Fill Out a Valid IRS Schedule C 1040 Form

For many individuals operating their own businesses, understanding the intricacies of the IRS Schedule C (Form 1040) is crucial for accurate tax reporting and compliance. This form, designed specifically for sole proprietors, allows business owners to report income or loss from their trade or profession. It encompasses various elements, including gross receipts, cost of goods sold, and deductible business expenses, which can significantly impact the overall tax liability. Moreover, the Schedule C provides a structured way to account for both direct and indirect costs associated with running a business, ensuring that eligible deductions are captured. By detailing income and expenses, this form not only helps in determining net profit or loss but also plays a pivotal role in establishing a clear financial picture for the business owner. As tax season approaches, familiarity with the nuances of Schedule C becomes increasingly important, empowering entrepreneurs to navigate the complexities of self-employment taxation effectively.

Common mistakes

-

Neglecting to report all income: Some individuals fail to include all sources of income. It's essential to report every dollar earned from your business activities, as the IRS requires complete transparency.

-

Incorrectly categorizing expenses: Misclassifying expenses can lead to inaccuracies. Ensure that each expense is placed in the correct category to avoid potential audits.

-

Forgetting to keep receipts: Many people overlook the importance of maintaining receipts. Without proper documentation, it can be challenging to substantiate your claims during an audit.

-

Failing to separate personal and business expenses: Mixing personal and business finances can complicate your tax situation. Always maintain separate accounts to simplify reporting.

-

Omitting the cost of goods sold: If your business involves selling products, neglecting to report the cost of goods sold can result in inflated profits. Accurately calculating this figure is crucial.

-

Not taking advantage of deductions: Some individuals are unaware of all the deductions available to them. Familiarize yourself with potential deductions to minimize your tax liability.

-

Incorrectly calculating self-employment tax: Miscalculations can lead to underpayment or overpayment. Understanding how to calculate self-employment tax accurately is vital.

-

Ignoring deadlines: Missing deadlines can result in penalties. Be aware of important dates to ensure timely filing and avoid unnecessary fees.

