Free General Power of Attorney Template for Georgia State

The Georgia General Power of Attorney form is a vital legal document that grants an individual, known as the agent or attorney-in-fact, the authority to act on behalf of another person, referred to as the principal, in a variety of financial and legal matters. This form is particularly useful for those who may be unable to manage their affairs due to health issues, travel, or other circumstances that may limit their capacity to make decisions. The powers conferred through this document can include managing bank accounts, signing checks, handling real estate transactions, and dealing with tax matters, among others. Importantly, the General Power of Attorney can be tailored to suit specific needs, allowing the principal to define the scope of authority granted to the agent. While this form is powerful, it is essential to understand that it can be revoked at any time, as long as the principal is mentally competent. Additionally, the document must be properly executed, which typically involves signing in the presence of a notary public. Understanding the implications of granting such authority is crucial, as it involves entrusting another person with significant control over one’s financial and legal decisions.

Common mistakes

-

Not specifying the powers granted: Individuals often fail to clearly outline the specific powers they wish to grant to their agent. This can lead to confusion and potential disputes.

-

Leaving out the agent's contact information: Some people neglect to include the full name, address, and phone number of the agent. This information is essential for identification and communication purposes.

-

Failing to date the document: A common oversight is not dating the form. Without a date, it can be challenging to determine the validity of the power of attorney.

-

Not signing in the correct location: Many individuals do not sign where indicated. Signatures should be placed in the designated area to ensure the document is legally binding.

-

Ignoring witness requirements: Georgia law requires that the General Power of Attorney form be signed in the presence of a witness. Failing to have a witness can invalidate the document.

-

Not using a notary public: While not always required, having the document notarized can enhance its legitimacy. Some individuals overlook this step, which can lead to complications.

-

Overlooking the agent's acceptance: It is important to ensure that the agent understands their responsibilities. Some people forget to confirm the agent's acceptance of the role.

-

Failing to review state-specific requirements: Each state may have different laws governing powers of attorney. Individuals sometimes do not check Georgia's specific requirements, leading to errors.

-

Using outdated forms: Some individuals use old versions of the power of attorney form. It is crucial to use the most current version to avoid issues.

-

Not considering alternative agents: People often name only one agent without considering a backup. Designating an alternate can help ensure that someone is always available to act on their behalf.

