Fill Out a Valid IRS 940 Form

The IRS 940 form is an essential document for employers in the United States, particularly those who pay federal unemployment taxes. Each year, businesses must file this form to report their annual Federal Unemployment Tax Act (FUTA) liability. Understanding the 940 form is crucial for maintaining compliance with federal regulations. This form helps determine how much tax an employer owes based on the wages paid to employees. It also plays a role in ensuring that workers have access to unemployment benefits should they find themselves out of work. Employers must keep accurate records throughout the year to make the filing process smoother. Additionally, the form provides important information about any adjustments or credits that may apply, which can ultimately affect the total amount owed. Filing the IRS 940 correctly can save businesses from penalties and ensure that they contribute to the unemployment system effectively.

Common mistakes

-

Not verifying the employer identification number (EIN). This number is crucial for the IRS to identify your business. An incorrect EIN can lead to processing delays.

-

Failing to report all taxable wages. Ensure that all wages subject to federal unemployment tax are included. Omitting any wages can result in penalties.

-

Incorrectly calculating the tax amount. The IRS requires a specific tax rate on taxable wages. Double-check your calculations to avoid underpayment or overpayment.

-

Neglecting to sign and date the form. A signature is necessary for the form to be valid. Missing this step can lead to rejection of the submission.

-

Using outdated forms. The IRS updates forms periodically. Always ensure you are using the most current version of the IRS 940 form.

-

Not keeping copies of submitted forms. Retaining copies for your records is essential. This can help resolve any discrepancies that may arise in the future.

-

Overlooking state unemployment tax obligations. While the IRS 940 form focuses on federal taxes, it's important to also comply with state requirements.

-

Ignoring deadlines. The IRS has specific deadlines for filing the 940 form. Late submissions can incur penalties and interest.

