Fill Out a Valid Goodwill donation receipt Form

When you decide to donate items to Goodwill, you not only contribute to a worthy cause but also open the door to potential tax benefits. A crucial part of this process is the Goodwill donation receipt form, which serves as proof of your charitable contribution. This form typically includes essential details such as the date of the donation, a description of the items donated, and their estimated value. While you don’t need to provide a detailed inventory, a general overview helps both you and Goodwill. It’s important to remember that this receipt is not just a piece of paper; it can play a significant role during tax season. By keeping this receipt, you can substantiate your donation when filing your taxes, potentially leading to deductions that can lighten your financial load. Understanding how to properly fill out and retain this form ensures that you maximize the benefits of your generosity while supporting Goodwill's mission of helping individuals achieve independence through education and employment.

Common mistakes

-

Inaccurate Item Descriptions: Donors often fail to provide detailed descriptions of the items they are donating. Instead of just writing "clothes," specify the type, such as "men's winter coat" or "women's jeans." This helps in assessing the value of the donation.

-

Missing Signatures: Some individuals forget to sign the receipt. A signature is crucial as it serves as proof of the donation for tax purposes. Ensure that the form is signed before leaving the donation center.

-

Not Keeping a Copy: After filling out the receipt, many donors neglect to keep a copy for their records. Retaining a copy is important for tax deductions and personal records. Always ask for a duplicate or make a photocopy.

-

Overestimating Value: Donors sometimes assign inflated values to their items. The IRS requires that the value of donated goods be fair market value. Be realistic when estimating how much your items are worth.

-

Failure to List All Items: Some people list only a few items instead of all the items donated. Every item counts towards your deduction. List everything to ensure you maximize your potential tax benefits.

-

Ignoring Condition of Items: Donors may overlook the importance of noting the condition of their items. Indicate whether items are new, gently used, or in need of repair. This information can affect the valuation and acceptance of the donation.

