Fill Out a Valid IRS 1096 Form

The IRS 1096 form plays a crucial role in the world of tax reporting, serving as a summary of various information returns submitted to the Internal Revenue Service. This form is typically filed by businesses and organizations that have issued certain types of payments, such as wages or dividends, to individuals or other entities throughout the year. One of its primary functions is to accompany other forms, like the 1099 series, which detail specific income information for recipients. Understanding the importance of the 1096 form is essential for ensuring compliance with tax regulations. Moreover, it helps streamline the IRS's processing of these returns, making it easier for the agency to track income and tax obligations. Filing the 1096 form accurately and on time is not just a bureaucratic necessity; it also fosters transparency and accountability in financial reporting. As taxpayers navigate the complexities of tax season, being informed about the requirements and implications of the 1096 form can significantly alleviate stress and confusion.

Common mistakes

When filling out the IRS 1096 form, many individuals make common mistakes that can lead to delays or issues with their tax filings. Here are seven mistakes to watch out for:

-

Incorrect Information on the Form: Providing inaccurate details such as the wrong employer identification number (EIN) or name can cause significant problems. Always double-check that the information matches what the IRS has on file.

-

Missing Signatures: Failing to sign the form is a frequent oversight. The IRS requires a signature to validate the submission, so ensure you sign and date the form before sending it in.

-

Not Including All Required Forms: The 1096 form serves as a summary for other forms, like 1099s. Make sure to attach all necessary forms to avoid complications.

-

Incorrect Filing Method: Submitting the form electronically instead of by mail, or vice versa, can lead to processing issues. Confirm the correct filing method based on your situation.

-

Failure to Use the Correct Version: Using an outdated version of the form can create problems. Always download the most recent version from the IRS website.

-

Not Keeping Copies: Neglecting to keep a copy of the submitted form for your records is a mistake. Always save a copy in case you need to reference it in the future.

-

Missing Deadlines: Ignoring the filing deadlines can result in penalties. Be aware of the due dates to ensure timely submission.

By avoiding these mistakes, you can help ensure that your IRS 1096 form is completed accurately and submitted without issue.

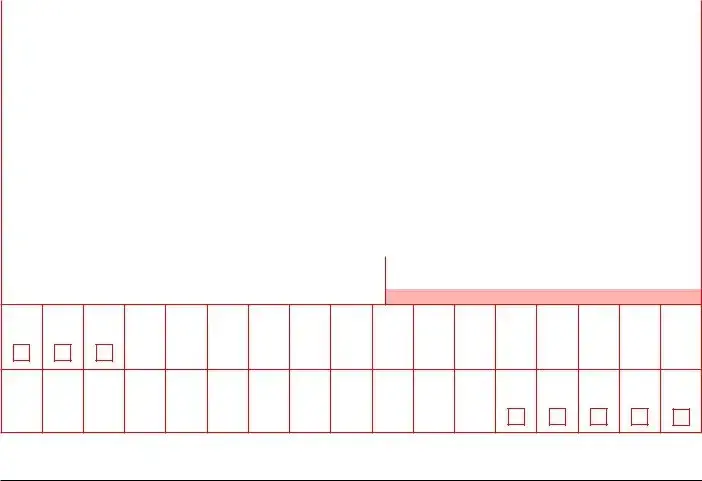

Preview - IRS 1096 Form

Attention filers of Form 1096:

This form is provided for informational purposes only. It appears in red, similar to the official IRS form. The official printed version of this IRS form is scannable, but a copy, printed from this website, is not. Do not print and file a Form 1096 downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

To order official IRS information returns, which include a scannable Form 1096 for filing with the IRS, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically. To file electronically, you must have software, or a service provider, that will create the file in the proper format. More information can be found at:

•IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE), or

•IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

Do Not Staple 6969

Form 1096 |

|

Annual Summary and Transmittal of |

|

|

|

|

|

|

|

|

|

OMB No. |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

2022 |

|

|

|||||||||||||||||||

Department of the Treasury |

|

|

U.S. Information Returns |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FILER’S name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (including room or suite number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

For Official Use Only |

|||||||||||||||||||||

Name of person to contact |

|

|

Telephone number |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address |

|

|

Fax number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Employer identification number |

2 Social security number |

|

3 Total number of forms |

4 Federal income tax withheld |

5 Total amount reported with this Form 1096 |

||||||||||||||||||||||||||

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 Enter an “X” in only one box below to indicate the type of form being filed.

