Fill Out a Valid IRS 1099-MISC Form

The IRS 1099-MISC form plays a crucial role in the reporting of various types of income that are not typically captured through standard wage reporting methods. This form is primarily used to report payments made to independent contractors, freelancers, and other non-employees for services rendered. In addition to compensating individuals, the 1099-MISC also covers a range of other payments, including rent, royalties, and certain types of prizes or awards. Businesses and organizations are responsible for issuing this form when payments exceed a specified threshold within a calendar year. Timely and accurate reporting is essential, as failure to comply can result in penalties for both the payer and the recipient. Understanding the specific requirements and deadlines associated with the 1099-MISC form is vital for individuals and businesses alike to ensure compliance with IRS regulations and to maintain proper financial records.

Common mistakes

-

Incorrect Recipient Information: Failing to provide the correct name, address, or taxpayer identification number (TIN) for the recipient can lead to significant issues. Always double-check this information.

-

Wrong Amounts: Reporting incorrect payment amounts can result in penalties. Ensure that the total payments made during the year are accurately reflected.

-

Missing Signature: Some filers forget to sign the form. A signature is often required to validate the submission.

-

Wrong Box Selection: Placing amounts in the wrong boxes can cause confusion. Each box is designated for specific types of payments; knowing which box to use is crucial.

-

Late Filing: Submitting the form after the deadline can lead to penalties. Be aware of the filing deadlines to avoid late fees.

-

Not Keeping Records: Failing to maintain copies of filed forms can create problems if questions arise later. Keep records for at least three years.

-

Ignoring State Requirements: Some states have additional requirements for reporting payments. Be sure to check if your state has specific rules that need to be followed.

-

Using Outdated Forms: Always use the most current version of the 1099-MISC form. Using an outdated form can lead to compliance issues.

Preview - IRS 1099-MISC Form

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at IRS.gov/Form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

If you have 10 or more information returns to file, you may be required to file

If you have fewer than 10 information returns to file, we strongly encourage you to

See Publications 1141, 1167, and 1179 for more information about printing these forms.