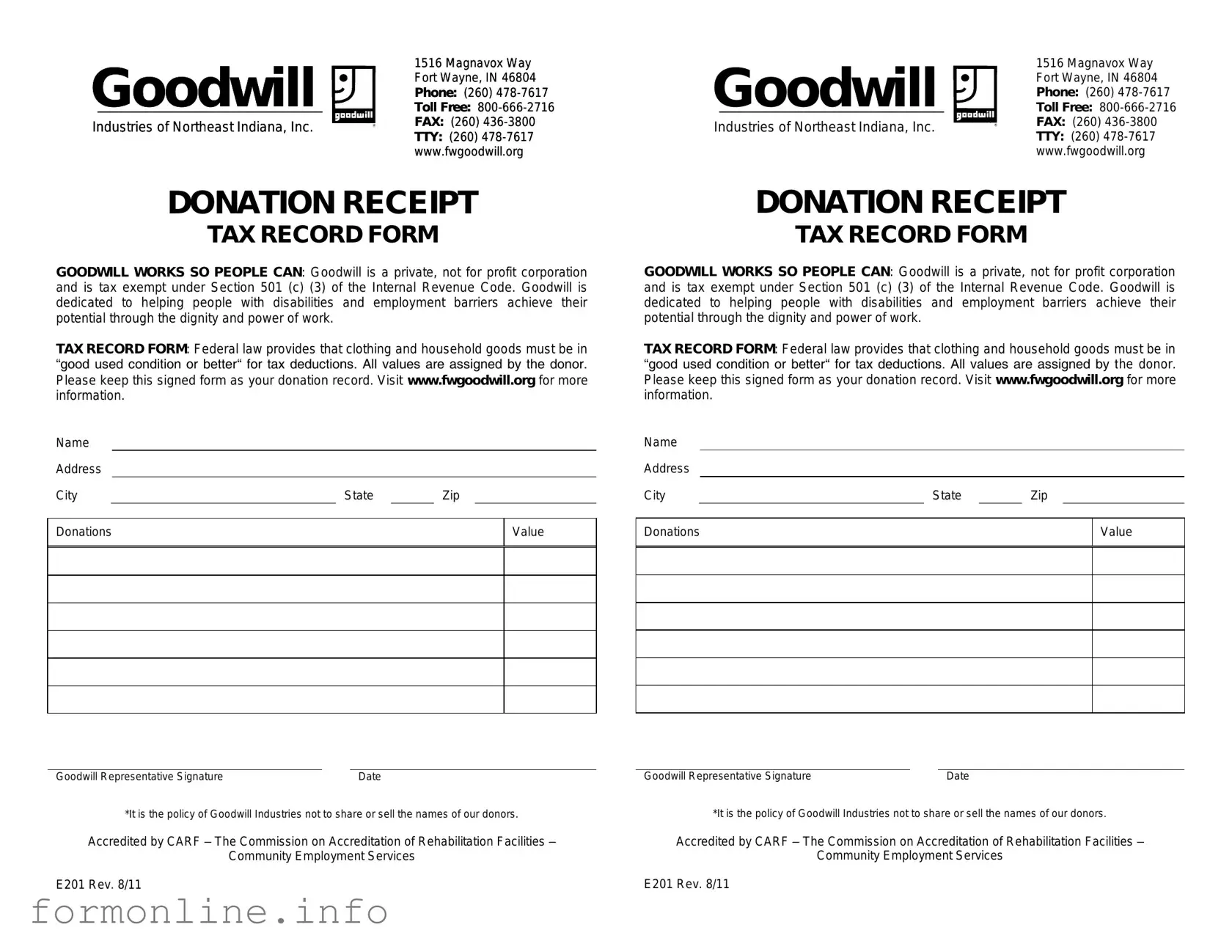

Preview - Goodwill donation receipt Form

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Other PDF Templates

Texas Driver License Renewal Form - Individuals must provide proof of identity when submitting the DL-43.

To streamline the process of requesting a refund, it's important to familiarize yourself with the ST-12B Georgia form as outlined on georgiapdf.com/, where you can find detailed instructions and resources to assist in accurately completing your affidavit for sales tax refunds.

Facial Release Form - You will be informed about alternative treatments.

Documents used along the form

The Goodwill donation receipt form is an important document for individuals donating items to Goodwill. It serves as proof of the donation for tax purposes. In addition to this receipt, several other forms and documents are commonly used in conjunction with the donation process. Below is a list of these documents, each with a brief description.

- Donation Inventory List: This list details the items donated, including their condition and estimated value. It helps the donor keep track of what has been given and is useful for tax deductions.

- Charitable Contribution Statement: This statement outlines the total value of all charitable contributions made within a tax year. It is essential for donors who wish to itemize deductions on their tax returns.

- Tax Deduction Worksheet: This worksheet assists donors in calculating the potential tax deductions based on the fair market value of donated items. It provides a structured way to assess the financial benefits of donations.

- Last Will and Testament Form: To ensure your final wishes are respected, consult the comprehensive Last Will and Testament guidelines for proper documentation of your estate planning.

- Appraisal Report: For high-value items, an appraisal report may be necessary. This document provides a professional assessment of an item's value, which can be crucial for tax purposes.

- Goodwill Donation Guidelines: These guidelines outline what items are acceptable for donation and any restrictions. They help donors understand the donation process and ensure compliance.

- Thank You Letter: After a donation, Goodwill may send a thank you letter. This letter serves as an acknowledgment of the donation and can also be used for tax records.

- IRS Form 8283: This form is required for non-cash charitable contributions exceeding $500. It must be completed and submitted with the donor's tax return to substantiate the donation.

Understanding these documents can facilitate a smoother donation process and ensure compliance with tax regulations. Proper documentation is essential for maximizing the benefits of charitable contributions.

Similar forms

The Goodwill donation receipt form shares similarities with the charitable contribution receipt. Both documents serve as proof of a donation made to a nonprofit organization. They typically include the donor's name, the date of the donation, and a description of the items donated. This receipt is crucial for tax purposes, allowing donors to claim deductions on their income tax returns. The main difference lies in the organizations to which they are addressed, as the charitable contribution receipt can be issued by any qualifying nonprofit, while the Goodwill receipt is specific to donations made to Goodwill Industries.

Another similar document is the IRS Form 8283, which is used for noncash charitable contributions. This form is required when a donor claims a deduction for items valued over $500. Like the Goodwill receipt, it requires details about the donated items, including their fair market value. However, Form 8283 is more comprehensive and requires additional information, such as appraisals for higher-value items. Both documents play a critical role in substantiating tax deductions for charitable donations.

The Pennsylvania Motor Vehicle Bill of Sale form is an essential document for validating the transfer of ownership from a seller to a buyer for motor vehicle transactions within the state. It functions as a legal contract, ensuring both parties are clear on the details of the sale, such as vehicle information and agreed terms. This form not only streamlines the transaction process but also acts as an important record for tax assessments and legal protection. For more information about this document, you can visit autobillofsaleform.com/pennsylvania-motor-vehicle-bill-of-sale-form.

