Free Loan Agreement Template for Georgia State

In the realm of personal finance and business transactions, a loan agreement serves as a crucial tool for both borrowers and lenders. Specifically, the Georgia Loan Agreement form outlines the terms and conditions under which a loan is granted, ensuring that all parties involved have a clear understanding of their rights and obligations. This document typically includes essential elements such as the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it may address default terms, late fees, and the governing law that applies to the agreement. By providing a structured framework for the lending process, the Georgia Loan Agreement not only protects the interests of the lender but also offers the borrower a transparent overview of their financial commitments. Whether you are an individual seeking a personal loan or a business in need of capital, understanding the intricacies of this form can pave the way for a smoother financial transaction.

Common mistakes

-

Not reading the entire form: Many individuals rush through the form and overlook important details. Taking the time to read each section can prevent misunderstandings later.

-

Incorrect personal information: Providing wrong names, addresses, or Social Security numbers can lead to delays or complications. Always double-check this information before submission.

-

Failing to understand loan terms: Some people do not fully grasp the terms of the loan, such as interest rates or repayment schedules. It’s crucial to understand what you are agreeing to.

-

Missing signatures: A common oversight is forgetting to sign the document. Without a signature, the agreement is not valid.

-

Not providing necessary documentation: Some applicants fail to attach required documents, such as proof of income or identification. Ensure you include everything needed for processing.

-

Ignoring deadlines: Submitting the form late can result in missed opportunities. Be aware of all deadlines related to the loan application.

-

Neglecting to ask questions: If something is unclear, many people hesitate to ask for help. Don’t hesitate to reach out for clarification when needed.

-

Assuming all loans are the same: Each loan agreement can have unique terms. Treat each application as a separate entity and review it thoroughly.

-

Not keeping a copy: After submitting the form, some forget to keep a copy for their records. Always retain a copy for your own reference.

