Printable Investment Letter of Intent Form

The Investment Letter of Intent (LOI) serves as a crucial document in the realm of investment transactions, outlining the preliminary terms and conditions agreed upon by the parties involved. This form typically includes essential elements such as the proposed investment amount, the structure of the deal, and the timeline for the transaction. It may also address confidentiality provisions, due diligence requirements, and any contingencies that must be met before finalizing the agreement. By establishing a framework for negotiations, the LOI helps clarify the intentions of both the investor and the recipient, thereby reducing misunderstandings and fostering a smoother transaction process. While the document is often non-binding, it plays a significant role in signaling commitment and seriousness, paving the way for more detailed agreements to follow. Understanding the key components of the Investment Letter of Intent is vital for anyone involved in investment activities, as it sets the stage for successful financial partnerships.

Common mistakes

-

Incomplete Information: Many individuals fail to fill out all required fields. Missing information can delay processing and lead to misunderstandings.

-

Incorrect Contact Details: Providing wrong or outdated contact information can hinder communication. Always double-check phone numbers and email addresses.

-

Not Specifying Investment Amount: Some people forget to clearly state how much they intend to invest. This omission can create confusion about their commitment.

-

Ignoring Terms and Conditions: Skimming over the terms and conditions can lead to unexpected obligations. It's essential to read and understand what you're agreeing to.

-

Failure to Sign: Forgetting to sign the document is a common mistake. A signature is often required for the form to be valid.

-

Using Unclear Language: Vague descriptions or terms can lead to misinterpretation. Be as clear and specific as possible when filling out the form.

-

Not Keeping a Copy: Some individuals neglect to keep a copy of the submitted form. Having a record is important for future reference and accountability.

-

Submitting After Deadline: Missing the submission deadline can result in disqualification. Always be aware of important dates and submit on time.

