Free Promissory Note Template for Georgia State

In Georgia, a Promissory Note serves as a critical financial instrument, establishing a clear agreement between a borrower and a lender regarding the repayment of a loan. This form outlines essential details such as the principal amount borrowed, the interest rate, and the repayment schedule, ensuring both parties have a mutual understanding of their obligations. Typically, the borrower promises to repay the loan amount within a specified timeframe, which can vary based on the terms agreed upon. Additionally, the Promissory Note may include provisions for late fees, default consequences, and the governing law, which is vital for resolving any disputes that may arise. By utilizing this form, individuals and businesses can protect their financial interests and create a legally binding agreement that fosters trust and accountability in financial transactions. Understanding the nuances of the Georgia Promissory Note is essential for anyone looking to engage in lending or borrowing, as it not only clarifies expectations but also provides a framework for legal recourse if necessary.

Common mistakes

-

Incorrect Borrower Information: One common mistake is providing inaccurate or incomplete details about the borrower. This includes not using the full legal name or failing to include the borrower's address. Ensure that all information is accurate to avoid confusion later.

-

Missing Loan Amount: Some individuals forget to clearly specify the total loan amount. This can lead to disputes down the line. Always double-check that the amount is written both numerically and in words to eliminate any ambiguity.

-

Omitting Interest Rate: Failing to include the interest rate is another frequent error. Without this crucial detail, the terms of repayment can become unclear. Clearly state the interest rate, whether it’s fixed or variable, to ensure both parties are on the same page.

-

Not Signing the Document: Perhaps the most critical mistake is neglecting to sign the promissory note. A document without signatures is essentially void. Make sure both the borrower and lender sign and date the note to validate the agreement.