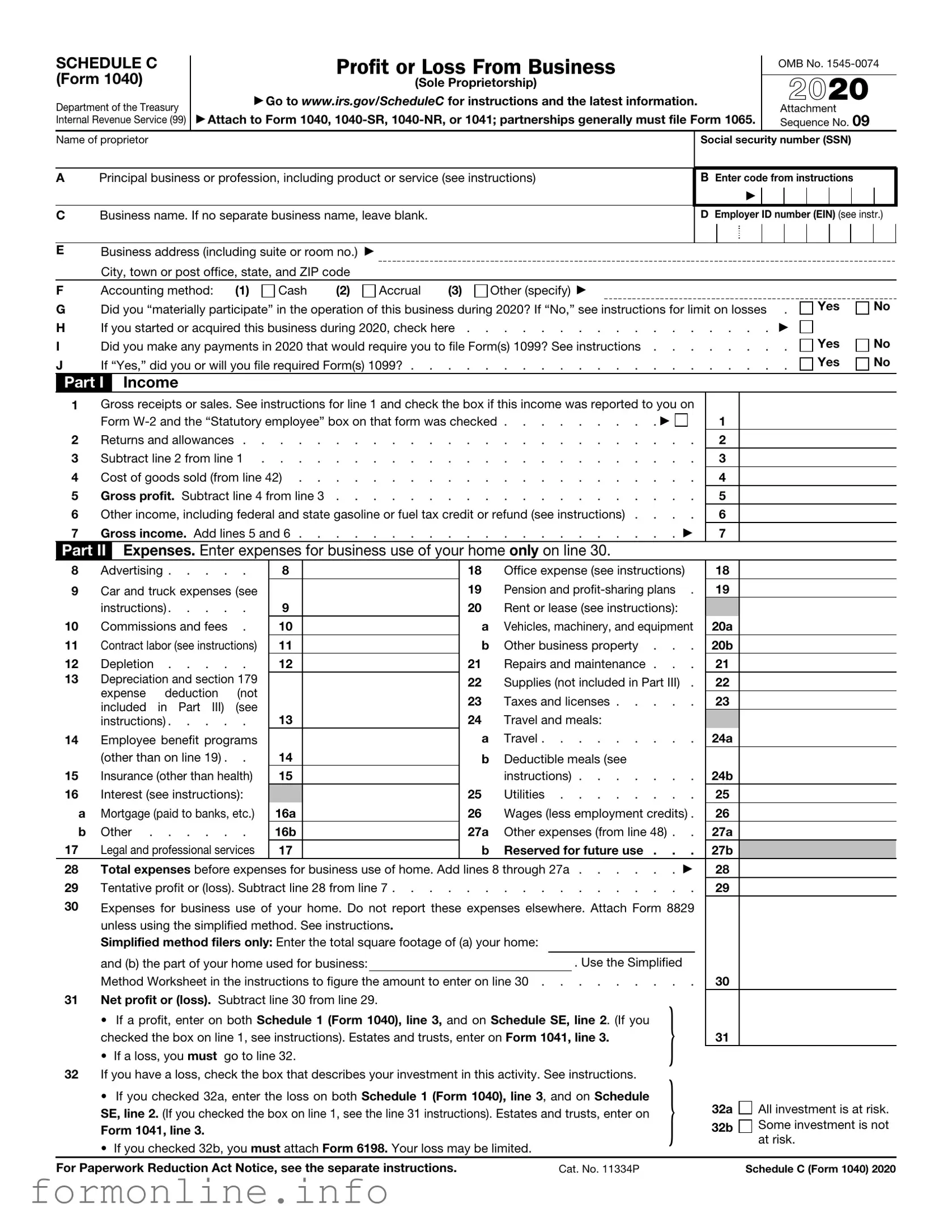

Preview - IRS Schedule C 1040 Form

SCHEDULE C |

|

Profit or Loss From Business |

|

OMB No. |

|||||||

|

|

||||||||||

(Form 1040) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||

|

(Sole Proprietorship) |

|

2020 |

|

|||||||

Department of the Treasury |

|

▶ Go to www.irs.gov/ScheduleC for instructions and the latest information. |

|

|

|||||||

|

|

|

|

Attachment |

|||||||

Internal Revenue Service (99) |

|

▶ Attach to Form 1040, |

Sequence No. 09 |

||||||||

Name of proprietor |

|

|

|

Social security number (SSN) |

|||||||

|

|

|

|

|

|

|

|

|

|

||

A |

Principal business or profession, including product or service (see instructions) |

|

B Enter code from instructions |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

C |

Business name. If no separate business name, leave blank. |

D Employer ID number (EIN) (see instr.) |

|||||||||

EBusiness address (including suite or room no.) ▶ City, town or post office, state, and ZIP code

F |

Accounting method: |

(1) |

Cash |

(2) |

Accrual |

(3) |

Other (specify) ▶ |

G |

Did you “materially participate” in the operation of this business during 2020? If “No,” see instructions for limit on losses . |

||||||

H |

If you started or acquired this business during 2020, check here . |

. . . . . . . . . . . . . . . . ▶ |

|||||

I |

Did you make any payments in 2020 that would require you to file Form(s) 1099? See instructions |

