Fill Out a Valid Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form is an essential tool for both contractors and businesses that engage their services. This form provides a clear record of payments made to independent contractors, detailing the amount earned for specific services rendered. It typically includes key information such as the contractor's name, payment date, and the total amount paid, along with any applicable deductions or taxes. By using this form, businesses can ensure compliance with tax regulations while offering transparency to contractors regarding their earnings. Moreover, independent contractors benefit from having a documented payment history, which can be crucial for personal budgeting or applying for loans. Understanding how to properly fill out and utilize the Independent Contractor Pay Stub form can streamline financial processes and foster a professional relationship between contractors and clients.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details, such as their name, address, or Social Security number. These errors can lead to tax issues or payment delays.

-

Miscalculating Hours Worked: It's common for contractors to misreport the number of hours worked. This can result in underpayment or overpayment, complicating future financial records.

-

Omitting Deductions: Some contractors neglect to include necessary deductions, such as taxes or benefits. This oversight can lead to unexpected tax liabilities at the end of the year.

-

Failing to Sign the Form: A signature is often required to validate the pay stub. Without it, the document may be considered incomplete or invalid, which can create problems with payment processing.

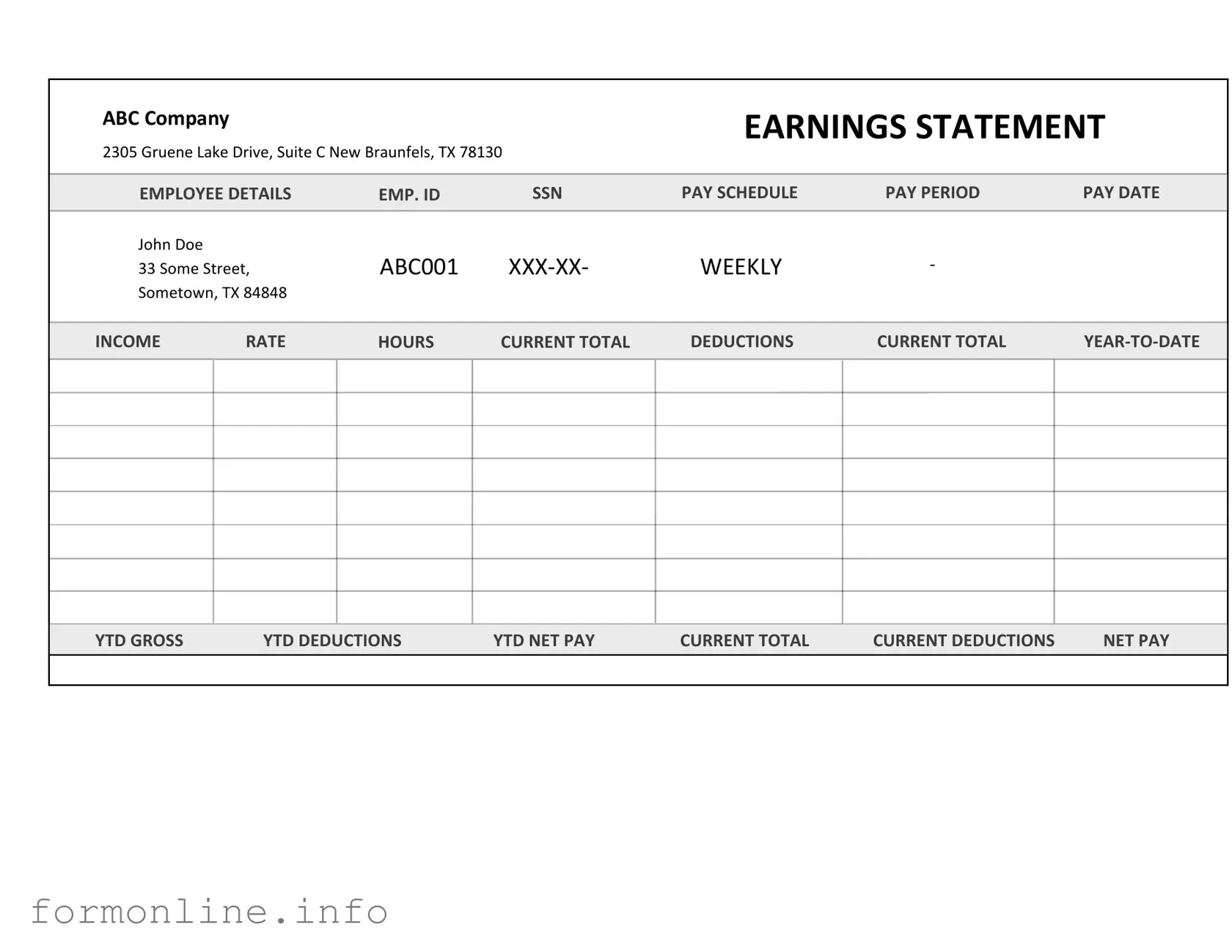

Preview - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Other PDF Templates

What Is a Release Form for Work - The form is necessary for tracking participation in work release programs.

For those seeking to understand the importance of a temporary Power of Attorney for a Child, this form serves as a crucial resource. It allows designated adults to step in during a parent's absence, ensuring the child's wellbeing and care are maintained without interruption.

Change Name on Title of Car - By signing this waiver, contractors acknowledge that they have received all contractual payments owed to them.

Documents used along the form

The Independent Contractor Pay Stub form serves as a crucial document in the financial relationship between a contractor and a hiring entity. However, it is often accompanied by other forms and documents that help clarify the terms of engagement, ensure compliance with tax regulations, and maintain accurate records. Below is a list of related documents that are commonly used in conjunction with the pay stub.

- Independent Contractor Agreement: This document outlines the terms and conditions of the working relationship. It typically includes details such as the scope of work, payment terms, and responsibilities of both parties.

- Arizona University Application Form: This form is essential for students applying for undergraduate programs at institutions such as Arizona State University and includes important details like the request for a waiver of the application fee for eligible Arizona residents. For more information, visit AZ Forms Online.