32 50

1098

81

78 |

|

84 |

|

03 |

|

74 |

|

83 |

|

80 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

79 |

|

85 |

|

73 |

91 |

|

86 |

|

92 |

|

10 |

|

16 |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3921 |

||||||||||||||||||||||||||||||

93 |

95 |

71 |

|

96 |

97 |

|

31 |

|

|

1A |

98 |

|

75 |

|

94 |

43 |

|

25 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3922

26

5498

28

72

2A 27

Return this entire page to the Internal Revenue Service. Photocopies are not acceptable.

Send this form, with the copies of the form checked in box 6, to the IRS in a flat mailer (not folded).

Under penalties of perjury, I declare that I have examined this return and accompanying documents and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature ▶ |

Title ▶ |

Date ▶ |

|

Instructions |

Enter the filer’s name, address (including room, suite, or other unit |

||

Future developments. For the latest information about developments |

number), and taxpayer identification number (TIN) in the spaces |

||

provided on the form. The name, address, and TIN of the filer on this |

|||

related to Form 1096, such as legislation enacted after it was |

|||

form must be the same as those you enter in the upper left area of |

|||

published, go to www.irs.gov/Form1096. |

|||

Forms 1097, 1098, 1099, 3921, 3922, 5498, or |

|||

|

|||

Reminder. The only acceptable method of electronically filing |

When to file. File Form 1096 as follows. |

|

|

information returns listed on this form in box 6 with the IRS is through |

• With Forms 1097, 1098, 1099, 3921, 3922, or |

||

the FIRE System. See Pub. 1220. |

|||

February 28, 2023. |

|

||

Purpose of form. Use this form to transmit paper Forms 1097, 1098, |

|

||

• With Forms |

|||

1099, 3921, 3922, 5498, and |

|||

• With Forms 5498, file by May 31, 2023. |

|

||

Caution: If you are required to file 250 or more information returns of |

|

||

|

|

||

any one type (excluding Form |

Where To File |

|

|

you are required to file electronically but fail to do so, and you do not |

Send all information returns filed on paper with Form 1096 to the |

||

have an approved waiver, you may be subject to a penalty. The |

|||

Taxpayer First Act of 2019, enacted July 1, 2019, authorized the |

following. |

|

|

Department of the Treasury and the IRS to issue regulations that |

If your principal business, office |

|

||

reduce the |

Use the following |

|||

or agency, or legal residence in |

||||

regulations are issued and effective for 2022 tax returns required to be |

the case of an individual, is |

address |

||

filed in 2023, we will post an article at www.irs.gov/Form1099 |

||||

|

located in |

|

||

explaining the change. Until regulations are issued, however, the |

|

|

||

|

▲ |

▲ |

||

number remains at 250, as reflected in these instructions. For more |

|

|||

|

|

|

||

information, see part F in the 2022 General Instructions for Certain |

Alabama, Arizona, Arkansas, Delaware, |

|

||

Information Returns. |

Florida, Georgia, Kentucky, Maine, |

Internal Revenue Service |

||

|

Massachusetts, Mississippi, New |

|||

Forms |

P.O. Box 149213 |

|||

Hampshire, New Jersey, New Mexico, |

||||

of the number of returns. |

New York, North Carolina, Ohio, Texas, |

Austin, TX |

||

Who must file. Any person or entity who files any of the forms shown |

Vermont, Virginia |

|

||

|

|

|

||

in line 6 above must file Form 1096 to transmit those forms to the IRS. |

|

|

|

|

Caution: Your name and TIN must match the name and TIN used on |

|

|

|

|

your 94X series tax return(s) or you may be subject to information |

|

|

|

|

return penalties. Do not use the name and/or TIN of your paying agent |

|

|

|

|

or service bureau. |

|

|

|

|

|

|

|

||

For more information and the Privacy Act and Paperwork Reduction Act Notice, |

Cat. No. 14400O |

Form 1096 (2022) |

||

see the 2022 General Instructions for Certain Information Returns. |

|

|

|

|

Form 1096 (2022) |

Page 2 |

Alaska, Colorado, Hawaii, Idaho, |

|

|

Illinois, Indiana, Iowa, Kansas, |

|

|

Michigan, Minnesota, Missouri, |

Internal Revenue Service Center |

|

Montana, Nebraska, Nevada, North |

P.O. Box 219256 |

|

Dakota, Oklahoma, Oregon, South |

Kansas City, MO |

|

Carolina, South Dakota, Tennessee, |

|

|

Utah, Washington, Wisconsin, Wyoming |

|

|

|

|

|

California, Connecticut, |

Internal Revenue Service Center |

|

District of Columbia, Louisiana, |

||

1973 North Rulon White Blvd. |

||

Maryland, Pennsylvania, |

||

Ogden, UT 84201 |

||

Rhode Island, West Virginia |

||

|

If your legal residence or principal place of business is outside the United States, file with the Internal Revenue Service, P.O. Box 149213, Austin, TX

