Free Deed Template for Georgia State

The Georgia Deed form serves as a critical document in real estate transactions, facilitating the transfer of property ownership from one party to another. This form encompasses essential details such as the names of the grantor and grantee, a legal description of the property, and the consideration or payment involved in the transaction. It is important to note that the Georgia Deed can take various forms, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving distinct purposes and offering different levels of protection to the parties involved. Additionally, the execution of the deed requires the signature of the grantor, and in many cases, the presence of a notary public to ensure its validity. Recording the deed with the county clerk’s office is a necessary step, as it provides public notice of the transfer and protects the rights of the new owner. Understanding the nuances of the Georgia Deed form is vital for anyone engaged in real estate transactions within the state, as it lays the groundwork for a legally binding transfer of property rights.

Common mistakes

-

Incorrect Names: One common mistake is failing to use the full legal names of the parties involved. Nicknames or abbreviations can lead to confusion and potential legal issues.

-

Missing Signatures: All parties must sign the deed. Forgetting to include a signature can invalidate the document, causing delays in the transfer process.

-

Improper Notarization: Deeds must be notarized to be legally binding. If the notarization is incomplete or done incorrectly, the deed may not be accepted.

-

Incorrect Property Description: Providing an inaccurate description of the property can lead to disputes. Ensure that the legal description matches what is on the property deed records.

-

Failure to Include Consideration: The deed should state the consideration, or value, exchanged for the property. Omitting this can create ambiguity regarding the transaction.

-

Not Using the Correct Deed Type: Different types of deeds serve different purposes. Using the wrong type can affect the rights and responsibilities of the parties involved.

-

Ignoring Local Laws: Each county may have specific requirements for deeds. Ignoring local regulations can result in the deed being rejected.

-

Failure to Record the Deed: After filling out the deed, it must be recorded with the county clerk's office. Failing to do so may leave the property transfer unprotected against future claims.