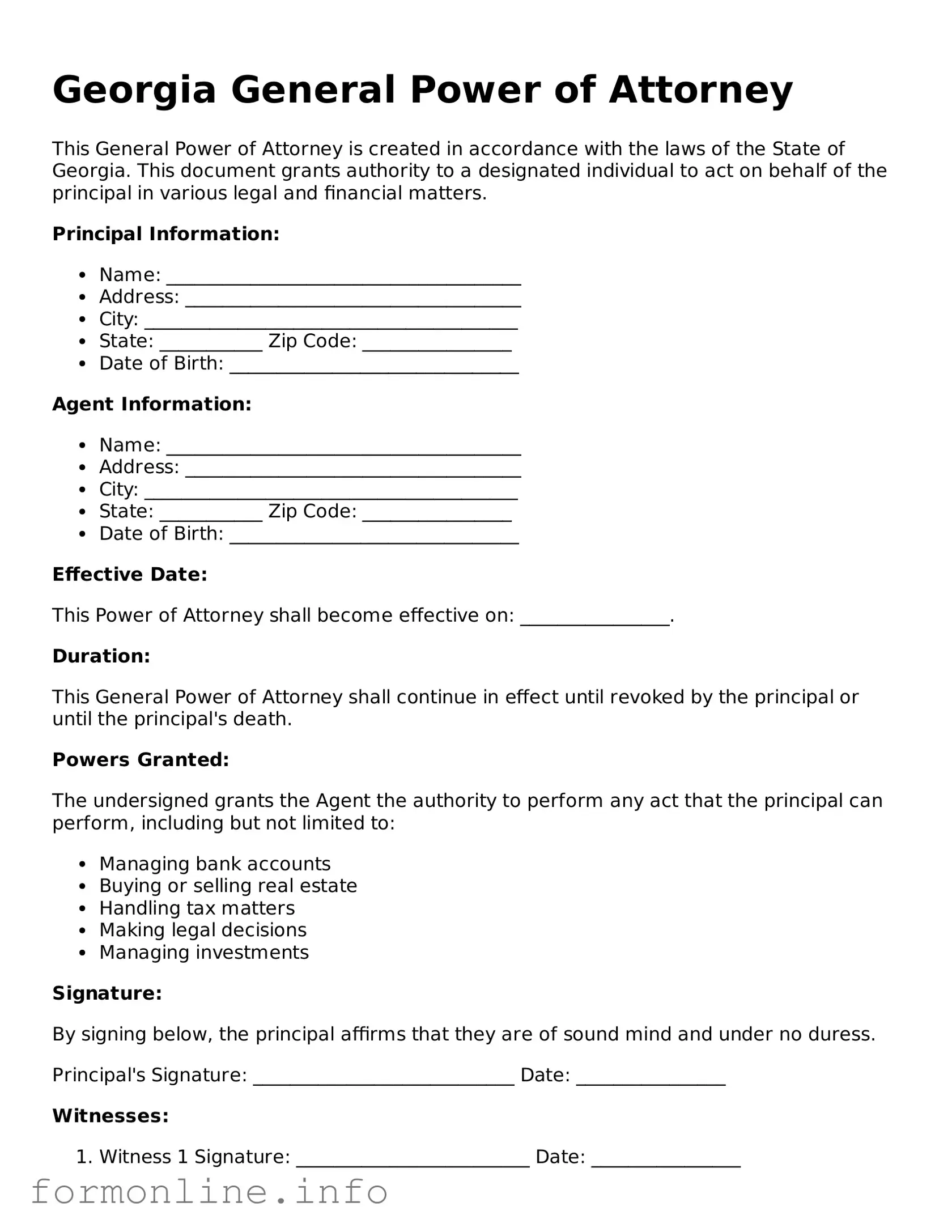

Preview - Georgia General Power of Attorney Form

Georgia General Power of Attorney

This General Power of Attorney is created in accordance with the laws of the State of Georgia. This document grants authority to a designated individual to act on behalf of the principal in various legal and financial matters.

Principal Information:

- Name: ______________________________________

- Address: ____________________________________

- City: ________________________________________

- State: ___________ Zip Code: ________________

- Date of Birth: _______________________________

Agent Information:

- Name: ______________________________________

- Address: ____________________________________

- City: ________________________________________

- State: ___________ Zip Code: ________________

- Date of Birth: _______________________________

Effective Date:

This Power of Attorney shall become effective on: ________________.

Duration:

This General Power of Attorney shall continue in effect until revoked by the principal or until the principal's death.

Powers Granted:

The undersigned grants the Agent the authority to perform any act that the principal can perform, including but not limited to:

- Managing bank accounts

- Buying or selling real estate

- Handling tax matters

- Making legal decisions

- Managing investments

Signature:

By signing below, the principal affirms that they are of sound mind and under no duress.

Principal's Signature: ____________________________ Date: ________________

Witnesses:

- Witness 1 Signature: _________________________ Date: ________________

- Witness 2 Signature: _________________________ Date: ________________

Notary Public:

State of Georgia, County of ________________

Subscribed and sworn to before me this ________ day of ______________, 20____.

Notary Public Signature: ________________________

My Commission Expires: ________________________

Popular General Power of Attorney State Templates

Free Durable Power of Attorney Form Florida - This form is often part of a broader estate planning strategy to safeguard your wishes.

