Fill Out a Valid Gift Deed Texas Form

When considering the transfer of property as a gift in Texas, the Gift Deed Texas form becomes an essential tool. This document not only allows individuals to convey property without the exchange of money but also formalizes the relationship between the giver, known as the Grantor, and the recipients, referred to as Grantees. The form includes critical information such as the names of the parties involved, the specific property being transferred, and the legal rights associated with that property. It’s designed to ensure that the Grantees hold the property as joint tenants, which means that if one of them passes away, the surviving Grantee automatically inherits the entire property. Additionally, the form addresses any existing restrictions or zoning laws that may affect the property, providing clarity and protecting the interests of all parties involved. Importantly, the Gift Deed also includes a section about confidentiality rights, allowing individuals to redact sensitive personal information before filing. This multifaceted document is not just a mere formality; it encapsulates the intent behind the gift and safeguards the legal rights of those involved.

Common mistakes

-

Neglecting to Provide Complete Names: It's crucial to fill in the full legal names of both the Grantor and Grantees. Abbreviations or nicknames can lead to confusion and potential legal issues down the line.

-

Omitting the Property Description: A clear and accurate description of the property being gifted is essential. Failing to include this information can result in the deed being invalid.

-

Forgetting to Sign the Document: The Grantor must sign the Gift Deed for it to be legally binding. Without this signature, the deed holds no legal weight.

-

Ignoring Notarization Requirements: In Texas, a Gift Deed must be notarized to be valid. Skipping this step can cause complications during the recording process.

-

Failing to Specify Joint Tenancy: If the intention is to create a joint tenancy with right of survivorship, it must be clearly stated. Otherwise, the default may be tenants in common, which can alter inheritance rights.

-

Leaving Out Tax Information: It’s important to provide the mailing address for tax statements. This ensures that Grantees receive necessary information regarding property taxes.

-

Not Reviewing Local Regulations: Each county may have specific requirements or restrictions. Not checking these can lead to issues when filing the deed.

