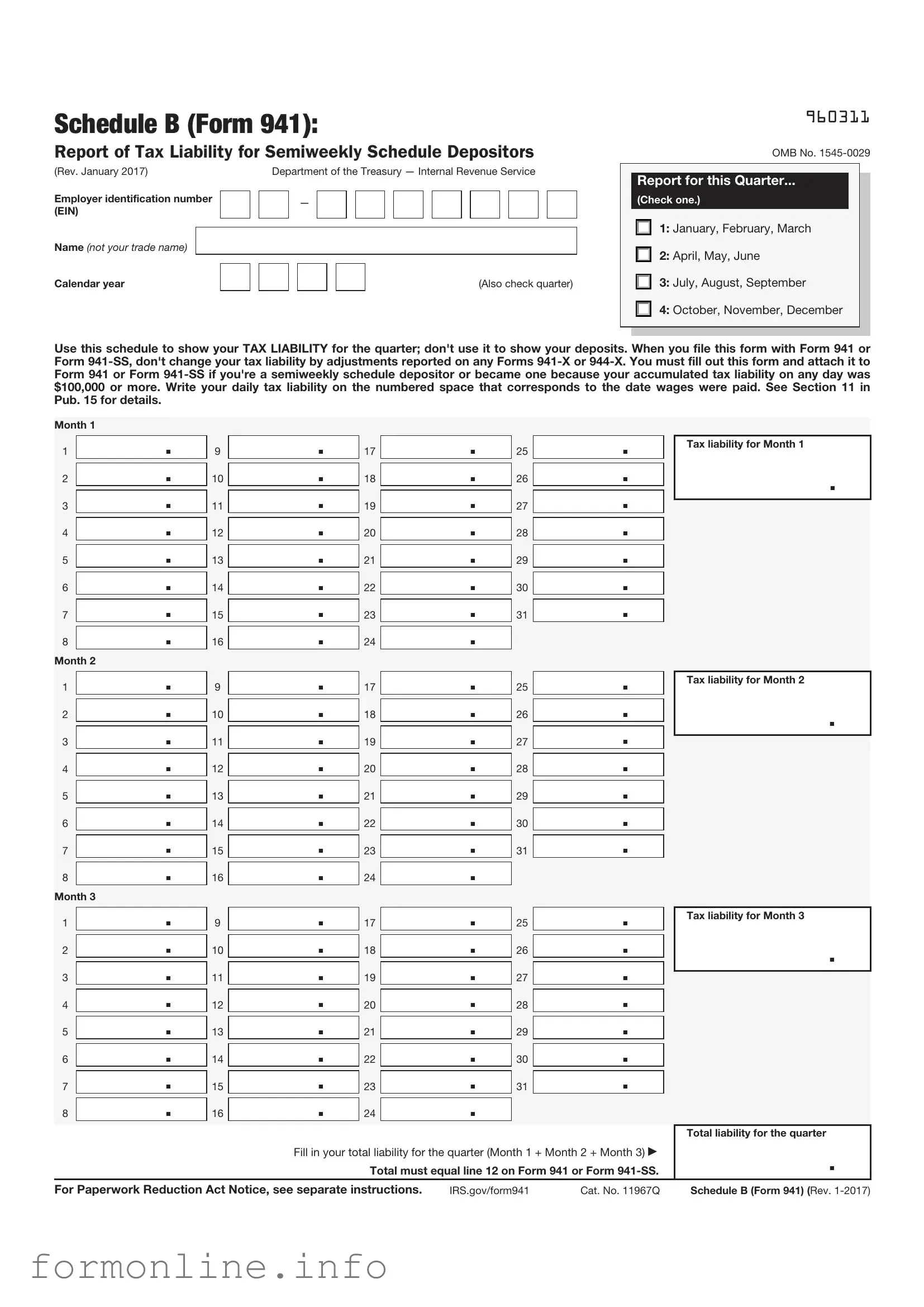

Fill Out a Valid IRS Schedule B 941 Form

The IRS Schedule B (Form 941) is an essential document for employers in the United States, providing a detailed account of their tax liabilities related to employee wages. This form is primarily used to report the total amount of federal income tax withheld from employees' paychecks, as well as the employer's share of Social Security and Medicare taxes. Employers must file this form quarterly, which helps the IRS track tax payments and ensure compliance with federal tax laws. Completing Schedule B accurately is crucial, as it requires information about the number of employees, the total wages paid, and the tax amounts withheld. Additionally, this form serves as a record of any adjustments made during the quarter, ensuring that all tax obligations are met. Understanding how to fill out Schedule B correctly can help employers avoid penalties and maintain good standing with the IRS.

Common mistakes

-

Incorrect Employer Identification Number (EIN): One of the most common mistakes occurs when individuals enter an incorrect EIN. This number is essential for identifying the business and must match the IRS records. A simple typo can lead to significant delays in processing.

-

Failure to Report All Tax Liabilities: Some filers neglect to include all tax liabilities. This oversight can result in penalties and interest charges. It's crucial to ensure that all wages and withholdings are accurately reported to avoid discrepancies.

-

Omitting Signature or Date: A form that lacks a signature or date is considered incomplete. This omission can lead to rejection of the form. Always double-check to ensure that the necessary signatures are in place before submission.

-

Using the Wrong Version of the Form: The IRS updates forms periodically. Using an outdated version of Schedule B can lead to complications. Always verify that you are using the most current version available on the IRS website.

-

Not Keeping Adequate Records: Failing to maintain proper documentation can create problems down the line. Good record-keeping is essential for substantiating the information reported on Schedule B. This includes payroll records and tax payment receipts.

Preview - IRS Schedule B 941 Form

Schedule B (Form 941):

Report of Tax Liability for Semiweekly Schedule Depositors

(Rev. January 2017) |

|

|

Department of the Treasury — Internal Revenue Service |