Transmitting to the IRS. Group the forms by form number and transmit each group with a separate Form 1096. For example, if you must file both Forms 1098 and

Box 1 or 2. Enter your TIN in either box 1 or 2, not both. Individuals not in a trade or business must enter their social security number (SSN) in box 2. Sole proprietors and all others must enter their employer identification number (EIN) in box 1. However, sole proprietors who do not have an EIN must enter their SSN in box 2. Use the same EIN or SSN on Form 1096 that you use on Form 1097, 1098, 1099, 3921, 3922, 5498, or

Box 3. Enter the number of forms you are transmitting with this Form 1096. Do not include blank or voided forms or the Form 1096 in your total. Enter the number of correctly completed forms, not the number of pages, being transmitted. For example, if you send one page of

Box 4. Enter the total federal income tax withheld shown on the forms being transmitted with this Form 1096.

Box 5. No entry is required if you are filing Form

Form |

Box 1 |

Form |

Box 1 |

Form 1098 |

Boxes 1 and 6 |

Form |

Box 4c |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 4 |

Form |

Boxes 1d and 13 |

Form |

Box 2 |

Form |

Box 2 |

Form |

Boxes 1a, 2a, 3, 9, 10, and 11 |

Form |

Boxes 1, 3, 8, 10, 11, and 13 |

Form |

Box 1a |

Form |

Box 1 |

Form |

Boxes 1 and 2 |

Form |

Boxes 1, 2, 3, 5, 6, 8, 9, 10, 11, and 13 |

Form |

Box 1 |

Form |

Boxes 1, 2, 5, 6, and 8 |

Form |

Boxes 1, 2, 3, and 5 |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 1 |

Form |

Box 2 |

Form |

Box 1 |

Form |

Boxes 1 and 2 |

Form 3921 |

Boxes 3 and 4 |

Form 3922 |

Boxes 3, 4, and 5 |

Form 5498 |

Boxes 1, 2, 3, 4, 5, 8, 9, 10, 12b, 13a, |

|

and 14a |

Form |

Boxes 1 and 2 |

Form |

Boxes 1 and 2 |

Form |

Box 1 |

Corrected returns. For information about filing corrections, see the 2022 General Instructions for Certain Information Returns. Originals and corrections of the same type of return can be submitted using one Form 1096.

Other PDF Templates

Da 7666 - DA 7666 can help identify trends in personnel management.

When engaging in the sale or purchase of a motorcycle in Minnesota, it's essential to utilize the Motorcycle Bill of Sale form for a seamless transaction. This form is vital for documenting the transfer of ownership and safeguarding the interests of both the buyer and seller. For those seeking more information, refer to autobillofsaleform.com/motorcycle-bill-of-sale-form/minnesota-motorcycle-bill-of-sale-form/ for additional details.

Florida Estate Tax Exemption 2023 - Filing this affidavit could potentially expedite the estate settlement process.

Quest Requisition Form - Pregnancy status to evaluate test suitability and safety.

Documents used along the form

The IRS 1096 form is an important document for reporting certain types of income. When filing this form, you may also need to prepare other related forms and documents. Here’s a list of five commonly used forms that often accompany the IRS 1096.

- IRS 1099-MISC: This form is used to report miscellaneous income, such as payments made to independent contractors. If you paid someone $600 or more during the year, you’ll likely need to file this form.

- IRS 1099-NEC: Introduced in 2020, this form is specifically for reporting non-employee compensation. It’s used when you pay independent contractors or freelancers $600 or more.

- IRS 1099-INT: This form is used to report interest income. If you earned $10 or more in interest from a bank or other financial institution, you’ll receive this form.

- IRS 1099-DIV: Use this form to report dividends and distributions. If you received dividends from investments, this form will help you report that income accurately.

