Free Deed in Lieu of Foreclosure Template for Georgia State

In the landscape of real estate and financial challenges, the Georgia Deed in Lieu of Foreclosure form serves as a vital tool for homeowners facing the prospect of losing their property. This form provides a way for borrowers to voluntarily transfer ownership of their home back to the lender, effectively sidestepping the lengthy and often stressful foreclosure process. By executing this document, homeowners can mitigate the impact of foreclosure on their credit scores and potentially avoid the emotional turmoil that comes with it. The form outlines the specific terms under which the property is surrendered, including any obligations that may remain for the borrower, such as outstanding debts or liens. It also emphasizes the importance of mutual agreement between the borrower and the lender, ensuring that both parties understand the implications of the transaction. Ultimately, the Georgia Deed in Lieu of Foreclosure is not just a legal form; it represents a strategic choice for homeowners looking to regain control over their financial futures while navigating the complexities of real estate ownership.

Common mistakes

-

Failing to provide accurate property information. Ensure that the legal description of the property is correct and matches public records.

-

Not including all necessary parties. All individuals listed on the mortgage must sign the deed.

-

Overlooking the requirement for notarization. A notary public must witness the signatures for the document to be valid.

-

Neglecting to check for outstanding liens. Unresolved liens can complicate the deed transfer process.

-

Using incorrect or outdated forms. Always ensure you are using the most current version of the Deed in Lieu of Foreclosure form.

-

Failing to review the document thoroughly. Errors or omissions can lead to delays or legal issues.

-

Not consulting with a legal professional. Seeking advice can help avoid potential pitfalls.

-

Ignoring tax implications. Understand how the deed in lieu may affect your tax situation.

-

Assuming all lenders will accept a deed in lieu. Each lender has different policies regarding this process.

-

Submitting the form without confirming lender approval. Always obtain written consent from your lender before proceeding.

