Free Articles of Incorporation Template for Georgia State

Incorporating a business in Georgia is a significant step that requires careful attention to detail, and the Articles of Incorporation form is a crucial part of this process. This form serves as the foundational document for establishing a corporation in the state, outlining essential information such as the corporation's name, its purpose, and the address of its principal office. Additionally, it includes details about the registered agent, who will be responsible for receiving legal documents on behalf of the corporation. The form also requires information about the initial board of directors, providing transparency and accountability from the outset. By filing the Articles of Incorporation, businesses not only gain legal recognition but also protect their owners from personal liability, making it a vital step for entrepreneurs looking to formalize their operations. Understanding the specific requirements and implications of this form is essential for anyone considering incorporation in Georgia.

Common mistakes

-

Incorrect Business Name: Choosing a name that is already in use or does not comply with Georgia naming rules can lead to rejection. Ensure the name is unique and includes the required designator, such as "Corporation" or "Inc."

-

Missing Registered Agent Information: Failing to provide the name and address of a registered agent can delay the incorporation process. The registered agent must be available during business hours to receive legal documents.

-

Inaccurate Purpose Statement: Writing a vague or overly broad purpose statement can cause confusion. Clearly state the business's purpose to avoid complications.

-

Omitting Incorporator Details: Not including the names and addresses of the incorporators is a common mistake. Each incorporator must be listed to validate the incorporation process.

-

Incorrect Number of Shares: Specifying an incorrect number of shares or failing to define the classes of shares can lead to issues. Clearly outline the total number of shares and their classifications.

-

Failure to Sign the Form: Not signing the Articles of Incorporation is a simple yet critical error. Ensure that all required signatures are present before submission.

-

Neglecting to Include Filing Fees: Submitting the form without the appropriate filing fee can result in delays. Check the current fee schedule and include payment with your application.

-

Ignoring Additional Requirements: Overlooking state-specific requirements or additional documentation can hinder the process. Review all guidelines and ensure compliance with Georgia laws.