||||||

J |

If “Yes,” did you or will you file required Form(s) 1099? |

||||||

Yes

Yes  No

No

Yes

Yes

No

No

Yes

Yes  No

No

Part I Income

1 |

Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on |

|

|

|||||||||||

|

Form |

. . . . . . . . |

. ▶ |

1 |

|

|||||||||

2 |

Returns and allowances |

. . . . . . . . . . . |

|

2 |

|

|||||||||

3 |

Subtract line 2 from line 1 |

. . . . . . . . . . . |

|

3 |

|

|||||||||

4 |

Cost of goods sold (from line 42) |

. . . . . . . . . . . |

|

4 |

|

|||||||||

5 |

Gross profit. Subtract line 4 from line 3 |

. . . . . . . . . . . |

|

5 |

|

|||||||||

6 |

Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) . . . . |

6 |

|

|||||||||||

7 |

Gross income. Add lines 5 and 6 |

. . . . . . . . |

. |

. ▶ |

7 |

|

||||||||

Part II |

Expenses. Enter expenses for business use of your home only on line 30. |

|

|

|

|

|

||||||||

8 |

Advertising |

8 |

|

|

18 |

Office expense (see instructions) |

18 |

|

||||||

9 |

Car and truck expenses (see |

|

|

|

19 |

Pension and |

19 |

|

||||||

|

instructions) |

9 |

|

|

20 |

Rent or lease (see instructions): |

|

|

||||||

10 |

Commissions and fees . |

10 |

|

|

a |

Vehicles, machinery, and equipment |

20a |

|

||||||

11 |

Contract labor (see instructions) |

11 |

|

|

b |

Other business property . . . |

20b |

|

||||||

12 |

Depletion |

12 |

|

|

21 |

Repairs and maintenance . . . |

21 |

|

||||||

13 |

Depreciation and section 179 |

|

|

|

22 |

Supplies (not included in Part III) . |

22 |

|

||||||

|

expense deduction (not |

|

|

|

|

|||||||||

|

|

|

|

23 |

Taxes and licenses |

23 |

|

|||||||

|

included in Part III) (see |

|

|

|

|

|||||||||

|

instructions) |

13 |

|

|

24 |

Travel and meals: |

|

|

|

|

|

|||

14 |

Employee benefit programs |

|

|

|

a |

Travel |

24a |

|

||||||

|

(other than on line 19) . . |

14 |

|

|

b |

Deductible meals (see |

|

|

|

|

|

|||

15 |

Insurance (other than health) |

15 |

|

|

|

instructions) |

24b |

|

||||||

16 |

Interest (see instructions): |

|

|

|

25 |

Utilities |

25 |

|

||||||

a |

Mortgage (paid to banks, etc.) |

16a |

|

|

26 |

Wages (less employment credits) . |

26 |

|

||||||

b |

Other |

16b |

|

|

27a |

Other expenses (from line 48) . . |

27a |

|

||||||

17 |

Legal and professional services |

17 |

|

|

b |

Reserved for future use . . . |

27b |

|

||||||

28 |

Total expenses before expenses for business use of home. Add lines 8 through 27a . . . . |

. |

. ▶ |

28 |

|

|||||||||

29 |

Tentative profit or (loss). Subtract line 28 from line 7 |

. . . . . . . . . . . |

|

29 |

|

|||||||||

30 |

Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 |

|

|

|||||||||||

|

unless using the simplified method. See instructions. |

|

|

|

|

|

|

|

|

|

||||

|

Simplified method filers only: Enter the total square footage of (a) your home: |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

and (b) the part of your home used for business: |

|

|

|

|

. Use the Simplified |

|

|

||||||

|

Method Worksheet in the instructions to figure the amount to enter on line 30 |

30 |

|

|||||||||||

31 |

Net profit or (loss). Subtract line 30 from line 29. |

|

|

|

|

|

} |

|

|

|

||||

|

• If a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (If you |

|

|

|

|

|||||||||

|

checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. |

|

|

31 |

|

|||||||||

|

• If a loss, you must go to line 32. |

|

|

|

|

|

|

|

|

|||||

32 |

If you have a loss, check the box that describes your investment in this activity. See instructions. |

|

} |

|

|

|

||||||||

|

• If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule |

|

|

32a |

All investment is at risk. |

|||||||||

|

SE, line 2. (If you checked the box on line 1, see the line 31 instructions). Estates and trusts, enter on |