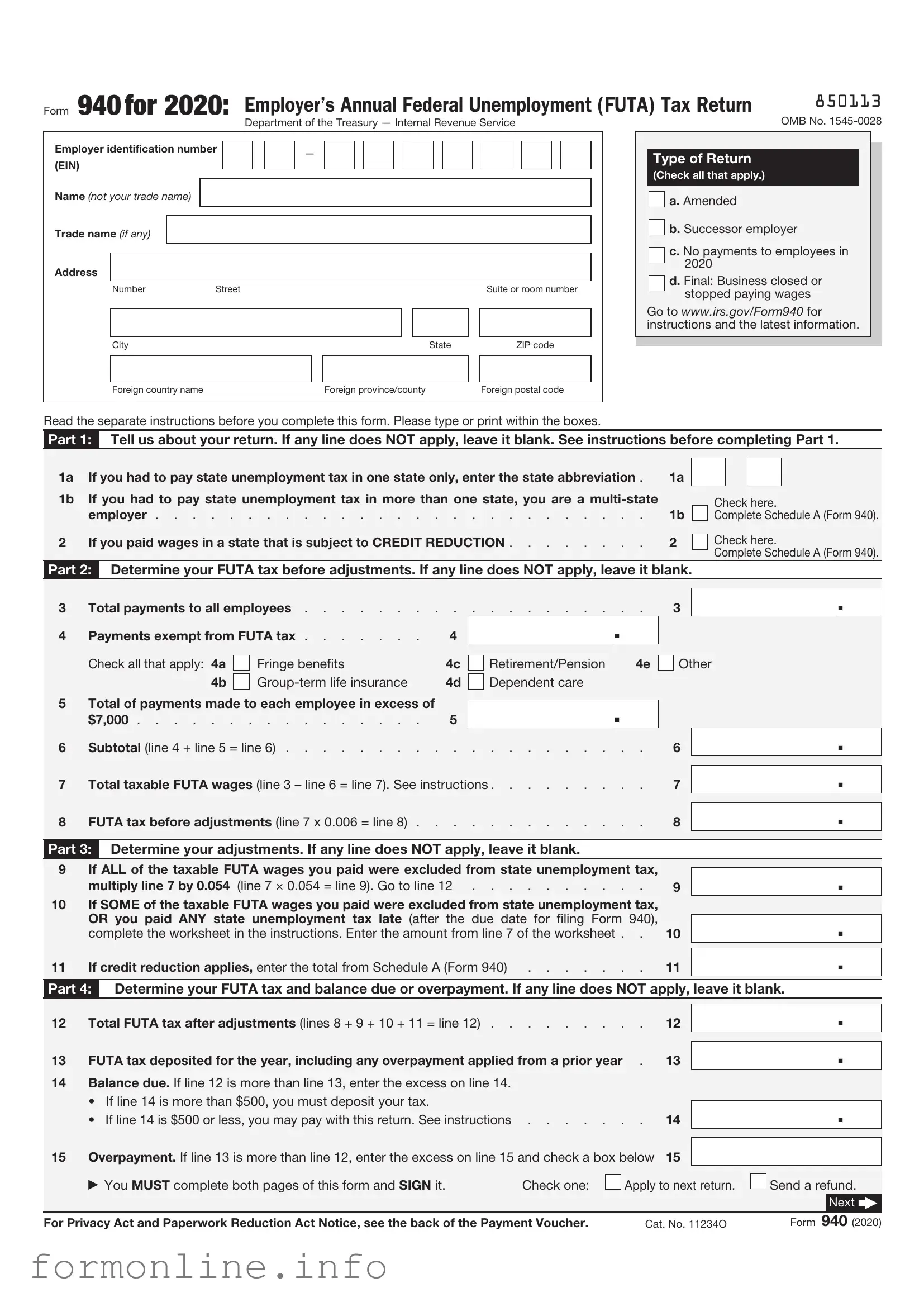

Preview - IRS 940 Form

Form 940for 2020: Employer’s Annual Federal Unemployment (FUTA) Tax Return |

850113 |

|

OMB No. |

||

Department of the Treasury — Internal Revenue Service |

Employer identification number |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Number |

Street |

|

|

|

|

Suite or room number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country name |

|

|

Foreign province/county |

|

Foreign postal code |

||

Type of Return

(Check all that apply.)

a. Amended

a. Amended

b. Successor employer

b. Successor employer

c. No payments to employees in 2020

d. Final: Business closed or stopped paying wages

Go to www.irs.gov/Form940 for instructions and the latest information.

Read the separate instructions before you complete this form. Please type or print within the boxes.

Part 1: Tell us about your return. If any line does NOT apply, leave it blank. See instructions before completing Part 1.

1a |

If you had to pay state unemployment tax in one state only, enter the state abbreviation . |

1a |

|

1b |

If you had to pay state unemployment tax in more than one state, you are a |

|

|

|

employer |

1b |

|

2 |

If you paid wages in a state that is subject to CREDIT REDUCTION |

2 |

|

|

Check here.

Complete Schedule A (Form 940).

Check here.

Complete Schedule A (Form 940).

Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank.

3 |

Total payments to all employees |

. |

3 |

|

|

|

|

. |

||||||||||

4 |

Payments exempt from FUTA tax |

4 |

|

|

|

. |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Check all that apply: 4a |

|

Fringe benefits |

4c |

|

Retirement/Pension |

4e |

|

Other |

|

|

|

|

|||||

|

|

4b |

|

4d |

|

Dependent care |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

5 |

Total of payments made to each employee in excess of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

