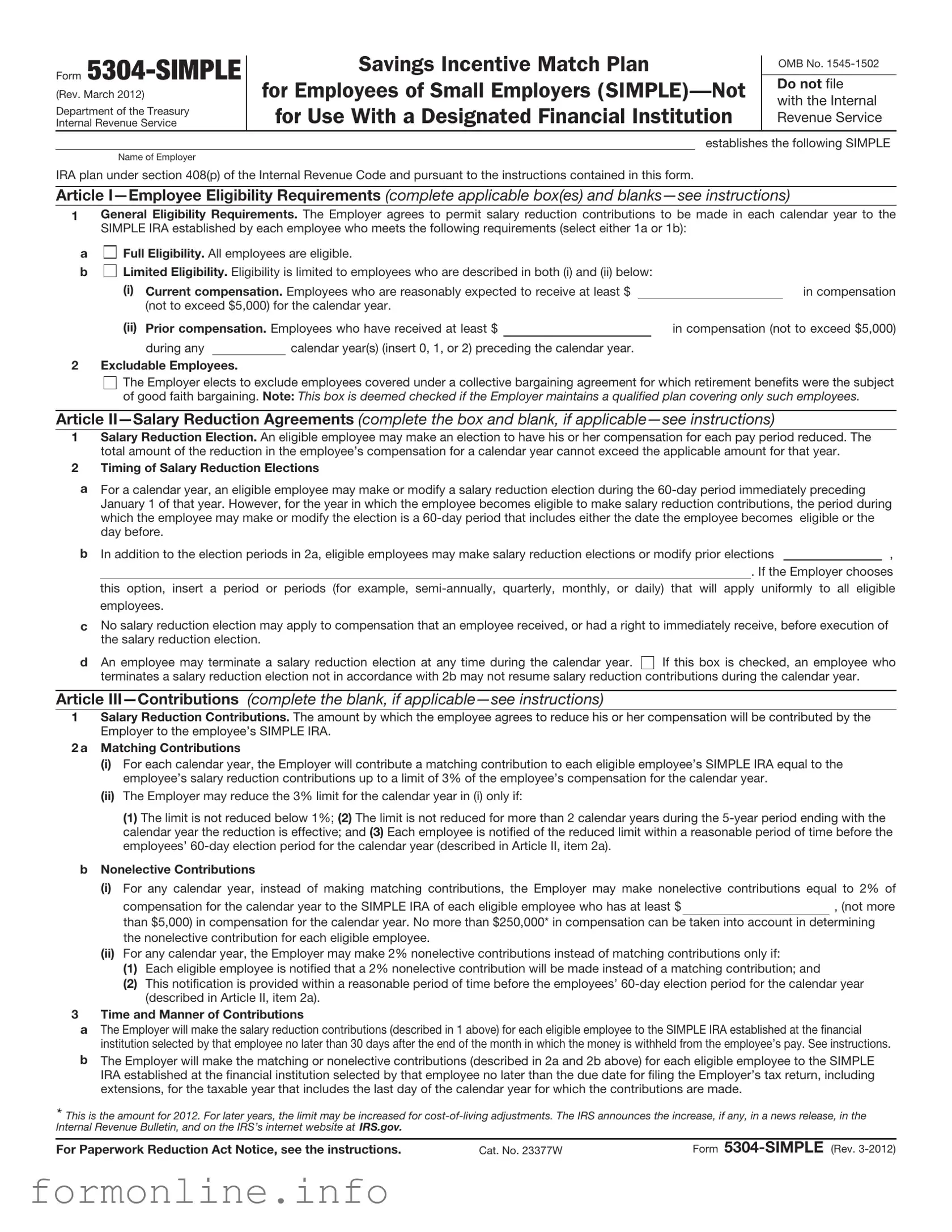

Fill Out a Valid IRS 5304-SIMPLE Form

The IRS 5304-SIMPLE form plays a crucial role in the establishment of a Savings Incentive Match Plan for Employees, commonly known as a SIMPLE IRA. This form is specifically designed for small businesses, allowing them to offer retirement savings options to their employees while benefiting from certain tax advantages. Employers who choose to adopt this plan must provide employees with information regarding their eligibility, contribution limits, and the matching contributions that the employer is willing to make. The form outlines the necessary steps for both employers and employees, ensuring compliance with IRS regulations. It is essential for employers to understand the deadlines for submitting the form, as well as the implications of not adhering to these timelines. By utilizing the IRS 5304-SIMPLE form, small businesses can enhance their employee benefits package, ultimately fostering a more engaged workforce and promoting long-term financial security for their employees.

