Free Quitclaim Deed Template for Georgia State

In Georgia, the Quitclaim Deed form serves as a crucial legal document for individuals looking to transfer property ownership without guaranteeing the title's validity. This form is particularly useful in situations such as transferring property between family members, settling estates, or correcting title issues. Unlike a warranty deed, a quitclaim deed does not provide any assurances regarding the property’s condition or any existing liens, making it a simpler, faster option for property transfers. The form requires specific information, including the names of the grantor and grantee, a description of the property, and the date of transfer. Additionally, it must be signed in the presence of a notary public to ensure its validity. Understanding the nuances of the Quitclaim Deed can help individuals navigate property transfers more effectively, minimizing potential disputes and ensuring a smoother transition of ownership.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a clear and accurate description of the property. The description should include the address and any relevant parcel numbers. Without this information, the deed may not be valid.

-

Not Including All Grantors and Grantees: It’s essential to list all parties involved in the transaction. Omitting a grantor or grantee can lead to disputes or complications down the line.

-

Improper Signatures: All parties must sign the deed. Sometimes, people forget to sign or have the wrong person sign. Ensure that each grantor’s signature is present and properly notarized.

-

Failure to Record the Deed: After filling out the Quitclaim Deed, some individuals neglect to record it with the county. This step is crucial for making the transfer official and protecting your ownership rights.

-

Not Understanding the Implications: A Quitclaim Deed transfers whatever interest the grantor has in the property without any guarantees. Many people don’t realize this and may be surprised by potential issues, such as existing liens or claims against the property.