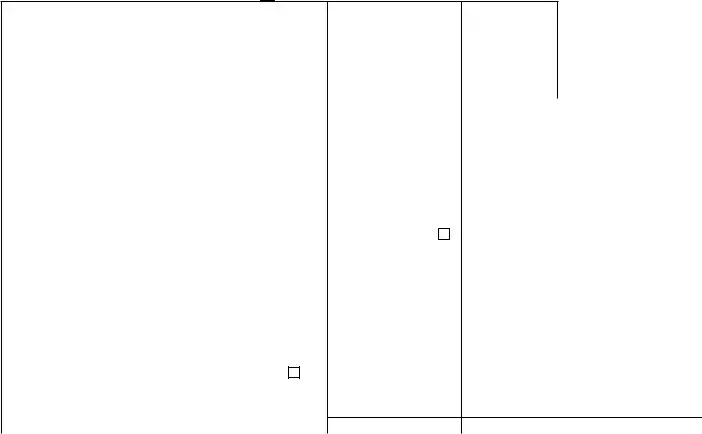

9595 |

|

VOID |

CORRECTED |

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1 |

Rents |

OMB No. |

|

|

|||||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

$ |

|

Form |

|

Miscellaneous |

||||

|

|

|

|

2 |

Royalties |

(Rev. January 2024) |

|

Information |

||||

|

|

|

|

|

|

For calendar year |

|

|

||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Other income |

4 |

Federal income tax withheld |

Copy A |

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

For |

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

5 |

Fishing boat proceeds |

6 |

Medical and health care |

Internal Revenue |

|||||

|

|

|

|

|

|

|

payments |

Service Center |

||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

File with Form 1096. |

|

RECIPIENT’S name |

|

|

7 |

Payer made direct sales |

8 |

Substitute payments in lieu |

For Privacy Act |

|||||

|

|

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

and Paperwork |

||||

|

|

|

|

|

consumer products to |

$ |

|

|

|

|

||

|

|

|

|

|

recipient for resale |

|

|

|

|

Reduction Act |

||

Street address (including apt. no.) |

|

|

9 |

Crop insurance proceeds |

10 |

Gross proceeds paid to an |

Notice, see the |

|||||

|

|

|

|

|

|

|

attorney |

current General |

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

Instructions for |

|

|

|

|

|

|

|

|

|

|

Certain |

|||

City or town, state or province, country, and ZIP or foreign postal code |

11 |

Fish purchased for resale |

12 |

Section 409A deferrals |

||||||||

Information |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

$ |

|

$ |

|

|

|

|

Returns. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

13 FATCA filing |

14 |

Excess golden parachute |

15 |

Nonqualified deferred |

|

||||

|

|

|

requirement |

|

payments |

|

compensation |

|

||||

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

2nd TIN not. |

16 |

State tax withheld |

17 |

State/Payer’s state no. |

18 State income |

||||

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

Form |

Cat. No. 14425J |

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

||||||||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

|

VOID |

CORRECTED |

|

|

|

|

|

|

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP |

1 |

Rents |

OMB No. |

|

|

|

|||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Form |

|

Miscellaneous |

||||

|

|

|

2 |

Royalties |

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

|

For calendar year |

|

|

|

|||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Other income |

4 |

Federal income tax withheld |

|

Copy 1 |

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

For State Tax |

PAYER’S TIN |

RECIPIENT’S TIN |

|

5 |

Fishing boat proceeds |

6 |

Medical and health care |

|

Department |

|||

|

|

|

|

|

|

payments |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 |

Payer made direct sales |

8 |

Substitute payments in lieu |

|

|

|||

|

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

|

|

|||

|

|

|

|

consumer products to |

$ |

|

|

|

|

|

|

|

|

|

|

recipient for resale |

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

9 |

Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

|

|||

|

|

|

|

|

|

attorney |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

11 |

Fish purchased for resale |

12 |

Section 409A deferrals |

|

|

|||||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

13 FATCA filing |

14 |

Excess golden parachute |

15 |

Nonqualified deferred |

|

|

|||

|

|

requirement |

|

payments |

|

compensation |

|

|

|||

|

|

|

$ |

|

$ |

|

|

|

|

|

|

Account number (see instructions) |

|

|

16 |

State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

|||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

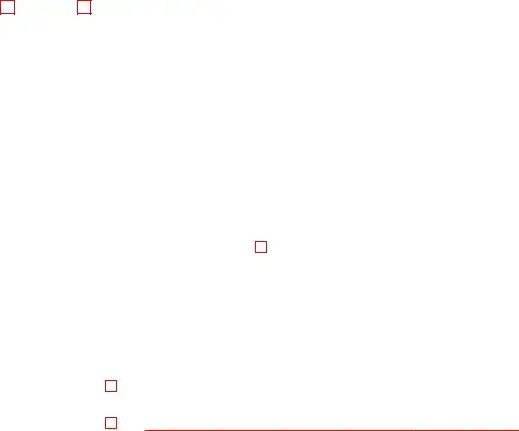

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents |

OMB No. |

or foreign postal code, and telephone no. |

|

|

|

|

$ |

Form |

Miscellaneous |

|||||

|

|

|

2 Royalties |

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

For calendar year |

|

|

||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

3 Other income |

4 Federal income tax withheld |

Copy B |

|||||

|

|

|

$ |

$ |

|

|

|

|

|

For Recipient |

PAYER’S TIN |

RECIPIENT’S TIN |

5 Fishing boat proceeds |

6 |

Medical and health care |

|

|

||||

|

|

|

|

|

payments |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 Payer made direct sales |

8 |

Substitute payments in lieu |

|

This is important tax |

|||

|

|

|

totaling $5,000 or more of |

|

of dividends or interest |

|

||||

|

|

|

consumer products to |

$ |

|

|

|

|

|

information and is |

|

|

|

recipient for resale |

|

|

|

|

|

being furnished to |

|

Street address (including apt. no.) |

|

|

9 Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

the IRS. If you are |

|||

|

|

|

|

|

attorney |

|

required to file a |

|||

|

|

|

$ |

$ |

|

|

|

|

|

return, a negligence |

|

|

|

|

|

|

|

|

penalty or other |

||

City or town, state or province, country, and ZIP or foreign postal code |

11 Fish purchased for resale |

12 |

Section 409A deferrals |

|

sanction may be |

|||||

|

|

|

|

|

|

|

|

|

|

imposed on you if |

|

|

|

$ |

$ |

|

|

|

|

|

this income is |

|

|

|

|

|

|

|

|

taxable and the IRS |

||

|

|

13 FATCA filing 14 Excess golden parachute |

15 |

Nonqualified deferred |

|

determines that it |

||||

|

|

requirement |

payments |

|

compensation |

|

has not been |

|||

|

|

|

$ |

$ |

|

|

|

|

|

reported. |

|

|

|

|

|

|

|

|

|

||

Account number (see instructions) |

|

|

16 State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

|||

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

$ |

Form |

(keep for your records) |

www.irs.gov/Form1099MISC |

|

Department of the Treasury - Internal Revenue Service |

||||||

Instructions for Recipient

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN). However, the payer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to distinguish your account.