When dealing with the sale or purchase of a trailer, it's crucial to have a properly completed Trailer Bill of Sale form, as it provides a clear record of the transaction. This form, which includes essential information such as the purchase price and details about the trailer, ensures that both parties understand the terms of the sale. For more information on how to obtain this document, you can visit autobillofsaleform.com/trailer-bill-of-sale-form/, which offers useful resources and templates to streamline the process.

Power of Attorney Template California - With a General Power of Attorney, you can appoint a trusted person to make decisions for you.

Documents used along the form

When preparing a Georgia General Power of Attorney, several other forms and documents may also be needed to ensure comprehensive legal coverage. Each of these documents serves a specific purpose and can help clarify the powers granted or address related matters. Below is a list of common forms that are often used alongside the General Power of Attorney.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It ensures that the agent can continue to act on behalf of the principal without interruption.

- Advance Healthcare Directive: This form allows individuals to specify their healthcare preferences in case they become unable to communicate those wishes themselves. It often includes a living will and a healthcare power of attorney.

- Financial Power of Attorney: Similar to a General Power of Attorney, this document specifically focuses on financial matters, allowing the agent to manage the principal's financial affairs.

- Revocation of Power of Attorney: If the principal decides to cancel a previously granted power of attorney, this document formally revokes the authority given to the agent.

- Lease Agreement Form: A New York Lease Agreement form is essential for defining the terms of renting property, which can be found at nypdfforms.com.

- Property Management Agreement: This agreement outlines the responsibilities of an agent managing real estate or other property on behalf of the principal, detailing terms and conditions for property management.

- Trust Agreement: If the principal has established a trust, this document outlines how the trust operates, including the roles of the trustee and beneficiaries. It may work in conjunction with a power of attorney.

- Will: While not directly related to the power of attorney, a will is essential for outlining how a person’s assets should be distributed upon their death. It complements the power of attorney by addressing end-of-life decisions.

Understanding these documents can help individuals make informed decisions when establishing a General Power of Attorney. Each form plays a crucial role in ensuring that personal, financial, and healthcare matters are managed according to the principal's wishes. It's important to consider each document's purpose and how they work together to provide a comprehensive plan.

Similar forms

The Durable Power of Attorney is similar to the General Power of Attorney but includes an important distinction. A Durable Power of Attorney remains effective even if the principal becomes incapacitated. This means that the appointed agent can continue to make decisions on behalf of the principal when they are unable to do so themselves. This feature makes it a critical document for long-term planning.

The Medical Power of Attorney allows an individual to designate someone to make healthcare decisions on their behalf. Like the General Power of Attorney, it grants authority to an agent; however, it is specifically focused on medical matters. This document is essential for ensuring that medical preferences are honored when the principal cannot communicate their wishes.

The Limited Power of Attorney grants authority to an agent for specific tasks or a limited period. This document is similar to the General Power of Attorney but restricts the agent’s powers to defined actions, such as managing a real estate transaction. This specificity can be beneficial when the principal wants to maintain control over broader decisions.

The Springing Power of Attorney only becomes effective under certain conditions, typically when the principal becomes incapacitated. This is akin to the General Power of Attorney, but the key difference lies in the timing of its activation. It provides peace of mind by ensuring that authority is only granted when necessary.

The Financial Power of Attorney is focused on financial matters, allowing an agent to manage the principal's financial affairs. While similar to the General Power of Attorney, it specifically addresses banking, investments, and property management. This document is crucial for individuals who want to ensure their financial interests are protected when they cannot manage them personally.

The Real Estate Power of Attorney is tailored for transactions involving real property. It allows an agent to act on behalf of the principal in buying, selling, or managing real estate. Similar to the General Power of Attorney, it grants authority but is limited to real estate matters, providing clarity and focus for property-related decisions.

The Child Power of Attorney permits a parent or guardian to designate someone to make decisions for their child. This document is similar to the General Power of Attorney in that it grants authority to an agent. However, it is specifically designed for the care and welfare of a minor, ensuring that the child’s needs are met when the parent cannot be present.