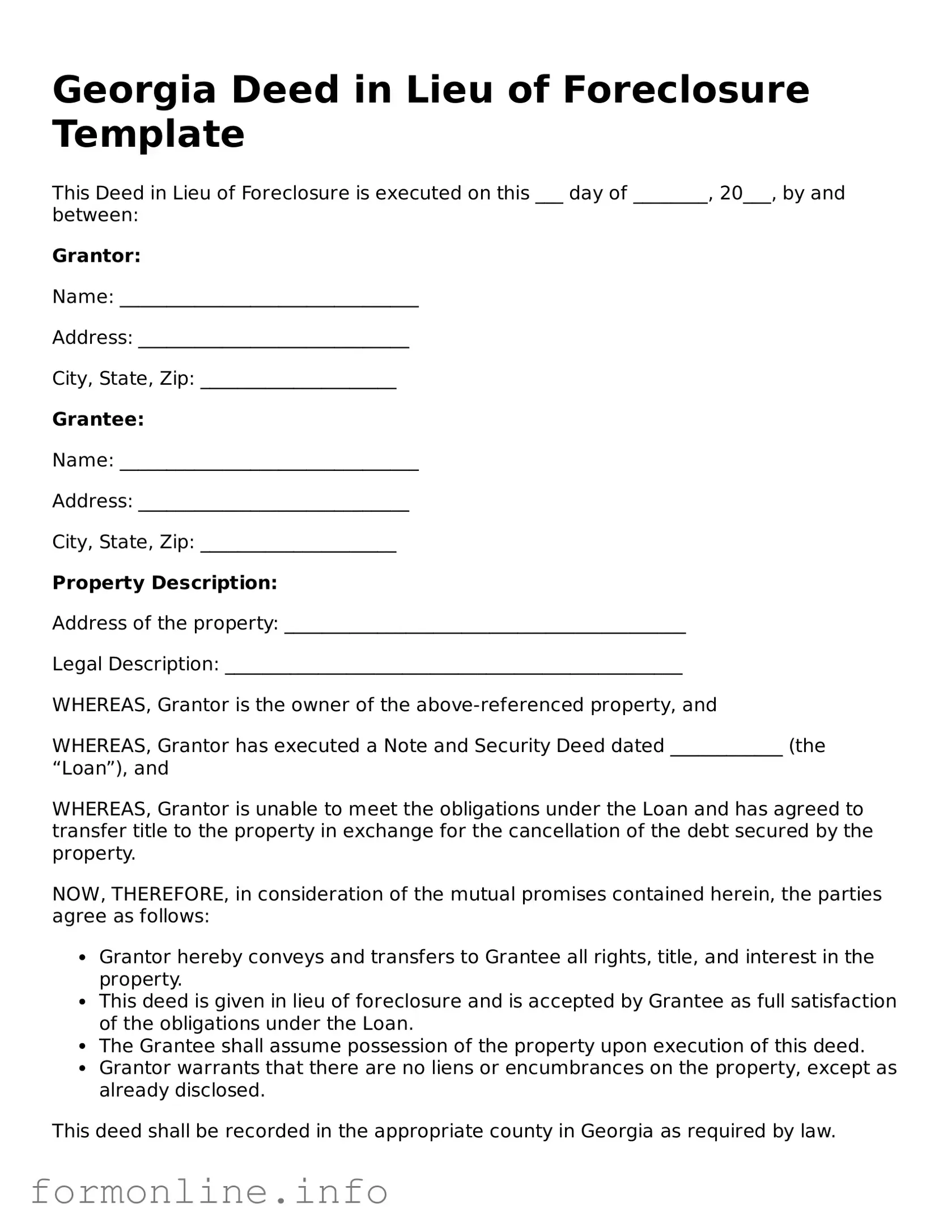

Preview - Georgia Deed in Lieu of Foreclosure Form

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed on this ___ day of ________, 20___, by and between:

Grantor:

Name: ________________________________

Address: _____________________________

City, State, Zip: _____________________

Grantee:

Name: ________________________________

Address: _____________________________

City, State, Zip: _____________________

Property Description:

Address of the property: ___________________________________________

Legal Description: _________________________________________________

WHEREAS, Grantor is the owner of the above-referenced property, and

WHEREAS, Grantor has executed a Note and Security Deed dated ____________ (the “Loan”), and

WHEREAS, Grantor is unable to meet the obligations under the Loan and has agreed to transfer title to the property in exchange for the cancellation of the debt secured by the property.

NOW, THEREFORE, in consideration of the mutual promises contained herein, the parties agree as follows:

- Grantor hereby conveys and transfers to Grantee all rights, title, and interest in the property.

- This deed is given in lieu of foreclosure and is accepted by Grantee as full satisfaction of the obligations under the Loan.

- The Grantee shall assume possession of the property upon execution of this deed.

- Grantor warrants that there are no liens or encumbrances on the property, except as already disclosed.

This deed shall be recorded in the appropriate county in Georgia as required by law.

IN WITNESS WHEREOF, Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor Signature: ___________________________

Date: ______________________

Grantee Signature: __________________________

Date: ______________________

Witnessed by:

______________________ (Witness Signature) Date: ___________

______________________ (Witness Printed Name)

Notarization:

State of Georgia, County of _______________

Subscribed and sworn to before me this ____ day of __________, 20___.

__________________________ (Notary Public)

My Commission Expires: ___________

Popular Deed in Lieu of Foreclosure State Templates

California Property Transfer Deed - Both parties will need to negotiate the terms to ensure a smooth transition and resolution.

When engaging in the sale of a motorcycle in Texas, it's essential to utilize the appropriate documentation, specifically the Texas Motorcycle Bill of Sale form. This form not only captures vital details regarding the transaction but also provides legal protection for both parties involved. To ensure you have the correct version of this important document, you can visit autobillofsaleform.com/motorcycle-bill-of-sale-form/texas-motorcycle-bill-of-sale-form/ which offers a comprehensive template.

Sample Deed in Lieu of Foreclosure - This option allows homeowners to regain control during a difficult financial time.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Georgia, several other forms and documents may also be necessary. These documents help clarify the process and ensure that all parties are informed and protected. Below is a list of commonly used forms that may accompany the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes made to the original loan terms. It may include adjusted interest rates or payment schedules.

- Notice of Default: This form notifies the borrower that they have defaulted on their loan payments. It serves as a formal warning before further action is taken.

- Release of Liability: This document releases the borrower from any further obligations related to the loan once the Deed in Lieu is executed.

- Georgia WC-100 form - Essential for initiating mediation for workers' compensation claims; find more information about it here: https://georgiapdf.com/.

- Property Condition Disclosure Statement: This form requires the borrower to disclose the condition of the property, including any known issues or defects.

- Agreement to Vacate: This document outlines the terms under which the borrower agrees to vacate the property after the Deed in Lieu is executed.

- Power of Attorney: This form allows one party to act on behalf of another in legal matters, including the signing of the Deed in Lieu.

- Settlement Statement: This document provides a detailed account of all financial transactions related to the Deed in Lieu, including any fees or costs incurred.

- Title Search Report: This report verifies the ownership of the property and identifies any liens or encumbrances that may affect the transfer.

- Affidavit of Title: This sworn statement confirms that the seller has the right to transfer the property and that there are no undisclosed claims against it.

- IRS Form 1099-C: This form is used to report cancellation of debt to the IRS. It may be necessary if the lender forgives a portion of the loan.

Each of these documents plays a role in the process of executing a Deed in Lieu of Foreclosure. Understanding their purpose can help ensure a smoother transaction for all parties involved.