Amounts shown may be subject to

Form

Box 1. Report rents from real estate on Schedule E (Form 1040). However, report rents on Schedule C (Form 1040) if you provided significant services to the tenant, sold real estate as a business, or rented personal property as a business. See Pub. 527.

Box 2. Report royalties from oil, gas, or mineral properties; copyrights; and patents on Schedule E (Form 1040). However, report payments for a working interest as explained in the Schedule E (Form 1040) instructions. For royalties on timber, coal, and iron ore, see Pub. 544.

Box 3. Generally, report this amount on the “Other income” line of Schedule 1 (Form 1040) and identify the payment. The amount shown may be payments received as the beneficiary of a deceased employee, prizes, awards, taxable damages, Indian gaming profits, or other taxable income. See Pub. 525. If it is trade or business income, report this amount on Schedule C or F (Form 1040).

Box 4. Shows backup withholding or withholding on Indian gaming profits. Generally, a payer must backup withhold if you did not furnish your TIN. See Form

Box 5. Shows the amount paid to you as a fishing boat crew member by the operator, who considers you to be

Box 6. For individuals, report on Schedule C (Form 1040).

Box 7. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a

Box 8. Shows substitute payments in lieu of dividends or

Box 9. Report this amount on Schedule F (Form 1040).

Box 10. Shows gross proceeds paid to an attorney in connection with legal services. Report only the taxable part as income on your return.

Box 11. Shows the amount of cash you received for the sale of fish if you are in the trade or business of catching fish.

Box 12. May show current year deferrals as a nonemployee under a nonqualified deferred compensation (NQDC) plan that is subject to the requirements of section 409A plus any earnings on current and prior year deferrals.

Box 13. If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code. You may also have a filing requirement. See the Instructions for Form 8938.

Box 14. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. See your tax return instructions for where to report.

Box 15. Shows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. Any amount included in box 12 that is currently taxable is also included in this box. Report this amount as income on your tax return. This income is also subject to a substantial additional tax to be reported on Form 1040,

Boxes

Future developments. For the latest information about developments related to Form