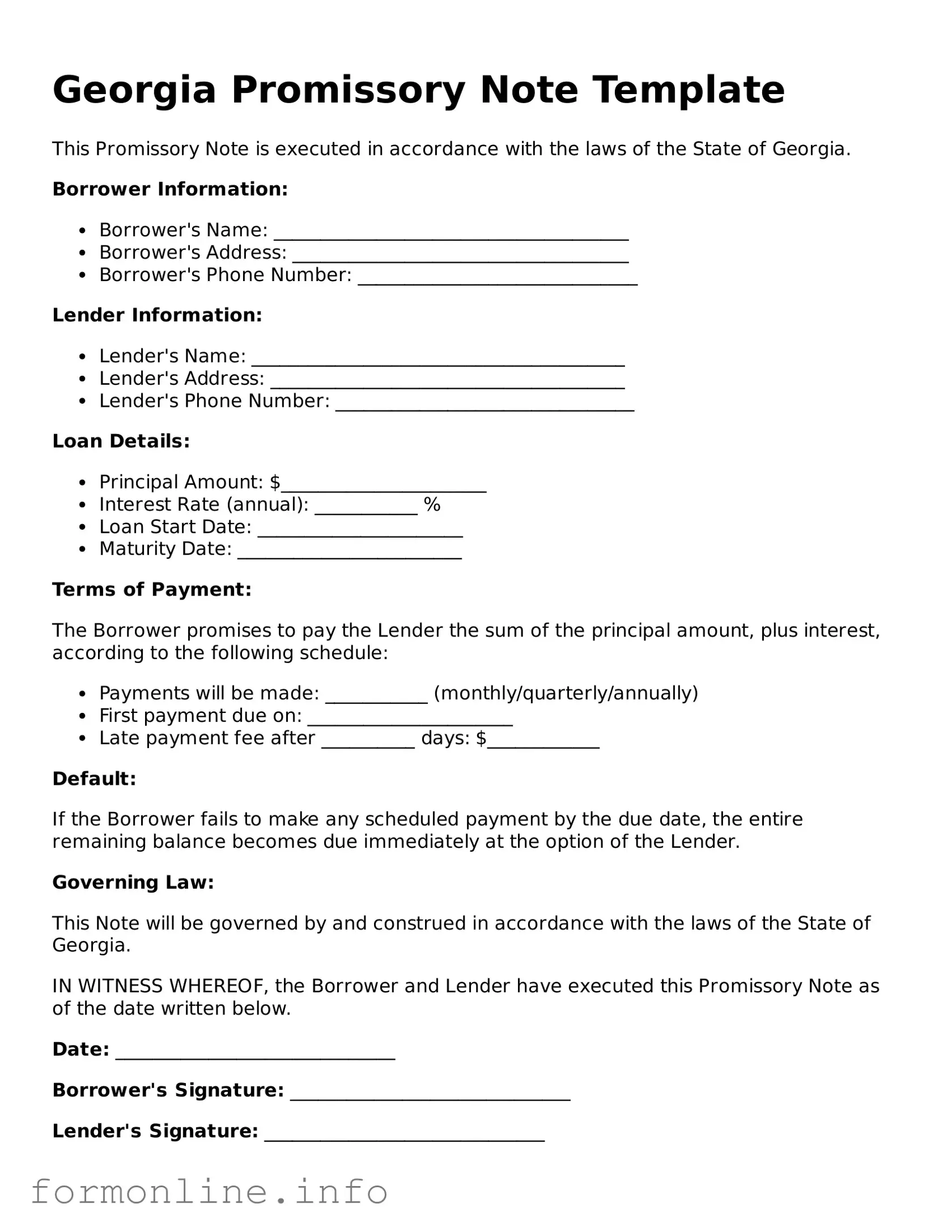

Preview - Georgia Promissory Note Form

Georgia Promissory Note Template

This Promissory Note is executed in accordance with the laws of the State of Georgia.

Borrower Information:

- Borrower's Name: ______________________________________

- Borrower's Address: ____________________________________

- Borrower's Phone Number: ______________________________

Lender Information:

- Lender's Name: ________________________________________

- Lender's Address: ______________________________________

- Lender's Phone Number: ________________________________

Loan Details:

- Principal Amount: $______________________

- Interest Rate (annual): ___________ %

- Loan Start Date: ______________________

- Maturity Date: ________________________

Terms of Payment:

The Borrower promises to pay the Lender the sum of the principal amount, plus interest, according to the following schedule:

- Payments will be made: ___________ (monthly/quarterly/annually)

- First payment due on: ______________________

- Late payment fee after __________ days: $____________

Default:

If the Borrower fails to make any scheduled payment by the due date, the entire remaining balance becomes due immediately at the option of the Lender.

Governing Law:

This Note will be governed by and construed in accordance with the laws of the State of Georgia.

IN WITNESS WHEREOF, the Borrower and Lender have executed this Promissory Note as of the date written below.

Date: ______________________________

Borrower's Signature: ______________________________

Lender's Signature: ______________________________

Popular Promissory Note State Templates

Promissory Note Form California - Promissory notes can be secured (backed by collateral) or unsecured.

The completion of the transaction requires the appropriate documentation, and for those in Indiana, the Mobile Home Bill of Sale is essential to ensure that all legal requirements are met and that both parties are protected throughout the ownership transfer process.

Printable Promissory Note Template - Both parties must agree to the terms before signing the Promissory Note.

Documents used along the form

When entering into a loan agreement in Georgia, a Promissory Note is a crucial document that outlines the borrower's promise to repay the loan. However, it is often accompanied by other forms and documents that help clarify the terms of the agreement and protect the interests of both parties involved. Below is a list of additional documents commonly used alongside the Georgia Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any conditions that must be met. It serves as a comprehensive guide to the expectations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, a Security Agreement outlines what assets are being used as security. This document specifies the rights of the lender in the event of default.

- Disclosure Statement: This statement provides important information about the loan, including fees, interest rates, and other costs associated with borrowing. It ensures that the borrower is fully informed before signing the Promissory Note.

- Hold Harmless Agreement: This legal document protects one party from liability for damages or injuries that may occur during an activity or event. For more information, visit georgiapdf.com/.

- Personal Guarantee: In cases where a business borrows money, a Personal Guarantee may be required. This document holds an individual personally liable for the loan, providing additional security for the lender.

- Amortization Schedule: This schedule breaks down each payment over the life of the loan, showing how much goes toward principal and interest. It helps borrowers understand their financial obligations over time.

- Default Notice: In the event that the borrower fails to make payments, a Default Notice serves as a formal communication from the lender. It outlines the breach of the loan agreement and the steps that may follow, including potential legal action.

Understanding these documents can empower both borrowers and lenders, ensuring that all parties are aware of their rights and responsibilities. This knowledge can help foster a positive lending experience and minimize misunderstandings down the road.

Similar forms

A promissory note is often compared to a loan agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. However, a loan agreement is typically more comprehensive, detailing additional terms such as collateral, default conditions, and the responsibilities of both the lender and borrower. In contrast, a promissory note is usually a simpler document focused primarily on the promise to repay the borrowed amount.

A mortgage is another document that shares similarities with a promissory note. While a promissory note serves as a promise to repay a loan, a mortgage secures that loan with real property. The mortgage outlines the lender's rights to the property in case of default. Both documents are often executed together in real estate transactions, with the promissory note detailing the repayment terms and the mortgage providing security for the lender.

