Printable Gift Deed Form

When considering the transfer of property or assets without the exchange of money, a Gift Deed form becomes an essential tool. This legal document serves to formalize the act of giving, ensuring that the intent of the donor is clearly articulated and legally recognized. Typically, a Gift Deed includes critical information such as the identities of the donor and recipient, a detailed description of the property being gifted, and any conditions attached to the gift. It's important to note that the form must be executed voluntarily, without any coercion, to uphold its validity. Additionally, the document often requires witnesses to affirm the authenticity of the transaction. Understanding the nuances of a Gift Deed is crucial, as it not only protects the interests of both parties but also helps avoid potential disputes in the future. The implications of signing such a deed can be significant, impacting tax liabilities and ownership rights, making it imperative for individuals to approach the process with clarity and diligence.

State-specific Tips for Gift Deed Templates

Common mistakes

-

Failing to include all necessary information about the donor and the recipient. This includes full names, addresses, and contact information.

-

Not clearly describing the gift. A detailed description of the property or item being gifted is essential to avoid confusion.

-

Neglecting to specify any conditions or restrictions related to the gift. If there are specific terms, they should be clearly stated.

-

Forgetting to sign the document. Both the donor and the recipient must sign the Gift Deed for it to be valid.

-

Not having the Gift Deed witnessed. In many states, a witness signature is required to make the document legally binding.

-

Failing to keep a copy of the completed Gift Deed. It is important for both parties to retain a copy for their records.