In the context of transferring ownership of various properties, understanding the significance of the necessary documentation is crucial. The Texas Mobile Home Bill of Sale form is particularly important for mobile homes, ensuring that all details regarding the transaction are clearly outlined. For those interested in learning more or needing access to this essential document, visit Mobile Home Bill of Sale.

The Financial Durable Power of Attorney combines elements of durability with financial authority. It remains effective even if the principal becomes incapacitated, similar to the Durable Power of Attorney. However, it is specifically geared toward managing financial matters, ensuring that the principal's financial interests are safeguarded during incapacity.

The Healthcare Proxy is closely related to the Medical Power of Attorney. It allows an individual to appoint someone to make healthcare decisions when they are unable to do so. While both documents serve similar purposes, the Healthcare Proxy may be more focused on end-of-life decisions and medical treatment preferences, providing a specific framework for health-related choices.

Finally, the Revocation of Power of Attorney document allows the principal to cancel a previously granted Power of Attorney. This document is essential for maintaining control over who has authority to act on one’s behalf. It is similar to the General Power of Attorney in that it directly affects the powers previously granted, ensuring that the principal can revoke authority as needed.

Dos and Don'ts

When filling out the Georgia General Power of Attorney form, it's essential to follow certain guidelines to ensure the document is valid and meets your needs. Here are some things to do and avoid:

- Do ensure that you understand the powers you are granting. Make sure the agent can act on your behalf in the specific areas you need.

- Do clearly identify yourself and your agent. Include full names and addresses to avoid any confusion.

- Do sign the document in front of a notary public. This step is crucial for the form's legality.

- Do keep a copy of the signed document for your records. This can be important for future reference.

- Don't rush through the form. Take your time to ensure all information is accurate and complete.

- Don't give your agent unlimited powers without careful consideration. Specify the limitations if necessary.

- Don't forget to review the form periodically. Changes in your life may require updates to the document.

- Don't assume that a verbal agreement is enough. Always have a written and notarized document.

Key takeaways

Filling out and using the Georgia General Power of Attorney form is an important step in managing your affairs. Here are some key takeaways to keep in mind:

- Understand the Purpose: This form allows you to appoint someone to act on your behalf in financial and legal matters.

- Choose Your Agent Wisely: Select a trustworthy person, as they will have significant authority over your decisions.

- Be Specific: Clearly outline the powers you are granting to your agent to avoid confusion later.

- Consider Limitations: You can limit the powers granted or set a specific duration for the authority.

- Sign in Front of a Notary: The form must be signed in the presence of a notary public to be valid.

- Keep Copies: After completing the form, make copies for both yourself and your agent.

- Review Regularly: Periodically review the document to ensure it still meets your needs and reflects your wishes.

- Know the Revocation Process: If you need to revoke the power of attorney, you can do so at any time by notifying your agent and any institutions involved.

- Consult a Professional: If you have questions or complex situations, consider seeking legal advice to ensure everything is in order.

Using the Georgia General Power of Attorney form effectively can help manage your affairs smoothly and provide peace of mind.

How to Use Georgia General Power of Attorney

After obtaining the Georgia General Power of Attorney form, you will need to complete it carefully. The form requires specific information about both the principal (the person granting the power) and the agent (the person receiving the power). Follow the steps below to ensure that the form is filled out correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the principal. This is the individual who is granting the authority.

- Next, enter the full name and address of the agent. This person will have the authority to act on behalf of the principal.

- Specify the powers being granted. You may choose to give general powers or limit the powers to specific areas, such as financial matters or healthcare decisions.

- Include any additional instructions or limitations if necessary. This can clarify the extent of the agent's authority.

- Sign and date the form. The principal must sign the document to make it valid.

- Have the form notarized. A notary public must witness the signing to ensure that it is legally binding.

- Provide copies of the completed form to the agent and any relevant institutions, such as banks or healthcare providers.