Fill Out a Valid Gift Letter Form

The Gift Letter form plays a crucial role in the realm of financial transactions, particularly when it comes to real estate purchases. This document serves as a formal declaration from the donor, confirming that the funds provided to the recipient are indeed a gift and not a loan. By clarifying the nature of the funds, the Gift Letter helps to prevent any misunderstandings that could arise during the mortgage application process. It typically includes essential details such as the donor's name, the recipient's name, the amount of the gift, and a statement affirming that repayment is not expected. Furthermore, lenders often require this form to ensure compliance with their guidelines, which can impact the recipient's eligibility for a mortgage. Understanding the significance of the Gift Letter form is vital for both donors and recipients, as it facilitates smoother financial transactions and strengthens the integrity of the borrowing process.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. This includes the donor's name, address, and relationship to the recipient. Leaving out any of this information can delay the process.

-

Incorrect Amount: Some individuals mistakenly write the wrong gift amount. Double-checking the figures ensures that the amount aligns with what was actually given.

-

Signature Issues: Not signing the letter or using a digital signature when a handwritten one is required can lead to complications. Always ensure the donor signs the document as needed.

-

Failure to Date: Omitting the date can create confusion regarding when the gift was made. Including the date is essential for record-keeping and clarity.

-

Not Clarifying the Gift Type: Some people forget to specify whether the gift is cash or property. Clearly stating the type of gift helps avoid misunderstandings and ensures proper documentation.

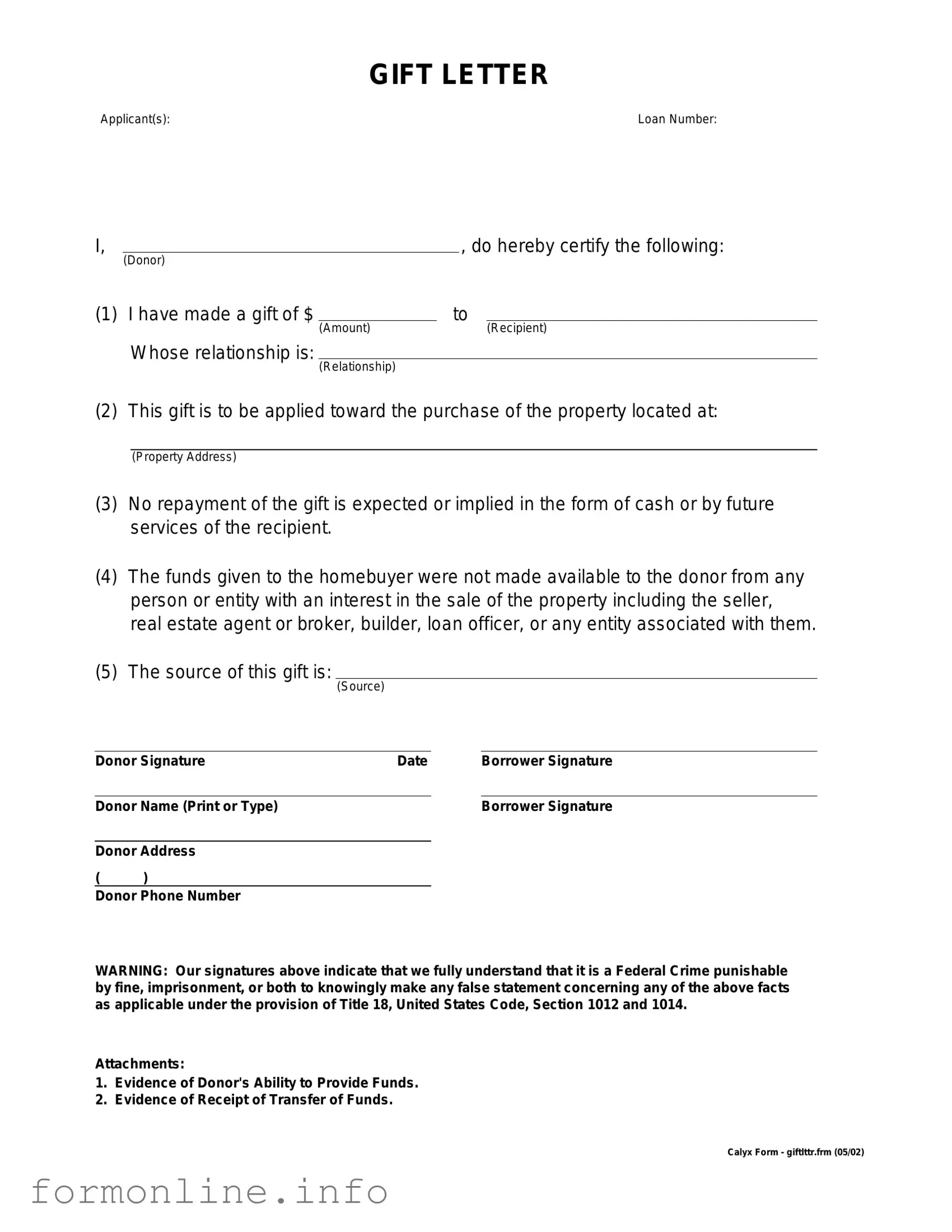

Preview - Gift Letter Form

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Other PDF Templates

Stock Transfer Form Download - The form allows for clear documentation of stock certificate information.

For a seamless and legally binding vehicle transaction, it is essential to reference the Alabama Motor Vehicle Bill of Sale, which can be found at https://billofsaleforvehicles.com/editable-alabama-motor-vehicle-bill-of-sale/, ensuring that all necessary details are correctly documented for both the seller and buyer.