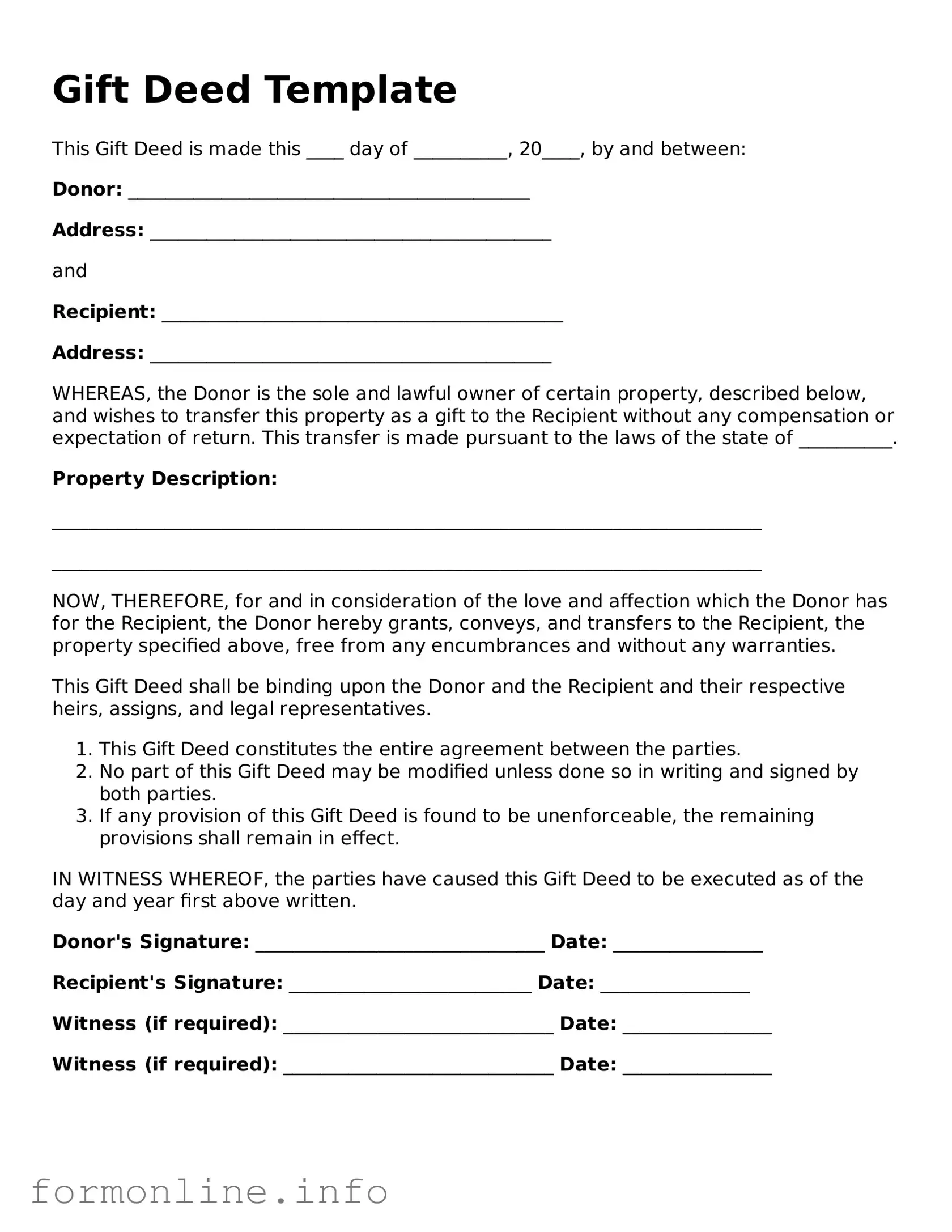

Preview - Gift Deed Form

Gift Deed Template

This Gift Deed is made this ____ day of __________, 20____, by and between:

Donor: ___________________________________________

Address: ___________________________________________

and

Recipient: ___________________________________________

Address: ___________________________________________

WHEREAS, the Donor is the sole and lawful owner of certain property, described below, and wishes to transfer this property as a gift to the Recipient without any compensation or expectation of return. This transfer is made pursuant to the laws of the state of __________.

Property Description:

____________________________________________________________________________

____________________________________________________________________________

NOW, THEREFORE, for and in consideration of the love and affection which the Donor has for the Recipient, the Donor hereby grants, conveys, and transfers to the Recipient, the property specified above, free from any encumbrances and without any warranties.

This Gift Deed shall be binding upon the Donor and the Recipient and their respective heirs, assigns, and legal representatives.

- This Gift Deed constitutes the entire agreement between the parties.

- No part of this Gift Deed may be modified unless done so in writing and signed by both parties.

- If any provision of this Gift Deed is found to be unenforceable, the remaining provisions shall remain in effect.

IN WITNESS WHEREOF, the parties have caused this Gift Deed to be executed as of the day and year first above written.

Donor's Signature: _______________________________ Date: ________________

Recipient's Signature: __________________________ Date: ________________

Witness (if required): _____________________________ Date: ________________

Witness (if required): _____________________________ Date: ________________

More Types of Gift Deed Templates:

Printable Quitclaim Deed - It is important for both parties involved to understand the implications of using a Quitclaim Deed.

For those seeking clarity in contractual agreements, understanding the nuances of the Hold Harmless Agreement is essential. This document plays a pivotal role in outlining liability protections, ensuring that parties engage with an awareness of their responsibilities. For detailed insights, refer to the resource on the Florida Hold Harmless Agreement form.

Does California Have a Transfer on Death Deed - This option may be especially beneficial for those with simple estates.

Free Deed of Trust Template - A Deed of Trust can be recorded with a county recorder's office.

Documents used along the form

A Gift Deed form is a crucial document used to transfer ownership of property or assets from one individual to another without any exchange of money. When preparing a Gift Deed, several other forms and documents may be required to ensure the process is smooth and legally compliant. Below is a list of common documents that are often used in conjunction with a Gift Deed.

- Property Title Deed: This document establishes the current ownership of the property being gifted. It outlines the legal description and the names of the current owners.

- Motorcycle Bill of Sale: This form is essential for documenting the sale of a motorcycle in Wisconsin, providing both parties with a record of the transaction and ensuring a smooth transfer of ownership. For more information, visit autobillofsaleform.com/motorcycle-bill-of-sale-form/wisconsin-motorcycle-bill-of-sale-form/.

- Gift Tax Return (Form 709): This form is required by the IRS if the value of the gift exceeds a certain threshold. It helps to report the gift for tax purposes.

- Affidavit of Gift: A sworn statement that confirms the intent to give a gift. This document can serve as additional proof of the donor's intentions.

- Change of Ownership Form: This form is often needed to update the records with local government authorities, reflecting the new ownership after the gift is made.

- Identification Documents: Valid ID for both the donor and recipient may be required to verify their identities during the transaction.

- Witness Statements: Some states require witnesses to sign the Gift Deed, affirming that the transfer was made voluntarily and without coercion.

- Notarization Certificate: A notarized document may be necessary to validate the Gift Deed, ensuring that all parties have signed willingly and are of sound mind.

Gathering these documents can help facilitate a clear and efficient transfer of ownership. Ensuring that all necessary paperwork is completed accurately will provide peace of mind for both the donor and recipient.

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of real property. Similar to a Gift Deed, it allows one party to relinquish any claim they may have on a property to another party. Unlike a Gift Deed, however, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. This means that the recipient may not receive full ownership rights or protection against future claims.