Common mistakes

-

Failing to provide accurate information about the employer. This includes the employer's name, address, and taxpayer identification number. Any errors can lead to processing delays.

-

Not including all eligible employees. It is important to ensure that all employees who meet the eligibility criteria are accounted for in the form.

-

Incorrectly calculating contribution amounts. Contributions must be calculated based on the rules set forth by the IRS. Mistakes in these calculations can result in penalties.

-

Missing the deadline for submission. The form must be submitted by a specific date to ensure compliance. Late submissions may affect the plan's status.

-

Not keeping a copy of the completed form. Retaining a copy is essential for record-keeping and may be needed for future reference or audits.

Preview - IRS 5304-SIMPLE Form

Form

(Rev. March 2012)

Department of the Treasury

Internal Revenue Service

Savings Incentive Match Plan

for Employees of Small Employers

OMB No.

Do not file

with the Internal Revenue Service

establishes the following SIMPLE

Name of Employer

IRA plan under section 408(p) of the Internal Revenue Code and pursuant to the instructions contained in this form.

Article

1General Eligibility Requirements. The Employer agrees to permit salary reduction contributions to be made in each calendar year to the SIMPLE IRA established by each employee who meets the following requirements (select either 1a or 1b):

a |

Full Eligibility. All employees are eligible. |

|

|

||||||

b |

Limited Eligibility. Eligibility is limited to employees who are described in both (i) and (ii) below: |

|

|

||||||

|

(i) |

Current compensation. Employees who are reasonably expected to receive at least $ |

|

in compensation |

|||||

|

(ii) |

(not to exceed $5,000) for the calendar year. |

|

|

|

||||

|

Prior compensation. Employees who have received at least $ |

|

|

in compensation (not to exceed $5,000) |

|||||

|

|

during any |

|

calendar year(s) (insert 0, 1, or 2) preceding the calendar year. |

|

|

|||

2Excludable Employees.

The Employer elects to exclude employees covered under a collective bargaining agreement for which retirement benefits were the subject of good faith bargaining. Note: This box is deemed checked if the Employer maintains a qualified plan covering only such employees.

Article

1Salary Reduction Election. An eligible employee may make an election to have his or her compensation for each pay period reduced. The total amount of the reduction in the employee’s compensation for a calendar year cannot exceed the applicable amount for that year.

2Timing of Salary Reduction Elections

aFor a calendar year, an eligible employee may make or modify a salary reduction election during the

b In addition to the election periods in 2a, eligible employees may make salary reduction elections or modify prior elections,

. If the Employer chooses this option, insert a period or periods (for example,

cNo salary reduction election may apply to compensation that an employee received, or had a right to immediately receive, before execution of the salary reduction election.

dAn employee may terminate a salary reduction election at any time during the calendar year.

If this box is checked, an employee who terminates a salary reduction election not in accordance with 2b may not resume salary reduction contributions during the calendar year.

If this box is checked, an employee who terminates a salary reduction election not in accordance with 2b may not resume salary reduction contributions during the calendar year.

Article

1Salary Reduction Contributions. The amount by which the employee agrees to reduce his or her compensation will be contributed by the Employer to the employee’s SIMPLE IRA.

2 a Matching Contributions

(i)For each calendar year, the Employer will contribute a matching contribution to each eligible employee’s SIMPLE IRA equal to the employee’s salary reduction contributions up to a limit of 3% of the employee’s compensation for the calendar year.

(ii)The Employer may reduce the 3% limit for the calendar year in (i) only if:

(1) The limit is not reduced below 1%; (2) The limit is not reduced for more than 2 calendar years during the

bNonelective Contributions

(i)For any calendar year, instead of making matching contributions, the Employer may make nonelective contributions equal to 2% of

compensation for the calendar year to the SIMPLE IRA of each eligible employee who has at least $, (not more

than $5,000) in compensation for the calendar year. No more than $250,000* in compensation can be taken into account in determining the nonelective contribution for each eligible employee.

(ii)For any calendar year, the Employer may make 2% nonelective contributions instead of matching contributions only if:

(1)Each eligible employee is notified that a 2% nonelective contribution will be made instead of a matching contribution; and

(2)This notification is provided within a reasonable period of time before the employees’

3Time and Manner of Contributions

aThe Employer will make the salary reduction contributions (described in 1 above) for each eligible employee to the SIMPLE IRA established at the financial institution selected by that employee no later than 30 days after the end of the month in which the money is withheld from the employee’s pay. See instructions.

bThe Employer will make the matching or nonelective contributions (described in 2a and 2b above) for each eligible employee to the SIMPLE IRA established at the financial institution selected by that employee no later than the due date for filing the Employer’s tax return, including extensions, for the taxable year that includes the last day of the calendar year for which the contributions are made.