Geico Supplement Request Portal - Authorization is required from GEICO for all supplement requests to be honored.

Documents used along the form

A Gift Letter form is commonly used in real estate transactions to document financial gifts received by a borrower. This form serves to clarify that the funds are a gift and not a loan, which can impact the borrower’s ability to qualify for a mortgage. In addition to the Gift Letter, several other documents may be required to support the transaction. Below is a list of these documents, along with brief descriptions of each.

- Bank Statements: These documents show the financial history of the donor. They help verify that the funds given as a gift are available and legitimate.

- Mobile Home Bill of Sale: This essential legal document facilitates the transfer of ownership of a mobile home, including details about the buyer and seller, the property description, and the sale price. For more information and to access a template, visit the Mobile Home Bill of Sale.

- Proof of Relationship: This may include documents such as birth certificates or marriage licenses. These documents establish the relationship between the donor and the recipient, confirming that the gift is from a family member or close friend.

- Loan Application: This form outlines the borrower's financial situation, including income, debts, and assets. It is crucial for lenders to assess the borrower's ability to repay the mortgage.

- Gift Tax Return (IRS Form 709): If the gift exceeds a certain amount, the donor may be required to file this form with the IRS. It reports the gift and ensures compliance with tax regulations.

- Purchase Agreement: This document outlines the terms of the property sale, including the purchase price and any contingencies. It is essential for the transaction process.

- Title Insurance Policy: This policy protects the buyer and lender from potential issues with the property title. It ensures that the title is clear of any claims or liens.

These documents collectively support the Gift Letter and help facilitate a smooth transaction process. Ensuring that all necessary paperwork is in order can significantly enhance the likelihood of a successful mortgage application.

Similar forms

The Gift Letter form is similar to a Donation Receipt. A Donation Receipt is often used when a person or organization makes a charitable contribution. Both documents serve to confirm the transfer of funds or assets without expecting anything in return. They typically include details such as the donor's name, the recipient's name, the amount donated, and the date of the transaction. This ensures transparency and provides a record for tax purposes, just like a Gift Letter does for personal gifts in real estate transactions.

The Texas Motor Vehicle Bill of Sale form is an essential document ensuring clarity and legality in vehicle transactions. This form formalizes the transfer of ownership, safeguarding both buyer and seller in the process. For those requiring more detailed information, resources are available at https://autobillofsaleform.com/texas-motor-vehicle-bill-of-sale-form.

Another document that resembles the Gift Letter is the Affidavit of Support. This form is commonly used in immigration processes to demonstrate that a person has adequate financial support. Like the Gift Letter, it outlines the relationship between the parties involved and specifies the financial commitment being made. Both documents aim to provide assurance to third parties, such as lenders or immigration officials, that the recipient will not face financial hardship.

The Gift Tax Return is also similar to the Gift Letter. This document is filed with the IRS when a person gives a gift above a certain value. While the Gift Letter is more informal and serves as a personal acknowledgment of a gift, the Gift Tax Return is a formal declaration of the gift for tax purposes. Both documents require the donor to provide details about the gift, including its value and the recipient's information, ensuring compliance with tax regulations.

A Promissory Note shares similarities with the Gift Letter as well. A Promissory Note is a financial document in which one party promises to pay a specified sum to another party. While it often involves a repayment plan, it can also be used in situations where funds are given without expectation of repayment, similar to a gift. Both documents establish a clear understanding between the parties involved, outlining the terms and intentions behind the financial transaction.

The Loan Agreement is another document that parallels the Gift Letter. Although a Loan Agreement typically involves a borrower and a lender, it can sometimes include provisions for gifts or grants. Both documents require clear communication about the terms of the financial arrangement. They ensure that all parties understand their rights and responsibilities, promoting transparency and reducing potential disputes.

Lastly, the Release of Liability form is akin to the Gift Letter in that both documents involve an understanding of risk and responsibility. A Release of Liability is often used when someone agrees not to hold another party responsible for any potential harm or loss. While the Gift Letter focuses on the transfer of a gift, both documents require the parties to acknowledge their relationship and the implications of the transaction, fostering clarity and mutual understanding.

Dos and Don'ts

When filling out the Gift Letter form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the donor and recipient.

- Do clearly state the amount of the gift.

- Do include a statement confirming that the gift is not a loan.

- Do sign and date the form to validate it.

- Don’t omit any required details, as this may delay processing.

- Don’t use vague language; be specific about the terms of the gift.

Key takeaways

When filling out and using the Gift Letter form, keep the following key points in mind:

- Clarity is essential. Clearly state the amount of the gift and the relationship between the giver and the recipient. This helps avoid any misunderstandings.

- Signature matters. Ensure that the giver signs the letter. A signature adds authenticity and confirms the giver’s intent.

- Document the purpose. Specify that the funds are a gift and not a loan. This distinction is crucial for financial institutions.

- Keep a copy. Retain a copy of the completed Gift Letter for your records. This can be important for future reference or if questions arise.

How to Use Gift Letter

Completing the Gift Letter form is a straightforward process that requires careful attention to detail. After filling out the form, you will be ready to submit it as part of your financial documentation.

- Begin by entering the date at the top of the form.

- Provide the full name of the donor. This is the person giving the gift.

- Next, include the donor's address. Make sure this is accurate and up-to-date.

- Fill in the recipient's name. This is the person receiving the gift.

- Enter the recipient's address, ensuring it is correct.

- Specify the amount of the gift. Write this clearly in both numbers and words.

- Indicate the relationship between the donor and the recipient. This could be parent, sibling, friend, etc.

- Have the donor sign and date the form at the bottom.

- Review the entire form for accuracy before submission.