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for

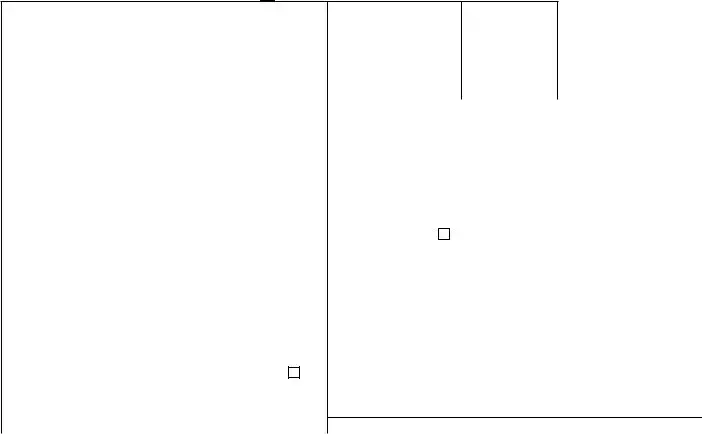

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP 1 Rents |

OMB No. |

or foreign postal code, and telephone no. |

|

|

|

|

$ |

|

Form |

Miscellaneous |

|||||

|

|

|

2 Royalties |

|

(Rev. January 2024) |

|

|

Information |

|||

|

|

|

|

|

For calendar year |

|

|

||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

3 Other income |

4 |

Federal income tax withheld |

|

Copy 2 |

||||

|

|

|

$ |

$ |

|

|

|

|

|

To be filed with |

|

PAYER’S TIN |

RECIPIENT’S TIN |

5 Fishing boat proceeds |

6 |

Medical and health care |

|

recipient’s state |

|||||

|

|

|

|

|

|

payments |

|

income tax return, |

|||

|

|

|

|

|

|

|

|

|

|

|

when required. |

|

|

|

$ |

$ |

|

|

|

|

|

|

|

RECIPIENT’S name |

|

|

7 Payer made direct sales |

8 |

Substitute payments in lieu |

|

|

||||

|

|

|

totaling $5,000 or more of |

|

|

of dividends or interest |

|

|

|||

|

|

|

consumer products to |

$ |

|

|

|

|

|

|

|

|

|

|

recipient for resale |

|

|

|

|

|

|

||

Street address (including apt. no.) |

|

|

9 Crop insurance proceeds |

10 |

Gross proceeds paid to an |

|

|

||||

|

|

|

|

|

|

attorney |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

11 Fish purchased for resale |

12 |

Section 409A deferrals |

|

|

||||||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

|

|

13 FATCA filing 14 Excess golden parachute |

15 |

Nonqualified deferred |

|

|

|||||

|

|

requirement |

payments |

|

|

compensation |

|

|

|||

|

|

|

$ |

$ |

|

|

|

|

|

|

|

Account number (see instructions) |

|

|

16 State tax withheld |

17 |

State/Payer’s state no. |

|

18 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

www.irs.gov/Form1099MISC |

|

|

Department of the Treasury - Internal Revenue Service |

|||||||

Other PDF Templates

Free Printable Gift Certificate - Show your love and appreciation with the gift of personal choice.

To streamline the process of providing a strong endorsement, you can download and fill out the form, which offers a clear structure for highlighting an individual's capabilities and accomplishments, ensuring that your recommendation is both coherent and compelling.

Bbb Review - Follow-up issues regarding repeated service problems.

Documents used along the form

The IRS 1099-MISC form is commonly used for reporting various types of income other than wages, salaries, or tips. When filing taxes, individuals and businesses often rely on several other forms and documents to ensure compliance and accuracy. Below is a list of additional forms and documents frequently associated with the 1099-MISC form.

- W-9 Form: This form is used to request the taxpayer identification number (TIN) of a contractor or vendor. It is essential for accurately completing the 1099-MISC.

- 1099-NEC Form: Introduced in 2020, this form is specifically for reporting non-employee compensation, which was previously included in the 1099-MISC.

- Schedule C: Self-employed individuals use this form to report income and expenses from their business activities. Income reported on the 1099-MISC may be included here.

- Schedule SE: This form is used to calculate self-employment tax. Individuals with income reported on the 1099-MISC must file this schedule if they meet certain income thresholds.

- Texas Homeschool Letter of Intent: To formally notify the local school district of your homeschooling decision, parents must complete this essential document. You can find an editable version of this form here: Homeschool Letter of Intent.

- Form 1040: This is the standard individual income tax return form. Income from the 1099-MISC is reported on this form as part of total income.

- Form 941: Employers use this form to report payroll taxes, including federal income tax withheld and Social Security and Medicare taxes. It is relevant for businesses that hire employees.

- Form 1096: This is a summary form used to transmit paper 1099 forms to the IRS. It provides a summary of the total number of forms being submitted.

- State Tax Forms: Depending on the state, additional forms may be required to report income. Each state has its own regulations regarding income reporting.

Understanding these forms and documents is crucial for accurate tax reporting. Ensuring that all necessary paperwork is completed correctly will help avoid potential penalties and complications with the IRS.

Similar forms

The IRS 1099-NEC form is similar to the 1099-MISC in that both are used to report income received by individuals who are not classified as employees. While the 1099-MISC was traditionally used for reporting non-employee compensation, the 1099-NEC has taken over this role starting in the 2020 tax year. This form is specifically designated for reporting payments of $600 or more made to independent contractors, freelancers, and other non-employees. The distinction between the two forms helps streamline the reporting process and clarify the types of payments being reported.

The IRS 1099-K form is another document that shares similarities with the 1099-MISC. This form is used to report payment card and third-party network transactions. Businesses and payment processors must issue a 1099-K if they process over $20,000 in payments and have more than 200 transactions in a calendar year. Like the 1099-MISC, the 1099-K helps the IRS track income that may not be reported on traditional tax returns, ensuring that all income is properly accounted for.

The IRS 1099-DIV form is used to report dividends and distributions received by taxpayers. While the 1099-MISC covers a broader range of non-employee income, the 1099-DIV specifically targets income from investments. Taxpayers who receive dividends from stocks, mutual funds, or other investments will receive this form if the total dividends exceed $10. This allows the IRS to monitor investment income and ensure that it is reported accurately.

The IRS 1099-INT form is similar to the 1099-DIV but focuses on interest income. Banks and financial institutions issue this form to report interest payments made to individuals, typically when the total interest exceeds $10. Just as the 1099-MISC helps track various forms of non-employee income, the 1099-INT plays a crucial role in ensuring that interest income is reported and taxed appropriately.

