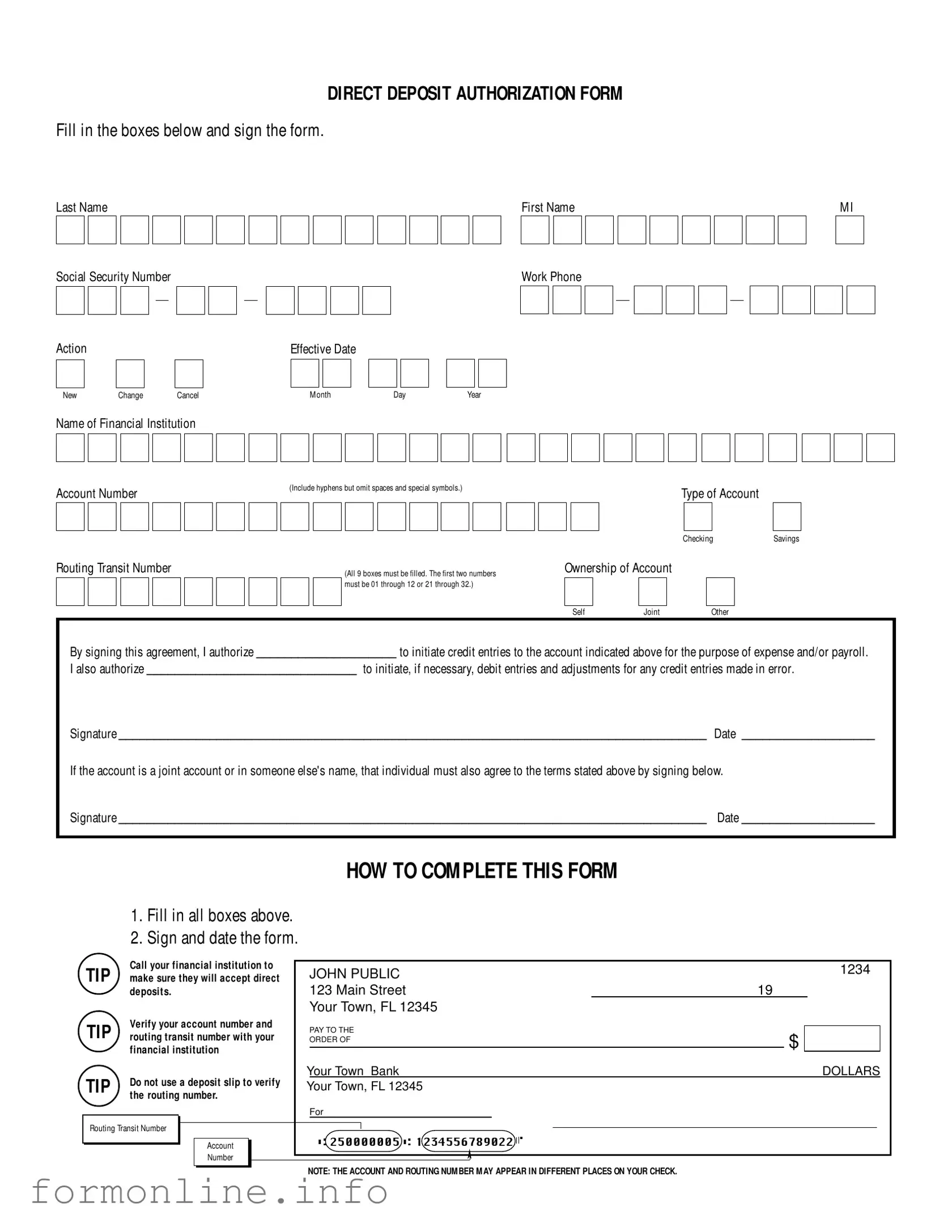

Fill Out a Valid Generic Direct Deposit Form

When it comes to receiving payments efficiently, the Generic Direct Deposit form plays a crucial role. This form allows individuals to authorize their employer or other organizations to deposit funds directly into their bank accounts, streamlining the payment process. Key components of the form include personal identification details such as your name and Social Security number, as well as information about your financial institution. You'll need to specify whether you are opening a new account, making a change, or canceling a previous authorization. Additionally, it's important to indicate the type of account—either checking or savings—and to provide the correct routing transit number and account number. Signing the form signifies your consent for the organization to initiate credit entries to your account, and if applicable, to make adjustments for any errors. If the account is a joint account, the other account holder must also provide their signature. Completing this form accurately ensures that payments are processed smoothly, eliminating delays and potential errors.

