Printable General Power of Attorney Form

When it comes to managing personal affairs, the General Power of Attorney (GPOA) serves as a vital tool for individuals seeking to delegate authority to someone they trust. This legal document empowers an appointed agent to make decisions on behalf of the principal, covering a wide array of financial and legal matters. From handling bank transactions to signing contracts, the GPOA is designed to ensure that your interests are represented, even when you cannot act on your own behalf. Importantly, this form can be tailored to fit specific needs, allowing for broad or limited powers depending on the principal’s preferences. Additionally, understanding the implications of granting such authority is crucial; the agent must act in the principal's best interest, and the principal retains the right to revoke the power at any time, as long as they remain competent. As we delve deeper into the intricacies of the General Power of Attorney form, we will explore its benefits, limitations, and the essential considerations one should keep in mind when deciding to use this powerful legal instrument.

State-specific Tips for General Power of Attorney Templates

Common mistakes

-

Not specifying the powers granted: Many people fail to clearly outline the specific powers they wish to grant to their agent. This can lead to confusion and potential misuse of authority.

-

Choosing the wrong agent: Selecting someone who lacks the necessary skills or trustworthiness can result in poor decision-making. It's essential to choose an individual who understands your wishes and can act in your best interest.

-

Not considering the scope of authority: Some individuals do not limit the authority of their agent. Without clear boundaries, the agent may take actions that the principal did not intend.

-

Failing to sign and date the document: A General Power of Attorney is not valid unless it is properly signed and dated. Omitting this step can render the document ineffective.

-

Ignoring state-specific requirements: Each state has its own rules regarding the creation of a General Power of Attorney. Not adhering to these rules can invalidate the document.

-

Not discussing the document with the agent: Failing to communicate your intentions and expectations with the chosen agent can lead to misunderstandings. Open dialogue is crucial for effective representation.

-

Neglecting to update the document: Life circumstances change. Not revisiting and updating the General Power of Attorney can result in outdated information or powers.

-

Overlooking witness and notarization requirements: Some states require the presence of witnesses or a notary when signing the document. Ignoring these requirements can lead to challenges in enforcing the document.