- W-9 Form: Contractors complete this form to provide their taxpayer identification information to the hiring entity. It is essential for tax reporting purposes, particularly when the contractor earns more than a specified threshold.

- Invoices: Independent contractors often submit invoices to request payment for services rendered. These documents itemize the work performed, the amount due, and the payment terms, serving as a formal request for compensation.

- 1099 Form: At the end of the tax year, the hiring entity issues this form to report the total amount paid to the contractor. It is a critical document for tax filing, as it informs the IRS about the contractor's earnings.

These documents collectively contribute to a transparent and organized financial relationship between independent contractors and their clients. Proper use of these forms can help prevent misunderstandings and ensure compliance with tax obligations.

Similar forms

The Independent Contractor Pay Stub form shares similarities with the Employee Pay Stub. Both documents serve as proof of payment for work completed, detailing the amount earned, deductions, and net pay. However, while the Employee Pay Stub typically includes information about taxes withheld and benefits provided, the Independent Contractor Pay Stub focuses more on the gross earnings without the same level of tax deductions. This distinction highlights the difference in employment status and the tax responsibilities that come with being an independent contractor versus an employee.

Another document akin to the Independent Contractor Pay Stub is the Invoice. Independent contractors often use invoices to request payment for services rendered. Like the pay stub, an invoice outlines the work completed, the amount due, and payment terms. However, invoices may not provide a detailed breakdown of deductions or taxes, as they are primarily focused on the amount owed rather than the payment received. The invoice acts as a request for payment, while the pay stub confirms that payment has been made.

The 1099 form is also closely related to the Independent Contractor Pay Stub. This tax document is issued to independent contractors at the end of the year to report income earned from various clients. While the pay stub provides a snapshot of earnings for a specific period, the 1099 summarizes total earnings for the entire year. Both documents serve important roles in financial record-keeping and tax reporting, ensuring that independent contractors can accurately report their income to the IRS.

The Receipt is another document that bears resemblance to the Independent Contractor Pay Stub. Receipts are issued as proof of payment for goods or services and can be provided by independent contractors to clients upon receiving payment. While a pay stub details the earnings and deductions associated with a specific job, a receipt confirms that payment has been made. Both documents are essential for financial tracking, but they serve different purposes in the payment process.