Common mistakes

-

Omitting Required Information: Many individuals forget to fill in all required fields, such as the Social Security Number or the account number. Each box must be completed for the form to be valid.

-

Incorrect Account Number: Entering the account number incorrectly can lead to funds being deposited into the wrong account. Always double-check this number with your financial institution.

-

Wrong Routing Transit Number: The routing number is crucial. If it is not accurate, the bank may reject the direct deposit. Verify this number directly with your bank.

-

Not Specifying Account Type: Failing to indicate whether the account is a checking or savings account can cause processing delays. Make sure to mark the appropriate box.

-

Neglecting to Sign: A common mistake is not signing the form. Without a signature, the authorization is incomplete and cannot be processed.

-

Not Including Effective Date: Leaving the effective date blank can create confusion about when the direct deposit should start. Always include this date.

-

Ignoring Joint Account Requirements: If the account is joint, both account holders must sign the form. Failing to do so will result in the form being rejected.

-

Using Deposit Slips for Verification: Some people mistakenly use deposit slips to verify their routing numbers. This can lead to errors, as the routing number may not be the same as on the deposit slip.

-

Not Contacting the Financial Institution: It is advisable to call the bank to ensure they accept direct deposits. Some banks may have specific requirements that need to be met.

Preview - Generic Direct Deposit Form

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Other PDF Templates

Florida Notice to Owner Template - It warns property owners of the risks involved with not ensuring payments are made to all contractors and subcontractors.

For those navigating rental agreements in Florida, a solid understanding of the Residential Lease Agreement is invaluable in ensuring a fair tenancy arrangement. You can find a well-structured guide at this resource on Residential Lease Agreement essentials.

Vics Bol - This documentation enables the carrier to perform their duties with clarity on responsibilities.

Documents used along the form

When setting up direct deposit, several other forms and documents may be necessary to ensure a smooth process. These documents help clarify your financial arrangements and confirm your identity. Below is a list of commonly used forms that accompany the Generic Direct Deposit form.

- W-4 Form: This form, known as the Employee's Withholding Certificate, helps employers determine the correct amount of federal income tax to withhold from your paycheck. It’s essential for tax purposes and should be updated if your personal circumstances change.

- Bank Account Verification Letter: This document, provided by your bank, confirms your account details, including your account number and routing number. It serves as proof that your bank account is legitimate and active.

- Motor Vehicle Bill of Sale: The DMV Bill of Sale serves as a crucial document for transferring ownership of a vehicle, ensuring that both parties have a clear record of the transaction.

- Employment Verification Letter: Issued by your employer, this letter confirms your employment status and income. It may be required by your bank or financial institution to process your direct deposit request.

- Form I-9: This form is used to verify your identity and employment authorization in the United States. It is a standard requirement for all new hires and may be requested by your employer during the direct deposit setup.

- Direct Deposit Change Request Form: If you need to update your banking information or change your deposit account, this form allows you to formally request those changes. It ensures that your employer has the most current information on file.

- Pay Stub: While not a formal document required for setting up direct deposit, your pay stub provides a detailed breakdown of your earnings and deductions. It can be useful for confirming your income when opening a new account.

- Authorization for Automatic Payments: This document allows you to authorize recurring payments, such as bills or loans, to be deducted directly from your bank account. It complements your direct deposit setup by streamlining your financial obligations.

Each of these documents plays a crucial role in the direct deposit process, ensuring that both you and your financial institution have the necessary information to facilitate seamless transactions. Keeping these forms organized and readily available can help prevent delays in receiving your funds.

Similar forms

The W-4 form, or Employee's Withholding Certificate, is similar to the Generic Direct Deposit form in that it is a crucial document for managing financial transactions related to employment. While the Direct Deposit form authorizes the deposit of wages into a bank account, the W-4 determines how much federal income tax should be withheld from an employee's paycheck. Both forms require personal information such as name, Social Security number, and signature, and they must be filled out accurately to ensure proper processing by the employer and the IRS.

The Virginia Mobile Home Bill of Sale is an important legal document that not only formalizes the transfer of ownership of a mobile home but also protects both the buyer and seller in the transaction. By including essential details such as the identity of both parties and the specifics of the mobile home, this document prevents ambiguities that might arise during the sale. To learn more about it, you can access the Mobile Home Bill of Sale for additional guidance and resources related to the process.

The I-9 form, or Employment Eligibility Verification, shares similarities with the Generic Direct Deposit form in that both are essential for employment documentation. The I-9 confirms an employee's identity and eligibility to work in the United States, while the Direct Deposit form facilitates the payment process. Each form requires the employee's personal details and must be completed and signed to comply with federal regulations. Employers use these forms to ensure they are following legal requirements in their hiring and payroll practices.