The donation acknowledgment letter is also comparable to the Goodwill donation receipt. This letter is issued by the charity to acknowledge the receipt of a donation. It typically includes the donor's name, the donation amount, and a statement confirming that no goods or services were provided in exchange for the donation. While both documents serve as proof of donation, the acknowledgment letter may be more formal and personalized, often expressing gratitude for the donor's generosity.

The cash donation receipt is another document that bears resemblance to the Goodwill receipt. This type of receipt is issued when a donor makes a cash contribution to a charity. It includes the donor's name, the date of the donation, and the amount donated. Similar to the Goodwill receipt, it is essential for tax deduction purposes. However, the cash donation receipt does not require a description of items, as it only pertains to monetary contributions.

The donor's tax return is also relevant when discussing donation documentation. While not a receipt, the tax return reflects any charitable contributions made during the year, including those documented by a Goodwill receipt. Donors must report their total contributions when filing their taxes, and the receipts serve as supporting documentation. The tax return consolidates all donations, whereas the Goodwill receipt focuses solely on the specific transaction.

The inventory list for donated items is another document that can be compared to the Goodwill receipt. This list is often created by the donor to itemize all goods being donated. It includes details such as the quantity and description of each item. While the Goodwill receipt acknowledges the donation, the inventory list provides a more detailed account of what was given. Both documents are useful for tax purposes, but the inventory list is not always required.

The donor's ledger is a document that tracks all charitable donations made by an individual throughout the year. This ledger can include entries for donations made to Goodwill as well as other charities. It serves as a personal record for the donor and can help in preparing tax returns. While the Goodwill receipt provides proof of a specific donation, the ledger offers a broader view of an individual's charitable giving.

The pledge card is another document that is somewhat similar. It is typically used during fundraising campaigns to record a donor's commitment to give a specific amount over a period. While the Goodwill receipt confirms a completed donation, the pledge card indicates an intention to donate in the future. Both documents are important for tracking donations, but they serve different purposes in the donation process.

Finally, the donor agreement is a formal document that outlines the terms of a donation, especially for significant gifts or bequests. This agreement may detail how the funds or items will be used by the charity. Similar to the Goodwill receipt, it serves as a record of the donation, but it often involves more complex terms and conditions. Both documents are critical for ensuring transparency and accountability in charitable giving.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it's important to follow certain guidelines to ensure the process goes smoothly. Below are some key dos and don'ts to consider.

- Do provide accurate information about the items donated.

- Do keep a copy of the receipt for your records.

- Do estimate the fair market value of your donated items.

- Do sign and date the receipt before submitting it.

- Do check for any specific instructions from Goodwill regarding the donation process.

- Don't leave any sections of the form blank.

- Don't overestimate the value of your items to avoid issues with tax deductions.

- Don't forget to list all items separately if required.

- Don't discard the receipt until you have confirmed your tax return has been filed.

Key takeaways

When using the Goodwill donation receipt form, there are several important points to keep in mind. These tips can help ensure a smooth donation process and make the most of your charitable contributions.

- Complete All Required Information: Fill out your name, address, and the date of the donation. This information is crucial for record-keeping and tax purposes.

- List Donated Items: Clearly describe the items you are donating. Include details such as quantity and condition to provide a complete record.

- Estimate Fair Market Value: Assign a reasonable value to each item. This valuation will be important when claiming deductions on your taxes.

- Keep a Copy for Your Records: Always retain a copy of the receipt for your personal records. This will help if you need to reference your donation later.

- Understand Tax Deduction Limits: Familiarize yourself with IRS guidelines on charitable donations. There are limits on how much you can deduct based on your income and the value of your donations.

- Use Receipts for Tax Filing: When tax season arrives, include your Goodwill donation receipt with your tax return. This documentation supports your claim for deductions.

By following these key points, you can ensure that your donation process is efficient and beneficial for both you and Goodwill.

How to Use Goodwill donation receipt

After gathering your donations for Goodwill, you will need to fill out the donation receipt form. This form serves as a record of your contribution and may be useful for tax purposes. Follow these steps carefully to ensure all necessary information is accurately recorded.

- Begin by entering the date of your donation at the top of the form.

- Write your name and address in the designated fields. Make sure to include your city, state, and ZIP code.

- List the items you are donating. Be specific about each item, including quantity and condition.

- Assign a fair market value to each item. This is the price you believe the items could sell for in a thrift store.

- Sign the form to confirm that the information provided is accurate.

- Keep a copy of the completed form for your records.