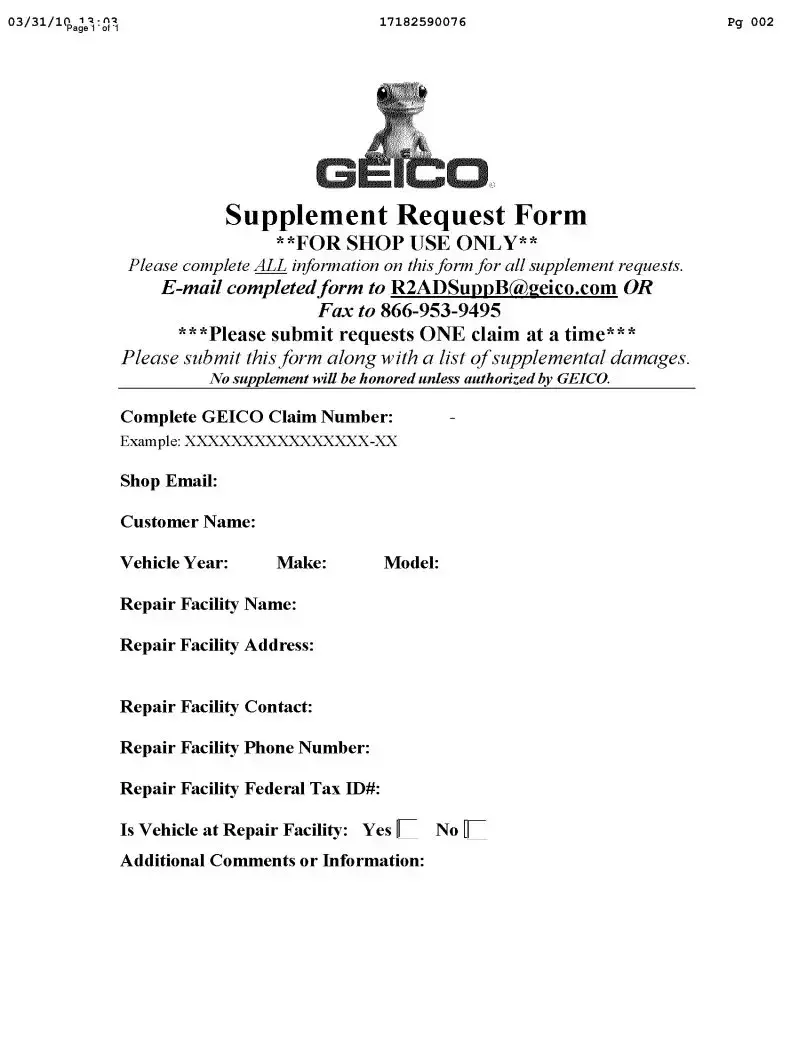

Fill Out a Valid Geico Supplement Request Form

The GEICO Supplement Request form is an essential tool for repair shops seeking reimbursement for additional damages discovered during vehicle repairs. This form must be filled out completely, ensuring that all necessary information is provided for a smooth processing experience. Each request should be submitted individually, and it’s crucial to include a detailed list of supplemental damages along with the form. GEICO requires authorization for any supplements, meaning that without their approval, requests may not be honored. Key details such as the GEICO claim number, customer name, vehicle information, and repair facility contact details are all necessary components of the form. Additionally, the form asks whether the vehicle is currently at the repair facility and provides space for any additional comments or information that might be relevant to the claim. By following these guidelines, repair shops can streamline the process and improve their chances of receiving timely compensation for the work performed.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. Ensure that every section, including the GEICO Claim Number and Repair Facility details, is completed.

-

Submitting Multiple Claims: Some individuals mistakenly submit requests for multiple claims at once. Remember, each request should be submitted one claim at a time.

-

Missing Supplemental Damages List: A common oversight is not including a list of supplemental damages. This list is essential for the processing of your request.

-

Incorrect Email Submission: Ensure that the completed form is sent to the correct email address. Double-check the shop email provided on the form.

-

Failure to Authorize Supplements: Some people assume that all supplements will be honored. Remember, no supplement will be processed unless it has been authorized by GEICO.

-

Omitting Additional Comments: Leaving out the section for additional comments can lead to misunderstandings. Use this space to provide any relevant information that could help clarify your request.

Preview - Geico Supplement Request Form

Other PDF Templates

Basic Direct Deposit Form - Make sure to review terms with your bank if unsure about details.

The necessary Power of Attorney for a Child document is crucial for parents needing temporary arrangements for their child's care, ensuring legal authority is properly assigned to a trusted adult during their absence.

Aspen Dental Health Information Release - You have the option to limit the information disclosed to specific treatment dates.

Documents used along the form

When submitting a Geico Supplement Request form, several other documents may be required to support the request. These documents help provide a comprehensive overview of the damages and repairs needed, ensuring a smoother claims process. Below is a list of commonly used forms and documents that accompany the supplement request.

- Supplemental Damage List: This document details all additional damages discovered after the initial estimate. It should itemize each damage with corresponding repair costs to justify the supplement request.

- Estimate from Repair Facility: A formal estimate from the repair shop outlines the costs associated with repairs. This estimate should include labor and parts, providing Geico with a clear understanding of the financial implications.

- Photos of Damages: Visual evidence can significantly enhance the supplement request. High-quality photos showing the extent of the damages help support the claims and clarify any discrepancies.

- Previous Repair Documentation: If applicable, documents related to prior repairs on the vehicle can be included. This helps establish a history of the vehicle's condition and any recurring issues.