Preview - Investment Letter of Intent Form

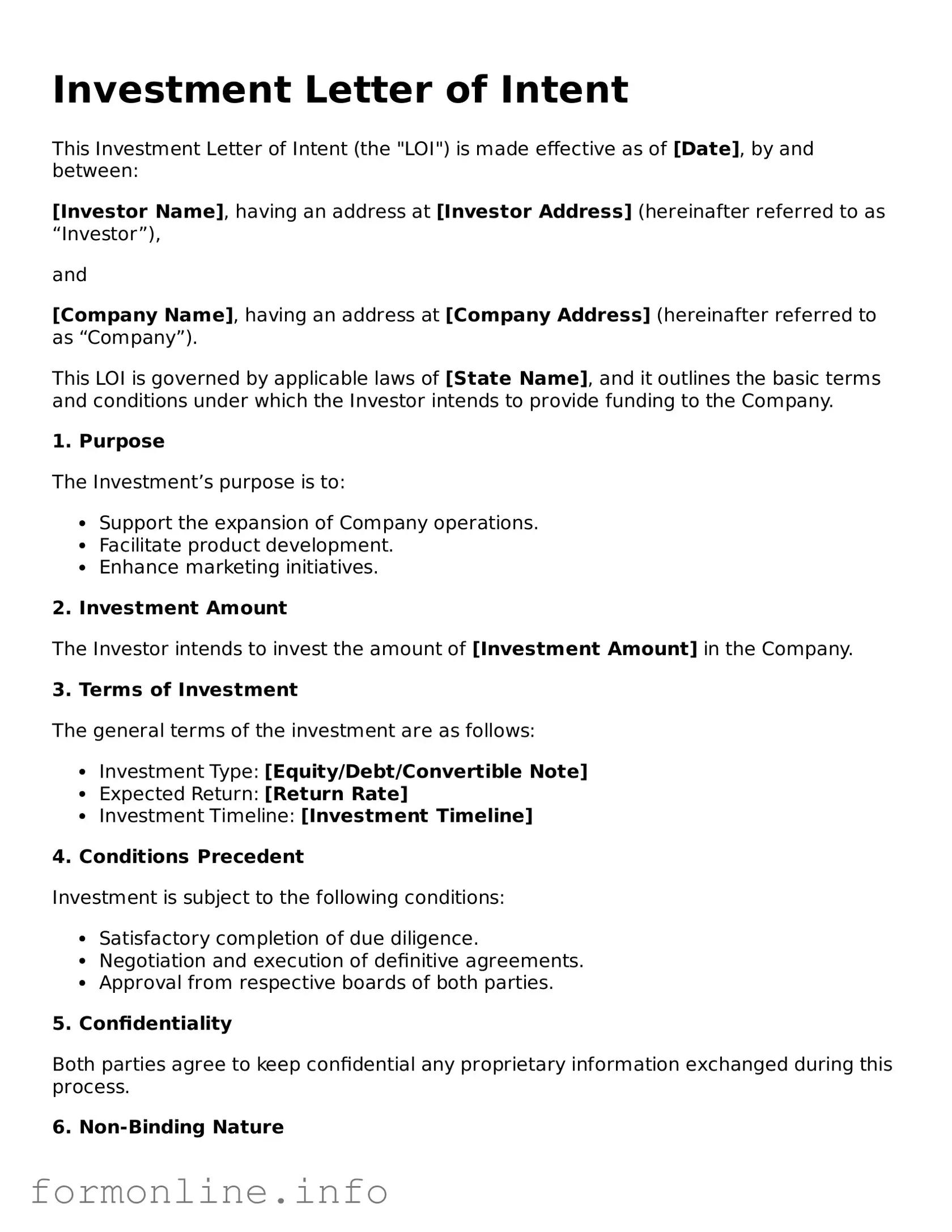

Investment Letter of Intent

This Investment Letter of Intent (the "LOI") is made effective as of [Date], by and between:

[Investor Name], having an address at [Investor Address] (hereinafter referred to as “Investor”),

and

[Company Name], having an address at [Company Address] (hereinafter referred to as “Company”).

This LOI is governed by applicable laws of [State Name], and it outlines the basic terms and conditions under which the Investor intends to provide funding to the Company.

1. Purpose

The Investment’s purpose is to:

- Support the expansion of Company operations.

- Facilitate product development.

- Enhance marketing initiatives.

2. Investment Amount

The Investor intends to invest the amount of [Investment Amount] in the Company.

3. Terms of Investment

The general terms of the investment are as follows:

- Investment Type: [Equity/Debt/Convertible Note]

- Expected Return: [Return Rate]

- Investment Timeline: [Investment Timeline]

4. Conditions Precedent

Investment is subject to the following conditions:

- Satisfactory completion of due diligence.

- Negotiation and execution of definitive agreements.

- Approval from respective boards of both parties.

5. Confidentiality

Both parties agree to keep confidential any proprietary information exchanged during this process.

6. Non-Binding Nature

This LOI is non-binding and does not create any obligation on either party to proceed with the investment, except for the confidentiality provisions and any other specific provisions herein.

Agreed and Accepted:

[Investor Name]

Signature: ______________________ Date: _______________

[Company Name]

Signature: ______________________ Date: _______________

More Types of Investment Letter of Intent Templates:

Letter of Intent for Grant - Indicate how you plan to communicate updates to stakeholders.

Teaching Job Ke Liye Application in English - A brief statement of commitment to education and student success.

Letter of Renting a Room - It can specify conditions or contingencies that must be met before a lease is finalized.

Documents used along the form

When engaging in investment opportunities, various forms and documents complement the Investment Letter of Intent (LOI). Each of these documents serves a specific purpose, helping to clarify terms, outline expectations, and protect the interests of all parties involved. Below is a list of commonly used documents in conjunction with an Investment Letter of Intent.

- Confidentiality Agreement: This document ensures that sensitive information shared between parties remains private. It outlines the obligations of each party to protect confidential information and specifies what constitutes confidential material.

- Term Sheet: A term sheet summarizes the key terms and conditions of an investment deal. It typically includes details like the investment amount, valuation, and ownership structure, providing a clear overview for all parties.

- Due Diligence Checklist: This checklist is a tool used to gather necessary information about the investment opportunity. It often includes financial statements, legal documents, and operational data to help assess the viability of the investment.