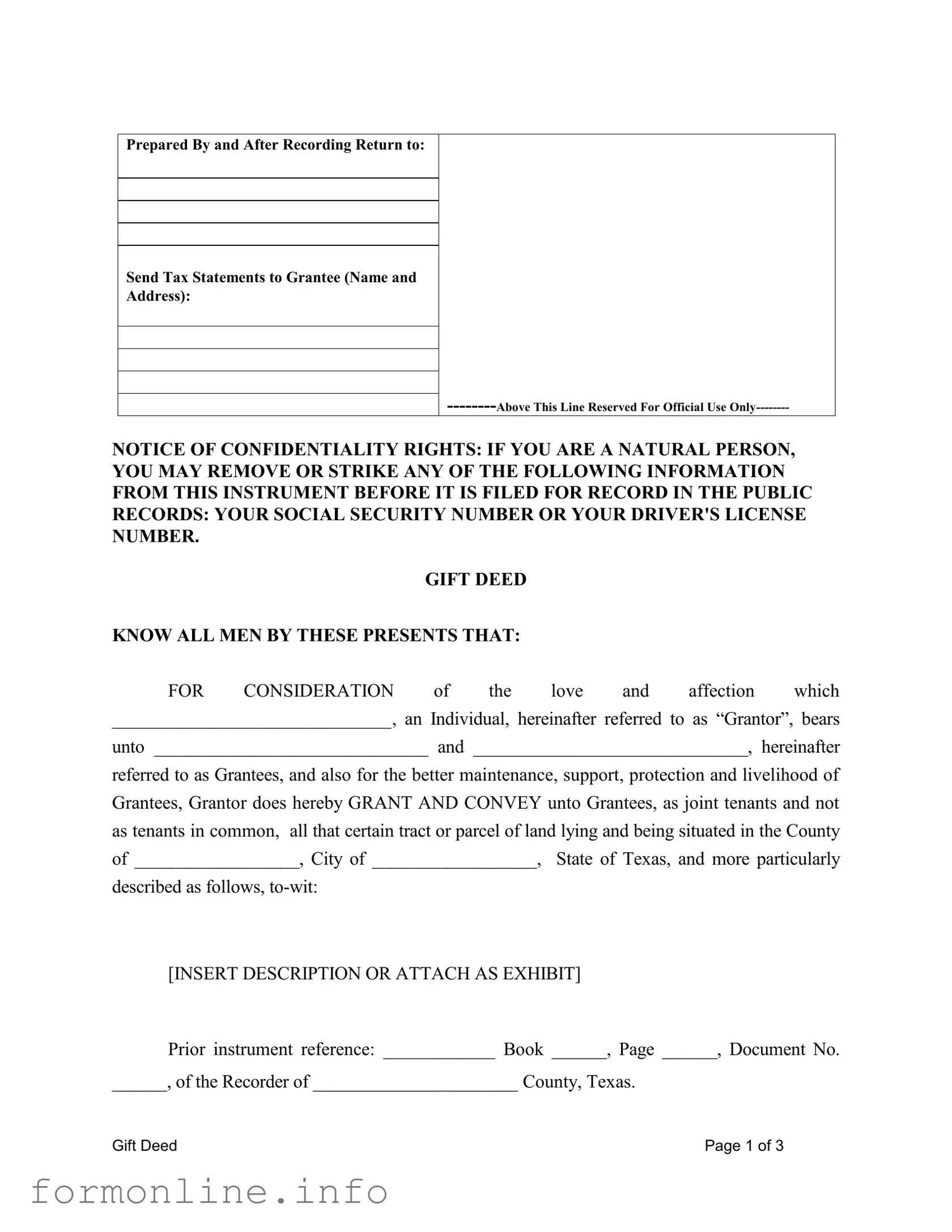

Preview - Gift Deed Texas Form

Prepared By and After Recording Return to:

Send Tax Statements to Grantee (Name and

Address):

NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU MAY REMOVE OR STRIKE ANY OF THE FOLLOWING INFORMATION FROM THIS INSTRUMENT BEFORE IT IS FILED FOR RECORD IN THE PUBLIC RECORDS: YOUR SOCIAL SECURITY NUMBER OR YOUR DRIVER'S LICENSE NUMBER.

GIFT DEED

KNOW ALL MEN BY THESE PRESENTS THAT:

FOR CONSIDERATION of the love and affection which

______________________________, an Individual, hereinafter referred to as “Grantor”, bears

unto ______________________________ and ______________________________, hereinafter

referred to as Grantees, and also for the better maintenance, support, protection and livelihood of Grantees, Grantor does hereby GRANT AND CONVEY unto Grantees, as joint tenants and not as tenants in common, all that certain tract or parcel of land lying and being situated in the County of __________________, City of __________________, State of Texas, and more particularly

described as follows,

[INSERT DESCRIPTION OR ATTACH AS EXHIBIT]

Prior instrument reference: ____________ Book ______, Page ______, Document No.

______, of the Recorder of ______________________ County, Texas.

Gift Deed |

Page 1 of 3 |

TO HAVE AND TO HOLD the above described premises together with all and singular the rights and appurtenances thereto in anywise belonging unto the above named Grantees, their successors and assigns forever; and Grantor herein hereby binds itself, its successors, assigns, and administrators to WARRANT AND FOREVER DEFEND all and singular the said premises unto the above named Grantee, their successors and assigns, against every person whomsoever lawfully claiming or to claim the same or any part thereof.

Grantees, TO HAVE AND TO HOLD as joint tenants, with right of survivorship and not as tenants in common, their heirs, personal representatives, executors and assigns forever: it being the intention of the parties to this conveyance, that (unless the joint tenancy hereby created is severed or terminated during the joint lives of the grantees herein) in the event one Grantee herein survives the other, the entire interest in fee simple shall pass to the surviving Grantee, and if one does not survive the other, then the heirs and assigns of the Grantees herein shall take as tenants in common.

This conveyance is made and accepted subject to the following matters, to the extent same are in effect at this time: Any and all restrictions, covenants, conditions and easements, if any, relating to the hereinabove described property, but only to the extent they are still in effect, shown of record in the hereinabove mentioned County and State; and to all zoning laws, regulations and ordinances of municipal and/or other governmental authorities, if any, but only to the extent that they are still in effect, relating to the hereinabove described property.

The property herein conveyed is not a part of the homestead of Grantor, or is part of the homestead of Grantor and the conveyance is joined by both Husband and Wife.

WITNESS Grantor’s hand this the ______ day of __________________, 20______.

Grantor

Type or Print Name

Gift Deed |

Page 2 of 3 |

STATE OF TEXAS

COUNTY OF __________________

This instrument was acknowledged before me on __________________ (date) by

____________________________________ (name of representative) as

____________________________________ (title of representative) of

________________________________________________ (name of entity or person

represented).