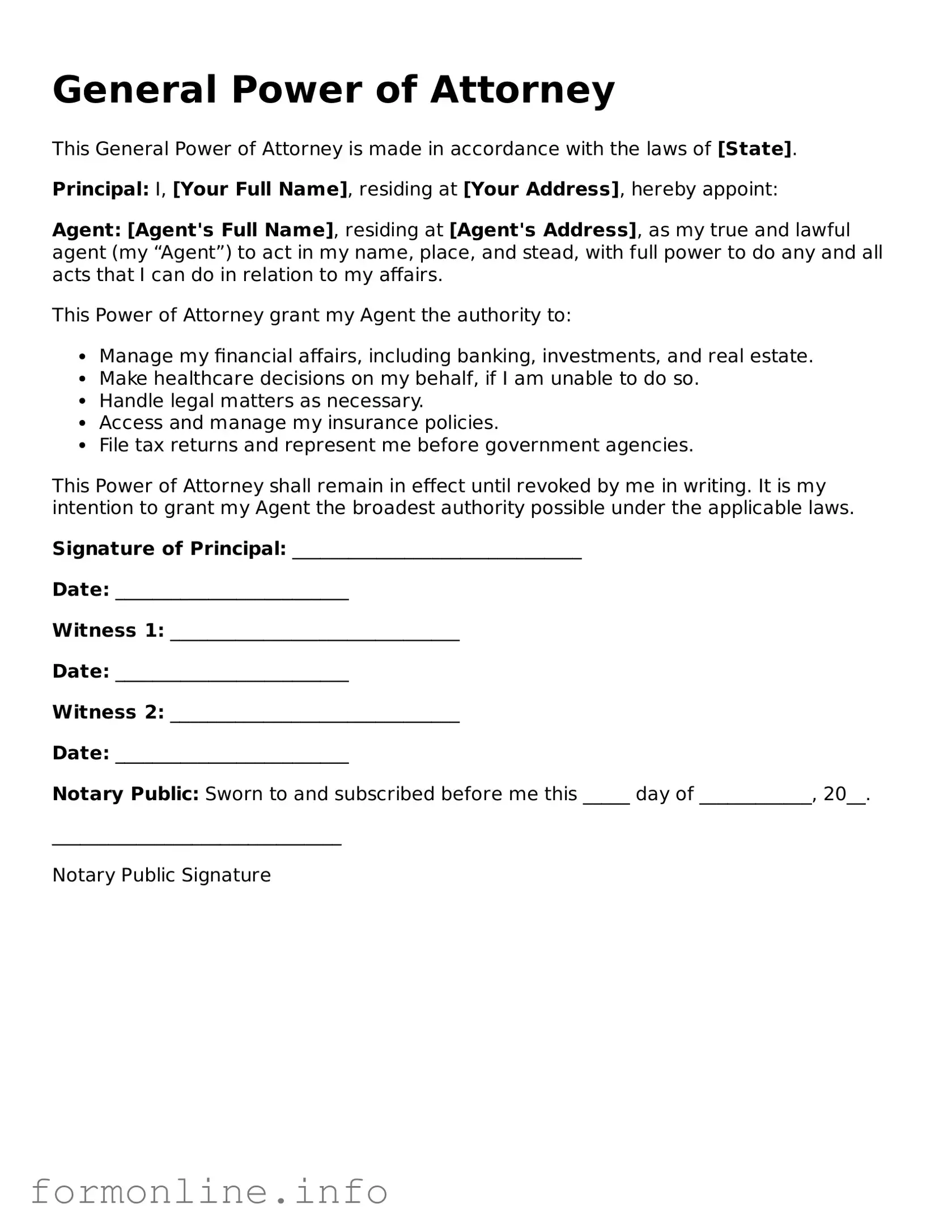

Preview - General Power of Attorney Form

General Power of Attorney

This General Power of Attorney is made in accordance with the laws of [State].

Principal: I, [Your Full Name], residing at [Your Address], hereby appoint:

Agent: [Agent's Full Name], residing at [Agent's Address], as my true and lawful agent (my “Agent”) to act in my name, place, and stead, with full power to do any and all acts that I can do in relation to my affairs.

This Power of Attorney grant my Agent the authority to:

- Manage my financial affairs, including banking, investments, and real estate.

- Make healthcare decisions on my behalf, if I am unable to do so.

- Handle legal matters as necessary.

- Access and manage my insurance policies.

- File tax returns and represent me before government agencies.

This Power of Attorney shall remain in effect until revoked by me in writing. It is my intention to grant my Agent the broadest authority possible under the applicable laws.

Signature of Principal: _______________________________

Date: _________________________

Witness 1: _______________________________

Date: _________________________

Witness 2: _______________________________

Date: _________________________

Notary Public: Sworn to and subscribed before me this _____ day of ____________, 20__.

_______________________________

Notary Public Signature

More Types of General Power of Attorney Templates:

Real Estate Power of Attorney California - Grant authority to someone to manage your real estate affairs.

Additionally, acquiring the necessary documentation can be simplified by accessing resources like autobillofsaleform.com/texas-motor-vehicle-bill-of-sale-form, which provides a comprehensive template for the Texas Motor Vehicle Bill of Sale, ensuring that all required information is captured for both parties involved in the transaction.

Does Ca Dmv Power of Attorney Need to Be Notarized - Fast-track vehicle title transfers with a trusted representative using this Power of Attorney.

Documents used along the form

A General Power of Attorney (GPOA) is a crucial document that allows one individual to act on behalf of another in various legal and financial matters. When creating a GPOA, it is often beneficial to consider additional documents that can complement its function. Below are some commonly used forms and documents that may accompany a General Power of Attorney.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. Unlike a standard GPOA, a Durable Power of Attorney ensures that the appointed agent can continue to manage the principal's affairs during times of mental or physical decline.

- Mobile Home Bill of Sale: This essential document facilitates the transfer of ownership for mobile homes, ensuring that both parties complete the transaction legally and efficiently. For more details, refer to the Mobile Home Bill of Sale.

- Healthcare Power of Attorney: This form designates an individual to make medical decisions on behalf of the principal if they are unable to do so. It is specifically focused on healthcare matters and can include directives regarding treatment preferences.

- Living Will: A Living Will outlines an individual's wishes regarding medical treatment in situations where they cannot communicate their preferences. It typically addresses end-of-life care and can work alongside a Healthcare Power of Attorney to guide decisions.

- Financial Power of Attorney: This document grants an agent the authority to manage financial matters specifically. It can cover a range of activities, such as managing bank accounts, real estate transactions, and tax filings, ensuring the principal's financial interests are protected.

Each of these documents serves a distinct purpose and can provide additional clarity and protection for both the principal and the agent. When used together, they create a comprehensive framework for managing personal and financial affairs effectively.

Similar forms

A Durable Power of Attorney is quite similar to a General Power of Attorney, with one key distinction: durability. While a General Power of Attorney typically becomes invalid if the principal becomes incapacitated, a Durable Power of Attorney remains effective even in such situations. This means that if you want someone to manage your affairs when you can’t, a Durable Power of Attorney is the better choice. It provides peace of mind, ensuring that your financial and legal matters can still be handled smoothly during challenging times.

Understanding the process for obtaining a nursing license in Arizona involves familiarizing oneself with the necessary documentation, including the AZ Forms Online, which provides essential resources and guidance for applicants. This ensures that individuals are well-prepared to comply with state requirements and effectively navigate their licensure journey.