- Recommendation Letter form: A structured template for endorsing abilities, character, and achievements, often required in academic admissions and job applications. For more details, find the document here.

- IRS 1099-R: This form is for reporting distributions from retirement plans. If you took money out of a retirement account, you’ll need to file this form to report the distribution.

Understanding these forms will help ensure you meet your tax obligations accurately. Always keep track of your income and the forms you receive to make filing easier.

Similar forms

The IRS 1099 form is similar to the 1096 form in that both are used for reporting income. While the 1096 serves as a summary form, the 1099 is used to report various types of income received by individuals or businesses. For example, if you paid an independent contractor $600 or more in a year, you would issue a 1099 form to report that payment. The 1096 form would then accompany the 1099 forms when you submit them to the IRS. This relationship helps the IRS track income and ensure that it is properly reported by taxpayers.

The W-2 form also shares similarities with the 1096 form. Like the 1099, the W-2 is used to report income, but it specifically pertains to wages paid to employees. Employers fill out the W-2 form to report salaries, tips, and other compensation. When submitting W-2 forms to the IRS, employers must also include a 1096 form as a summary of all W-2s issued. This ensures that the IRS receives a complete picture of employee earnings and tax withholdings for the year.

The 1042-S form is another document that parallels the 1096. This form is used to report income paid to non-resident aliens. If you are making payments to foreign individuals or entities, you would use the 1042-S to detail those payments. Similar to the 1099 and W-2, when submitting 1042-S forms to the IRS, a 1096 form is required as a summary. This helps the IRS monitor income paid to non-residents and ensures compliance with tax regulations.

Understanding various tax forms is essential for both individuals and businesses to navigate their financial responsibilities effectively. One such resource for managing property transactions, including the necessary forms, can be found at https://georgiapdf.com, where users can access important legal documents required for transferring ownership of real estate in Georgia.

The 941 form, which reports payroll taxes, is also related to the 1096 form. While the 941 focuses on reporting employment taxes withheld from employee wages, it serves a different purpose than the 1096. However, businesses often submit the 941 alongside various income reporting forms. In this way, the 1096 can be seen as a tool for summarizing various reporting obligations, including those that may arise from the 941 form. This connection highlights the importance of accurate reporting across different tax forms.

Dos and Don'ts

When filling out the IRS 1096 form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do double-check all information for accuracy before submitting.

- Do use black ink and write clearly to avoid any misunderstandings.

- Do ensure that the form is signed and dated where required.

- Do file the form by the deadline to avoid penalties.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use correction fluid or tape on the form; it may cause issues during processing.

- Don't forget to keep a copy of the completed form for your records.

Key takeaways

The IRS 1096 form serves as a summary of information returns submitted to the IRS. Here are some key takeaways regarding its use:

- The form is required when filing certain information returns, such as Forms 1099, 1098, and W-2G.

- It must be submitted along with paper copies of the information returns. Electronic submissions do not require Form 1096.

- Ensure that the form is completed accurately, including the correct number of forms being filed.

- Deadlines for filing Form 1096 align with the deadlines for the associated information returns. Late submissions may incur penalties.

- Keep a copy of the completed Form 1096 for your records. This can help resolve any discrepancies in the future.

- If you are filing multiple types of information returns, a separate Form 1096 must be submitted for each type.

How to Use IRS 1096

Once you have gathered all necessary information and forms, you can begin filling out the IRS 1096 form. This form serves as a summary of information returns you are submitting to the IRS. Follow the steps below to ensure accurate completion.

- Obtain the IRS 1096 form. You can download it from the IRS website or order it through the IRS.

- Enter your name in the top left box. Use the name of the person or business filing the form.

- Fill in your address. Include street address, city, state, and ZIP code.

- Provide your taxpayer identification number (TIN) in the designated box. This is typically your Social Security Number or Employer Identification Number.

- In the “Filer’s name” section, write the name of the entity that is submitting the forms.

- In the “Total number of forms” box, indicate the total number of information returns you are submitting with this form.

- Enter the total amount of federal income tax withheld, if applicable, in the appropriate box.

- Check the box that corresponds to the type of return you are submitting. This could include forms like 1099 or W-2.

- Sign and date the form at the bottom. The person authorized to file must sign it.

After completing the form, make copies for your records. Then, submit the IRS 1096 along with the accompanying information returns by the due date. Ensure that you mail them to the correct IRS address based on your location.