An installment agreement is akin to a promissory note, as both involve a borrower agreeing to repay a loan in fixed payments over time. However, an installment agreement may involve more complex terms, including provisions for late payments and penalties. The promissory note, on the other hand, typically emphasizes the borrower's commitment to repay the debt without delving into the intricacies of payment schedules.

A personal guarantee is another document that can be compared to a promissory note. A personal guarantee involves an individual agreeing to be responsible for another party's debt. While a promissory note is a direct promise to repay a loan, a personal guarantee provides additional security for the lender by holding an individual accountable if the primary borrower defaults. Both documents are used to establish trust and responsibility in financial transactions.

For those interested in legal protections, the Florida Hold Harmless Agreement provides a crucial framework that ensures one party does not hold another liable for certain damages or injuries. This document is essential for anyone navigating agreements, as it establishes clear expectations and responsibilities. To learn more about the specifics of this agreement, you can refer to the important Hold Harmless Agreement details.

A bill of exchange bears similarities to a promissory note in that both are negotiable instruments used in financial transactions. A bill of exchange involves three parties: the drawer, the drawee, and the payee. It orders the drawee to pay a specified sum to the payee. In contrast, a promissory note is a direct promise from the borrower to the lender. Both documents can be transferred to third parties, making them useful in various financial contexts.

A security agreement is another document related to promissory notes. While a promissory note outlines the borrower's promise to repay a loan, a security agreement provides collateral for that loan. This document details the specific assets pledged by the borrower to secure the loan. Both documents work together to protect the lender's interests, with the promissory note focusing on repayment and the security agreement addressing collateral.

Lastly, a lease agreement can also be compared to a promissory note, especially in the context of financing. In a lease agreement, a lessee agrees to make periodic payments for the use of an asset, similar to how a borrower agrees to repay a loan in a promissory note. While a lease agreement typically involves the use of property rather than a direct loan, both documents establish a payment structure and obligations between the parties involved.

Dos and Don'ts

When filling out the Georgia Promissory Note form, it's important to approach the task with care. Here are some guidelines to help you navigate the process effectively.

- Do read the entire form carefully before filling it out.

- Do provide accurate information to avoid complications later.

- Do ensure all parties involved sign the document where required.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't use white-out or erase any mistakes; instead, cross out errors and initial them.

Following these steps will help ensure that your Promissory Note is completed correctly and serves its intended purpose. Take your time, and don’t hesitate to seek assistance if needed.

Key takeaways

The Georgia Promissory Note is a legal document that establishes a borrower's promise to repay a loan to a lender.

It is essential to include the full names and addresses of both the borrower and the lender to ensure clarity and enforceability.

The note should specify the principal amount borrowed, which is the total sum that the borrower agrees to repay.

Interest rates must be clearly stated; Georgia law allows for both fixed and variable rates, but they must comply with state regulations.

Payment terms should be detailed, including the frequency of payments (e.g., monthly, quarterly) and the due date for each payment.

Consider including a section on late fees to outline penalties for missed payments, which can encourage timely repayment.

It is advisable to include a clause regarding prepayment, which allows the borrower to pay off the loan early without penalties.

The document must be signed by both parties to be legally binding; witnesses or notarization may enhance its validity.

Keep a copy of the signed Promissory Note for personal records, as this document serves as proof of the agreement.

In the event of a dispute, the Promissory Note can be used in court to enforce the terms of the loan.

How to Use Georgia Promissory Note

Once you have the Georgia Promissory Note form in hand, you can begin the process of filling it out. Ensure you have all necessary information readily available to complete the form accurately. Follow the steps below to guide you through the process.

- Begin by entering the date at the top of the form. This should be the date you are completing the note.

- Identify the borrower by writing their full name and address in the designated section.

- Next, provide the lender's full name and address in the appropriate area.

- Specify the principal amount being borrowed. This is the total amount that the borrower agrees to repay.

- Indicate the interest rate, if applicable. Write the percentage clearly to avoid any confusion.

- Detail the repayment terms. This includes the frequency of payments (monthly, quarterly, etc.) and the due date for the final payment.

- Include any additional terms or conditions that apply to the loan in the designated section.

- Both the borrower and lender should sign and date the form at the bottom. Ensure that all parties understand the terms before signing.

After completing the form, review it for accuracy. Ensure that all information is correct and that both parties have signed. It may be advisable to keep a copy for your records.