaries when they inherit the property.

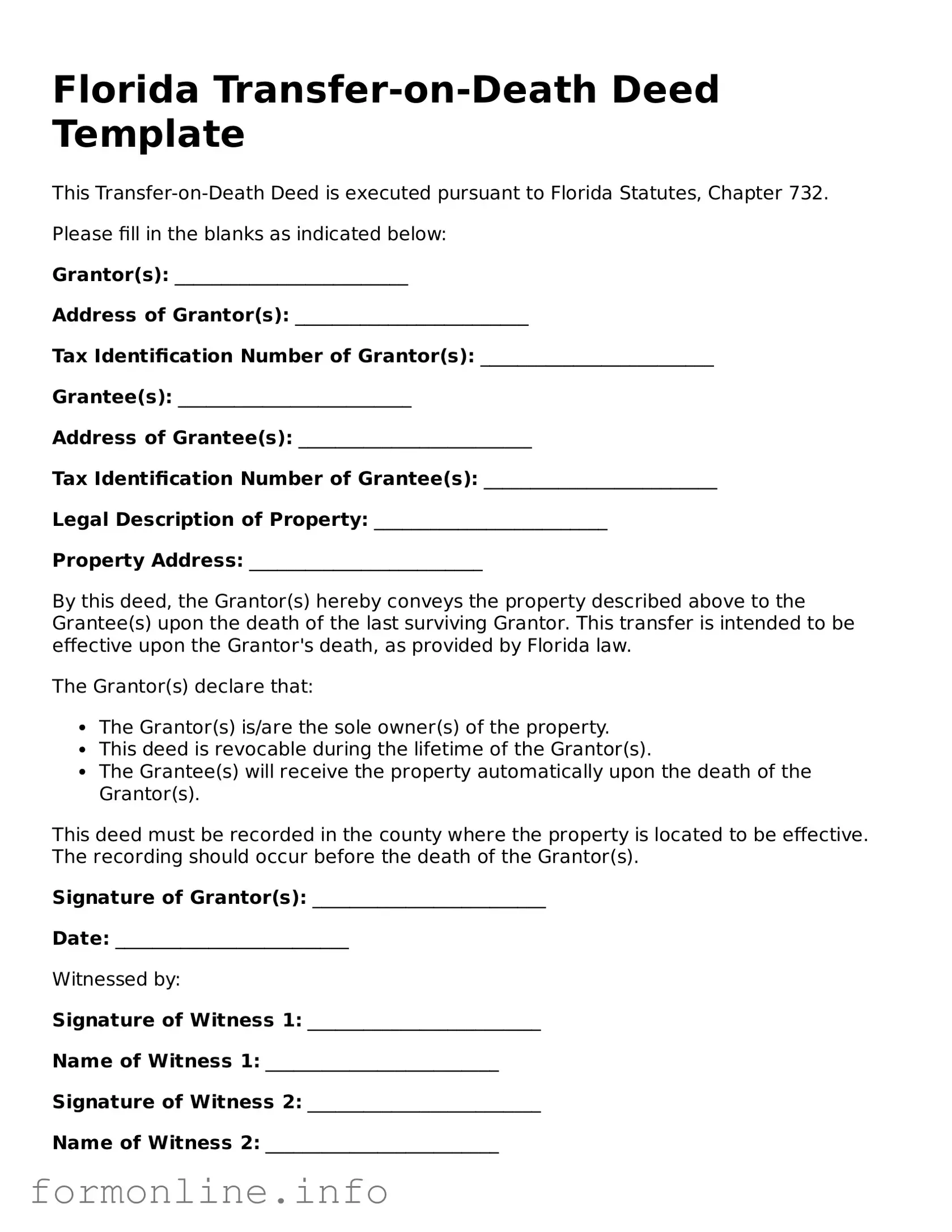

Preview - Florida Transfer-on-Death Deed Form

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to Florida Statutes, Chapter 732.

Please fill in the blanks as indicated below:

Grantor(s): _________________________

Address of Grantor(s): _________________________

Tax Identification Number of Grantor(s): _________________________

Grantee(s): _________________________

Address of Grantee(s): _________________________

Tax Identification Number of Grantee(s): _________________________

Legal Description of Property: _________________________

Property Address: _________________________

By this deed, the Grantor(s) hereby conveys the property described above to the Grantee(s) upon the death of the last surviving Grantor. This transfer is intended to be effective upon the Grantor's death, as provided by Florida law.

The Grantor(s) declare that:

- The Grantor(s) is/are the sole owner(s) of the property.

- This deed is revocable during the lifetime of the Grantor(s).

- The Grantee(s) will receive the property automatically upon the death of the Grantor(s).

This deed must be recorded in the county where the property is located to be effective. The recording should occur before the death of the Grantor(s).

Signature of Grantor(s): _________________________

Date: _________________________

Witnessed by:

Signature of Witness 1: _________________________

Name of Witness 1: _________________________

Signature of Witness 2: _________________________

Name of Witness 2: _________________________

This Transfer-on-Death Deed requires no consideration and is effective upon the Grantor(s)' passing, contingent on the terms outlined herein.

Note: It is advisable to consult with a legal professional regarding the execution and implications of this deed.