Similar forms

A short sale is a process where a homeowner sells their property for less than the amount owed on the mortgage. Similar to a deed in lieu of foreclosure, a short sale allows the homeowner to avoid foreclosure proceedings. In both scenarios, the lender agrees to accept a loss on the loan, which can mitigate the impact on the homeowner’s credit score. However, a short sale involves selling the property to a third party, while a deed in lieu transfers ownership directly to the lender.

A mortgage modification is another document that bears similarities to a deed in lieu of foreclosure. In a mortgage modification, the lender and borrower agree to change the terms of the existing mortgage to make payments more manageable. Like a deed in lieu, this option is often pursued to prevent foreclosure. Both processes aim to find a solution that benefits both the homeowner and the lender, although a mortgage modification keeps the homeowner in the property, while a deed in lieu results in the homeowner vacating the premises.

Another related document is a forbearance agreement. This is an arrangement between the lender and borrower that temporarily suspends or reduces mortgage payments. This option helps homeowners who are facing financial difficulties but expect to regain their ability to pay. While both a forbearance agreement and a deed in lieu of foreclosure are designed to avoid foreclosure, the former allows the homeowner to remain in the property for a period, whereas the latter leads to the transfer of ownership to the lender.

The Connecticut Mobile Home Bill of Sale form is essential in facilitating the transition of ownership for mobile homes, ensuring that both parties are aware of their rights and responsibilities during the process. By utilizing this form, individuals can streamline transactions and avoid potential disputes. For further clarity on this important document, you can refer to the Mobile Home Bill of Sale, which provides a comprehensive template for those looking to complete a sale effectively.

Finally, a bankruptcy filing can also be compared to a deed in lieu of foreclosure. In a bankruptcy, individuals may seek relief from their debts, which can include their mortgage. This legal process can halt foreclosure proceedings temporarily. Both options serve as methods to address financial distress, but bankruptcy is a more comprehensive legal remedy that affects all debts, while a deed in lieu specifically addresses the mortgage issue without involving the broader bankruptcy process.

Dos and Don'ts

When filling out the Georgia Deed in Lieu of Foreclosure form, it’s important to approach the process carefully. Here are some key things to keep in mind:

- Do ensure that all property information is accurate and up to date.

- Don't rush through the form; take your time to avoid mistakes.

- Do consult with a legal professional if you have any questions about the process.

- Don't forget to include all necessary signatures from all parties involved.

- Do provide a clear description of the property being transferred.

- Don't overlook any required documentation that needs to accompany the form.

- Do keep copies of the completed form for your records.

- Don't submit the form without verifying that all information is correct.

Key takeaways

Filling out and using the Georgia Deed in Lieu of Foreclosure form can be a significant step for homeowners facing financial difficulties. Here are key takeaways to consider:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer ownership of the property to the lender, helping avoid the foreclosure process.

- Eligibility Requirements: Not all homeowners qualify. Ensure you meet the lender's criteria, which may include being in default on your mortgage.

- Consult a Professional: It is wise to seek legal advice or consult with a housing counselor before proceeding. They can help you understand your rights and options.

- Gather Necessary Documentation: Prepare relevant documents such as your mortgage agreement, proof of income, and any correspondence with the lender.

- Negotiate with the Lender: Open a dialogue with your lender. Discuss the possibility of a Deed in Lieu and any potential impacts on your credit.

- Complete the Form Accurately: Fill out the Deed in Lieu of Foreclosure form carefully. Ensure all information is correct to avoid delays.

- Sign in the Presence of a Notary: Sign the completed form in front of a notary public. This step is crucial for the document to be legally binding.

- Keep Copies: After signing, retain copies of the executed deed and any related documents for your records.

- Understand Tax Implications: Be aware that transferring your property may have tax consequences. Consult a tax professional for guidance.

By following these key takeaways, you can navigate the process of using a Deed in Lieu of Foreclosure with greater confidence and clarity.

How to Use Georgia Deed in Lieu of Foreclosure

After completing the Georgia Deed in Lieu of Foreclosure form, the next step involves submitting the document to the appropriate parties, typically the lender and the county clerk. It’s essential to ensure that all necessary signatures are in place and that the form is filed correctly to avoid any potential issues.

- Begin by downloading the Georgia Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the name of the borrower(s) in the designated section at the top of the form.

- Provide the property address, including the street number, street name, city, and zip code.

- Enter the legal description of the property. This information can usually be found on the property deed or tax records.

- Include the lender’s name and address in the appropriate fields.

- Clearly state the date of the deed execution.

- Both the borrower(s) and the lender must sign the form. Ensure that all signatures are notarized to validate the document.

- Make copies of the completed form for your records before submitting it.

- Submit the original signed form to the lender and file a copy with the county clerk's office.