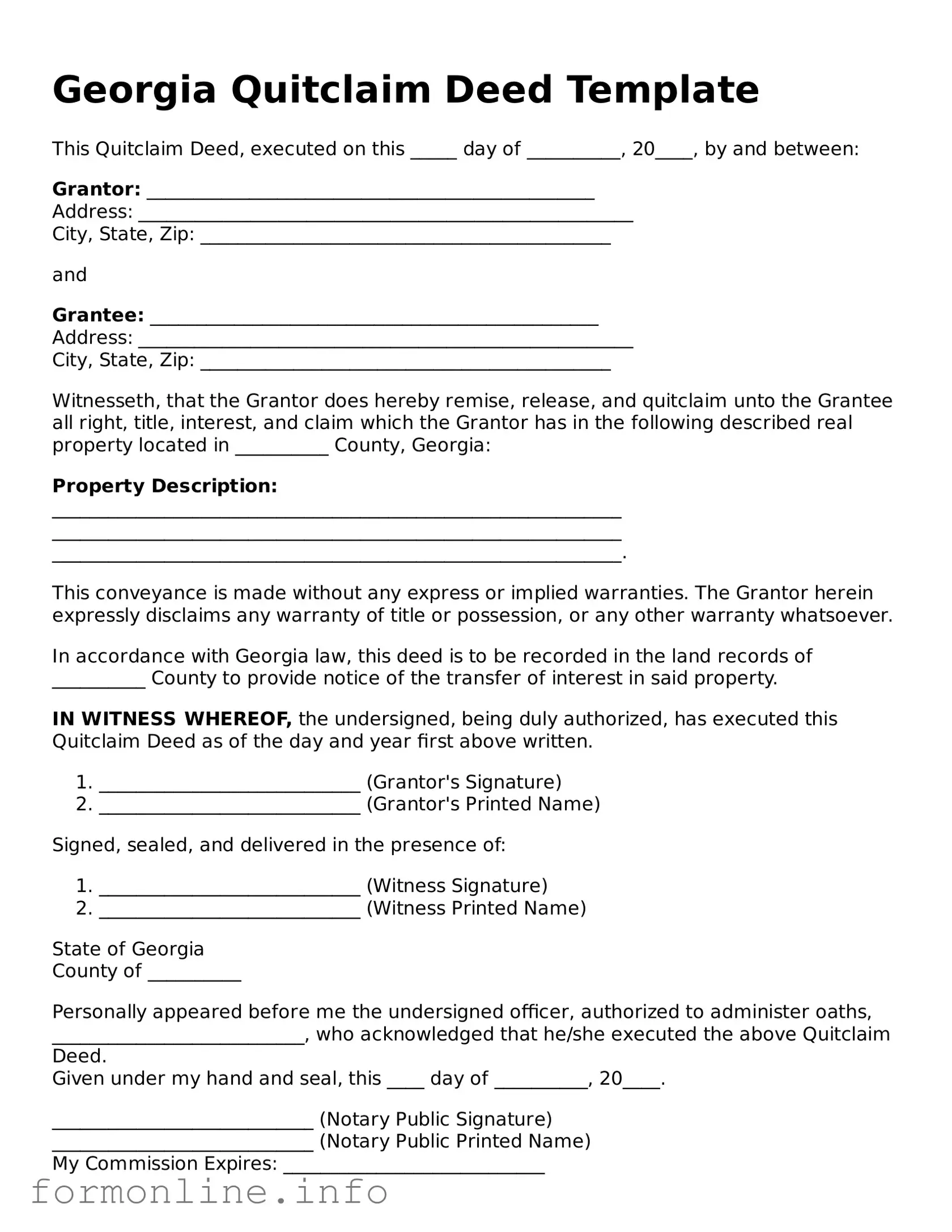

Preview - Georgia Quitclaim Deed Form

Georgia Quitclaim Deed Template

This Quitclaim Deed, executed on this _____ day of __________, 20____, by and between:

Grantor: ________________________________________________

Address: _____________________________________________________

City, State, Zip: ____________________________________________

and

Grantee: ________________________________________________

Address: _____________________________________________________

City, State, Zip: ____________________________________________

Witnesseth, that the Grantor does hereby remise, release, and quitclaim unto the Grantee all right, title, interest, and claim which the Grantor has in the following described real property located in __________ County, Georgia:

Property Description:

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________.

This conveyance is made without any express or implied warranties. The Grantor herein expressly disclaims any warranty of title or possession, or any other warranty whatsoever.

In accordance with Georgia law, this deed is to be recorded in the land records of __________ County to provide notice of the transfer of interest in said property.

IN WITNESS WHEREOF, the undersigned, being duly authorized, has executed this Quitclaim Deed as of the day and year first above written.

- ____________________________ (Grantor's Signature)

- ____________________________ (Grantor's Printed Name)

Signed, sealed, and delivered in the presence of:

- ____________________________ (Witness Signature)

- ____________________________ (Witness Printed Name)

State of Georgia

County of __________

Personally appeared before me the undersigned officer, authorized to administer oaths, ___________________________, who acknowledged that he/she executed the above Quitclaim Deed.

Given under my hand and seal, this ____ day of __________, 20____.

____________________________ (Notary Public Signature)

____________________________ (Notary Public Printed Name)

My Commission Expires: ____________________________

Popular Quitclaim Deed State Templates

Quit Claim Deed Form Florida - A Quitclaim Deed allows an individual to transfer their interest in a property to another party without any warranties or guarantees.

The Illinois Motor Vehicle Bill of Sale is essential for anyone looking to formally document the transfer of vehicle ownership. This document not only acts as proof of sale but also provides a receipt for the buyer, guaranteeing that all critical information is recorded accurately. To facilitate this process, you can obtain the necessary paperwork by accessing the Motor Vehicle Bill of Sale form and ensuring a smooth transaction.

Documents used along the form

When dealing with property transfers in Georgia, the Quitclaim Deed is an essential document. However, it is often accompanied by other forms and documents that help clarify the transaction and ensure all legal requirements are met. Below is a list of related documents commonly used in conjunction with the Quitclaim Deed.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, it provides a warranty of title, protecting the buyer against any future claims.

- FedEx Bill of Lading: This essential shipping document details the freight shipment and establishes the carrier's responsibility for the goods. For more information, visit Top Forms Online.

- Property Transfer Tax Form: This form is required to report the transfer of property for tax purposes. It helps local authorities assess any applicable transfer taxes based on the property's sale price.

- Title Search Report: A title search report provides a history of the property’s ownership and any liens or encumbrances. This document is crucial for buyers to ensure they are acquiring a clear title.

- Affidavit of Title: This affidavit is a sworn statement from the seller affirming that they are the rightful owner of the property and that there are no undisclosed claims or liens against it.

- Closing Statement: Also known as a settlement statement, this document outlines the final financial details of the transaction, including the purchase price, closing costs, and any adjustments made during the closing process.

- Power of Attorney: If the seller cannot be present at the closing, a power of attorney allows another person to act on their behalf. This document must be properly executed to ensure validity.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide rules, regulations, and any outstanding dues. Buyers should review these to understand their obligations as property owners.

Understanding these documents can significantly ease the property transfer process. Each plays a vital role in ensuring that all parties are protected and that the transaction proceeds smoothly. Always consider consulting with a legal professional for personalized guidance.

Similar forms

A Warranty Deed is one of the most common documents similar to a Quitclaim Deed. While a Quitclaim Deed transfers ownership without guaranteeing that the title is free of defects, a Warranty Deed provides assurances that the grantor holds a clear title to the property. This means that if any issues arise with the title, the grantor is responsible for resolving them. Buyers often prefer Warranty Deeds for this reason, as they offer greater protection and security in the transaction.