Popular Transfer-on-Death Deed State Templates

How to File a Transfer on Death Deed - Filing a Transfer-on-Death Deed is typically straightforward, requiring basic information about the property and beneficiaries.

To ensure that you have all the necessary information when completing the Georgia Divorce form, it may be helpful to visit georgiapdf.com/, which provides resources and guidance specific to the divorce process in Georgia.

Documents used along the form

When utilizing a Florida Transfer-on-Death Deed, several additional forms and documents may be necessary to ensure a smooth transfer of property upon the owner's passing. These documents serve various purposes, from establishing ownership to facilitating the probate process. Below is a list of commonly associated forms.

- Will: A legal document that outlines how a person's assets and responsibilities should be handled after their death. It provides instructions for the distribution of property and can appoint guardians for minors.

- Durable Power of Attorney: This document allows an individual to designate someone else to make financial and legal decisions on their behalf if they become incapacitated.

- Living Will: A type of advance directive that specifies an individual’s wishes regarding medical treatment and life-sustaining measures in the event of terminal illness or incapacity.

- Affidavit of Heirship: A sworn statement used to establish the heirs of a deceased person, particularly when no will exists, to simplify the transfer of property.

- Death Certificate: An official document issued by a government authority that confirms a person's death, often required to access financial accounts or transfer property.

- Real Estate Title Search: A review of public records to determine the legal ownership of a property and to identify any liens or encumbrances that may affect the transfer.

- This legal document facilitates the transfer of ownership of a motorcycle, ensuring all transaction details are recorded and recognized legally, as outlined in the https://autobillofsaleform.com/motorcycle-bill-of-sale-form/new-york-motorcycle-bill-of-sale-form/.

- Notice of Intent to File a Claim: A document that may be filed by creditors to notify the estate of a deceased person about any debts owed, ensuring that all claims are addressed during the probate process.

Understanding these forms and documents can facilitate a more efficient property transfer process in Florida. Each plays a critical role in ensuring that the wishes of the property owner are honored and that legal obligations are met.

Similar forms

The Florida Transfer-on-Death Deed (TODD) form is similar to a Last Will and Testament. Both documents serve to transfer property upon the death of the owner. However, a key difference lies in the timing of the transfer. A will takes effect only after the individual passes away and goes through probate. In contrast, the TODD allows the property to transfer directly to the designated beneficiary without going through probate, making the process quicker and more efficient.

In the realm of educational choices, parents who decide to take the homeschooling route should be aware of the necessary documentation involved. For example, in Virginia, the Homeschool Letter of Intent serves as a formal notification to local school divisions, marking the families' commitment to homeschooling their children and ensuring compliance with state regulations.

Dos and Don'ts

When filling out the Florida Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure the document is completed correctly. Below is a list of five things to do and five things to avoid during this process.

Things You Should Do:

- Ensure you have the correct legal description of the property.

- Include the names and addresses of all beneficiaries clearly.

- Sign the deed in the presence of a notary public.

- File the completed deed with the appropriate county clerk's office.

- Consult with a legal professional if you have any questions about the process.

Things You Shouldn't Do:

- Do not leave any sections of the form blank.

- Avoid using ambiguous language when describing the property.

- Do not forget to date the deed when signing.

- Refrain from using outdated forms or templates.

- Do not assume the deed is valid without proper filing and notarization.

Key takeaways

Filling out and using the Florida Transfer-on-Death Deed form can be a straightforward process, but there are essential points to consider. Here are key takeaways:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries to receive property upon their death.

- This deed does not require the beneficiary to pay taxes or incur costs until the property is transferred.

- Property owners must complete the deed form accurately to ensure it is valid and enforceable.

- Both the owner and the designated beneficiaries must be clearly identified on the deed.

- It is crucial to have the deed notarized and recorded in the appropriate county office for it to take effect.

- The deed can be revoked or changed at any time before the owner's death.

- Consulting with a legal expert can help clarify any questions and ensure compliance with state laws.

- Beneficiaries should be informed about the deed to avoid confusion after the owner's passing.

- Using this deed can help avoid probate, streamlining the transfer of property upon death.

Understanding these aspects can help property owners make informed decisions regarding their estate planning in Florida.

How to Use Florida Transfer-on-Death Deed

After obtaining the Florida Transfer-on-Death Deed form, you will need to complete it accurately to ensure that your property is transferred as intended upon your passing. Following these steps will help you fill out the form correctly.

- Obtain the Florida Transfer-on-Death Deed form from a reliable source, such as the Florida Department of State website or a legal forms provider.

- Begin by entering the name of the property owner (grantor) at the top of the form. Include the full legal name as it appears on the property title.

- Provide the address of the property being transferred. This should include the street address, city, state, and zip code.

- Next, identify the beneficiaries who will receive the property upon your death. List their full legal names and relationship to you.

- Indicate whether the property will be transferred to multiple beneficiaries. If so, specify how the property will be divided among them.

- Include a legal description of the property. This can often be found on the current property deed or tax records.

- Sign and date the form in the presence of a notary public. Ensure that the notary also signs and stamps the form to validate it.

- Finally, record the completed deed with the county clerk’s office where the property is located. There may be a fee for this service.