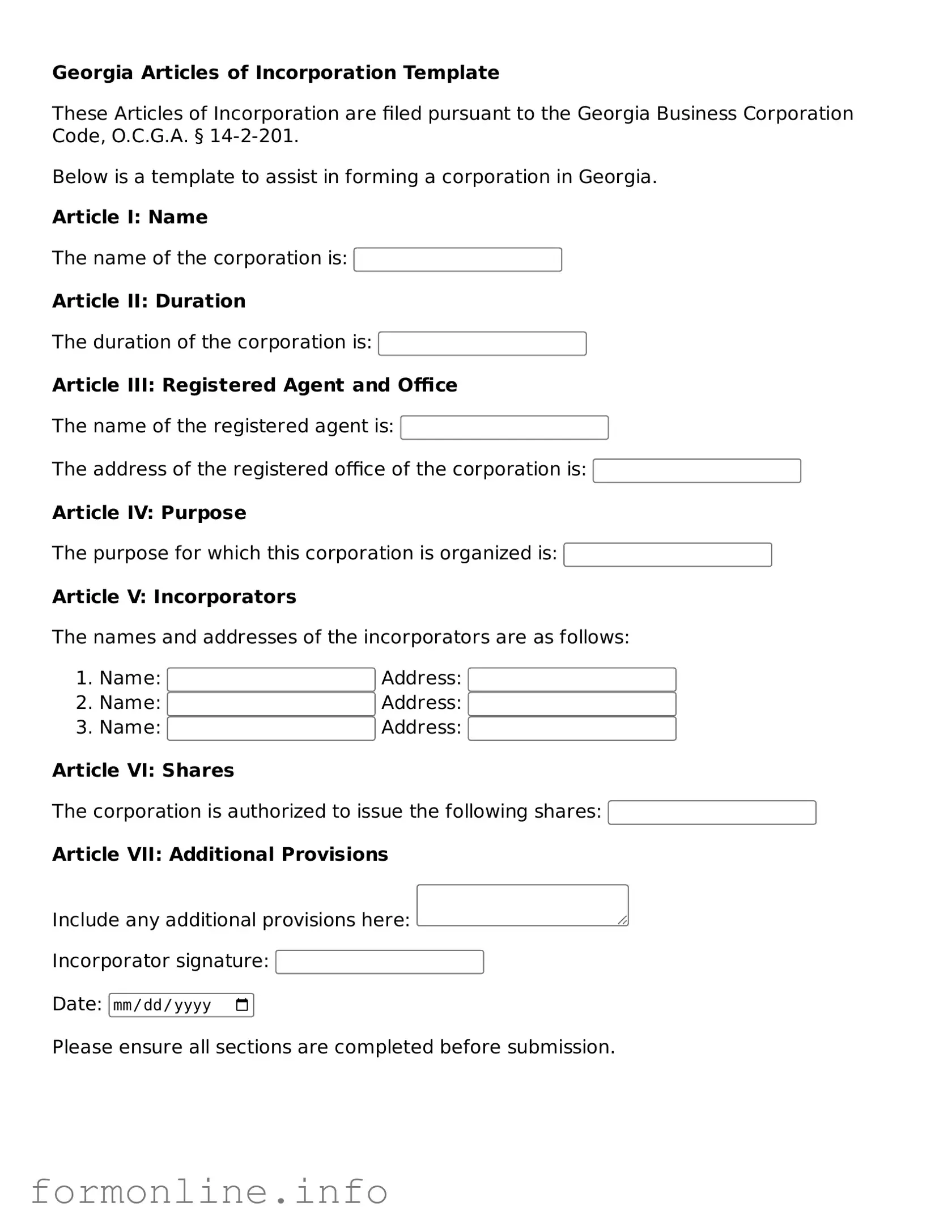

Preview - Georgia Articles of Incorporation Form

Georgia Articles of Incorporation Template

These Articles of Incorporation are filed pursuant to the Georgia Business Corporation Code, O.C.G.A. § 14-2-201.

Below is a template to assist in forming a corporation in Georgia.

Popular Articles of Incorporation State Templates

Florida Corporations - The Articles are an essential step for those looking to attract investors and financing.

A Georgia Last Will and Testament form is a legal document that outlines an individual's wishes regarding the distribution of their assets after death. This essential tool ensures that your intentions are respected and that your loved ones are cared for according to your preferences. Understanding the importance of this form can provide peace of mind, so consider filling it out by visiting https://georgiapdf.com/ for more information.

Llc Register - Ensures compliance with state laws for incorporation.

Documents used along the form

When forming a corporation in Georgia, the Articles of Incorporation serve as the foundational document. However, several other forms and documents are often necessary to ensure compliance with state regulations and to facilitate smooth business operations. Below are five important documents that may accompany the Articles of Incorporation.

- Bylaws: Bylaws outline the internal rules and procedures for managing the corporation. They detail the roles of directors and officers, meeting protocols, and voting procedures. This document is crucial for establishing governance and ensuring that all members understand their rights and responsibilities.

- Motorcycle Bill of Sale: The autobillofsaleform.com/motorcycle-bill-of-sale-form/wisconsin-motorcycle-bill-of-sale-form/ is essential for documenting the sale and transfer of ownership of a motorcycle in Wisconsin, ensuring that both buyer and seller have the necessary evidence of transaction for registration and tax purposes.

- Initial Report: In Georgia, corporations are required to file an initial report within a certain timeframe after incorporation. This report provides essential information about the corporation, including its address and the names of its officers and directors. It helps maintain accurate records with the state.

- Registered Agent Consent Form: This form is necessary if a corporation designates a registered agent to receive legal documents on its behalf. The consent form confirms that the registered agent agrees to fulfill this important role, ensuring that the corporation can be reached for legal matters.

- Employer Identification Number (EIN) Application: An EIN is essential for tax purposes and is required for hiring employees. This application, typically submitted to the IRS, allows a corporation to obtain a unique identifier for tax reporting and other financial transactions.

- Business License Application: Depending on the nature of the business and its location, a corporation may need to apply for a business license. This document ensures compliance with local regulations and permits the corporation to operate legally within its jurisdiction.

These documents, when prepared and submitted alongside the Articles of Incorporation, help lay a solid foundation for a new corporation in Georgia. Understanding their significance and ensuring their timely completion can greatly enhance the chances of a successful business venture.

Similar forms

The Georgia Articles of Incorporation form is similar to the Certificate of Incorporation used in many states. Both documents serve as foundational legal papers that establish a corporation's existence. They outline essential details such as the corporation's name, purpose, and registered agent. While the specific requirements may vary by state, the overall function remains the same: to officially create a corporation recognized by state law.

Another related document is the Bylaws of a corporation. While the Articles of Incorporation focus on the creation of the corporation, the Bylaws govern its internal operations. They detail how the corporation will be managed, including the roles and responsibilities of directors and officers, meeting protocols, and voting procedures. Together, these documents form the backbone of corporate governance.