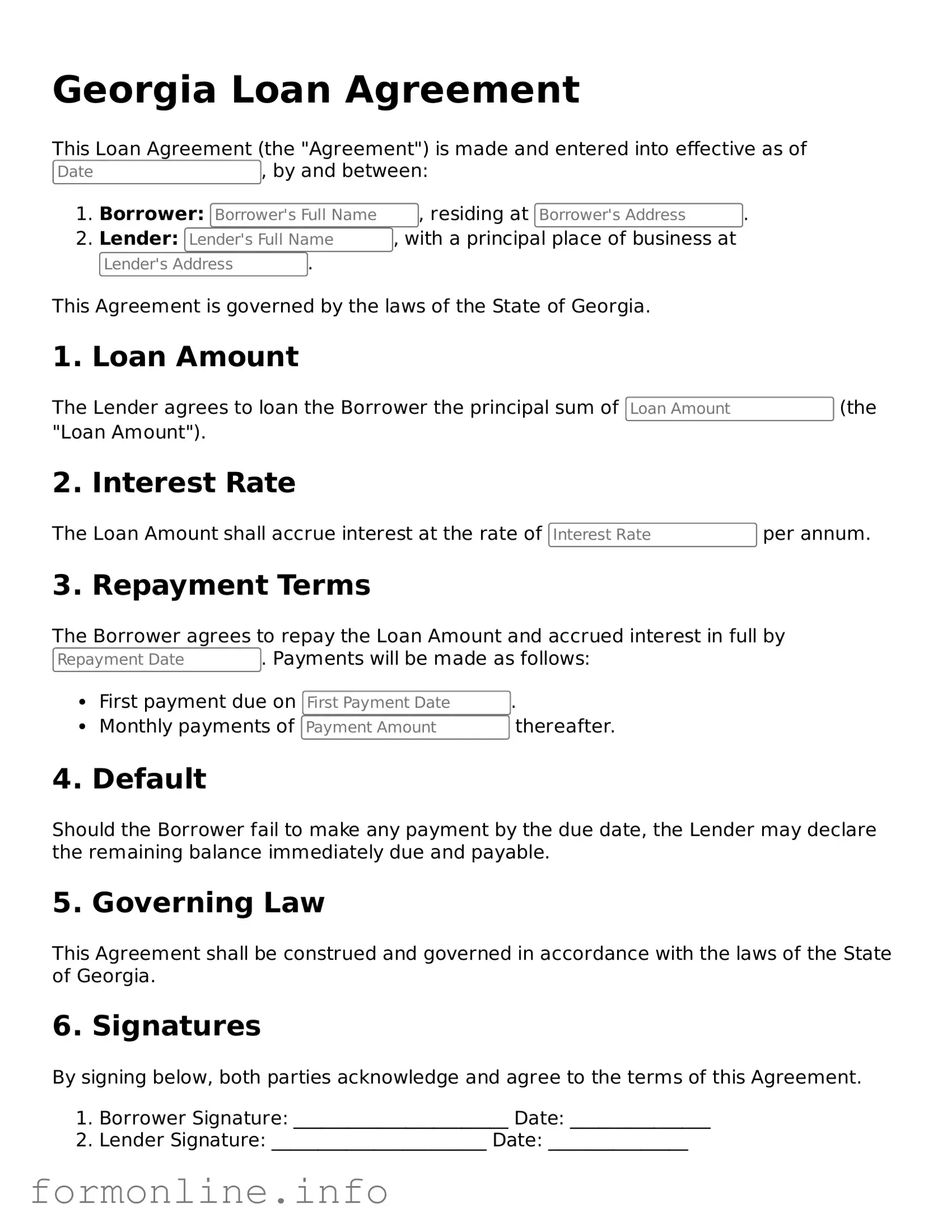

Preview - Georgia Loan Agreement Form

Georgia Loan Agreement

This Loan Agreement (the "Agreement") is made and entered into effective as of , by and between:

- Borrower: , residing at .

- Lender: , with a principal place of business at .

This Agreement is governed by the laws of the State of Georgia.

1. Loan Amount

The Lender agrees to loan the Borrower the principal sum of (the "Loan Amount").

2. Interest Rate

The Loan Amount shall accrue interest at the rate of per annum.

3. Repayment Terms

The Borrower agrees to repay the Loan Amount and accrued interest in full by . Payments will be made as follows:

- First payment due on .

- Monthly payments of thereafter.

4. Default

Should the Borrower fail to make any payment by the due date, the Lender may declare the remaining balance immediately due and payable.

5. Governing Law

This Agreement shall be construed and governed in accordance with the laws of the State of Georgia.

6. Signatures

By signing below, both parties acknowledge and agree to the terms of this Agreement.

- Borrower Signature: _______________________ Date: _______________

- Lender Signature: _______________________ Date: _______________

Popular Loan Agreement State Templates

Sample Promissory Note California - A Loan Agreement may reference applicable laws governing the loan transaction.

For those seeking guidance on completing administrative tasks, understanding the importance of the Employment Verification form is crucial. This critical document is often required for employment checks, and you can find more information on how to handle it effectively by visiting this link: detailed instructions on Employment Verification.

Documents used along the form

The Georgia Loan Agreement form is a key document used in financial transactions involving loans. However, several other forms and documents are commonly utilized alongside it to ensure clarity and legal compliance. Below is a list of these documents, each serving a specific purpose in the loan process.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount under specified terms. It includes details such as the interest rate, repayment schedule, and consequences of default.

- Loan Disclosure Statement: This statement provides borrowers with essential information about the loan terms, including fees, interest rates, and the total cost of the loan. It ensures transparency in the lending process.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used and the rights of the lender in the event of default. It protects the lender's interests.

- Personal Guarantee: This document may be required if the borrower is a business entity. It holds the individual(s) personally responsible for repaying the loan if the business defaults.

- Amortization Schedule: This schedule outlines each payment over the life of the loan, showing how much goes toward interest and how much goes toward the principal. It helps borrowers understand their repayment obligations.

- Homeschool Letter of Intent: This document is essential for families choosing to educate their children at home, as it notifies the state of their decision and includes vital information required by law. For more details, visit Homeschool Letter of Intent.

- Loan Application: This form collects the borrower's personal and financial information necessary for the lender to assess creditworthiness. It typically includes income details, credit history, and employment information.

These documents collectively facilitate the loan process, ensuring that both lenders and borrowers are protected and informed. Proper completion and understanding of each document are crucial for a successful loan transaction in Georgia.

Similar forms

The Promissory Note is a document that outlines the borrower's promise to repay a loan under specific terms. Like the Georgia Loan Agreement, it includes details such as the loan amount, interest rate, and repayment schedule. Both documents serve as a legal contract between the lender and borrower, ensuring that both parties understand their obligations. While the Loan Agreement may cover additional terms and conditions, the Promissory Note focuses primarily on the repayment promise itself.

