Free Transfer-on-Death Deed Template for Georgia State

In the state of Georgia, individuals seeking to simplify the transfer of their property upon death may find the Transfer-on-Death Deed form to be a valuable tool. This legal document allows property owners to designate beneficiaries who will automatically receive ownership of the property without the need for probate, thereby reducing the complexities often associated with estate management. By completing this form, property owners can ensure that their wishes are honored and that their loved ones are spared the burdens of lengthy legal processes. The form requires specific information, including the names of the beneficiaries and a clear description of the property in question. Importantly, the Transfer-on-Death Deed can be revoked or modified at any time during the owner's lifetime, providing flexibility and peace of mind. Understanding the nuances of this deed is essential for anyone looking to make informed decisions about their estate planning in Georgia.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. Ensure that the legal description matches what is on the property deed.

-

Missing Signatures: All necessary parties must sign the form. Forgetting to include a signature can render the deed invalid.

-

Not Notarizing the Document: A Transfer-on-Death Deed must be notarized to be legally binding. Skipping this step can lead to complications.

-

Inaccurate Beneficiary Information: Providing incorrect names or details about the beneficiary can create confusion. Double-check spelling and relationship to the owner.

-

Failing to Record the Deed: After completing the form, it must be filed with the county clerk’s office. Neglecting this step means the deed has no legal effect.

-

Using an Outdated Form: Always ensure you are using the most current version of the Transfer-on-Death Deed form. Laws can change, and using an outdated form may lead to issues.

-

Not Understanding the Implications: Some individuals fill out the form without fully understanding how it affects their estate. It’s important to grasp how this deed interacts with other estate planning documents.

-

Leaving Out Alternate Beneficiaries: In case the primary beneficiary cannot inherit, it’s wise to name alternate beneficiaries. Omitting this can lead to unintended consequences.

-

Confusion Over Joint Ownership: When property is owned jointly, it’s crucial to understand how the Transfer-on-Death Deed affects the ownership rights of all parties involved.

-

Not Keeping Copies: After filing the deed, it’s essential to keep copies for personal records. This ensures all parties have access to the document if needed.