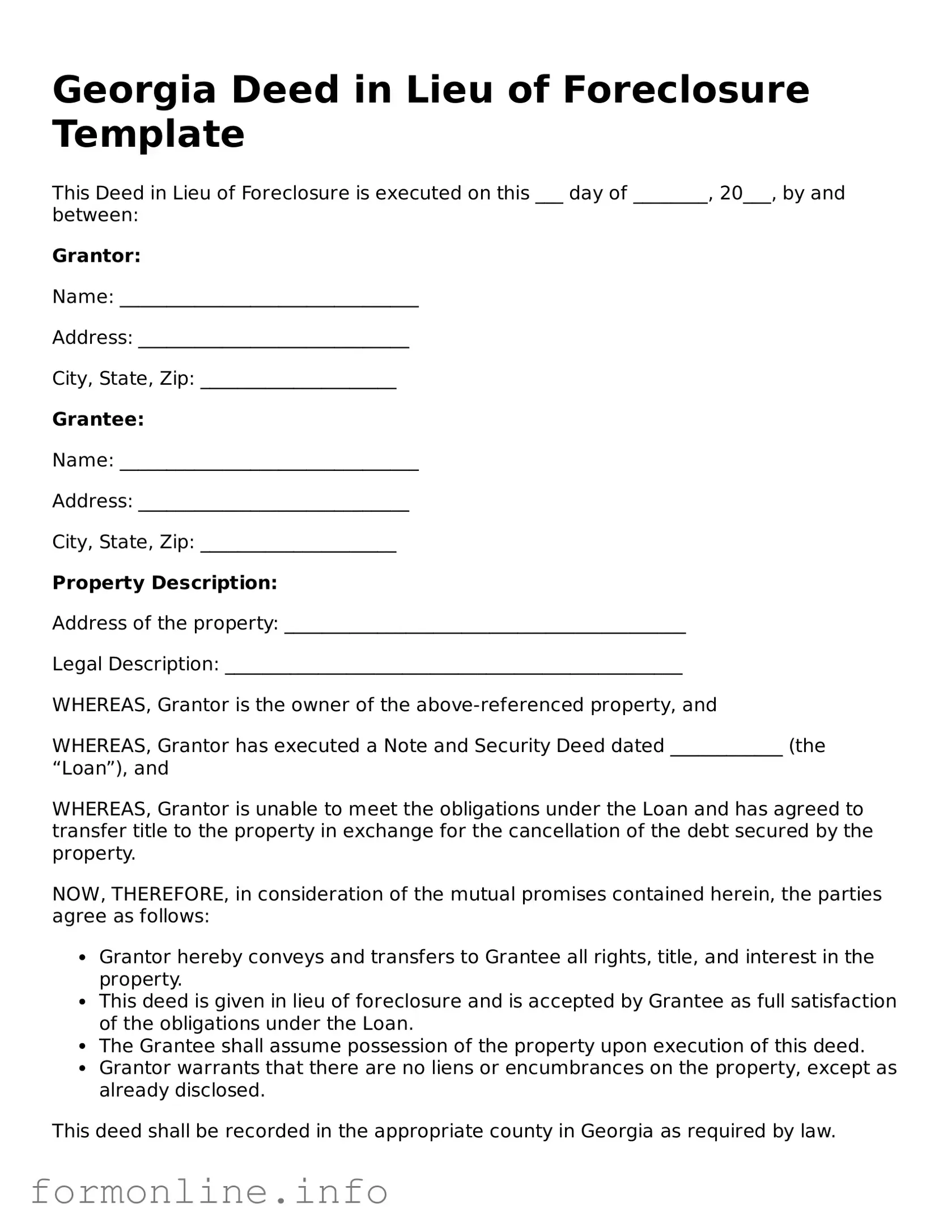

Preview - Georgia Deed Form

Georgia General Warranty Deed

This General Warranty Deed is made this ___ day of __________, 20__, by and between:

Grantor: ____________________________________ (Name of Grantor)

Address: ____________________________________ (Address of Grantor)

and

Grantee: ____________________________________ (Name of Grantee)

Address: ____________________________________ (Address of Grantee)

For and in consideration of the sum of $___________________ (Amount), the Grantor does hereby grant, bargain, sell, and convey unto the Grantee the following described property situated in ______________ County, Georgia:

Property Description:

___________________________________________________________________________

___________________________________________________________________________

The Grantor warrants that the Grantor is lawfully seized in fee simple of the above-described property and that the property is free from all encumbrances except as noted herein. The Grantor covenants to defend the title against all claims and demands.

In witness whereof, the parties hereto have executed this Deed on the day and year first above written.

Grantor Signature: _______________________________

Grantor Printed Name: ___________________________

Date: _____________________________________________

Grantee Signature: _______________________________

Grantee Printed Name: ___________________________

Date: _____________________________________________

Signed, sealed, and delivered in the presence of:

- Witness Signature: _______________________________

- Witness Printed Name: ___________________________

This Deed must be recorded in the office of the Clerk of Superior Court of ______________ County.

Prepared by: ______________________________________ (Name of Preparer)

Popular Deed State Templates

Florida Deed Form - Always consult a legal expert when preparing a Deed to avoid pitfalls.

To ensure a smooth hiring process, employers often require an Employment Verification form to establish a candidate's previous work experience. Alongside this document, it is equally important to have a Letter of Income Comfirmation to provide insights into the financial aspects of the employee's past roles. Together, these resources help facilitate a comprehensive and accurate verification of an applicant's background.

Documents used along the form

When transferring property in Georgia, the Deed form is just one piece of the puzzle. Several other documents often accompany it to ensure a smooth transaction. Understanding these forms can help clarify the process and protect the interests of all parties involved.

- Affidavit of Title: This document serves as a sworn statement by the seller, confirming their ownership of the property and that there are no undisclosed liens or encumbrances. It provides assurance to the buyer regarding the seller's right to transfer the property.

- Property Disclosure Statement: Required in many real estate transactions, this statement outlines any known issues with the property, such as structural problems or environmental hazards. It is designed to inform the buyer of any potential concerns before the sale is finalized.

- Motor Vehicle Bill of Sale: This document serves as proof of the sale and transfer of ownership for a vehicle, detailing essential information about the vehicle and parties involved; ensure you have the necessary Motor Vehicle Bill of Sale form completed for a smooth transaction.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document itemizes all costs associated with the sale, including fees, taxes, and the final sale price. It provides transparency for both the buyer and seller regarding the financial aspects of the transaction.

- Title Insurance Policy: This policy protects the buyer and lender from potential disputes over property ownership. It covers legal fees and other costs that may arise if a claim is made against the title after the sale.

Each of these documents plays a crucial role in the property transfer process in Georgia. Being familiar with them can help ensure that all legal requirements are met and that the transaction proceeds without complications.

Similar forms

The Georgia Deed form shares similarities with a Quitclaim Deed. Both documents transfer ownership of real estate, but they do so in different ways. A Quitclaim Deed conveys whatever interest the grantor has in the property without making any guarantees about the title's validity. This means that if the grantor has no legal claim to the property, the grantee receives nothing. In contrast, the Georgia Deed form typically offers more assurance regarding the title, making it a more secure option for buyers who want to ensure their ownership rights are protected.