. |

|

|

|

|

|

|

|

|

||||||

|

$7,000 |

5 |

|

|

|

|

|

|

|

|

|

|

|

|||||

6 |

Subtotal (line 4 + line 5 = line 6) |

. |

6 |

|

|

|

. |

|||||||||||

|

|

|

|

|

|

|

|

|||||||||||

7 |

Total taxable FUTA wages (line 3 – line 6 = line 7). See instructions |

. |

7 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

8 |

FUTA tax before adjustments (line 7 x 0.006 = line 8) |

. |

8 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3: |

Determine your adjustments. If any line does NOT apply, leave it blank. |

|

|

|

|

|

|

|

|

|||||||||

9 |

If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

. |

||||||||||||

|

multiply line 7 by 0.054 |

(line 7 × 0.054 = line 9). Go to line 12 |

. |

9 |

|

|

|

|||||||||||

10 |

If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, |

|

|

|

|

|

|

|

||||||||||

|

OR you paid ANY state unemployment tax late (after the due date for filing Form 940), |

|

|

|

|

|

|

. |

||||||||||

|

complete the worksheet in the instructions. Enter the amount from line 7 of the worksheet . |

. |

10 |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

11 |

If credit reduction applies, enter the total from Schedule A (Form 940) |

. |

11 |

|

|

|

|

. |

||||||||||

|

|

|

||||||||||||||||

Part 4: |

Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

12 |

Total FUTA tax after adjustments (lines 8 + 9 + 10 + 11 = line 12) |

. |

12 |

|

|

|

|

. |

||||||||||

|

|

|

|

|

|

|

|

|||||||||||

13 |

FUTA tax deposited for the year, including any overpayment applied from a prior year |

. |

13 |

|

|

|

|

. |

||||||||||

14 |

Balance due. If line 12 is more than line 13, enter the excess on line 14. |

|

|

|

|

|

|

|

|

|||||||||

|

• If line 14 is more than $500, you must deposit your tax. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

14 |

|

|

|

|

. |

|||||

|

• |

If line 14 is $500 or less, you may pay with this return. See instructions |

. |

|

|

|

||||||||||||

|

|

|

|

|

|

|

||||||||||||

15 |

Overpayment. If line 13 is more than line 12, enter the excess on line 15 and check a box below |

15 |

|

|

|

|

. |

|||||||||||

|

|

You MUST complete both pages of this form and SIGN it. |

|

|

Check one: |

|

|

|

Apply to next return. |

|

Send a refund. |

|||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Next N |

|

|

|

|

|

|

||||||||||||||

For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. |

Cat. No. 11234O |

|

Form |

940 (2020) |

||||||||||||||

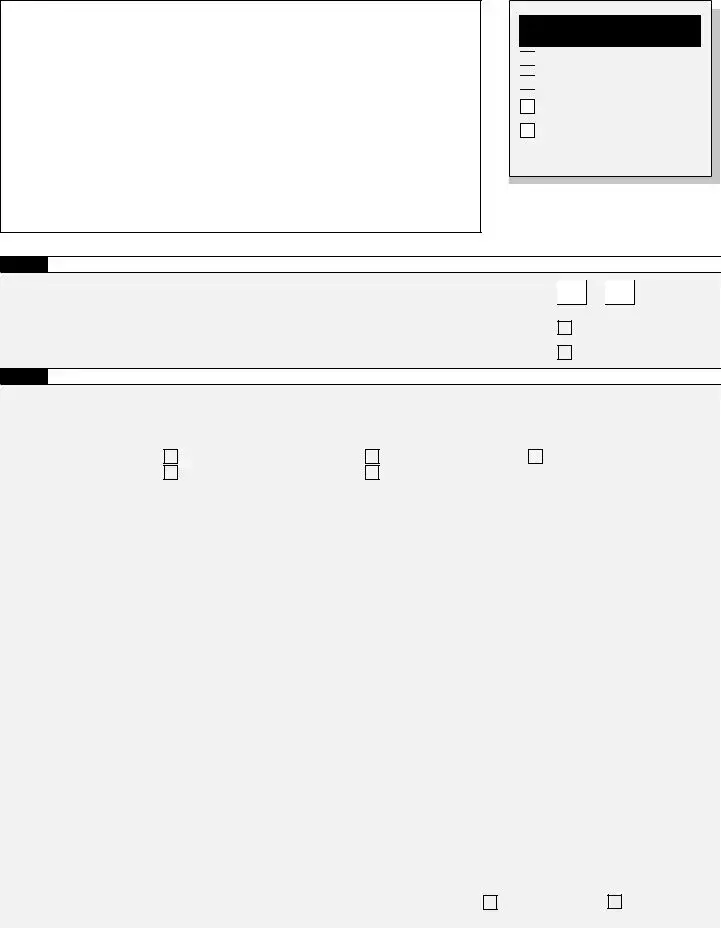

850212

Name (not your trade name)