* This is the amount for 2012. For later years, the limit may be increased for

For Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 23377W |

Form |

Form |

Page 2 |

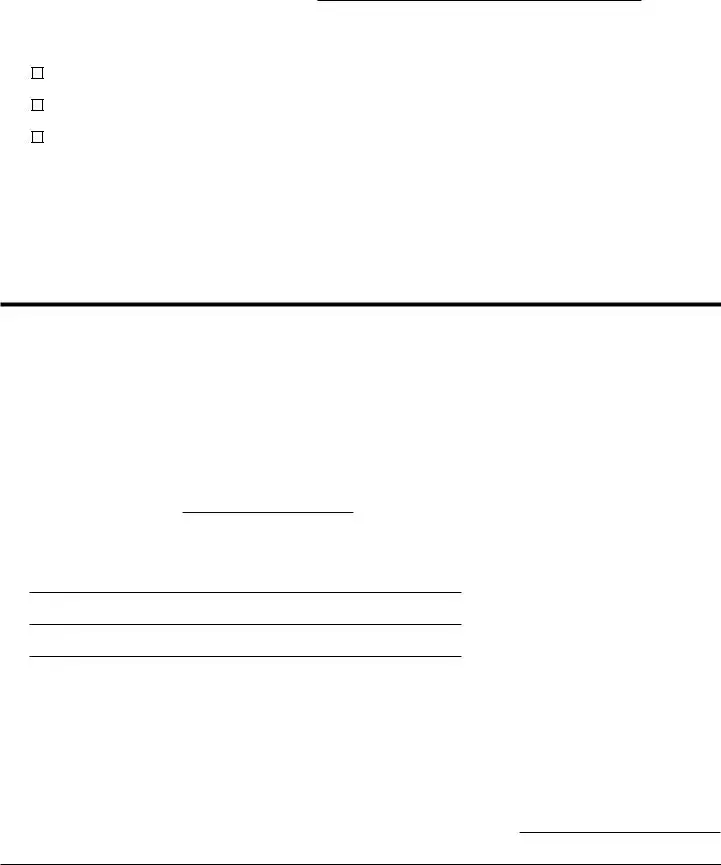

Article |

|

1Contributions in General. The Employer will make no contributions to the SIMPLE IRAs other than salary reduction contributions (described in Article III, item 1) and matching or nonelective contributions (described in Article III, items 2a and 2b).

2Vesting Requirements. All contributions made under this SIMPLE IRA plan are fully vested and nonforfeitable.

3No Withdrawal Restrictions. The Employer may not require the employee to retain any portion of the contributions in his or her SIMPLE IRA or otherwise impose any withdrawal restrictions.

4Selection of IRA Trustee. The Employer must permit each eligible employee to select the financial institution that will serve as the trustee, custodian, or issuer of the SIMPLE IRA to which the Employer will make all contributions on behalf of that employee.

5Amendments To This SIMPLE IRA Plan. This SIMPLE IRA plan may not be amended except to modify the entries inserted in the blanks or boxes provided in Articles I, II, III, VI, and VII.

6Effects Of Withdrawals and Rollovers

aAn amount withdrawn from the SIMPLE IRA is generally includible in gross income. However, a SIMPLE IRA balance may be rolled over or transferred on a

bIf an individual withdraws an amount from a SIMPLE IRA during the

Article

1Compensation

aGeneral Definition of Compensation. Compensation means the sum of the wages, tips, and other compensation from the Employer subject to federal income tax withholding (as described in section 6051(a)(3)), the amounts paid for domestic service in a private home, local college club, or local chapter of a college fraternity or sorority, and the employee’s salary reduction contributions made under this plan, and, if applicable, elective deferrals under a section 401(k) plan, a SARSEP, or a section 403(b) annuity contract and compensation deferred under a section 457 plan required to be reported by the Employer on Form

bCompensation for

2Employee. Employee means a

3Eligible Employee. An eligible employee means an employee who satisfies the conditions in Article I, item 1 and is not excluded under Article I, item 2.

4SIMPLE IRA. A SIMPLE IRA is an individual retirement account described in section 408(a), or an individual retirement annuity described in section 408(b), to which the only contributions that can be made are contributions under a SIMPLE IRA plan and rollovers or transfers from another SIMPLE IRA.