A Medical Power of Attorney focuses specifically on healthcare decisions. This document allows you to designate someone to make medical choices on your behalf if you are unable to do so. Like a General Power of Attorney, it grants authority to another person, but its scope is limited to health-related matters. This can be crucial for ensuring that your medical wishes are honored, especially in emergencies or when you are incapacitated.

An Advance Healthcare Directive, sometimes called a living will, is another document that shares similarities with a General Power of Attorney. However, it specifically outlines your preferences for medical treatment and interventions. While a Medical Power of Attorney allows someone to make decisions for you, an Advance Healthcare Directive provides explicit instructions about what you do or do not want in terms of medical care. This ensures that your values and wishes are respected, even when you cannot voice them yourself.

A Financial Power of Attorney is closely related to a General Power of Attorney but is specifically tailored for financial matters. This document allows someone to manage your finances, pay bills, and handle transactions on your behalf. While a General Power of Attorney can encompass both financial and legal decisions, a Financial Power of Attorney is focused solely on your monetary affairs. This can be particularly useful if you want to separate your financial decisions from other legal or health-related ones.

A Limited Power of Attorney is another variant that shares some characteristics with a General Power of Attorney. However, as the name suggests, it grants authority for a specific purpose or a limited time. For example, you might use a Limited Power of Attorney for a real estate transaction or to allow someone to sign documents on your behalf while you are out of town. This document is useful when you need someone to act on your behalf but only in specific situations, rather than granting broad powers.

A Trust is a legal arrangement that can also bear similarities to a General Power of Attorney, especially when it comes to managing assets. A trust allows a designated person, known as a trustee, to manage your assets for the benefit of your beneficiaries. While a General Power of Attorney allows someone to act on your behalf during your lifetime, a trust often continues to operate after your death, ensuring a smooth transition of your assets. This can be an effective way to manage and distribute your estate according to your wishes.

An Executor’s Will is a document that outlines your wishes regarding the distribution of your assets after your death. While it doesn’t grant authority in the same way a General Power of Attorney does, it is similar in that it designates someone to carry out your wishes. The executor is responsible for managing your estate, paying debts, and distributing assets according to your instructions. This document is essential for ensuring that your desires are respected once you are no longer able to express them.

Dos and Don'ts

Filling out a General Power of Attorney form is an important task that requires careful attention. Here are ten things you should and shouldn't do to ensure the process goes smoothly.

- Do read the entire form carefully before filling it out.

- Don't rush through the process; take your time to understand each section.

- Do consult with a legal professional if you have any questions.

- Don't leave any sections blank unless instructed; incomplete forms may be rejected.

- Do clearly identify the person you are granting power to, including their full name and address.

- Don't use nicknames or informal titles; accuracy is crucial.

- Do specify the powers you are granting in detail.

- Don't assume that general terms will be understood; clarity is key.

- Do sign and date the form in the presence of a notary if required.

- Don't forget to keep a copy for your records after submission.

Key takeaways

Filling out and utilizing a General Power of Attorney (GPOA) form is a significant step in ensuring your financial and legal matters are managed according to your wishes. Here are key takeaways to consider:

- Understand the Scope: A General Power of Attorney grants broad authority to the designated agent, allowing them to make decisions on your behalf. This can include handling financial transactions, managing real estate, and dealing with legal issues.

- Choose Your Agent Wisely: Selecting a trustworthy and competent individual is crucial. The agent will have significant control over your affairs, so consider their reliability and judgment.

- Specify Limitations: While a GPOA is typically broad, you can specify limitations or conditions in the document. Clearly outline any areas where the agent should not have authority.

- Revocation is Possible: You have the right to revoke the General Power of Attorney at any time, as long as you are mentally competent. This can be done through a written notice to your agent and any institutions they may have dealt with on your behalf.

- Consult Legal Advice: It is advisable to seek legal counsel when drafting a GPOA. An attorney can help ensure that the document meets state requirements and accurately reflects your intentions.

How to Use General Power of Attorney

Filling out a General Power of Attorney form is an important step in designating someone to act on your behalf in various matters. Make sure to have all necessary information ready before you begin. This process requires careful attention to detail to ensure that everything is completed correctly.

- Obtain the General Power of Attorney form. You can find this form online or at a local legal office.

- Read through the form carefully. Familiarize yourself with each section before you start filling it out.

- Provide your full name and address in the designated section. This identifies you as the principal.

- Enter the name and address of the person you are appointing as your agent. This person will have the authority to act on your behalf.

- Specify the powers you are granting to your agent. This could include financial decisions, legal matters, or other specific powers.

- Indicate the duration of the power of attorney. You can choose to make it effective immediately or set a specific date.

- Sign and date the form in the appropriate section. Ensure that you are signing in front of a notary public, if required.

- Have your agent sign the form, if necessary. Some states require the agent's signature to acknowledge their acceptance of the role.

- Make copies of the completed form for your records and for your agent.

After completing the form, ensure that it is stored safely. You may need to provide copies to banks, healthcare providers, or other institutions where your agent will act on your behalf.