|||||||||||||||||||

Employer identification number |

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(EIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (not your trade name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Also check quarter) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

960311

OMB No.

Report for this Quarter...

(Check one.)

1: January, February, March

2: April, May, June

3: July, August, September

4: October, November, December

Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form

Month 1

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 2

1 .

.

2 .

.

3 .

.

4 .

.

5 .

.

6 .

.

7 .

.

8 .

.

Month 3

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

9 .

.

10 .

.

11 .

.

12 .

.

13 .

.

14 .

.

15 .

.

16 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

17 .

.

18 .

.

19 .

.

20 .

.

21 .

.

22 .

.

23 .

.

24 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

25 .

.

26 .

.

27 .

.

28 .

.

29 .

.

30 .

.

31 .

.

Tax liability for Month 1

.

Tax liability for Month 2

.

1 |

|

. |

9 |

|

. |

17 |

|

|

. |

25 |

|

. |

|

Tax liability for Month 3 |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

2 |

|

. |

10 |

|

. |

18 |

|

|

. |

26 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

. |

11 |

|

. |

19 |

|

|

. |

27 |

|

. |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

. |

12 |

|

. |

20 |

|

|

. |

28 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

. |

13 |

|

. |

21 |

|

|

. |

29 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

. |

14 |

|

. |

22 |

|

|

. |

30 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

|

. |

15 |

|

. |

23 |

|

|

. |

31 |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

. |

16 |

|

. |

24 |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liability for the quarter |

|

|

|

|

Fill in your total liability for the quarter (Month 1 + Month 2 + Month 3) |

. |

|||||||||

|

|

|

|

|

|

Total must equal line 12 on Form 941 or Form |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Paperwork Reduction Act Notice, see separate instructions. |

IRS.gov/form941 |

Cat. No. 11967Q |

Schedule B (Form 941) (Rev. |

|||||||||||

Other PDF Templates

Restroom Cleaning Sign Off Sheet - Maintain a clean restroom by recording cleaning schedules precisely.