Employer identification number (EIN)

Part 5: Report your FUTA tax liability by quarter only if line 12 is more than $500. If not, go to Part 6.

16Report the amount of your FUTA tax liability for each quarter; do NOT enter the amount you deposited. If you had no liability for a quarter, leave the line blank.

16a |

1st quarter (January 1 – March 31) . . |

. . |

. |

. |

. |

. |

. |

16a |

16b |

2nd quarter (April 1 – June 30) . . . |

. . |

. |

. |

. |

. |

. |

16b |

16c |

3rd quarter (July 1 – September 30) . |

. . |

. |

. |

. |

. |

. |

16c |

16d |

4th quarter (October 1 – December 31) |

. . |

. |

. |

. |

. |

. |

16d |

17 Total tax liability for the year (lines 16a + 16b + 16c + 16d = line 17) 17

.

.

.

.

.

.

.

.

.

.

Total must equal line 12.

Part 6: May we speak with your

Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for details.

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number

Select a

No.

No.

Part 7: Sign here. You MUST complete both pages of this form and SIGN it.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign your name here

Date

/ /

Print your name here

Print your title here

Best daytime phone

Paid Preparer Use Only

Preparer’s name

Preparer’s signature

Firm’s name (or yours if

Address

City

Check if you are

|

|

PTIN |

|

|

|

|

|

|

|

|

|

|

|

Date |

/ |

/ |

|

|

|

EIN |

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

Page 2 |

Form 940 (2020) |

Form

Purpose of Form

Complete Form

Making Payments With Form 940

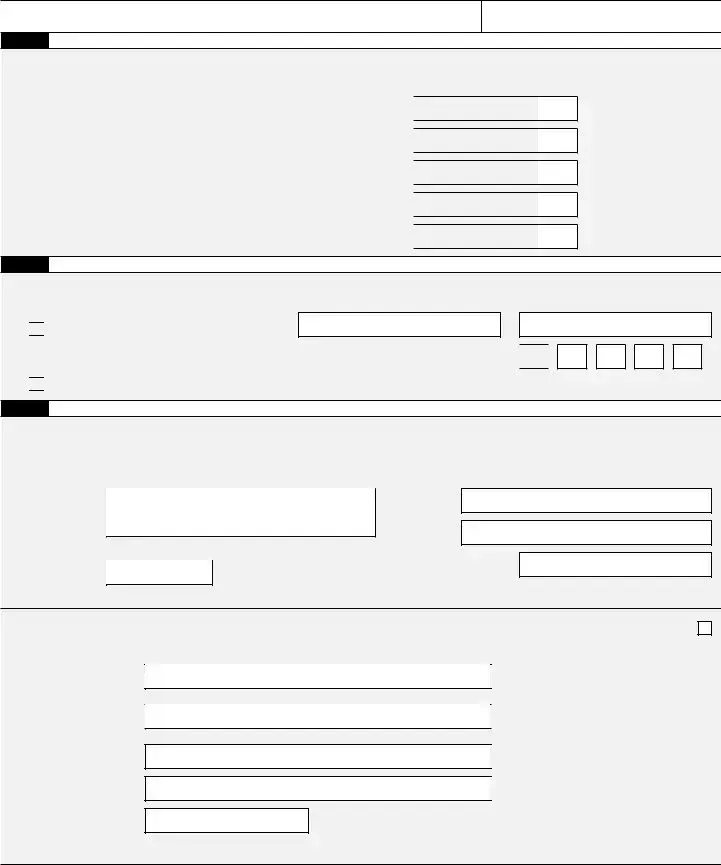

To avoid a penalty, make your payment with your 2020 Form 940 only if your FUTA tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. If your total FUTA tax after adjustments (Form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. See When Must You Deposit Your FUTA Tax? in the Instructions for Form

940.Also see sections 11 and 14 of Pub. 15 for more information about deposits.

