Free Gift Deed Template for Georgia State

The Georgia Gift Deed form serves as a crucial legal document that facilitates the transfer of property without the exchange of monetary compensation. This form is primarily used when an individual wishes to give a piece of real estate to another person, often a family member or friend, as a gesture of goodwill. The document outlines essential details such as the identities of the giver and recipient, a clear description of the property being transferred, and any specific conditions attached to the gift. In Georgia, it is important for the Gift Deed to be properly executed and notarized to ensure its validity and enforceability. This form not only simplifies the process of property transfer but also helps in avoiding potential disputes in the future. Understanding the nuances of the Gift Deed can be beneficial for both donors and recipients, as it provides clarity on ownership and the intentions behind the gift. Additionally, the implications of tax responsibilities and potential legal ramifications should be considered, making it essential for parties involved to be well-informed before proceeding with this type of transaction.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required information on the Gift Deed form. This includes not listing the full names and addresses of both the donor and the recipient. Ensure that all fields are filled out completely to avoid delays or rejections.

-

Improper Signatures: The form must be signed correctly. Often, individuals neglect to have the signatures notarized, which is a requirement for the deed to be legally binding. Without proper notarization, the document may not be recognized by the state.

-

Incorrect Property Description: Another frequent error is providing an inaccurate or vague description of the property being gifted. It’s crucial to include the complete legal description of the property, as this ensures clarity and avoids potential disputes in the future.

-

Failure to Record the Deed: After completing the Gift Deed, some individuals forget to record it with the county clerk's office. Recording the deed is essential for it to be valid against third parties and to protect the recipient's ownership rights.