- Subscription Agreement: This agreement outlines the terms under which an investor agrees to purchase shares or interests in a company. It includes details on the investment amount, payment terms, and representations made by the investor.

- Operating Agreement: For LLCs, this document defines the management structure and operational procedures of the company. It outlines the rights and responsibilities of members, ensuring clarity in governance.

- Shareholder Agreement: This agreement governs the relationship between shareholders in a corporation. It covers issues such as voting rights, transfer of shares, and dispute resolution, protecting the interests of all shareholders.

- Investment Memorandum: Also known as a private placement memorandum (PPM), this document provides detailed information about the investment opportunity. It typically includes financial projections, risks, and the use of proceeds, helping investors make informed decisions.

- Escrow Agreement: This agreement establishes a third-party escrow agent to hold funds or assets until certain conditions are met. It ensures that both parties fulfill their obligations before the transaction is completed.

- Closing Statement: At the conclusion of a transaction, the closing statement summarizes the final terms, including the amounts paid and any adjustments made. It serves as a record of the transaction and is often required for legal compliance.

Understanding these documents can greatly enhance the investment process. Each one plays a vital role in ensuring that all parties are aligned and protected, ultimately fostering a smoother transaction experience. Always consider consulting with a professional to navigate these documents effectively.

Similar forms

The Investment Letter of Intent (LOI) shares similarities with a Memorandum of Understanding (MOU). Both documents outline the intentions of the parties involved and serve as a preliminary agreement. An MOU typically details the terms and conditions that the parties agree upon before finalizing a formal contract. It sets the stage for future negotiations, just like an LOI does, by clarifying the expectations and responsibilities of each party.

An Offer Letter is another document that resembles the Investment LOI. While an LOI expresses interest in pursuing a deal, an Offer Letter presents a specific proposal. It includes terms such as price, payment methods, and deadlines. Both documents aim to establish a mutual understanding between the parties, but the Offer Letter is more definitive in its intent to move forward with a transaction.

Dos and Don'ts

When filling out the Investment Letter of Intent form, it is essential to approach the task with care and attention to detail. Here are ten things to keep in mind:

- Do: Read the entire form thoroughly before starting.

- Do: Provide accurate and complete information.

- Do: Use clear and concise language.

- Do: Double-check all figures and calculations.

- Do: Sign and date the form where required.

- Don't: Rush through the form without reviewing your answers.

- Don't: Leave any sections blank unless instructed.

- Don't: Use abbreviations or jargon that may be unclear.

- Don't: Forget to attach any required supporting documents.

- Don't: Submit the form without a final review.

Following these guidelines can help ensure that the Investment Letter of Intent form is completed accurately and effectively. Taking the time to do it right can make a significant difference in the investment process.

Key takeaways

When filling out and using the Investment Letter of Intent form, consider the following key takeaways:

- Clarity is essential: Ensure all information provided is clear and concise. Ambiguities can lead to misunderstandings.

- Provide accurate details: Double-check all figures, names, and dates. Accuracy is crucial for the validity of the document.

- Understand the purpose: The Investment Letter of Intent serves as a preliminary agreement outlining the intent to invest. It is not a legally binding contract.

- Review before submission: Take time to review the completed form. Any errors or omissions can delay the investment process.

- Keep a copy: Retain a copy of the signed letter for your records. This can be useful for future reference or disputes.

How to Use Investment Letter of Intent

After you have received the Investment Letter of Intent form, it's time to complete it accurately. This form is essential for moving forward with your investment plans. Follow the steps below to ensure you fill it out correctly.

- Begin by entering your personal information at the top of the form. This includes your full name, address, and contact details.

- Provide the name of the investment opportunity you are interested in.

- Fill in the amount you intend to invest. Be clear and specific.

- Indicate your preferred method of payment. This could include options like bank transfer, check, or credit card.

- Review any terms and conditions outlined in the form. Make sure you understand them before proceeding.

- Sign and date the form at the designated area. Your signature confirms your intent to proceed with the investment.

- Submit the completed form as instructed, whether by email, mail, or in person.

Once you have submitted the form, the next steps will be communicated to you by the investment team. Stay tuned for further instructions or confirmations regarding your investment.