- Claim History: A summary of the claim history for the vehicle may be necessary. This includes any previous claims filed with Geico, which can provide context for the current supplement request.

- Articles of Incorporation Form: For those establishing a business, our required Articles of Incorporation form details the fundamental aspects of corporate existence.

- Authorization Forms: In some cases, authorization forms from the vehicle owner may be required. These forms grant the repair facility permission to discuss the claim and repairs with Geico.

Including these documents along with the Geico Supplement Request form can facilitate a more efficient review process. Each piece of information contributes to a clearer picture of the situation, ultimately aiding in the approval of the supplement request.

Similar forms

The Geico Supplement Request form shares similarities with an Insurance Claim Form. Both documents are designed to facilitate communication between the repair facility and the insurance provider. An Insurance Claim Form typically requires detailed information about the incident, the insured party, and the damages incurred. Like the Geico form, it demands accuracy and completeness to ensure that claims are processed smoothly. Both forms aim to expedite the claims process, allowing for timely repairs and financial settlements.

Another document that resembles the Geico Supplement Request form is the Vehicle Damage Assessment Form. This form is used to document the extent of damages to a vehicle after an accident. It requires specific details about the vehicle, including its make, model, and year, similar to the Geico form. Both documents necessitate a thorough listing of damages, ensuring that all necessary repairs are accounted for and approved by the insurance company. The Vehicle Damage Assessment Form serves as a crucial tool in determining the scope of repairs needed, much like the supplement request.

The Repair Authorization Form is also comparable to the Geico Supplement Request form. This document is used by repair facilities to obtain permission from the insurance company before proceeding with repairs. Both forms include essential information about the repair facility and the vehicle, ensuring that all parties are aligned on the repair process. The Repair Authorization Form must be filled out accurately to prevent delays, just as the Geico form requires complete information for supplement requests to be honored.

The New York Mobile Home Bill of Sale form is an essential legal document for anyone involved in the sale or purchase of a mobile home, ensuring the transaction is transparent and binding. It provides comprehensive details about the buyer, seller, and mobile home itself, including the agreed sale price. By utilizing a formal document like the Mobile Home Bill of Sale, both parties can safeguard their interests and confirm the ownership transfer with clarity and accuracy.

Additionally, the Proof of Loss Form bears similarities to the Geico Supplement Request form. This document is often required by insurance companies when a claim is filed, detailing the losses incurred due to an incident. Like the Geico form, the Proof of Loss Form demands comprehensive information about the damages and the claimant. Both forms serve to substantiate the claims made and facilitate the approval process, emphasizing the importance of clarity and detail in the information provided.

Lastly, the Supplemental Insurance Claim Form can be likened to the Geico Supplement Request form. This form is used when additional damages are discovered after an initial claim has been submitted. Just as the Geico form requests a list of supplemental damages, the Supplemental Insurance Claim Form requires a detailed account of any new damages that may not have been included in the original claim. Both documents are essential in ensuring that all necessary repairs are recognized and funded by the insurance provider, thereby supporting the claimant's needs effectively.

Dos and Don'ts

When filling out the GEICO Supplement Request form, it is important to follow certain guidelines to ensure a smooth process. Below are five things you should and shouldn't do:

- Do complete all required fields on the form.

- Don't submit multiple claims at once; handle one claim at a time.

- Do include a list of supplemental damages with your request.

- Don't forget to provide the GEICO claim number accurately.

- Do ensure that the form is sent via email to the correct address.

Following these guidelines will help facilitate the review and approval of your supplement request.

Key takeaways

When filling out the GEICO Supplement Request form, keep these key takeaways in mind:

- Complete all sections of the form. Missing information can delay processing.

- Submit requests for only one claim at a time. This helps streamline the review process.

- Include a list of supplemental damages with your submission. This is essential for approval.

- Ensure that the GEICO claim number is accurate. Use the format provided in the example.

- Provide the repair facility's contact details. This includes the name, address, phone number, and federal tax ID.

- Indicate whether the vehicle is currently at the repair facility. This information is crucial for GEICO.

- Any additional comments or information should be clearly stated. This can help clarify your request.

- Remember that no supplement will be honored without prior authorization from GEICO.

How to Use Geico Supplement Request

When you're ready to submit a supplement request to GEICO, it's important to follow the steps carefully to ensure a smooth process. Completing the form accurately will help facilitate the approval of your request. Below are the steps to fill out the GEICO Supplement Request form.

- Obtain the Form: Start by downloading or printing the GEICO Supplement Request form.

- Fill in the GEICO Claim Number: Enter the complete GEICO claim number in the designated field. Make sure to follow the example format provided.

- Shop Email: Provide the email address of the repair facility that will be submitting the request.

- Customer Name: Enter the name of the customer associated with the claim.

- Vehicle Information: Fill in the year, make, and model of the vehicle being repaired.

- Repair Facility Name: Write the name of the repair facility handling the repairs.

- Repair Facility Address: Include the complete address of the repair facility.

- Repair Facility Contact: Provide the name of the primary contact person at the repair facility.

- Repair Facility Phone Number: Enter a phone number where the repair facility can be reached.

- Repair Facility Federal Tax ID#: Input the Federal Tax ID number of the repair facility.

- Vehicle Status: Indicate whether the vehicle is currently at the repair facility by selecting "Yes" or "No."

- Additional Comments: If there are any additional comments or information relevant to the supplement request, include them in this section.

After completing the form, make sure to review all the information for accuracy. Once verified, submit the form along with a list of supplemental damages via email, ensuring that only one claim is submitted at a time. Remember, GEICO will not honor any supplement requests without prior authorization.