Understanding the nuances of various property transfer documents is crucial for both buyers and sellers. For example, the Georgia Deed serves to assure buyers of clear title, while the Quitclaim Deed transfers any interest without warranties, posing more risks. To navigate these complexities, utilizing resources such as the Top Forms Online can provide essential guidance and clarity on necessary forms and details involved in real estate transactions.

Another document that resembles the Georgia Deed form is the Warranty Deed. Like the Georgia Deed, a Warranty Deed transfers property ownership, but it also includes a guarantee from the seller that they hold clear title to the property. This means the seller is legally responsible for any claims against the title. In essence, while both documents serve to transfer ownership, the Warranty Deed provides an added layer of protection for the buyer, ensuring that they are acquiring a property free from legal disputes.

The Bargain and Sale Deed is also similar to the Georgia Deed form. This type of deed conveys property ownership but does not include warranties about the title. It implies that the seller has the right to sell the property, but it does not guarantee that the title is free from defects. While both the Bargain and Sale Deed and the Georgia Deed facilitate the transfer of ownership, the former leaves the buyer with less security regarding the property's title, which can be a significant consideration for potential buyers.

A Special Purpose Deed is another document that bears resemblance to the Georgia Deed form. This type of deed is used for specific transactions, such as transferring property from a corporation to an individual or vice versa. While the Georgia Deed form is more general in its application, both documents serve the purpose of transferring ownership. However, the Special Purpose Deed often comes with unique stipulations and conditions tailored to the specific circumstances of the transaction, making it distinct in its use.

Lastly, the Personal Representative Deed is akin to the Georgia Deed form in that it transfers property after the death of an owner. This deed is used by an executor or administrator of an estate to convey property to heirs or beneficiaries. While the Georgia Deed form is typically used for regular transactions, the Personal Representative Deed addresses the nuances of estate law. Both documents serve the essential function of transferring ownership but do so in different contexts, reflecting the specific legal requirements of estate management.

Dos and Don'ts

When filling out the Georgia Deed form, it's important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check the names of all parties involved. Ensure they are spelled correctly and match official documents.

- Do provide a clear and accurate description of the property. Include any relevant details that define the boundaries.

- Do sign the deed in the presence of a notary public. This step is crucial for the document's validity.

- Do keep a copy of the completed deed for your records. This can be useful for future reference.

- Do file the deed with the appropriate county office promptly. This ensures the transfer is officially recorded.

- Don't leave any sections of the form blank. Incomplete forms can lead to delays or rejection.

- Don't use abbreviations or shorthand. Write everything out clearly to avoid confusion.

- Don't forget to check local requirements. Some counties may have additional rules or forms.

- Don't rush through the process. Take your time to review each detail carefully.

Key takeaways

When filling out and using the Georgia Deed form, keep these key points in mind:

- Understand the Types of Deeds: Familiarize yourself with different types of deeds available in Georgia, such as warranty deeds and quitclaim deeds, as they serve different purposes.

- Complete All Required Fields: Ensure that all necessary information is filled out accurately, including the names of the grantor and grantee, property description, and consideration amount.

- Signatures Are Essential: The deed must be signed by the grantor. In some cases, notarization may also be required to validate the document.

- File with the County Clerk: After completing the deed, file it with the appropriate county clerk's office to make the transfer official and to ensure public record.

How to Use Georgia Deed

Once you have the Georgia Deed form in hand, the next step is to carefully fill it out with the required information. This process involves providing details about the property, the parties involved, and ensuring that everything is accurate to avoid any issues later on. Follow these steps to complete the form properly.

- Begin by writing the date at the top of the form.

- Identify the grantor (the person transferring the property). Fill in their full name and address.

- Next, identify the grantee (the person receiving the property). Include their full name and address as well.

- Provide a legal description of the property. This may include the lot number, block number, or other identifying information. You may need to refer to previous documents or property records for accuracy.

- Indicate the consideration (the amount of money or value exchanged for the property). This is often a nominal amount, such as $10, unless a larger sum is applicable.

- Include any special provisions or conditions, if applicable. This may involve restrictions or requirements that affect the property.

- Sign the form where indicated. The grantor must sign, and it may need to be notarized.

- Ensure that all parties involved have reviewed the form for accuracy before submitting it.

- Finally, file the completed deed with the appropriate county office to make it official.