Printable Lady Bird Deed Form

When it comes to estate planning, few documents are as beneficial and versatile as the Lady Bird Deed. This unique legal instrument, often overlooked, allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. By using a Lady Bird Deed, individuals can avoid the lengthy and often costly probate process, ensuring a smoother transition of assets to their heirs. One of its standout features is the ability to change beneficiaries or even revoke the deed entirely without the need for consent from those named. This flexibility empowers property owners to adapt their estate plans as life circumstances evolve. Additionally, the Lady Bird Deed provides a safeguard against Medicaid estate recovery, allowing individuals to qualify for benefits without losing their home. With these advantages in mind, understanding the nuances of the Lady Bird Deed can be crucial for anyone looking to secure their legacy and provide for their loved ones in the most efficient way possible.

State-specific Tips for Lady Bird Deed Templates

Common mistakes

-

Not Including All Owners: One common mistake is failing to list all current property owners on the deed. If multiple people own the property, each must be named to ensure proper transfer of ownership.

-

Incorrect Property Description: The legal description of the property must be accurate. Errors in this section can lead to disputes or complications during the transfer process.

-

Omitting the Right of Survivorship: Some individuals forget to specify the right of survivorship. This detail is crucial as it determines how property ownership will transfer upon the death of one owner.

-

Not Understanding the Implications: Failing to comprehend the implications of a Lady Bird Deed can lead to unintended consequences. It is essential to understand how it affects taxes and Medicaid eligibility.

-

Improper Witness Signatures: Many people overlook the requirement for witnesses. The deed must be signed in front of witnesses to be valid, and missing this step can invalidate the document.

-

Neglecting to Record the Deed: After completing the form, it is vital to record the deed with the appropriate county office. Failing to do so can leave the property in legal limbo.

-

Using Outdated Forms: Legal forms can change over time. Using an outdated version of the Lady Bird Deed can lead to mistakes or rejection by the county clerk.

-

Not Consulting a Professional: Some individuals attempt to fill out the deed without seeking professional advice. Consulting an attorney or real estate expert can help prevent errors and ensure compliance with state laws.