Article

are unavailable, or (2) that financial institution provides the procedures directly to the employee. See Employee Notification in the instructions.)

Article

This SIMPLE IRA plan is effective |

|

|

|

|

. See |

|

instructions. |

|

|

|

|

|

|

* |

* |

* |

* |

* |

|

|

|

|

|

|

|

|

|

Name of Employer |

|

By: |

Signature |

Date |

||

|

|

|

|

|

|

|

Address of Employer |

|

Name and title |

|

|

||

Form

Form |

Page 3 |

Model Notification to Eligible Employees

I.Opportunity to Participate in the SIMPLE IRA Plan

You are eligible to make salary reduction contributions to theSIMPLE IRA

plan. This notice and the attached summary description provide you with information that you should consider before you decide whether to start, continue, or change your salary reduction agreement.

II.Employer Contribution Election

For the |

|

calendar year, the Employer elects to contribute to your SIMPLE IRA (employer must select either (1), (2), or (3)): |

|||||

(1) |

A matching contribution equal to your salary reduction contributions up to a limit of 3% of your compensation for the year; |

||||||

(2) |

A matching contribution equal to your salary reduction contributions up to a limit of |

% (employer must insert a |

|||||

number from 1 to 3 and is subject to certain restrictions) of your compensation for the |

year; or |

|

|||||

(3) |

A nonelective contribution equal to 2% of your compensation for the year (limited to compensation of $250,000*) if you are an |

||||||

employee who makes at least $ |

|

(employer must insert an amount that is $5,000 or less) in compensation for |

|||||

the year. |

|

|

|

|

|

||

|

|

|

|

|

|||

III.Administrative Procedures

To start or change your salary reduction contributions, you must complete the salary reduction agreement and return it to

|

|

|

(employer should designate a place or |

individual by |

|

(employer should insert a date that is not less than 60 |

days after notice is given). |

|

|

|

|

IV. Employee Selection of Financial Institution

You must select the financial institution that will serve as the trustee, custodian, or issuer of your SIMPLE IRA and notify your Employer of your selection.

Model Salary Reduction Agreement

I.Salary Reduction Election

Subject to the requirements of the SIMPLE IRA plan of |

|

|

|

|

(name of |

|||

employer) I authorize |

|

% or $ |

|

|

(which equals |

|

% of my current rate of pay) to be withheld from |

|

my pay for each pay period and contributed to my SIMPLE IRA as a salary reduction contribution.

II.Maximum Salary Reduction

I understand that the total amount of my salary reduction contributions in any calendar year cannot exceed the applicable amount for that year. See instructions.

III.Date Salary Reduction Begins

I understand that my salary reduction contributions will start as soon as permitted under the SIMPLE IRA plan and as soon as

administratively feasible or, if later,. (Fill in the date you want the salary reduction contributions to begin. The date must be after you sign this agreement.)

IV. Employee Selection of Financial Institution

I select the following financial institution to serve as the trustee, custodian, or issuer of my SIMPLE IRA.

Name of financial institution

Address of financial institution

SIMPLE IRA account name and number

I understand that I must establish a SIMPLE IRA to receive any contributions made on my behalf under this SIMPLE IRA plan. If the information regarding my SIMPLE IRA is incomplete when I first submit my salary reduction agreement, I realize that it must be completed by the date contributions must be made under the SIMPLE IRA plan. If I fail to update my agreement to provide this information by that date, I understand that my Employer may select a financial institution for my SIMPLE IRA.

V.Duration of Election

This salary reduction agreement replaces any earlier agreement and will remain in effect as long as I remain an eligible employee under the SIMPLE IRA plan or until I provide my Employer with a request to end my salary reduction contributions or provide a new salary reduction agreement as permitted under this SIMPLE IRA plan.

Signature of employee |

|

Date |

*This is the amount for 2012. For later years, the limit may be increased for

Form

Form |

Page 4 |

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

Form

SIMPLE IRA.

These instructions are designed to assist in the establishment and administration of the SIMPLE IRA plan. They are not intended to supersede any provision in the SIMPLE IRA plan.

Do not file Form

For more information, see Pub. 560, Retirement Plans for Small Business (SEP, SIMPLE, and Qualified Plans), and Pub. 590, Individual Retirement Arrangements (IRAs).

Note. If you used the March 2002, August 2005, or September 2008 version of Form

Which Employers May

Establish and Maintain a

SIMPLE IRA Plan?