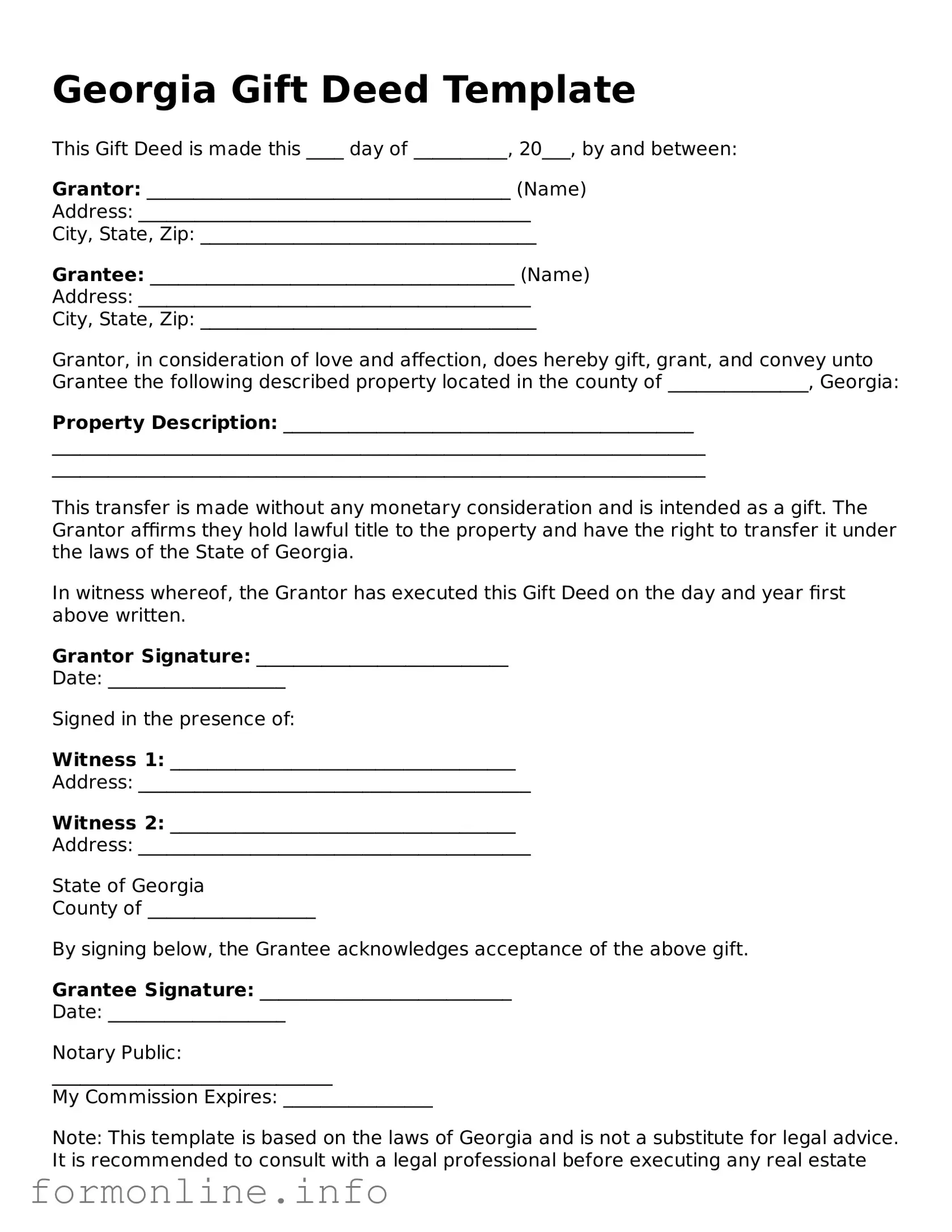

Preview - Georgia Gift Deed Form

Georgia Gift Deed Template

This Gift Deed is made this ____ day of __________, 20___, by and between:

Grantor: _______________________________________ (Name)

Address: __________________________________________

City, State, Zip: ____________________________________

Grantee: _______________________________________ (Name)

Address: __________________________________________

City, State, Zip: ____________________________________

Grantor, in consideration of love and affection, does hereby gift, grant, and convey unto Grantee the following described property located in the county of _______________, Georgia:

Property Description: ____________________________________________

______________________________________________________________________

______________________________________________________________________

This transfer is made without any monetary consideration and is intended as a gift. The Grantor affirms they hold lawful title to the property and have the right to transfer it under the laws of the State of Georgia.

In witness whereof, the Grantor has executed this Gift Deed on the day and year first above written.

Grantor Signature: ___________________________

Date: ___________________

Signed in the presence of:

Witness 1: _____________________________________

Address: __________________________________________

Witness 2: _____________________________________

Address: __________________________________________

State of Georgia

County of __________________

By signing below, the Grantee acknowledges acceptance of the above gift.

Grantee Signature: ___________________________

Date: ___________________

Notary Public:

______________________________

My Commission Expires: ________________

Note: This template is based on the laws of Georgia and is not a substitute for legal advice. It is recommended to consult with a legal professional before executing any real estate transfer documentation.

Popular Gift Deed State Templates

Transfer Deed to Family Member - The value of the gift may be subject to gift tax regulations under federal law.

The process of transferring ownership of a mobile home can be streamlined by using the proper documentation, such as the Ohio Mobile Home Bill of Sale. This legal form not only contains critical information about the buyer and seller but also includes the mobile home's description and the sale price. For clarity and to avoid any ambiguities in the transfer, it is advisable to ensure this document is filled out accurately. You can find a template for the necessary documentation at Mobile Home Bill of Sale.

Documents used along the form

The Georgia Gift Deed form is commonly used in property transactions where a property owner wishes to transfer ownership of real estate as a gift. Alongside this form, several other documents may be necessary to ensure a smooth transfer and to comply with legal requirements. Below is a list of additional forms and documents frequently associated with the Georgia Gift Deed.

- Quitclaim Deed: This document transfers ownership of property without guaranteeing that the title is clear. It is often used in informal transfers, such as between family members.

- Warranty Deed: Unlike a quitclaim deed, a warranty deed provides a guarantee that the grantor holds clear title to the property. It offers protection to the grantee against any claims to the property.

- Affidavit of Value: This sworn statement provides information about the value of the property being gifted. It may be required for tax purposes or to establish fair market value.

- Property Tax Exemption Application: If the gifted property qualifies for any exemptions, this application may be necessary to ensure that the new owner receives the appropriate tax benefits.

- Limited Liability Company Agreement: When forming an LLC, it's essential to have a Limited Liability Company Agreement in place to outline the financial and operational guidelines for the business.

- Title Search Report: This report confirms the current ownership and any liens or encumbrances on the property. It is crucial for verifying that the property can be transferred without issues.

- Gift Tax Return (Form 709): This form is required by the IRS if the value of the gift exceeds a certain threshold. It documents the transfer for tax purposes and ensures compliance with federal tax laws.

Each of these documents plays a vital role in the process of transferring property ownership through a gift deed. It is essential to understand their functions and requirements to facilitate a successful transaction.