Understanding the significance of a comprehensive guide to Last Will and Testament forms can greatly aid individuals in making informed decisions about their estate planning. This document not only clarifies one’s wishes regarding asset distribution but also helps reduce potential conflicts among heirs during a challenging time.

A Bargain and Sale Deed is another document that shares similarities with a Quitclaim Deed. This type of deed implies that the grantor has the right to sell the property but does not guarantee a clear title. While it may not offer the same level of protection as a Warranty Deed, it does suggest that the seller has some interest in the property. In essence, it’s a middle ground between a Quitclaim Deed and a Warranty Deed, offering some assurance to the buyer without the full guarantees of a Warranty Deed.

The Special Purpose Deed is also comparable to a Quitclaim Deed. This document is used for specific situations, such as transferring property between family members or in divorce settlements. Like a Quitclaim Deed, it does not provide any warranties about the title. Instead, it serves to facilitate the transfer of ownership in a straightforward manner, often used when the parties involved have a level of trust or familiarity with one another.

A Deed of Trust is another document that can be likened to a Quitclaim Deed, although it serves a different purpose. This document is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property to the trustee, who holds it as collateral for the loan. While it doesn’t transfer ownership in the same way as a Quitclaim Deed, it does involve the transfer of interest in the property, making it relevant in discussions about property rights.

An Executor’s Deed is also similar in that it involves the transfer of property, typically after someone has passed away. This document is used by the executor of an estate to convey real property to the beneficiaries. Like a Quitclaim Deed, it does not provide warranties about the title. Instead, it simply allows the executor to transfer ownership based on the deceased’s wishes as outlined in their will.

Finally, a Grant Deed shares some characteristics with a Quitclaim Deed. This type of deed is used to transfer property and includes some assurances from the grantor that the property has not been sold to anyone else and that there are no undisclosed encumbrances. While it offers more protection than a Quitclaim Deed, it still does not guarantee a clear title, making it a useful option for certain transactions where the buyer is willing to take on some risk.

Dos and Don'ts

When filling out the Georgia Quitclaim Deed form, it is essential to approach the task with care. Here are six important dos and don'ts to consider:

- Do ensure that all parties involved are clearly identified, including their full names and addresses.

- Do provide a legal description of the property being transferred. This description should be accurate and detailed.

- Do sign the form in front of a notary public. This step is crucial for the document's validity.

- Do check for any local requirements or additional documentation that may be needed for your specific county.

- Don't leave any sections of the form blank. Incomplete forms can lead to delays or rejections.

- Don't use vague language when describing the property. Precision is key to avoid future disputes.

Key takeaways

When using the Georgia Quitclaim Deed form, it’s essential to understand the following key points:

- Purpose: A Quitclaim Deed transfers ownership of property from one party to another without guaranteeing the title's validity.

- Parties Involved: Ensure that the grantor (the person transferring the property) and the grantee (the person receiving the property) are correctly identified.

- Property Description: Provide a clear and accurate legal description of the property being transferred. This helps avoid any confusion in the future.

- Consideration: While not always required, it’s good practice to include the consideration (the value exchanged) in the deed.

- Notarization: The Quitclaim Deed must be signed in front of a notary public to be legally valid.

- Recording: After execution, the deed should be recorded with the local county clerk’s office to ensure public notice of the property transfer.

- Tax Implications: Be aware of any potential tax consequences related to the transfer of property ownership.

- Legal Advice: Consider consulting a legal professional if you have questions or concerns about the process or implications of using a Quitclaim Deed.

Understanding these points can help ensure a smooth transfer of property ownership in Georgia.

How to Use Georgia Quitclaim Deed

Once you've obtained the Georgia Quitclaim Deed form, you'll need to complete it accurately to ensure a smooth transfer of property ownership. After filling out the form, you will need to sign it in front of a notary public and then file it with the appropriate county office. This process helps to legally document the transfer and protect the interests of all parties involved.

- Obtain the form: Download the Georgia Quitclaim Deed form from a reliable source or visit your local county office to get a hard copy.

- Identify the parties: Fill in the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Describe the property: Provide a clear description of the property being transferred, including the address and any relevant legal descriptions.

- Include consideration: Indicate the amount of money or other value exchanged for the property, even if it is nominal.

- Sign the form: The grantor must sign the form in the presence of a notary public. Ensure that the signature matches the name on the form.

- Notarization: The notary public will complete their section, confirming the identity of the signer and the date of signing.

- File the deed: Submit the completed and notarized Quitclaim Deed to the county clerk's office where the property is located. Pay any required filing fees.