To establish and maintain a SIMPLE IRA plan, you must meet both of the following requirements:

1.Last calendar year, you had no more than 100 employees (including

2.You do not maintain during any part of the calendar year another qualified plan with respect to which contributions are made, or benefits are accrued, for service in the calendar year. For this purpose, a qualified plan (defined in section 219(g)(5)) includes a qualified pension plan, a

participating in the SIMPLE IRA plan. If the failure to continue to satisfy the

Certain related employers (trades or businesses under common control) must be treated as a single employer for purposes of the SIMPLE IRA requirements. These are: (1) a controlled group of corporations under section 414(b); (2) a partnership or sole proprietorship under common control under section 414(c); or (3) an affiliated service group under section 414(m). In addition, if you have leased employees required to be treated as your own employees under the rules of section 414(n), then you must count all such leased employees for the requirements listed above.

What Is a SIMPLE IRA Plan?

A SIMPLE IRA plan is a written arrangement that provides you and your employees with an easy way to make contributions to provide retirement income for your employees. Under a SIMPLE IRA plan, employees may choose whether to make salary reduction contributions to the SIMPLE IRA plan rather than receiving these amounts as part of their regular compensation. In addition, you will contribute matching or nonelective contributions on behalf of eligible employees (see Employee Eligibility Requirements below and Contributions later). All contributions under this plan will be deposited into a SIMPLE individual retirement account or annuity established for each eligible employee with the financial institution selected by him or her.

When To Use Form

A SIMPLE IRA plan may be established by using this Model Form or any other document that satisfies the statutory requirements.

Do not use Form

1.You want to require that all SIMPLE IRA plan contributions initially go to a financial institution designated by you. That is, you do not want to permit each of your eligible employees to choose a financial institution that will initially receive contributions. Instead, use Form

2.You want employees who are nonresident aliens receiving no earned income from you that is income from sources within the United States to be eligible under this plan; or

3.You want to establish a SIMPLE 401(k) plan.

Completing Form

Pages 1 and 2 of Form

The SIMPLE IRA plan is a legal document with important tax consequences for you and your employees. You may want to consult with your attorney or tax advisor before adopting this plan.

Employee Eligibility Requirements (Article I)

Each year for which this SIMPLE IRA plan is effective, you must permit salary reduction contributions to be made by all of your employees who are reasonably expected to receive at least $5,000 in compensation from you during the year, and who received at least $5,000 in compensation from you in any 2 preceding years. However, you can expand the group of employees who are eligible to participate in the SIMPLE IRA plan by completing the options provided in Article I, items 1a and 1b. To choose full eligibility, check the box in Article I, item 1a. Alternatively, to choose limited eligibility, check the box in Article I, item 1b, and then insert “$5,000” or a lower compensation amount (including zero) and “2” or a lower number of years of service in the blanks in (i) and (ii) of Article I, item 1b.

In addition, you can exclude from participation those employees covered under a collective bargaining agreement for which retirement benefits were the subject of good faith bargaining. You may do this by checking the box in Article I, item 2. Under certain circumstances, these employees must be excluded. See Which Employers May Establish and Maintain a SIMPLE IRA Plan? above.

Salary Reduction Agreements (Article II)

As indicated in Article II, item 1, a salary reduction agreement permits an eligible employee to make a salary reduction election to have his or her compensation for each pay period reduced by a percentage (expressed as a percentage or dollar amount). The total amount of

Form |

Page 5 |

the reduction in the employee’s compensation cannot exceed the applicable amount for any calendar year. The applicable amount is $11,500 for 2012. After 2012, the $11,500 amount may be increased for

Timing of Salary Reduction Elections

For any calendar year, an eligible employee may make or modify a salary reduction election during the

You can extend the

You may use the Model Salary Reduction Agreement on page 3 to enable eligible employees to make or modify salary reduction elections.

Employees must be permitted to terminate their salary reduction elections at any time. They may resume salary reduction contributions for the year if permitted under Article II, item 2b. However, by checking the box in Article II, item 2d, you may prohibit an employee who terminates a salary reduction election outside the normal election cycle from resuming salary reduction contributions during the remainder of the calendar year.

Contributions (Article III)

Only contributions described below may be made to this SIMPLE IRA plan. No additional contributions may be made.

Salary Reduction Contributions

As indicated in Article III, item 1, salary reduction contributions consist of the amount by which the employee agrees to reduce his or her compensation. You must contribute the salary reduction contributions to the financial institution selected by each eligible employee.

Matching Contributions

In general, you must contribute a matching contribution to each eligible employee’s SIMPLE IRA equal to the employee’s salary reduction contributions. This matching contribution cannot exceed 3% of the employee’s compensation. See Definition of Compensation, below.