|

|

|||||||||||

|

|

|

32b |

Some investment is not |

||||||||||

|

Form 1041, line 3. |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

at risk. |

|||

|

• If you checked 32b, you must attach Form 6198. Your loss may be limited. |

|

|

|

|

|

||||||||

For Paperwork Reduction Act Notice, see the separate instructions. |

|

|

Cat. No. 11334P |

|

|

|

|

Schedule C (Form 1040) 2020 |

||||||

Schedule C (Form 1040) 2020 |

Page 2 |

|

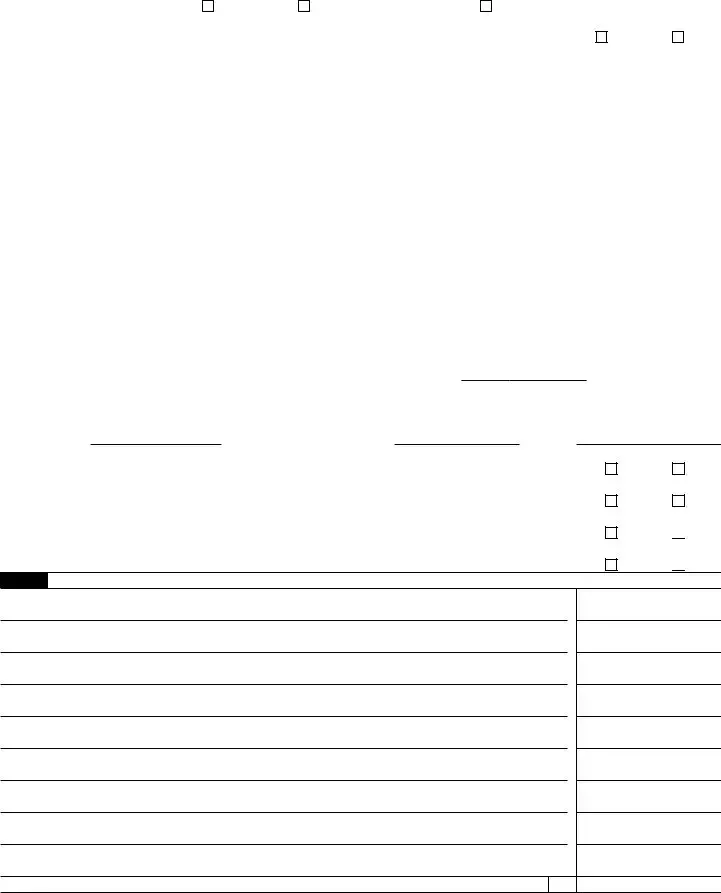

Part III |

Cost of Goods Sold (see instructions) |

|

33 |

Method(s) used to |

|

|

|

|

|

|

|

value closing inventory: |

a |

Cost |

b |

Lower of cost or market |

c |

Other (attach explanation) |

34Was there any change in determining quantities, costs, or valuations between opening and closing inventory?

If “Yes,” attach explanation |

Yes |

No

35 |

Inventory at beginning of year. If different from last year’s closing inventory, attach explanation . . . |

35 |

|

|||

36 |

Purchases less cost of items withdrawn for personal use |

36 |

|

|||

37 |

Cost of labor. Do not include any amounts paid to yourself |

37 |

|

|||

38 |

Materials and supplies |

38 |

|

|||

39 |

Other costs |

39 |

|

|||

40 |

Add lines 35 through 39 |

40 |

|

|||

41 |

Inventory at end of year |

41 |

|

|||

42 |

Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 |

42 |

|

|||

Part IV |

Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 |

|||||

|

|

and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must |

||||

|

|

file Form 4562. |

|

|

|

|

43 |

When did you place your vehicle in service for business purposes? (month/day/year) |

▶ |

/ |

/ |

|

|

44Of the total number of miles you drove your vehicle during 2020, enter the number of miles you used your vehicle for:

a |

Business |

b Commuting (see instructions) |

c Other |

|

45 |

Was your vehicle available for personal use during |

. . . . . . . . . . . . . |

Yes |

|

46 |

Do you (or your spouse) have another vehicle available for personal use?. |

. . . . . . . . . . . . . |

Yes |

|

47a |

Do you have evidence to support your deduction? |

. . . . . . . . . . . . . |

Yes |

|

b |

If “Yes,” is the evidence written? |

. . . . . . . . . . . . . |

Yes |

|

Part V Other Expenses. List below business expenses not included on lines

No

No

No

No

No

No

48 Total other expenses. Enter here and on line 27a . . . . . . . . . . . . . . . .

48

Schedule C (Form 1040) 2020

Other PDF Templates

How to Fill Out a Bill of Lading - It provides a clear outline of the responsibilities of both the shipper and carrier.