Pay Stub Sample - Keeping pay stubs can assist in disputes over wages and facilitate constructive dialogue between employees and employers.

When engaging in the transfer of a mobile home, it is vital to utilize the correct legal documentation, such as the Mobile Home Bill of Sale, which ensures clarity and security for both the buyer and seller throughout the process.

Notarized Letter of Consent - Signature verification may be required for the consent to be accepted.

Documents used along the form

The IRS Schedule B (Form 941) is an important document for employers who report their payroll taxes. It provides a summary of the employer's tax liability for the quarter. However, several other forms and documents are often used in conjunction with Schedule B to ensure compliance with federal tax regulations. Below is a list of these forms, along with a brief description of each.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It reports the amount of federal income tax withheld, Social Security tax, and Medicare tax from employees' wages.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It reports the annual federal unemployment tax that employers must pay based on employee wages.

- Form W-2: This form is used to report wages paid to employees and the taxes withheld. Employers must provide a W-2 to each employee by January 31 of the following year.

- Boat Bill of Sale: Essential for the transfer of ownership, this form includes critical details about the transaction. For more information, visit nypdfforms.com/.

- Form W-3: This is the Transmittal of Wage and Tax Statements. It summarizes all W-2 forms issued by an employer and is submitted to the Social Security Administration.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It is typically issued to independent contractors and freelancers.

- Form 1040: This is the U.S. Individual Income Tax Return. While not directly related to employer payroll taxes, it is important for employees to report their income and tax obligations.

Understanding these forms and their purposes can help employers navigate their tax responsibilities more effectively. Ensuring accurate and timely filing of all related documents is crucial to maintaining compliance with IRS regulations.

Similar forms

The IRS Schedule B (Form 941) is similar to the Form 940, which is the Employer’s Annual Federal Unemployment (FUTA) Tax Return. Both forms are used by employers to report taxes related to employee wages. While Form 941 is filed quarterly to report income taxes, Social Security, and Medicare taxes withheld from employees, Form 940 is an annual return that focuses specifically on unemployment taxes. Employers must ensure compliance with both forms to avoid penalties and maintain proper tax records.

Another document that shares similarities is the IRS Form W-2, which reports wages paid to employees and the taxes withheld. Like Schedule B, the W-2 provides essential information to the IRS about employee earnings and tax contributions. Employers must file W-2 forms for each employee by January 31 of the following year, ensuring that all withheld amounts align with what is reported on Form 941. Both documents play a crucial role in the overall tax reporting process for businesses.

The IRS Form 1099-MISC is also comparable to Schedule B, particularly in how it reports payments made to non-employees. While Schedule B focuses on payroll taxes for employees, Form 1099-MISC is used to report payments to independent contractors and other non-employee compensation. Both forms are critical for accurate tax reporting and compliance, as they help the IRS track income and tax obligations for different types of workers.

The South Carolina Motor Vehicle Bill of Sale form is a legal document that records the sale and purchase of a motor vehicle in the state of South Carolina. It serves as proof of ownership transfer from the seller to the buyer. This form is essential for both parties to ensure the transaction is acknowledged legally and to facilitate the vehicle's registration process. For further details, you can visit https://autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form/.

Form 944, the Employer’s Annual Federal Tax Return, is another document that is similar to Schedule B. Small employers may use Form 944 instead of Form 941 to report their payroll taxes annually rather than quarterly. Both forms require detailed information about employee wages and withheld taxes, but Form 944 simplifies the reporting process for businesses with lower payroll tax liabilities. Understanding the differences between these forms is essential for proper tax compliance.

The IRS Form 945 is also relevant, as it is used to report non-payroll tax withheld, such as backup withholding. Like Schedule B, Form 945 requires detailed reporting of amounts withheld from payments made to individuals or entities. Employers must file Form 945 annually, similar to how Schedule B provides a snapshot of payroll tax liabilities for a specific quarter. Both forms help the IRS track different types of tax withholding and ensure that the correct amounts are reported.