You may reduce this 3% limit to a lower percentage, but not lower than 1%. You cannot lower the 3% limit for more than 2 calendar years out of the

Note. If any year in the

To elect this option, you must notify the employees of the reduced limit within a reasonable period of time before the applicable

Nonelective Contributions

Instead of making a matching contribution, you may, for any year, make a nonelective contribution equal to 2% of compensation for each eligible employee who has at least $5,000 in compensation for the year.

Nonelective contributions may not be based on more than $250,000* of compensation.

To elect to make nonelective contributions, you must notify employees within a reasonable period of time before the applicable

Note. Insert “$5,000” in Article III, item 2b(i) to impose the $5,000 compensation requirement. You may expand the group of employees who are eligible for nonelective contributions by inserting a compensation amount lower than $5,000.

Effective Date (Article VII)

Insert in Article VII the date you want the provisions of the SIMPLE IRA plan to become effective. You must insert January 1 of the applicable year unless this is the first year for which you are adopting any SIMPLE IRA plan. If this is the first year for which you are adopting a SIMPLE IRA plan, you may insert any date between January 1 and October 1, inclusive of the applicable year.

Additional Information

Timing of Salary Reduction Contributions

The employer must make the salary reduction contributions to the financial institution selected by each eligible employee for his or her SIMPLE IRA no later than the 30th day of the month following the month in which the amounts would otherwise have been payable to the employee in cash.

The Department of Labor has indicated that most SIMPLE IRA plans are also subject to Title I of the Employee Retirement Income Security Act of 1974 (ERISA). Under Department of Labor regulations at 29 CFR

Definition of Compensation

“Compensation” means the amount described in section 6051(a)(3) (wages, tips, and other compensation from the employer subject to federal income tax withholding under section 3401(a)), and amounts paid for domestic service in a private home, local college club, or local chapter of a college fraternity or sorority. Usually, this is the amount shown in box 1 of Form

For

Employee Notification

You must notify each eligible employee prior to the employee’s

*This is the amount for 2012. For later years, the limit may be increased for

Form |

Page 6 |

issuer of the employee’s SIMPLE IRA. In this notification, you must indicate whether you will provide:

1.A matching contribution equal to your employees’ salary reduction contributions up to a limit of 3% of their compensation;

2.A matching contribution equal to your employees’ salary reduction contributions subject to a percentage limit that is between 1 and 3% of their compensation; or

3.A nonelective contribution equal to 2% of your employees’ compensation.

You can use the Model Notification to Eligible Employees earlier to satisfy these employee notification requirements for this SIMPLE IRA plan. A Summary Description must also be provided to eligible employees at this time. This summary description requirement may be satisfied by providing a completed copy of pages 1 and 2 of Form

Article

If you fail to provide the employee notification (including the summary description) described above, you will be liable for a penalty of $50 per day until the notification is provided. If you can show that the failure was due to reasonable cause, the penalty will not be imposed.

If the financial institution’s name, address, or withdrawal procedures are not available at the time the employee must be given the summary description, you must provide the summary description without this information. In that case, you will have reasonable cause for not including this information in the summary description, but only if you ensure that it is provided to the employee as soon as administratively feasible.

Reporting Requirements

You are not required to file any annual information returns for your SIMPLE IRA plan, such as Form 5500, Annual Return/Report of Employee Benefit Plan, or Form

Deducting Contributions

Contributions to this SIMPLE IRA plan are deductible in your tax year containing the end of the calendar year for which the contributions are made.

Contributions will be treated as made for a particular tax year if they are made for that year and are made by the due date (including extensions) of your income tax return for that year.

Summary Description

Each year the SIMPLE IRA plan is in effect, the financial institution for the SIMPLE IRA of each eligible employee must provide the employer the information described in section 408(l)(2)(B). This requirement may be satisfied by providing the employer a current copy of Form

There is a penalty of $50 per day imposed on the financial institution for each failure to provide the summary description described above. However, if the failure was due to reasonable cause, the penalty will not be imposed.

Paperwork Reduction Act Notice. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping . . |

. |

. |

3 hr., 38 min. |

Learning about the |

|

|

|

law or the form . . |

. |

. |

2 hr., 26 min. |

Preparing the form |

. |

. |

. . 47 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:M:S, 1111 Constitution Ave. NW,

Other PDF Templates

Lyft Inspection Form Pass - Documenting vehicle conditions helps maintain service quality for riders.

Section 8 Gold Street - This form is used to request an extension for your Housing Choice Voucher under the Section 8 program.