Use Form

may be subject to a penalty. See Deposit Penalties in section 11 of Pub. 15.

Specific Instructions

Box

Box

Box

•Enclose your check or money order made payable to “United States Treasury.” Be sure to enter your EIN, “Form 940,” and “2020” on your check or money order. Don’t send cash. Don’t staple Form

•Detach Form

Note: You must also complete the entity information above Part 1 on Form 940.

Detach Here and Mail With Your Payment and Form 940. |

|

|||||

|

|

|

|

|||

Form |

|

Payment Voucher |

|

OMB No. |

||

|

|

|||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Department of the Treasury |

|

Don’t staple or attach this voucher to your payment. |

|

2020 |

||

Internal Revenue Service |

|

|

||||

1 Enter your employer identification number (EIN). |

2 |

|

Dollars |

|

Cents |

|

|

|

Enter the amount of your payment. |

|

|

|

|

|

|

Make your check or money order payable to “United States Treasury” |

|

|

|

|

|

|

|

|

|

|

|

3Enter your business name (individual name if sole proprietor).

Enter your address.

Enter your city, state, and ZIP code; or your city, foreign country name, foreign province/county, and foreign postal code.

Form 940 (2020)

Privacy Act and Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to figure and collect the right amount of tax. Chapter 23, Federal Unemployment Tax Act, of Subtitle C, Employment Taxes, of the Internal Revenue Code imposes a tax on employers with respect to employees. This form is used to determine the amount of the tax that you owe. Section 6011 requires you to provide the requested information if you are liable for FUTA tax under section 3301. Section 6109 requires you to provide your identification number. If you fail to provide this information in a timely manner or provide a false or fraudulent form, you may be subject to penalties.

You’re not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as required by section 6103. However, section 6103 allows or requires the IRS to disclose or give the information shown on your tax return to others as described in the Code. For example, we may disclose

your tax information to the Department of Justice for civil and criminal litigation, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions to administer their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Recordkeeping |

9 hr., 19 min. |

Learning about the law or the form . . |

1 hr., 23 min. |

Preparing, copying, assembling, and |

|

sending the form to the IRS |

1 hr., 36 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making Form 940 simpler, we would be happy to hear from you. You can send us comments from www.irs.gov/FormComments. Or you can send your comments to Internal Revenue Service, Tax Forms and Publications Division, 1111 Constitution Ave. NW,

Other PDF Templates

Florida Notice to Owner Template - This notice is an essential tool for maintaining payment integrity in Florida’s construction landscape.

Utilizing the proper documentation is vital when selling or purchasing a mobile home. The Utah Mobile Home Bill of Sale is a key component of this process, as it not only serves as proof of the sale but also outlines essential details about the transaction. To ensure clarity and legality in the transfer of ownership, interested parties should familiarize themselves with the Mobile Home Bill of Sale form, which protects the rights of both the buyer and the seller.

Medication Administration Record Pdf - The form acts as a crucial communication tool among medical staff.

Aphis Form 7001 - Documenting your pet's breed, sex, and color is crucial for identification.

Documents used along the form

The IRS 940 form is essential for employers who need to report their annual Federal Unemployment Tax Act (FUTA) tax. However, it is often accompanied by other forms and documents that help ensure compliance with tax obligations. Below is a list of commonly used forms and documents that complement the IRS 940 form.

- IRS 941 Form: This form is used to report quarterly payroll taxes. Employers must submit it to report income taxes, Social Security tax, and Medicare tax withheld from employee wages.