Notary Public

My commission expires:

Type or Print Name

Mailing Address of Grantee:

Name

Address

Gift Deed |

Page 3 of 3 |

Other PDF Templates

How to Count Down a Register - Document cash transactions to ensure accountability.

A Georgia Last Will and Testament form is a legal document that outlines an individual's wishes regarding the distribution of their assets after death. This essential tool ensures that your intentions are respected and that your loved ones are cared for according to your preferences. Understanding the importance of this form can provide peace of mind, so consider filling it out by visiting georgiapdf.com and following the necessary steps.

Cuddle Buddy Application Meme - Connect with others and experience the benefits of cuddling.

Documents used along the form

When preparing a Gift Deed in Texas, several other forms and documents may also be required or beneficial to have on hand. These documents can help ensure that the transfer of property goes smoothly and complies with local laws. Here’s a list of commonly used forms alongside the Gift Deed:

- Property Description Form: This document provides a detailed description of the property being transferred. It may include boundaries, dimensions, and any significant features. Accurate descriptions help prevent disputes in the future.

- Affidavit of Heirship: This affidavit is often used when the property owner has passed away. It establishes the heirs' rights to the property and can simplify the transfer process.

- Title Search Report: A title search report reveals any liens, claims, or encumbrances on the property. It is essential for ensuring that the grantor has the right to gift the property without any legal issues.

- Texas Form 50-114 (Affidavit of Exempt Use): This form is used to claim an exemption from property taxes for a property being gifted. It helps clarify the tax implications of the transfer.

- Transfer Tax Declaration: Some counties require a declaration of the transfer tax when property changes hands. This form provides information necessary for calculating any applicable taxes.

- Hold Harmless Agreement: When engaging in contracts, consider utilizing the comprehensive Hold Harmless Agreement resources to safeguard interests and mitigate liability risks.

- Notice of Confidentiality Rights: This document informs individuals about their rights to protect personal information when filing public documents. It is particularly important for those concerned about privacy.

- Joint Tenancy Agreement: If the property is being transferred to multiple grantees as joint tenants, this agreement outlines the rights and responsibilities of each party involved in the ownership.

- Warranty Deed: Although different from a Gift Deed, a warranty deed may be used in conjunction to provide additional assurance about the property’s title. It guarantees that the grantor holds clear title to the property.

- Power of Attorney: If the grantor cannot be present to sign the Gift Deed, a power of attorney allows someone else to act on their behalf. This document must be properly executed to be valid.

Having these documents ready can facilitate a smoother transaction and help protect the interests of all parties involved. It's always wise to consult with a professional if you have questions about specific requirements or processes in your area.

Similar forms

The Gift Deed in Texas shares similarities with a Warranty Deed, which is commonly used in real estate transactions. Both documents serve to transfer ownership of property from one party to another. However, while a Gift Deed conveys property without any exchange of money or consideration, a Warranty Deed guarantees that the seller holds clear title to the property and is responsible for any claims against it. This distinction is crucial; the Warranty Deed offers a level of protection to the buyer that is not present in a Gift Deed, which is often based on trust and personal relationships.

Another document similar to the Gift Deed is the Quitclaim Deed. Like the Gift Deed, a Quitclaim Deed transfers ownership of property but does so without any warranties regarding the title. This means that the grantor does not guarantee that they have any ownership interest in the property being transferred. While both documents can be used to transfer property between family members or friends, the Quitclaim Deed is often used in situations where the parties know each other well, as it carries more risk for the grantee.

When dealing with tax documentation, it's important for individuals to understand the various forms available to them, such as a Sample Tax Return Transcript form, which details an individual's tax return status with the IRS. For those needing to access this specific documentation for verification or financial planning purposes, you can download the form to ensure you have the right information at hand.

A Transfer on Death Deed (TOD) also resembles the Gift Deed in its purpose of transferring property. The key difference lies in the timing of the transfer. A Gift Deed takes effect immediately upon signing, while a TOD Deed allows the property to pass to the beneficiary upon the death of the owner without going through probate. This can be a strategic choice for individuals looking to simplify the transfer of their estate, while still retaining control over the property during their lifetime.

The Special Warranty Deed is another document that bears similarities to the Gift Deed. Both documents involve the transfer of property, but a Special Warranty Deed provides limited warranties from the grantor. The grantor only guarantees that they have not caused any issues with the title during their ownership. This contrasts with the Gift Deed, which does not include any warranties at all. As a result, the Special Warranty Deed may offer some reassurance to the grantee regarding the title, even though it does not provide the full protections of a Warranty Deed.