The 1099 form, specifically the 1099-MISC or 1099-NEC, relates closely to the Generic Direct Deposit form as both documents are involved in the payment process. While the Direct Deposit form is used to authorize the electronic transfer of funds, the 1099 form reports income paid to independent contractors or freelancers. Both documents require accurate financial information and signatures to ensure proper reporting and compliance with tax laws, making them integral to the financial relationship between payers and payees.

The ACH Authorization form, or Automated Clearing House Authorization, is another document that functions similarly to the Generic Direct Deposit form. Both forms allow for the electronic transfer of funds, whether for payroll or other payments. The ACH Authorization form is often used for recurring payments like utilities or subscriptions, while the Direct Deposit form is specifically for payroll deposits. Each requires the account holder's information and consent to facilitate the transactions, ensuring smooth financial operations.

The Paycheck Protection Program (PPP) Loan Application is relevant in this context as it involves financial information and the management of funds. Similar to the Generic Direct Deposit form, the PPP application requires detailed information about the applicant's business and financial accounts. Both documents aim to facilitate the flow of funds, whether for employee wages or business loans, and require signatures to validate the information provided. They are both critical in ensuring that financial transactions are authorized and properly documented.

The Expense Reimbursement Form also bears resemblance to the Generic Direct Deposit form, as both are used to manage financial transactions within an organization. The Expense Reimbursement Form allows employees to request repayment for expenses incurred while performing their job duties. Like the Direct Deposit form, it requires personal information and signatures to process payments. Both forms are essential for ensuring that employees are compensated accurately and in a timely manner for their contributions to the company.

Lastly, the Payroll Change Form is similar to the Generic Direct Deposit form in that it is used to update employee information regarding payment methods. While the Direct Deposit form specifically authorizes the deposit of funds into a bank account, the Payroll Change Form can modify various aspects of an employee's payroll, including changes to direct deposit accounts, withholding allowances, or pay rates. Both forms necessitate careful completion and signatures to ensure that the changes are implemented correctly and promptly, safeguarding the employee's financial interests.

Dos and Don'ts

Things You Should Do:

- Fill in all boxes completely, ensuring no sections are left blank.

- Sign and date the form to validate your authorization.

- Verify your account number and routing transit number with your financial institution.

- Call your financial institution to confirm they accept direct deposits.

Things You Shouldn't Do:

- Do not use a deposit slip to verify the routing number.

- Do not omit any required information, as incomplete forms may delay processing.

- Do not forget to include hyphens in your account number.

- Do not submit the form without the necessary signatures if it's a joint account.

Key takeaways

Key Takeaways for Filling Out the Generic Direct Deposit Form:

- Complete all sections of the form, including your last name, first name, and Social Security number.

- Clearly indicate whether you are setting up a new direct deposit, making a change, or canceling an existing one.

- Ensure that you enter the correct account number and routing transit number, as these must be verified with your financial institution.

- Both account owners must sign the form if the account is a joint account or held in someone else's name.

- Always sign and date the form to authorize the initiation of credit entries to your account.

How to Use Generic Direct Deposit

Completing the Generic Direct Deposit form is a straightforward process, but it is essential to ensure accuracy to avoid any issues with your deposits. Follow these steps carefully to fill out the form correctly.

- Begin by entering your Last Name, First Name, and Middle Initial in the designated boxes.

- Provide your Social Security Number in the format: XXX-XX-XXXX.

- Select the appropriate Action by checking the box for New, Change, or Cancel.

- Fill in the Effective Date by entering the month, day, and year.

- Enter your Work Phone number in the format: XXX-XXX-XXXX.

- Write the name of your Financial Institution in the provided space.

- Input your Account Number (include hyphens but omit spaces and special symbols).

- Indicate the Type of Account by checking either Savings or Checking.

- Fill in the Routing Transit Number (ensure all 9 boxes are filled, and the first two numbers are between 01-12 or 21-32).

- Select the Ownership of Account by checking the appropriate box: Self, Joint, or Other.

- Sign the form in the designated area to authorize the direct deposit.

- Enter the Date of your signature.

- If applicable, have the co-owner of the account sign below your signature, and include the date next to their signature.

After completing the form, double-check all entries for accuracy. It is advisable to contact your financial institution to confirm that they will accept direct deposits and to verify your account and routing numbers. Avoid using a deposit slip for verification, as the account and routing numbers may appear in different locations on your check.