- IRS 944 Form: Smaller employers may use this form to report annual payroll taxes instead of filing quarterly. It simplifies the process for those with lower payroll obligations.

- Form W-2: Employers must issue this form to employees by January 31 each year. It reports annual wages and the taxes withheld from those wages.

- Form W-3: This is a summary form that accompanies Form W-2 when submitted to the Social Security Administration. It provides a total of all W-2 forms issued by an employer.

- Trailer Bill of Sale Form: A crucial document that formalizes the sale and transfer of a trailer, including important details like the purchase price and parties involved. More information can be found at https://autobillofsaleform.com/trailer-bill-of-sale-form/.

- Form 1099-MISC: Used to report payments made to independent contractors and other non-employee compensation, this form is essential for businesses that hire freelancers.

- Form 1096: This is a summary form that accompanies certain information returns, like 1099s, when filed by mail. It provides the IRS with a summary of the forms submitted.

- State Unemployment Tax Forms: Each state has its own unemployment tax forms that employers must file. These forms are necessary for reporting state unemployment taxes and ensuring compliance with state laws.

- Form 940-EZ: This simplified version of the IRS 940 form is available for smaller employers with straightforward tax situations, making it easier to file.

- Payroll Records: Maintaining accurate payroll records is crucial. These documents help support the information reported on tax forms and can be essential in case of an audit.

- Employee Tax Withholding Forms (W-4): Employees fill out this form to determine how much federal income tax should be withheld from their paychecks. Employers need this information for accurate tax reporting.

Understanding these additional forms and documents can help employers navigate their tax responsibilities more effectively. Each form serves a specific purpose, ensuring that all aspects of payroll and employment taxes are managed correctly.

Similar forms

The IRS Form 941 is another important document for employers. It is used to report employment taxes on a quarterly basis. While Form 940 focuses on the Federal Unemployment Tax Act (FUTA), Form 941 covers Social Security and Medicare taxes, as well as federal income tax withholding. Both forms are essential for businesses to remain compliant with federal tax regulations, but they serve different purposes in tracking employee wages and taxes withheld throughout the year.

Form 944 is similar to Form 941 but is designed for smaller employers. This annual form allows eligible businesses with a lower payroll to report their employment taxes once a year instead of quarterly. Like Form 940, which is filed annually, Form 944 simplifies the reporting process for those who may not have the resources to file more frequently. Both forms ensure that employers are fulfilling their tax obligations, but they cater to different business sizes and needs.

Form 945 is another related document, specifically for reporting federal income tax withheld from nonpayroll payments. This form is used by businesses that make payments such as pensions, annuities, or other forms of compensation. While Form 940 deals with unemployment taxes, Form 945 focuses on income tax withholding, highlighting the different aspects of tax responsibilities that employers must manage.

In the whirlwind of paperwork surrounding mobile home sales, it's essential to utilize the correct documentation to ensure clarity and compliance. The New York Mobile Home Bill of Sale form plays a crucial role in this process, acting as the official record of the transaction between the buyer and seller. This legal document not only serves as proof of ownership transfer but also clearly outlines the terms of the sale, making it vital for both parties involved. For those looking to access or learn more about this important form, they can visit nypdfforms.com/ for further details.

Form 1099 is widely recognized as a form used to report various types of income other than wages. Different variations of the 1099 form exist, depending on the nature of the payment. While Form 940 deals with unemployment taxes, 1099 forms help businesses report payments made to independent contractors or freelancers. Both forms are essential for accurate tax reporting, but they target different types of income and tax obligations.

Form W-2 is another crucial document for employers, as it reports wages paid to employees and the taxes withheld from those wages. Unlike Form 940, which focuses on unemployment taxes, Form W-2 provides a comprehensive summary of an employee's earnings and tax contributions for the year. Employers must file Form W-2 for each employee, ensuring that individuals receive the necessary information to file their personal tax returns.