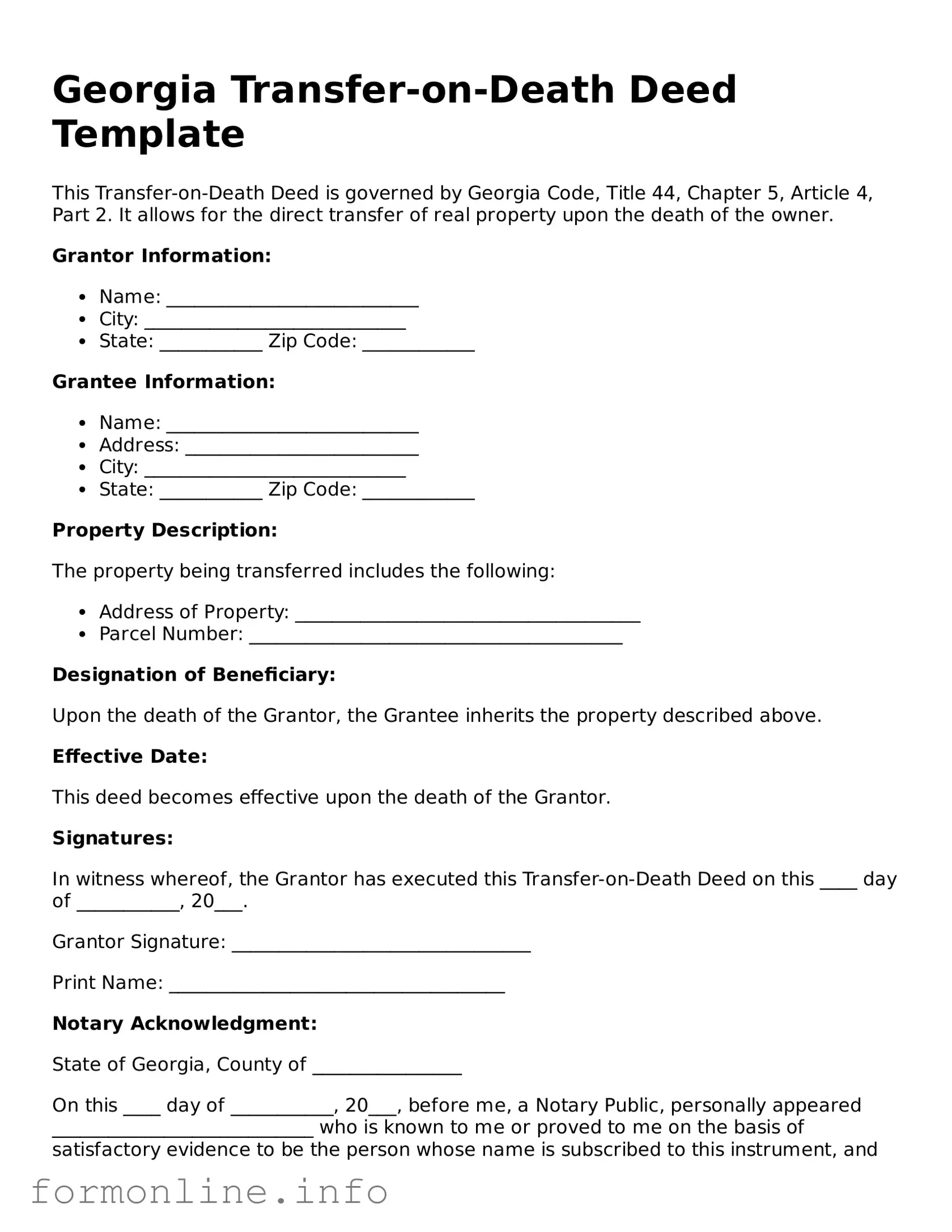

Preview - Georgia Transfer-on-Death Deed Form

Georgia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is governed by Georgia Code, Title 44, Chapter 5, Article 4, Part 2. It allows for the direct transfer of real property upon the death of the owner.

Grantor Information:

- Name: ___________________________

- City: ____________________________

- State: ___________ Zip Code: ____________

Grantee Information:

- Name: ___________________________

- Address: _________________________

- City: ____________________________

- State: ___________ Zip Code: ____________

Property Description:

The property being transferred includes the following:

- Address of Property: _____________________________________

- Parcel Number: ________________________________________

Designation of Beneficiary:

Upon the death of the Grantor, the Grantee inherits the property described above.

Effective Date:

This deed becomes effective upon the death of the Grantor.

Signatures:

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on this ____ day of ___________, 20___.

Grantor Signature: ________________________________

Print Name: ____________________________________

Notary Acknowledgment:

State of Georgia, County of ________________

On this ____ day of ___________, 20___, before me, a Notary Public, personally appeared ____________________________ who is known to me or proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to this instrument, and acknowledged to me that he/she executed the same in his/her capacity, and that by his/her signature on the instrument, he/she executed the instrument.

Witness my hand and official seal:

Notary Public Signature: _____________________________

My Commission Expires: ______________________________

Popular Transfer-on-Death Deed State Templates

How to File a Transfer on Death Deed - Using this deed can reduce the emotional burden on your beneficiaries during a difficult time by simplifying property transfer.

When dealing with the transfer of a mobile home, it is crucial to utilize the Connecticut Mobile Home Bill of Sale form to formalize the transaction. This legal document not only delineates the terms of the sale but also ensures that both parties are protected throughout the process. For further details on how to obtain this important form, you can refer to the Mobile Home Bill of Sale, which provides a helpful resource to navigate the complexities of mobile home ownership transfer.

Transfer on Death Deed Florida Form - Keep in mind that this deed may have limitations based on your state’s specific estate laws and real estate regulations.

Documents used along the form

The Georgia Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property upon their death. This deed is often accompanied by several other important documents to ensure a smooth transfer process. Below is a list of forms and documents commonly used alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can complement the Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies. They specify who will receive these assets upon the account holder's death, similar to the intent of the Transfer-on-Death Deed.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in legal or financial matters. It can be useful if the property owner becomes incapacitated before death.

- Pennsylvania Motor Vehicle Bill of Sale - When engaging in vehicle transactions, it's essential to use proper documentation such as the autobillofsaleform.com/pennsylvania-motor-vehicle-bill-of-sale-form/ to confirm the transfer of ownership and protect both the seller and buyer in accordance with state laws.