Form 941-X is another related document, serving as the adjusted employer’s quarterly federal tax return or claim for refund. It is used to correct errors made on previously filed Form 941. This form shares similarities with Schedule B in that both require detailed reporting of wages and taxes. Filing Form 941-X allows employers to rectify mistakes and ensure accurate reporting, which is essential for maintaining compliance with tax regulations.

The IRS Form 720 is also similar, as it reports federal excise taxes. While Schedule B focuses on employment taxes, Form 720 is used for various excise taxes that may apply to specific goods or services. Both forms require accurate reporting and payment of taxes, although they serve different purposes within the tax system. Understanding the distinctions and requirements of each form is important for businesses involved in excise tax activities.

Form 1095-C is another document that relates to employer reporting requirements, specifically regarding health insurance coverage. While Schedule B deals with payroll taxes, Form 1095-C is used to report health coverage provided to employees under the Affordable Care Act. Both forms require accurate information and adherence to reporting deadlines, ensuring compliance with federal regulations. Employers must understand the implications of both forms to avoid penalties.

Lastly, the IRS Form 1120 is relevant for corporations, as it reports income, gains, losses, deductions, and credits for corporate tax purposes. While Schedule B pertains to payroll taxes for employees, Form 1120 focuses on the overall financial performance of a corporation. Both forms are integral to the tax reporting process, and accurate completion is essential for compliance and financial accountability.

Dos and Don'ts

When filling out the IRS Schedule B (Form 941), it is essential to be meticulous and informed. This form is crucial for reporting your tax liabilities accurately. Below are some key dos and don’ts to consider.

- Do ensure that all information is accurate and complete. Double-check names, addresses, and identification numbers.

- Do report all tax liabilities for each pay period accurately. This includes wages, tips, and other compensation.

- Do keep records of your payroll and tax deposits. Documentation is vital for future reference and potential audits.

- Do file the form on time. Late submissions can result in penalties and interest charges.

- Don’t leave any sections blank. Every part of the form must be filled out to avoid delays or rejections.

- Don’t ignore the instructions provided with the form. They contain important guidelines that can help you avoid mistakes.

- Don’t underestimate the importance of signatures. Ensure that the form is signed by an authorized person.

- Don’t forget to keep copies of submitted forms for your records. This practice is essential for tracking your submissions and payments.

Key takeaways

When filling out and using the IRS Schedule B (Form 941), keep these key takeaways in mind:

- Understand the Purpose: Schedule B is used to report your tax liability for Social Security, Medicare, and withheld federal income taxes for each pay period.

- Accurate Record-Keeping: Maintain accurate payroll records to ensure the amounts reported on Schedule B match your payroll records.

- Timeliness is Crucial: Submit Schedule B along with Form 941 by the due date to avoid penalties and interest.

- Monitor Changes: Stay updated on any changes to tax laws or IRS guidelines that may affect how you complete Schedule B.

How to Use IRS Schedule B 941

Once you have gathered all necessary information, you can begin filling out the IRS Schedule B (Form 941). This form is essential for reporting your tax obligations related to employment. Ensure you have your business details, employee information, and any relevant tax data ready before you start.

- Begin with your business name and address at the top of the form.

- Enter your Employer Identification Number (EIN) in the designated box.

- Fill in the quarter for which you are reporting. Indicate the year and the specific quarter (1, 2, 3, or 4).

- In Part 1, report the total number of employees who received wages during the quarter.

- List the total wages, tips, and other compensation paid to employees in the appropriate section.

- Calculate the total taxes withheld from employee wages and enter that amount.

- In Part 2, indicate if you had any adjustments to your tax liability, such as corrections from previous quarters.

- Complete the certification section by signing and dating the form.

- Double-check all entries for accuracy before submitting.

After completing the form, make sure to file it by the deadline to avoid penalties. Keep a copy for your records, as it may be useful for future reference or audits.