Form 720 is used to report and pay federal excise taxes. This form is relevant for businesses that deal with specific goods or services subject to excise tax, such as fuel or certain types of insurance. While Form 940 is concerned with unemployment taxes, Form 720 addresses a different category of tax obligations. Both forms require timely filing to avoid penalties, but they apply to distinct areas of taxation.

Finally, Form 1040 is the individual income tax return form used by taxpayers to report their annual income. While this form is for personal tax reporting, it connects to the information provided by employers through forms like W-2 and 1099. Form 940 is not directly filed by individuals but plays a role in the overall tax system by ensuring that employers contribute to unemployment insurance. Each of these forms serves a unique purpose, yet they collectively contribute to the broader landscape of tax compliance in the United States.

Dos and Don'ts

When filling out the IRS Form 940, it is essential to approach the task with care and attention to detail. This form is used to report and pay federal unemployment taxes. Here are some important dos and don'ts to keep in mind:

- Do ensure all information is accurate and complete before submission.

- Do double-check your calculations to avoid any errors that could lead to penalties.

- Do file the form on time to avoid late fees and interest charges.

- Do keep a copy of the completed form for your records.

- Don't forget to report all employees who are subject to unemployment tax.

- Don't leave any required fields blank; this can delay processing.

- Don't ignore any correspondence from the IRS regarding your form; respond promptly to any inquiries.

By adhering to these guidelines, individuals can navigate the complexities of the IRS Form 940 with greater confidence and accuracy.

Key takeaways

When it comes to the IRS 940 form, understanding the essentials can help ensure compliance and avoid potential penalties. Here are some key takeaways:

- Purpose of the Form: The IRS 940 form is used to report annual Federal Unemployment Tax Act (FUTA) taxes. Employers pay this tax to fund unemployment benefits.

- Filing Deadline: Employers must file the form by January 31 of the following year. If you deposit your FUTA tax on time, you may have until February 10 to file.

- Who Must File: Any business that pays $1,500 or more in wages in any calendar quarter or has at least one employee for a day in any week must file this form.

- Calculating Taxes: The FUTA tax rate is 6.0% on the first $7,000 of each employee's wages. However, you may receive a credit of up to 5.4% if you pay state unemployment taxes.

- Record Keeping: Maintain accurate payroll records. This documentation is crucial for completing the form correctly and for potential audits.

- Payment Options: You can pay your FUTA taxes electronically or by check. Choose the method that best suits your business needs.

By keeping these points in mind, you can navigate the process of filling out and using the IRS 940 form more effectively.

How to Use IRS 940

Filling out the IRS 940 form is an important task for employers who need to report their annual Federal Unemployment Tax Act (FUTA) tax. Completing this form accurately ensures compliance with federal regulations. Below are the steps to guide you through the process of filling out the form.

- Obtain a copy of the IRS 940 form. You can download it from the IRS website or request a paper form.

- At the top of the form, enter your business name, address, and Employer Identification Number (EIN).

- In the section labeled "Part 1," indicate whether you are filing for the current year or if you are amending a previous return.

- Complete "Part 2" by reporting the total amount of wages subject to FUTA tax for the year. This includes all wages paid to employees.

- In "Part 3," calculate the FUTA tax owed by multiplying the taxable wages by the applicable tax rate.

- In "Part 4," report any adjustments or credits that apply to your business, such as state unemployment tax credits.

- Complete "Part 5" by entering the total FUTA tax after adjustments. This is the amount you owe.

- If applicable, fill out "Part 6" to report any payments made throughout the year towards your FUTA tax liability.

- Sign and date the form at the bottom. If you are filing for a business, ensure that an authorized person signs it.

- Finally, send the completed form to the appropriate IRS address based on your location, or e-file it if you prefer that method.

Once you have completed these steps, keep a copy of the form for your records. It’s essential to ensure that all information is accurate and submitted on time to avoid penalties.