When dealing with properties in Georgia, it's essential to be aware of the various forms required for a smooth transfer of ownership. One crucial document in this process is the Georgia Deed form, which serves to formalize the transfer of real estate between parties. To obtain this form, you can visit https://georgiapdf.com, where you will find comprehensive resources to assist you in preparing the necessary documentation accurately.

The IRS 1099-R form is used to report distributions from retirement accounts, pensions, and annuities. This form is similar to the 1099-MISC in that it reports income that may not be classified as wages or salaries. Taxpayers who receive distributions from retirement plans will receive a 1099-R, which helps the IRS monitor retirement income and ensure compliance with tax regulations.

The IRS 1099-S form is used to report proceeds from real estate transactions. This document is similar to the 1099-MISC in that it reports income that is not derived from traditional employment. When a property is sold, the 1099-S is issued to report the gross proceeds, helping the IRS track capital gains and ensure proper tax reporting on real estate transactions.

The IRS 1099-C form reports canceled debts. This form is similar to the 1099-MISC as it deals with income that is not received through traditional employment. When a creditor cancels a debt of $600 or more, they must issue a 1099-C. This helps the IRS monitor income that taxpayers may not consider taxable but is nonetheless reportable.

The IRS 1099-G form is used to report certain government payments, such as unemployment compensation and state tax refunds. This form is similar to the 1099-MISC in that it reports income received from sources other than employment. Recipients of government payments will receive a 1099-G, allowing the IRS to track these payments for tax purposes.

The IRS 1099-LTC form is used to report long-term care benefits. This form is similar to the 1099-MISC in that it reports income that is not classified as wages. Individuals who receive long-term care benefits from insurance policies will receive this form, ensuring that the IRS is aware of these benefits for tax purposes.

Finally, the IRS 1099-PATR form is used to report patronage dividends from cooperatives. This form is similar to the 1099-MISC in that it reports income received from a non-employment source. Cooperatives issue this form to their members when patronage dividends exceed $10, helping the IRS track this type of income and ensure compliance with tax regulations.

Dos and Don'ts

When filling out the IRS 1099-MISC form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do double-check the recipient's Taxpayer Identification Number (TIN).

- Do ensure that the payment amount is correctly reported in the appropriate box.

- Do keep a copy of the form for your records.

- Do file the form by the IRS deadline to avoid penalties.

- Do use clear and legible handwriting or type the information.

- Don't forget to provide your own business information, including your TIN.

- Don't leave any required fields blank; fill in all necessary information.

- Don't mix up the form with other tax forms; ensure you are using the correct one.

- Don't submit the form without reviewing it for errors.

- Don't ignore the specific instructions provided by the IRS for the form.

Key takeaways

Filling out and using the IRS 1099-MISC form is essential for reporting various types of income. Here are some key takeaways to consider:

- Understand the Purpose: The 1099-MISC form is used to report payments made to non-employees, such as independent contractors and freelancers.

- Know the Threshold: You must issue a 1099-MISC if you paid $600 or more to a non-employee during the tax year.

- Collect Accurate Information: Ensure you have the correct name, address, and Taxpayer Identification Number (TIN) for the recipient to avoid penalties.

- File on Time: Submit the 1099-MISC form to the IRS by the deadline, which is typically January 31st of the following year for non-employee compensation.

How to Use IRS 1099-MISC

After you have gathered all necessary information, you are ready to fill out the IRS 1099-MISC form. Completing this form accurately is crucial for reporting payments made to non-employees. Following the steps below will help ensure that you provide the correct details.

- Begin by entering your name and address in the top left corner of the form. This identifies you as the payer.

- In the next box, provide your taxpayer identification number (TIN). This is usually your Social Security Number (SSN) or Employer Identification Number (EIN).

- Next, fill in the recipient's name and address. Make sure the information is accurate to avoid any issues.

- Enter the recipient's TIN in the appropriate box. This is typically their SSN or EIN.

- In Box 1, report the total amount you paid to the recipient during the tax year. This should reflect the gross payments made.

- If applicable, complete additional boxes based on the nature of the payments. For example, Box 3 is for other income, and Box 7 is for non-employee compensation.

- If you have withheld any federal income tax, report that amount in Box 4.

- Complete the rest of the form as necessary, including any state tax information if applicable.

- Review all entries for accuracy. Errors can lead to delays or complications.

- Once confirmed, sign and date the form. Keep a copy for your records.

After completing the form, you will need to submit it to the IRS and provide a copy to the recipient. Ensure that you meet the filing deadlines to avoid penalties. Properly maintaining your records will also help in case of any future inquiries.