A Bill of Sale is also related to the Gift Deed in that it can be used to transfer ownership of personal property, rather than real estate. While the Gift Deed specifically pertains to real property, a Bill of Sale can be utilized for items such as vehicles, furniture, or equipment. Both documents can be executed without monetary exchange and rely on the intent of the parties involved. However, a Bill of Sale does not require the same level of detail regarding the property description, making it a more straightforward option for personal property transfers.

Lastly, the Deed of Trust can be considered similar in that it involves the transfer of property interests. However, a Deed of Trust is primarily used in financing transactions and establishes a security interest in the property for a lender. While a Gift Deed conveys ownership without any financial obligation, a Deed of Trust creates a lien against the property, which serves as collateral for a loan. This fundamental difference highlights the distinct purposes these documents serve, even though both involve the transfer of property interests.

Dos and Don'ts

When filling out the Gift Deed Texas form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do provide complete names and addresses for both the Grantor and Grantees. This information is crucial for legal clarity.

- Do include a clear description of the property being conveyed. This helps avoid any confusion about what is being gifted.

- Do ensure that any necessary signatures are obtained. The Grantor must sign the document, and it may need to be notarized.

- Do check for any outstanding restrictions or conditions related to the property. This ensures that the transfer complies with local laws.

- Don't forget to remove sensitive personal information, such as Social Security numbers, before filing the document. This helps protect your privacy.

- Don't leave any sections of the form blank. Incomplete forms can lead to delays or rejection of the deed.

- Don't ignore the requirement for notarization if applicable. Notarizing the document may be necessary for it to be legally binding.

- Don't overlook local zoning laws and regulations that may affect the property. Understanding these can prevent future legal issues.

Key takeaways

Filling out and using the Gift Deed Texas form involves several important steps and considerations. Here are key takeaways to keep in mind:

- Understand the Purpose: A Gift Deed transfers property without monetary exchange, often based on love and affection.

- Identify the Parties: Clearly specify the Grantor (the person giving the gift) and the Grantees (the recipients).

- Property Description: Include a precise description of the property being transferred. Attach an exhibit if necessary.

- Joint Tenancy: The deed typically establishes joint tenancy with right of survivorship, meaning if one Grantee passes away, the other automatically inherits the property.

- Homestead Status: Indicate whether the property is part of the Grantor's homestead. This affects the validity of the transfer.

- Confidentiality Rights: Grantors can remove personal information, such as Social Security numbers, from the deed before filing.

- Notarization Requirement: The deed must be acknowledged by a notary public to be legally binding.

- Compliance with Local Laws: Ensure the deed complies with local zoning laws, restrictions, and covenants that may affect the property.

- Record the Deed: After completion, the deed should be recorded in the county where the property is located to provide public notice of the transfer.

- Tax Implications: Consider potential tax implications for both the Grantor and Grantees, including gift tax responsibilities.

Taking these steps will help ensure a smooth transfer of property through a Gift Deed in Texas.

How to Use Gift Deed Texas

Filling out the Gift Deed Texas form requires careful attention to detail. After completing the form, it must be signed and notarized before being filed with the appropriate county office. Ensure that all information is accurate to avoid complications during the transfer of property.

- Prepare the form: Obtain a copy of the Gift Deed Texas form. This can typically be found online or at your local county clerk's office.

- Identify the Grantor: In the designated area, write the name of the person giving the gift (the Grantor).

- Identify the Grantees: Enter the names of the individuals receiving the gift (the Grantees). If there are multiple Grantees, ensure all names are included.

- Specify the property: Clearly describe the property being transferred. This includes the county, city, and a detailed description of the land. If necessary, attach an exhibit with the description.

- Reference prior instruments: If applicable, provide information about any previous deeds related to the property, including book, page, and document numbers.

- Indicate the nature of ownership: Specify that the Grantees will hold the property as joint tenants with the right of survivorship, unless otherwise stated.

- Check for restrictions: Acknowledge any existing restrictions, covenants, conditions, or easements that may affect the property.

- Homestead declaration: Indicate whether the property is part of the Grantor's homestead and confirm if both spouses are joining in the conveyance.

- Sign the form: The Grantor must sign and date the document in the designated area.

- Notarization: Take the completed form to a notary public for acknowledgment. The notary will sign and stamp the document.

- File the deed: Submit the notarized Gift Deed to the appropriate county office for recording. Ensure to keep a copy for personal records.