To further clarify the process of ownership transfer, it is advisable for both parties to use a Mobile Home Bill of Sale, which can help ensure that all legal requirements are met and that the transaction is fully documented.

Odometer Disclosure Statement California - Before signing any sales agreement, ensure this statement is part of the paperwork.

Documents used along the form

The IRS Schedule C (Form 1040) is a crucial document for self-employed individuals and sole proprietors to report income and expenses from their business activities. However, several other forms and documents are commonly used in conjunction with Schedule C to provide a comprehensive view of one's financial situation. Below is a list of these forms, each serving a specific purpose in the tax reporting process.

- Form 1040: This is the standard individual income tax return form used by all taxpayers in the United States. It summarizes total income, tax deductions, and tax credits, ultimately determining the amount of tax owed or refund due.

- Schedule SE: This form is used to calculate self-employment tax, which applies to individuals who earn income through self-employment. It helps determine the amount owed for Social Security and Medicare taxes.

- Form 130-U: This form is necessary for the application of a Texas title and registration for motor vehicles. It aligns with the completion of the autobillofsaleform.com/texas-motor-vehicle-bill-of-sale-form to confirm ownership transfer in Texas.

- Form 4562: This form is used to claim depreciation and amortization on business assets. If a business has significant assets that lose value over time, this form allows the owner to deduct that loss from their taxable income.

- Form 8829: This form is utilized to calculate the expenses related to the business use of a home. If a portion of the home is used exclusively for business, this form helps determine the allowable deductions for home office expenses.

- Form 1099-MISC: This form is issued to report income received from sources other than employment. If a business pays an independent contractor or freelancer, it must provide this form to report payments made throughout the year.

Understanding these additional forms can help self-employed individuals ensure they are accurately reporting their income and expenses. Properly completing these documents not only aids in compliance with tax laws but also maximizes potential deductions, ultimately benefiting the taxpayer's financial situation.

Similar forms

The IRS Schedule C form, used by sole proprietors to report income and expenses from their business, shares similarities with the IRS Form 1040 itself. The Form 1040 is the standard individual income tax return form. Both documents are integral parts of the individual tax filing process and require taxpayers to report their income. While Form 1040 serves as the primary document for reporting overall income, Schedule C provides a detailed breakdown of business income and expenses, allowing for a more precise calculation of net profit or loss from self-employment activities.

Another document similar to Schedule C is the IRS Schedule E. This form is used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Like Schedule C, Schedule E requires detailed reporting of income and expenses. Both forms help taxpayers determine their overall income and tax liability, but Schedule E focuses specifically on passive income sources, while Schedule C is tailored for active business income.

IRS Schedule F is also comparable to Schedule C. This form is specifically for farmers to report their farming income and expenses. Similar to Schedule C, Schedule F allows farmers to detail their revenue sources and costs associated with farming operations. Both forms aim to capture the financial performance of a business, though Schedule F is specialized for agricultural activities, reflecting the unique nature of farming income and expenses.

If you're looking to establish your business structure, the Florida Operating Agreement is an essential component that outlines key management details. For further guidance, refer to this key Florida Operating Agreement document.

Form 1065, the U.S. Return of Partnership Income, shares a relationship with Schedule C as well. While Schedule C is for sole proprietors, Form 1065 is used by partnerships to report their income, deductions, gains, and losses. Both forms require detailed reporting of financial activities, but Form 1065 also necessitates the distribution of income and deductions among partners, making it more complex. However, both documents are essential for determining the tax obligations of the respective business entities.