Preview - Lady Bird Deed Form

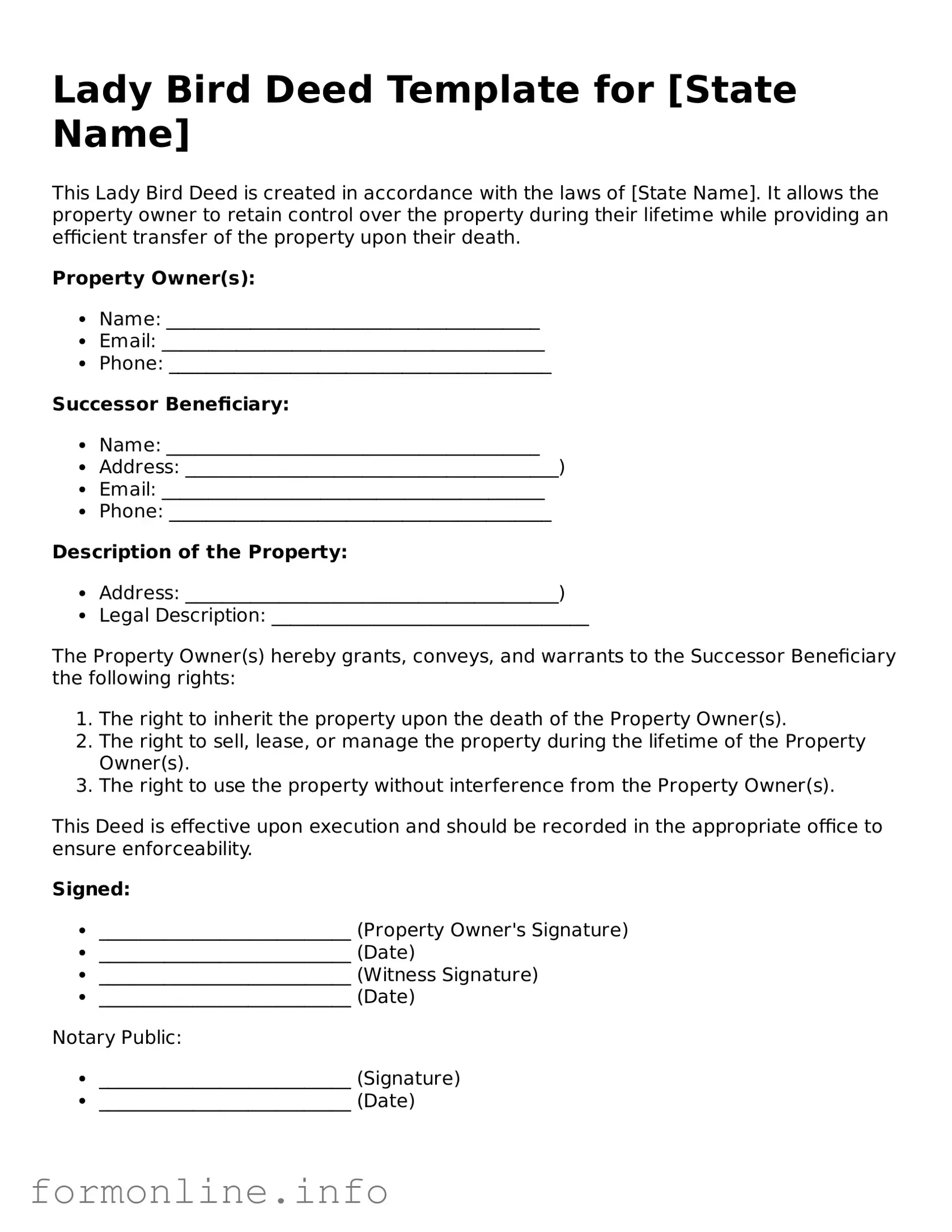

Lady Bird Deed Template for [State Name]

This Lady Bird Deed is created in accordance with the laws of [State Name]. It allows the property owner to retain control over the property during their lifetime while providing an efficient transfer of the property upon their death.

Property Owner(s):

- Name: ________________________________________

- Email: _________________________________________

- Phone: _________________________________________

Successor Beneficiary:

- Name: ________________________________________

- Address: ________________________________________)

- Email: _________________________________________

- Phone: _________________________________________

Description of the Property:

- Address: ________________________________________)

- Legal Description: __________________________________

The Property Owner(s) hereby grants, conveys, and warrants to the Successor Beneficiary the following rights:

- The right to inherit the property upon the death of the Property Owner(s).

- The right to sell, lease, or manage the property during the lifetime of the Property Owner(s).

- The right to use the property without interference from the Property Owner(s).

This Deed is effective upon execution and should be recorded in the appropriate office to ensure enforceability.

Signed:

- ___________________________ (Property Owner's Signature)

- ___________________________ (Date)

- ___________________________ (Witness Signature)

- ___________________________ (Date)

Notary Public:

- ___________________________ (Signature)

- ___________________________ (Date)

More Types of Lady Bird Deed Templates:

What Is Deed in Lieu - A Deed in Lieu of Foreclosure can often be more straightforward than a foreclosure process.

Free Deed of Trust Template - This provides public notice of the lender's interest in the property.

When engaging in a motor vehicle transaction in Pennsylvania, understanding the significance of the Pennsylvania Motor Vehicle Bill of Sale is essential. This form is not only a formal agreement that outlines the transfer of ownership from seller to buyer, but it also includes critical details regarding the vehicle and the terms of the sale. For more information, you can visit autobillofsaleform.com/pennsylvania-motor-vehicle-bill-of-sale-form, where you will find resources that can help make the process clearer and ensure all legal requirements are met.

Printable Quitclaim Deed - In real estate transactions, Quitclaim Deeds are quick and less expensive compared to other deed types.

Documents used along the form

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. While this deed is a crucial document, it is often accompanied by other forms and documents that facilitate the estate planning process. Below are some commonly used documents that work in conjunction with the Lady Bird Deed.

- Will: A will is a legal document that outlines how a person's assets will be distributed upon their death. It can specify guardians for minor children and may include instructions for funeral arrangements. Unlike the Lady Bird Deed, a will does not take effect until the individual passes away.

- Durable Power of Attorney: This document allows an individual to designate someone else to make financial and legal decisions on their behalf if they become incapacitated. It is important for ensuring that one’s financial affairs are managed according to their wishes when they cannot do so themselves.

- Health Care Proxy: A health care proxy is a legal document that allows a person to appoint someone to make medical decisions for them if they are unable to communicate their wishes. This document is essential for ensuring that a person's health care preferences are honored during critical times.

- Mobile Home Bill of Sale: The Mobile Home Bill of Sale is a vital document for anyone looking to transfer ownership of a mobile home, ensuring all necessary details are clear and legally binding.

- Trust Agreement: A trust agreement is a legal arrangement in which one party holds property for the benefit of another. Trusts can help manage assets during a person's lifetime and after their death, providing more control over how and when assets are distributed compared to a will.

Incorporating these documents into an estate plan can provide a comprehensive approach to managing assets and ensuring that personal wishes are fulfilled. Each document plays a specific role in addressing various aspects of an individual's financial and medical needs, making them essential companions to the Lady Bird Deed.