A Warranty Deed provides a more secure transfer of property ownership compared to a Gift Deed. It includes a guarantee from the seller that they hold clear title to the property and have the right to sell it. In contrast, a Gift Deed does not provide such warranties. While both documents transfer property, a Warranty Deed offers greater protection for the recipient against potential claims from third parties.

A Lease Agreement can also be compared to a Gift Deed in that it involves the transfer of rights related to property. However, while a Gift Deed transfers ownership, a Lease Agreement allows one party to use another's property for a specified time in exchange for rent. Both documents require the consent of the property owner, but their purposes and implications differ significantly.

An Easement Agreement grants one party the right to use a portion of another party's property for a specific purpose. This document is similar to a Gift Deed in that it involves property rights. However, unlike a Gift Deed, an Easement does not transfer ownership. Instead, it allows for limited use of the property while the original owner retains full ownership rights.

The Indiana Mobile Home Bill of Sale form is essential when transferring ownership of a mobile home, serving as pivotal proof of the transaction and detailing crucial information such as the sale price, identities of the buyer and seller, and a description of the mobile home. For comprehensive guidance, refer to the Mobile Home Bill of Sale, which clarifies the rights and responsibilities inherent in such transfers.

Finally, a Release of Lien is a document that removes a lien from a property. It is similar to a Gift Deed in that it involves property rights. However, a Release of Lien is focused on clearing any financial claims against the property, while a Gift Deed is about transferring ownership. Both documents play important roles in property transactions, ensuring that the new owner has clear rights to the property.

Dos and Don'ts

When filling out a Gift Deed form, there are important practices to follow in order to ensure that the document is valid and meets all necessary requirements. Below is a list of six things to do and avoid during this process.

- Do: Clearly identify the donor and the recipient, including full names and addresses.

- Do: Describe the gift in detail, specifying the property or assets being transferred.

- Do: Include the date of the gift and any relevant terms or conditions.

- Do: Sign the document in the presence of a notary public, if required by state law.

- Don't: Leave any sections of the form blank; incomplete information can lead to disputes.

- Don't: Use vague language; specificity helps prevent misunderstandings in the future.

By adhering to these guidelines, individuals can help ensure that their Gift Deed is properly executed and legally binding.

Key takeaways

When filling out and using a Gift Deed form, consider the following key takeaways:

- Understand the Purpose: A Gift Deed is a legal document used to transfer ownership of property or assets from one person to another without any exchange of money.

- Identify the Parties: Clearly identify the donor (the person giving the gift) and the donee (the person receiving the gift) in the document.

- Describe the Gift: Provide a detailed description of the property or asset being gifted. Include any relevant identification numbers or legal descriptions.

- Consider Tax Implications: Be aware that gifting property may have tax consequences. Consult with a tax advisor to understand potential gift tax liabilities.

- Signatures Required: Ensure that both the donor and donee sign the Gift Deed. Depending on the state, witnesses or notarization may also be required.

- State Laws Matter: Gift Deed requirements can vary by state. Research local laws to ensure compliance with all legal requirements.

- Record the Deed: After signing, consider recording the Gift Deed with the appropriate local government office to provide public notice of the transfer.

- Revocation: Understand that a Gift Deed cannot typically be revoked once executed, unless specific conditions are met.

- Keep Copies: Maintain copies of the signed Gift Deed for your records. This documentation can be important for future reference.

- Consult Legal Advice: If unsure about any aspect of the Gift Deed, seek legal advice to ensure that all procedures are followed correctly.

How to Use Gift Deed

Filling out a Gift Deed form is a straightforward process. Once completed, the form will need to be signed and notarized to ensure its validity. Follow these steps to fill out the form correctly.

- Start with the date at the top of the form. Write the date when you are filling out the form.

- Provide the name and address of the donor, the person giving the gift. Make sure to include their full legal name.

- Next, enter the name and address of the recipient, the person receiving the gift. Again, use their full legal name.

- Clearly describe the gift being given. Include details such as the type of property or item, and any relevant identification numbers if applicable.

- Indicate whether the gift is conditional or unconditional. This will affect the terms of the transfer.

- Both the donor and recipient should sign the form. Ensure that signatures are dated.

- Finally, have the form notarized. This step is crucial for the document to be legally binding.

After completing these steps, you can proceed with any additional requirements specific to your state or local jurisdiction. Make sure to keep a copy of the completed Gift Deed for your records.