When engaging in the sale of a recreational vehicle, it is essential to use an Arizona RV Bill of Sale form to formalize the transfer of ownership. This important legal document not only substantiates the sale but also outlines the details of the transaction, including the condition of the RV and any agreed-upon terms. For those looking for a comprehensive template, you can find one here: https://autobillofsaleform.com/rv-bill-of-sale-form/arizona-rv-bill-of-sale-form/.

Md Safety Inspection - Constitutes a valuable resource for vehicle maintenance and repair records.

Documents used along the form

When establishing a SIMPLE IRA plan, it's essential to have a comprehensive understanding of the various forms and documents that accompany the IRS 5304-SIMPLE form. These documents help ensure compliance with IRS regulations and provide clear communication to both employers and employees. Below is a list of commonly used forms and documents that you may encounter alongside the IRS 5304-SIMPLE.

- IRS 5305-SIMPLE: This form is used by employers to set up a SIMPLE IRA plan. It outlines the plan's terms and conditions and must be completed and maintained for IRS records.

- IRS Form 5304-SIMPLE (for employee choice): This version allows employees to choose their financial institution for their SIMPLE IRA. It provides necessary information about the plan and the options available to employees.

- Employee Enrollment Form: This document is used by employees to officially enroll in the SIMPLE IRA plan. It typically requires personal information and may include investment choices.

- Plan Summary Description: This summary gives employees an overview of the SIMPLE IRA plan, including eligibility, contributions, and withdrawal rules. It serves as a helpful guide for participants.

- Contribution Agreement: This document details the agreement between the employer and employees regarding salary deferrals. It specifies how much employees will contribute to their SIMPLE IRA.

- Mobile Home Bill of Sale: For those involved in mobile home transactions, it's vital to utilize the Mobile Home Bill of Sale to document the transfer of ownership and protect all parties' interests.

- Annual Reporting Forms: Employers may need to file annual reports with the IRS or provide employees with statements about their account balances and contributions. These reports help maintain transparency.

- Withdrawal Request Form: If an employee wishes to withdraw funds from their SIMPLE IRA, they must complete this form. It outlines the necessary steps and requirements for processing withdrawals.

Understanding these forms and documents is crucial for both employers and employees participating in a SIMPLE IRA plan. Each document plays a significant role in ensuring that the plan operates smoothly and adheres to IRS guidelines. By familiarizing yourself with these materials, you can navigate the complexities of retirement planning with greater confidence.

Similar forms

The IRS 5304-SIMPLE form is similar to the IRS Form 5500, which is used for annual reporting of employee benefit plans. Both forms serve to provide necessary information to the IRS regarding retirement plans. While the 5304-SIMPLE focuses specifically on SIMPLE IRA plans, Form 5500 requires broader disclosures about various types of employee benefit plans, including health and welfare plans. Both documents help ensure compliance with federal regulations and provide transparency for plan participants.

Another comparable document is the IRS Form 8880, which is used for claiming the Retirement Savings Contributions Credit. This form is relevant for individuals contributing to retirement accounts, including SIMPLE IRAs. Both forms aim to promote retirement savings among employees and provide incentives for contributions. While Form 8880 focuses on tax credits for individual contributions, the 5304-SIMPLE addresses the establishment and operation of the SIMPLE IRA plan itself.

The Florida Mobile Home Bill of Sale form is essential for anyone looking to transfer ownership of a mobile home in the state. This document provides critical information regarding the transaction, ensuring that both the buyer and seller have a clear understanding of the details involved. For those interested in further information regarding the procedure, the Mobile Home Bill of Sale is a valuable resource that can guide them through the necessary steps for a seamless transfer.

The IRS Form 5305-SEP is also similar, as it is used to establish a Simplified Employee Pension (SEP) plan. Both forms are designed for small businesses seeking to provide retirement benefits to employees. While the 5304-SIMPLE is specific to SIMPLE IRAs, the 5305-SEP focuses on SEPs, which allow for different contribution limits and eligibility criteria. Each form simplifies the process of setting up retirement plans for small employers.

Form 401(k) is another document that shares similarities with the 5304-SIMPLE. Both forms are used to establish retirement savings plans for employees, but they cater to different types of plans. The 401(k) plan allows for employee contributions and employer matches, while the SIMPLE IRA provides a more straightforward approach for smaller businesses. Both forms help employers comply with regulatory requirements and offer retirement savings options to their employees.