IRS Form 1120, the U.S. Corporation Income Tax Return, is similar to Schedule C in that it is used to report business income. However, Form 1120 is specifically for corporations, while Schedule C is for sole proprietorships. Both forms require a comprehensive accounting of income and expenses, but the structure and requirements differ due to the legal status of the business. Corporations often face different tax rates and regulations, which is reflected in the complexity of Form 1120 compared to Schedule C.

Schedule SE, used to calculate self-employment tax, is another document that complements Schedule C. When a taxpayer reports income on Schedule C, they often also need to file Schedule SE to determine their self-employment tax liability. Both forms are interconnected, as the net profit reported on Schedule C directly affects the self-employment tax calculated on Schedule SE. This relationship underscores the importance of accurate reporting on both forms to ensure compliance with tax obligations.

Lastly, Form 8949, the Sales and Other Dispositions of Capital Assets, can be viewed as similar to Schedule C in that it deals with income reporting. While Schedule C focuses on business income, Form 8949 is used to report capital gains and losses from the sale of assets. Both forms require taxpayers to provide detailed information about income-generating activities, but they apply to different types of income. The accurate reporting on Form 8949 can impact the overall tax liability, just as Schedule C does for business income.

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it is important to follow certain guidelines to ensure accuracy and compliance. Below are six things to do and not do while completing this form.

Things You Should Do:

- Gather all necessary documents, including income statements and expense receipts.

- Report all income accurately, including cash, checks, and online payments.

- Keep detailed records of business expenses to support your deductions.

Things You Shouldn't Do:

- Do not underestimate your expenses; every legitimate cost can help reduce your tax liability.

- Avoid rounding numbers; use exact figures for accuracy.

- Do not neglect to sign and date the form before submission.

Key takeaways

Filling out and using the IRS Schedule C (Form 1040) can seem daunting, but understanding its key aspects can simplify the process. Here are some essential takeaways to keep in mind:

- Purpose of Schedule C: This form is used by sole proprietors to report income and expenses from their business. It is an integral part of your individual income tax return.

- Accurate Record-Keeping: Keeping detailed records of all income and expenses throughout the year is crucial. This will help ensure that you report accurate figures and maximize your deductions.

- Deductions Matter: Familiarize yourself with the types of expenses you can deduct, such as home office expenses, supplies, and business travel. Properly claiming these can significantly reduce your taxable income.

- Filing Deadlines: Be mindful of the tax filing deadlines. Schedule C is typically due on April 15, along with your personal income tax return, unless you apply for an extension.

How to Use IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals or those who run a business as a sole proprietor. This form helps report income and expenses related to your business activities. To ensure accuracy and compliance, follow these steps carefully.

- Gather Your Information: Collect all relevant documents, including income records, receipts for expenses, and any other financial statements related to your business.

- Download the Form: Obtain the Schedule C form from the IRS website or use tax preparation software that includes the form.

- Fill Out Your Business Information: Enter your name, Social Security number, and the name of your business. If applicable, include your Employer Identification Number (EIN) and the business address.

- Choose Your Accounting Method: Indicate whether you use the cash or accrual method for accounting. This choice affects how you report income and expenses.

- Report Your Income: List all income earned from your business. This includes sales, services, and any other revenue streams.

- Detail Your Expenses: Break down your business expenses into categories such as advertising, car and truck expenses, rent, utilities, and supplies. Be sure to include only those expenses that are necessary and ordinary for your business.

- Calculate Your Net Profit or Loss: Subtract your total expenses from your total income. This figure will be your net profit or loss for the year.

- Complete Additional Sections: If applicable, fill out any additional sections for specific deductions or credits, such as home office deductions or other business-related tax benefits.

- Review Your Form: Double-check all entries for accuracy. Ensure that numbers are correctly added and that all necessary information is included.

- Sign and Date the Form: Don’t forget to sign and date the form before submitting it. If you are filing jointly, your spouse must also sign.

- Submit Your Schedule C: Attach the completed Schedule C to your Form 1040 when filing your taxes. You can file electronically or send a paper return to the IRS.