The Payment Confirmation Email is similar in function to the Independent Contractor Pay Stub. This informal document often accompanies a payment, providing a digital record of the transaction. It typically includes the amount paid, the date of payment, and a brief description of the services rendered. While it lacks the formal structure of a pay stub, it serves as an acknowledgment of payment, ensuring both parties have a record of the transaction.

In transactions involving mobile homes, it's important to utilize a formal process to ensure all details are captured accurately; that's where tools like the Mobile Home Bill of Sale come into play. This document provides clarity and legal protection for both buyers and sellers, helping to navigate the complexities associated with the transfer of ownership.

The Contract Agreement also shares common ground with the Independent Contractor Pay Stub. This document outlines the terms of the working relationship, including payment details, scope of work, and deadlines. While the pay stub reflects the financial outcome of the contract, the contract itself sets the stage for the expectations and obligations of both the contractor and the client. Together, they create a comprehensive view of the independent contractor's work and compensation.

Lastly, the Statement of Work (SOW) is another document that parallels the Independent Contractor Pay Stub. The SOW outlines the specific tasks, deliverables, and timelines agreed upon by the contractor and the client. While the pay stub provides details about payment for completed work, the SOW serves as a roadmap for the work to be done. Both documents are crucial for ensuring clarity and accountability in the contractor-client relationship, helping to avoid misunderstandings regarding compensation and deliverables.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, there are several important dos and don’ts to keep in mind. Following these guidelines can help ensure accuracy and compliance. Here’s a helpful list to consider:

- Do double-check all personal information for accuracy.

- Do include the correct payment period dates.

- Do clearly list all services provided and their corresponding rates.

- Do ensure that tax information is filled out correctly.

- Do maintain a copy for your records.

- Don’t leave any required fields blank.

- Don’t use vague descriptions for services rendered.

- Don’t forget to sign and date the form.

- Don’t submit the form without reviewing it for errors.

By following these dos and don’ts, you can fill out the Independent Contractor Pay Stub form with confidence and clarity.

Key takeaways

When filling out and using the Independent Contractor Pay Stub form, several important points should be kept in mind to ensure accuracy and compliance. Here are key takeaways to consider:

- Accurate Information: Always provide accurate personal and business information. This includes the contractor's name, address, and tax identification number.

- Payment Details: Clearly specify the payment amount and the period for which the payment is made. This helps in maintaining transparency and clarity.

- Deduction Information: If applicable, include any deductions taken from the payment. This could involve taxes, fees, or other withholdings.

- Payment Method: Indicate the method of payment, whether it is by check, direct deposit, or other means. This is important for record-keeping.

- Record Keeping: Keep a copy of the pay stub for your records. This documentation may be necessary for tax purposes or future reference.

- Legal Compliance: Ensure that the pay stub complies with any relevant state or federal laws regarding independent contractor payments.

- Professional Presentation: Use a clear and professional format for the pay stub. This enhances credibility and ensures that the information is easily understood.

How to Use Independent Contractor Pay Stub

Filling out the Independent Contractor Pay Stub form is a straightforward process that requires attention to detail. By carefully following the steps outlined below, you can ensure that all necessary information is accurately captured. Once completed, this form will serve as a record of payment for services rendered.

- Gather your information: Before you start, collect all relevant details such as your name, address, and Social Security number. You will also need the payment amount and the date of service.

- Fill in your personal information: Begin by entering your name and contact information at the top of the form. Make sure to include your full name, address, and any other required personal details.

- Provide the payment details: Next, indicate the amount you are being paid for your services. Clearly state this amount in the designated section of the form.

- Enter the service date: Specify the date when the services were performed. This helps in maintaining a clear record of when the work was completed.

- Include any deductions: If applicable, list any deductions that may need to be taken from your payment. This could include taxes or other agreed-upon amounts.

- Sign the form: Finally, sign and date the form to confirm that the information provided is accurate. This step is essential for validating the pay stub.

Once you have completed these steps, review the form to ensure that everything is correct. It’s a good idea to keep a copy for your records. You are now ready to submit the pay stub as needed.