Similar forms

A Quitclaim Deed is similar to a Gift Deed in that both documents transfer ownership of property without any guarantee of clear title. In a Quitclaim Deed, the grantor relinquishes any claim they may have to the property, but they do not warrant that they own it free and clear. This means that if there are any liens or other claims against the property, the grantee may inherit those issues. Like a Gift Deed, a Quitclaim Deed is often used in situations where the transfer is between family members or close friends, making it a straightforward option for informal property transfers.

The Texas Bill of Sale form is a legal document that records the details of a transaction between a seller and a buyer, specifically the sale and transfer of personal property. It serves as proof of purchase and can be vital for personal records or legal requirements. This form is widely used in Texas for various transactions, including the sale of vehicles, boats, and other valuable items. For more information on how to properly execute this important document, you can find the document here.

A Warranty Deed differs from a Gift Deed primarily in the level of protection it offers to the grantee. With a Warranty Deed, the grantor guarantees that they hold clear title to the property and have the right to sell it. This assurance provides the buyer with a degree of security that is absent in a Gift Deed. However, both documents serve the purpose of transferring ownership; the key difference lies in the assurances provided regarding the property’s title. In cases where a person is gifting property, a Warranty Deed could be used instead of a Gift Deed if the grantor wishes to offer those guarantees.

Finally, a Special Purpose Deed is akin to a Gift Deed in that it is often used for specific transactions, such as transferring property for a particular purpose or under certain conditions. Special Purpose Deeds can be utilized for various reasons, including transferring property to a trust or for tax purposes. Like a Gift Deed, these documents may not require the same level of scrutiny regarding the title, depending on the intent behind the transfer. While the context may vary, both types of deeds serve to convey ownership and can simplify the process of property transfer in unique situations.

Dos and Don'ts

When filling out the Georgia Gift Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of what to do and what to avoid.

- Do double-check all names and addresses for accuracy.

- Do include a clear description of the property being gifted.

- Do sign the form in the presence of a notary public.

- Do provide the correct date of the gift.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; fill out all required sections.

- Don't use unclear or vague language when describing the property.

- Don't forget to have all parties involved sign the document.

- Don't submit the form without proper notarization.

- Don't overlook any local regulations that may apply to the deed.

Key takeaways

When filling out and using the Georgia Gift Deed form, consider the following key takeaways:

- Understand the purpose: A Gift Deed transfers property without any exchange of money. It is essential to recognize that this is a gift, not a sale.

- Identify the parties: Clearly state the names of the donor (the person giving the gift) and the donee (the person receiving the gift). Accurate identification is crucial.

- Describe the property: Provide a detailed description of the property being transferred. This includes the address and any relevant legal descriptions.

- Consider tax implications: Gifts may have tax consequences. Consult with a tax professional to understand potential gift tax liabilities.

- Signatures are required: Both the donor and the donee must sign the Gift Deed. Ensure that signatures are notarized to validate the document.

- File with the county: After completing the form, file the Gift Deed with the county clerk's office where the property is located. This step is necessary for public record.

- Retain copies: Keep copies of the signed Gift Deed for your records. This documentation may be important for future reference or legal matters.

How to Use Georgia Gift Deed

After gathering the necessary information and documents, you can proceed to fill out the Georgia Gift Deed form. This process involves providing specific details about the parties involved and the property being transferred. Ensuring accuracy is crucial, as any errors may delay the recording of the deed.

- Obtain the Form: Download the Georgia Gift Deed form from a reliable source or visit your local county clerk's office to get a physical copy.

- Identify the Grantor: Fill in the name and address of the person giving the gift. This is the individual transferring ownership of the property.

- Identify the Grantee: Enter the name and address of the person receiving the gift. This is the individual who will take ownership of the property.

- Describe the Property: Provide a detailed description of the property being gifted. This includes the address and any legal description necessary to identify the property.

- Include Consideration: State the consideration for the gift. In most cases, this is a nominal amount, often $1, indicating that the transfer is a gift.

- Signatures: Both the grantor and grantee must sign the form. Ensure that the signatures are dated and properly witnessed if required.

- Notarization: Have the form notarized. A notary public will verify the identities of the signers and affix their seal to the document.

- File the Deed: Submit the completed and notarized Gift Deed form to the county clerk’s office where the property is located. Pay any applicable recording fees.