- Property Deed: The original property deed provides proof of ownership. It is essential to reference when creating a Transfer-on-Death Deed to ensure accurate property description and ownership verification.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It can help clarify the distribution of property when there is no will or deed in place.

- Notice of Death: This is a formal notification that a property owner has passed away. It may be required to inform interested parties and initiate the transfer process outlined in the Transfer-on-Death Deed.

Using these documents in conjunction with the Georgia Transfer-on-Death Deed can help ensure that property is transferred smoothly and according to the owner's wishes. It is important to consider each document's role in the overall estate planning process.

Similar forms

The Georgia Transfer-on-Death Deed (TODD) allows property owners to transfer their real estate to beneficiaries without going through probate. This document is similar to a Will, as both serve to dictate how assets should be distributed after death. However, a Will takes effect only after the individual's passing and requires probate, while a TODD allows for the immediate transfer of property upon death, bypassing the often lengthy and costly probate process.

A Living Trust also shares similarities with the TODD. Both documents facilitate the transfer of assets outside of probate. However, a Living Trust can encompass a wider range of assets and allows for more control during the grantor's lifetime. The trust remains active while the individual is alive, and assets can be managed or altered. In contrast, a TODD is solely focused on real estate and becomes effective only upon the owner's death.

In navigating the landscape of property transfer documents, it is essential to understand forms like the Mobile Home Bill of Sale, which serves as a formal agreement for the sale of mobile homes, outlining important details such as the parties involved and the terms of sale, similar to how other estate planning documents streamline asset transfers.

A Beneficiary Designation is similar in purpose to a TODD, particularly in how it allows for the transfer of assets outside of probate. Commonly used for financial accounts and insurance policies, a Beneficiary Designation allows individuals to name who will receive their assets upon death. However, unlike a TODD, which is specific to real estate, Beneficiary Designations apply to various types of accounts and assets.

Dos and Don'ts

When filling out the Georgia Transfer-on-Death Deed form, it's important to approach the task with care. This document allows property owners to transfer their real estate to beneficiaries without going through probate. Here are some essential dos and don’ts to keep in mind:

- Do ensure you have the correct legal description of the property.

- Do clearly identify all beneficiaries by their full legal names.

- Do sign the deed in the presence of a notary public.

- Do record the deed with the appropriate county office to make it effective.

- Don't leave any blanks on the form; incomplete information can lead to complications.

- Don't forget to check state laws for any specific requirements or restrictions.

- Don't assume the deed is valid until it has been properly recorded.

By following these guidelines, you can help ensure that your Transfer-on-Death Deed is filled out correctly and serves its intended purpose effectively.

Key takeaways

Filling out the Georgia Transfer-on-Death Deed form can simplify the transfer of property upon death. Here are some key takeaways to keep in mind:

- The form allows property owners to designate beneficiaries who will receive the property without going through probate.

- It is important to provide accurate information about the property and the beneficiaries to avoid complications later.

- The deed must be signed in front of a notary public to be valid, ensuring that the document is legally binding.

- Once completed, the deed must be filed with the county clerk's office where the property is located.

- Beneficiaries should be informed about the deed to ensure a smooth transition of ownership after the property owner's death.

How to Use Georgia Transfer-on-Death Deed

Once you have the Georgia Transfer-on-Death Deed form ready, you can begin filling it out. This process involves providing specific information about the property and the beneficiaries. Make sure to have all necessary details at hand to ensure accuracy.

- Start by entering the name of the current owner(s) of the property at the top of the form. This should match the name(s) on the property title.

- Provide the address of the property being transferred. Include the full street address, city, state, and zip code.

- Next, describe the property in detail. Include the legal description, which can typically be found on the property deed or tax records.

- List the name(s) of the beneficiary(ies) who will receive the property after your passing. Make sure to include their full names and any relevant details, such as their relationship to you.

- Indicate whether the transfer is to be made to one beneficiary or multiple beneficiaries. If there are multiple beneficiaries, specify how the property will be divided among them.

- Sign and date the form in the designated area. Ensure that your signature matches the name listed as the current owner.

- Have the form notarized. A notary public must witness your signature to validate the deed.

- Finally, file the completed and notarized form with the county clerk's office in the county where the property is located. This step is crucial for the deed to take effect.