The IRS Form 5498 is also relevant, as it reports contributions to various retirement accounts, including SIMPLE IRAs. Both forms are integral to the retirement savings process, with the 5304-SIMPLE focusing on plan establishment and the 5498 on reporting contributions. This reporting ensures that contributions are tracked for tax purposes, thereby helping both the IRS and plan participants understand their retirement savings status.

Another related document is the IRS Form W-2, which reports wages and tax withholdings for employees. While the 5304-SIMPLE deals specifically with retirement plan establishment, the W-2 form includes information about contributions made to retirement accounts, including SIMPLE IRAs. Both documents are essential for accurate tax reporting and compliance, helping employees understand their earnings and retirement contributions.

Form 1099-R is also similar, as it reports distributions from retirement accounts, including SIMPLE IRAs. While the 5304-SIMPLE is focused on setting up the plan, the 1099-R addresses the tax implications of withdrawing funds from these accounts. Both forms play a crucial role in the overall retirement savings landscape, ensuring that both contributions and distributions are properly documented for tax purposes.

The IRS Form 8606 is another document that bears similarities to the 5304-SIMPLE. This form is used to report nondeductible contributions to traditional IRAs and distributions from Roth IRAs. Both forms are part of the broader retirement planning framework, helping individuals track their contributions and understand their tax implications. While the 5304-SIMPLE focuses on SIMPLE IRAs, Form 8606 addresses different types of retirement accounts, emphasizing the importance of accurate reporting.

The IRS Form 1040 is also relevant in this context. This is the individual income tax return form that taxpayers use to report their annual income, including contributions to retirement accounts like SIMPLE IRAs. While the 5304-SIMPLE deals with plan establishment, the 1040 form captures the tax impact of contributions and distributions. Both forms are essential for ensuring compliance with tax laws and accurately reflecting an individual’s financial situation.

Lastly, the IRS Form 5329 is similar in that it is used to report additional taxes on qualified retirement plans and other tax-favored accounts. This form comes into play when there are excess contributions or early distributions from retirement accounts, including SIMPLE IRAs. While the 5304-SIMPLE focuses on setting up the plan, Form 5329 addresses potential penalties and compliance issues, ensuring that individuals remain informed about their retirement savings and any associated tax consequences.

Dos and Don'ts

When filling out the IRS 5304-SIMPLE form, it's essential to follow some best practices to ensure accuracy and compliance. Here are four things you should do and four things you should avoid:

- Do: Read the instructions carefully before starting the form.

- Do: Double-check all personal and business information for accuracy.

- Do: Ensure you are eligible to establish a SIMPLE IRA plan.

- Do: Keep a copy of the completed form for your records.

- Don't: Rush through the form; take your time to avoid mistakes.

- Don't: Leave any required fields blank; all sections must be completed.

- Don't: Forget to sign and date the form before submission.

- Don't: Ignore deadlines; submit the form on time to avoid penalties.

Key takeaways

The IRS 5304-SIMPLE form is an important document for small businesses that want to establish a SIMPLE IRA plan for their employees. Here are some key takeaways to keep in mind when filling out and using this form:

- Eligibility Requirements: Ensure that your business qualifies for a SIMPLE IRA. Generally, businesses with 100 or fewer employees who earned $5,000 or more in compensation during the preceding year can participate.

- Employee Participation: Employees must be informed about the plan and given the opportunity to participate. The form outlines how to notify employees about their rights and the benefits of the plan.

- Contribution Limits: Be aware of the contribution limits set by the IRS. For 2023, employees can contribute up to $15,500, with an additional catch-up contribution for those aged 50 and older.

- Filing and Maintenance: After completing the form, keep it on file for your records. It is essential to maintain accurate records of contributions and employee participation to comply with IRS regulations.

How to Use IRS 5304-SIMPLE

Completing the IRS 5304-SIMPLE form is an essential step for employers who wish to establish a SIMPLE IRA plan for their employees. After filling out this form, you will need to distribute it to eligible employees and provide them with the necessary information regarding the plan.

- Begin by downloading the IRS 5304-SIMPLE form from the official IRS website.

- Enter the name of your business in the designated field at the top of the form.

- Provide the Employer Identification Number (EIN) for your business.

- Fill in the plan year start date. This is the date your SIMPLE IRA plan will begin.

- Indicate the method of funding for the SIMPLE IRA plan. You can choose between matching contributions or non-elective contributions.

- Complete the section that outlines the eligibility requirements for employees. Be clear about who qualifies to participate in the plan.

- Include any additional information about the plan, such as contribution limits and withdrawal rules, if necessary.

- Sign and date the form to certify that the information provided is accurate.

- Make copies of the completed form for your records and for each eligible employee.