The Mortgage Agreement is another similar document that secures a loan with real property as collateral. In both the Mortgage Agreement and the Georgia Loan Agreement, the lender has rights to the property if the borrower fails to repay the loan. The Mortgage Agreement provides detailed information about the property being used as collateral, while the Loan Agreement may include broader terms regarding the loan's use and repayment conditions.

The Georgia SOP form not only clarifies the visitation guidelines but also plays a vital role in fostering connections between inmates and their loved ones. For comprehensive information regarding these procedures, you can visit https://georgiapdf.com/ to better understand the requirements and steps necessary to facilitate successful visits.

A Security Agreement is used when a borrower offers collateral for a loan. This document is similar to the Georgia Loan Agreement in that it outlines the terms of the loan and the consequences of default. Both agreements protect the lender's interests, but the Security Agreement specifically identifies the collateral being pledged, while the Loan Agreement may encompass a wider range of terms related to the overall loan arrangement.

The Loan Application is a document completed by the borrower to request a loan. It shares similarities with the Georgia Loan Agreement in that both require the borrower to provide personal and financial information. However, the Loan Application is focused on gathering information to assess creditworthiness, whereas the Loan Agreement formalizes the terms of the loan once it has been approved.

The Loan Disclosure Statement is a document that provides borrowers with important information about the loan, including costs and terms. Similar to the Georgia Loan Agreement, it aims to ensure that borrowers are fully informed before entering into a loan. Both documents emphasize transparency and help borrowers understand their financial obligations, though the Disclosure Statement is typically provided at the outset of the loan process.

The Closing Disclosure is a document that outlines the final terms of the loan before the closing process. It is similar to the Georgia Loan Agreement in that it details the loan amount, interest rate, and closing costs. Both documents are crucial for ensuring that borrowers understand the full scope of their financial commitments. However, the Closing Disclosure is specifically designed to be reviewed just before the loan is finalized.

The Loan Modification Agreement is a document that changes the terms of an existing loan. It shares similarities with the Georgia Loan Agreement in that it must be agreed upon by both the lender and borrower. Both agreements aim to clarify the terms of the loan, but the Loan Modification Agreement focuses on adjusting the original terms, such as interest rates or repayment schedules, to better suit the borrower's current financial situation.

Dos and Don'ts

When filling out the Georgia Loan Agreement form, follow these guidelines to ensure accuracy and compliance.

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use white-out or make alterations to the form.

- Don't submit the form without reviewing it for errors.

- Don't ignore any instructions provided with the form.

Key takeaways

When filling out and using the Georgia Loan Agreement form, it's essential to understand several key aspects to ensure a smooth process. Here are some important takeaways:

- Identify the Parties: Clearly state the names and contact information of both the lender and the borrower. This helps avoid any confusion later on.

- Loan Amount: Specify the exact amount being borrowed. Precision is crucial to prevent disputes.

- Interest Rate: Clearly outline the interest rate applicable to the loan. This should comply with Georgia's legal limits.

- Repayment Terms: Detail the repayment schedule, including due dates and payment methods. This keeps both parties accountable.

- Default Conditions: Define what constitutes a default and the consequences. Transparency here can prevent misunderstandings.

- Collateral: If applicable, describe any collateral securing the loan. This provides security for the lender.

- Governing Law: Specify that the agreement is governed by Georgia law. This is important for legal clarity.

- Signatures: Ensure both parties sign the agreement. Without signatures, the document may not hold legal weight.

- Witness or Notary: Consider having the agreement witnessed or notarized. This adds an extra layer of legitimacy.

- Keep Copies: Both parties should retain copies of the signed agreement. This is vital for future reference.

By keeping these points in mind, you can navigate the Georgia Loan Agreement process with confidence. Proper attention to detail will help protect the interests of both parties involved.

How to Use Georgia Loan Agreement

Filling out the Georgia Loan Agreement form is straightforward. Once you have the form ready, you can start entering your information. Make sure you have all the necessary details at hand, as this will help you complete the form efficiently.

- Begin by entering the date at the top of the form.

- Fill in the names of the borrower and lender in the designated sections.

- Provide the address of the borrower and lender.

- Specify the loan amount clearly in the appropriate field.

- Indicate the interest rate, if applicable.

- Detail the repayment terms, including the payment schedule.

- Include any additional terms or conditions that may apply.

- Sign and date the form at the bottom to finalize it.

After completing these steps, review the form for accuracy. Ensure all information is correct before submitting it to the relevant parties.