The Limited Liability Company (LLC) Articles of Organization is also similar. This document is used to establish an LLC, which is a different type of business entity. Like the Articles of Incorporation, it requires basic information about the business, such as its name and registered agent. Both documents provide a legal framework for the entity, offering protections and defining its structure.

Incorporation by Reference is another concept that relates to the Articles of Incorporation. This document allows a corporation to incorporate certain documents by referencing them within the Articles. This can streamline the process, as it eliminates the need to restate all the information in multiple places. It ensures that all relevant documents are considered part of the corporate structure.

For those looking to understand the intricacies of tax documentation, it is essential to explore various forms, including the Sample Tax Return Transcript form, which details an individual's tax return as filed with the IRS. To learn more about this important document, read here.

The Certificate of Good Standing is a document that complements the Articles of Incorporation. Once a corporation is formed, it may need to obtain this certificate to prove its legal existence and compliance with state regulations. This document is often required for various business transactions, such as securing loans or entering contracts, highlighting the importance of maintaining good standing.

Another similar document is the Statement of Information, which is often required by states after incorporation. This document provides updated information about the corporation, including its address and the names of its officers and directors. It ensures that the state has current records, which is crucial for transparency and compliance.

The Business License is also related to the Articles of Incorporation. While the Articles establish the corporation, the business license allows it to operate legally within a specific jurisdiction. Obtaining a business license often requires proof of incorporation, making these documents interconnected in the process of starting a business.

The Employer Identification Number (EIN) application is another important document. While not a formation document, obtaining an EIN is essential for tax purposes once a corporation is established. The EIN serves as the corporation's Social Security number for tax reporting and is necessary for hiring employees, opening bank accounts, and filing tax returns.

Lastly, the Annual Report is a document that corporations must file periodically to maintain their good standing. This report updates the state on the corporation's activities, financial status, and any changes in management. It is a crucial part of ongoing compliance, ensuring that the corporation remains in good standing after its initial formation.

Dos and Don'ts

When filling out the Georgia Articles of Incorporation form, it's essential to approach the task with care. Here are five important dos and don'ts to guide you through the process.

- Do ensure that all information is accurate and complete. Double-check names, addresses, and other details.

- Do include the purpose of your corporation. Clearly stating your business goals helps clarify your intent.

- Do provide the names and addresses of the initial directors. This information is crucial for the formation of your corporation.

- Don't leave any sections blank. Each part of the form must be filled out to avoid delays in processing.

- Don't forget to sign and date the form. An unsigned form will be rejected, causing unnecessary setbacks.

By following these guidelines, you can navigate the incorporation process more smoothly and set a solid foundation for your new business venture.

Key takeaways

- Ensure the name of the corporation is unique and complies with Georgia naming requirements.

- Include the purpose of the corporation clearly and concisely.

- Provide the physical address of the corporation's initial registered office.

- Designate a registered agent who will receive legal documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue.

- Include the names and addresses of the initial directors.

- Ensure that the form is signed by the incorporator.

- Consider whether to include provisions for the management of the corporation in the articles.

- File the completed Articles of Incorporation with the Georgia Secretary of State.

- Pay the required filing fee at the time of submission.

How to Use Georgia Articles of Incorporation

After you have gathered all the necessary information, you are ready to fill out the Georgia Articles of Incorporation form. This form is essential for officially establishing your corporation in Georgia. Completing it accurately is crucial to ensure your business is recognized legally.

- Download the Form: Obtain the Georgia Articles of Incorporation form from the Georgia Secretary of State's website or your local business office.

- Choose Your Corporation Name: Enter the name of your corporation. Ensure it is unique and complies with Georgia naming regulations.

- Specify the Corporation's Purpose: Briefly describe the purpose of your corporation. This can be a general statement about the business activities.

- Provide the Registered Agent Information: Enter the name and address of the registered agent who will receive legal documents on behalf of the corporation.

- List the Incorporators: Include the names and addresses of the individuals who are forming the corporation. Typically, this is at least one person.

- Indicate the Number of Shares: Specify the number of shares the corporation is authorized to issue. This is important for ownership structure.

- Sign the Form: Ensure that the incorporators sign the form. This step is necessary for validation.

- File the Form: Submit the completed Articles of Incorporation to the Georgia Secretary of State, along with the required filing fee.

Once you have completed these steps, your form will be processed. After approval, you will receive confirmation, and your corporation will officially be recognized in Georgia. Keep a copy of the filed Articles of Incorporation for your records, as it is an important document for your business.