Similar forms

The Lady Bird Deed, also known as an enhanced life estate deed, shares similarities with the traditional life estate deed. Both documents allow an individual to retain the right to use and control the property during their lifetime. However, the Lady Bird Deed offers more flexibility. It enables the property owner to sell or mortgage the property without the consent of the remaindermen, who are the individuals that will inherit the property after the owner's death. This flexibility can be crucial for estate planning and financial management.

Another document akin to the Lady Bird Deed is the transfer-on-death deed. This deed allows property owners to designate beneficiaries who will receive the property upon their death. Like the Lady Bird Deed, the transfer-on-death deed bypasses the probate process, making it easier and quicker for heirs to obtain the property. However, unlike the Lady Bird Deed, the transfer-on-death deed does not provide the property owner with the same level of control during their lifetime.

The revocable living trust is also similar to the Lady Bird Deed. A revocable living trust allows individuals to place their assets into a trust during their lifetime, retaining control over those assets. Upon death, the assets are distributed according to the terms of the trust, avoiding probate. While both documents facilitate the transfer of property and avoid probate, a revocable living trust can cover a wider range of assets beyond just real estate.

The quitclaim deed is another document that bears resemblance to the Lady Bird Deed. A quitclaim deed transfers whatever interest a person has in a property without guaranteeing that the title is clear. While it is often used to transfer property between family members, it does not provide the same protections or retainment of rights as a Lady Bird Deed. The Lady Bird Deed offers more security for the owner while allowing for a smooth transfer upon death.

Understanding the various legal documents involved in property transfer is crucial for effective estate planning. One such important document is the Mobile Home Bill of Sale, which is used to facilitate the transfer of ownership of mobile homes, ensuring both parties' interests are protected during a transaction. This form outlines key details, including the identities of the buyer and seller, and the specifications of the mobile home, making it essential for a smooth ownership transition.

The warranty deed is also comparable to the Lady Bird Deed. A warranty deed provides a guarantee that the property title is clear and free of liens or encumbrances. It offers protection to the buyer and assures them of ownership rights. While both deeds facilitate property transfer, the warranty deed does not allow for the same level of control during the owner's lifetime as the Lady Bird Deed.

The special warranty deed is similar in nature to the warranty deed but with some distinctions. It guarantees that the grantor has not encumbered the property during their ownership. Like the warranty deed, it provides some level of assurance to the buyer. However, it does not offer the same lifetime control features as the Lady Bird Deed, which allows the owner to manage their property freely while alive.

The general power of attorney is another document that relates to the management of property. It grants someone the authority to act on behalf of another person in legal or financial matters. While a Lady Bird Deed allows for property transfer upon death, a general power of attorney is useful for managing property during the owner's lifetime. However, it does not provide the same automatic transfer benefits that the Lady Bird Deed does.

The durable power of attorney is similar to the general power of attorney but remains effective even if the principal becomes incapacitated. It allows someone to manage the property and financial affairs of another person. While both powers of attorney focus on management, the Lady Bird Deed specifically addresses property transfer upon death, making it distinct in its purpose.

Lastly, the will is a document that outlines how a person's assets will be distributed after their death. While both a will and a Lady Bird Deed can dictate property transfer, the Lady Bird Deed takes effect immediately upon the owner's death without the need for probate. This can simplify the process for heirs and ensure a smoother transition of property ownership.

Dos and Don'ts

When filling out the Lady Bird Deed form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do: Clearly identify the property being transferred.

- Do: Include the full names of all parties involved.

- Do: Specify the intended beneficiaries accurately.

- Do: Sign the form in the presence of a notary public.

- Do: Keep a copy of the completed form for your records.

- Don’t: Forget to check for any state-specific requirements.

- Don’t: Use vague language that could lead to confusion.

- Don’t: Leave any sections of the form blank.

- Don’t: Attempt to fill out the form without understanding its implications.

- Don’t: Neglect to inform all parties about the deed once it’s completed.

Key takeaways

Filling out and using a Lady Bird Deed form can be a straightforward process, but it is important to understand its implications. Here are seven key takeaways to keep in mind:

- Transfer of Property: A Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining the right to use and control the property during their lifetime.

- Avoids Probate: One of the main benefits of a Lady Bird Deed is that it helps avoid the probate process, allowing for a smoother transition of property upon death.

- Retain Control: The original owner maintains full control over the property, including the ability to sell, mortgage, or change the beneficiaries at any time.

- Tax Implications: The property retains its tax basis, which can benefit heirs by minimizing capital gains taxes when they sell the property.

- State-Specific Rules: The use of Lady Bird Deeds is not recognized in all states. It is essential to check local laws to ensure compliance.

- Clear Language: When filling out the form, use clear and precise language to avoid any confusion regarding the intent and details of the transfer.

- Consult a Professional: It is advisable to consult with a legal professional to ensure that the deed is properly executed and meets all legal requirements.

Understanding these key points can help ensure that the Lady Bird Deed is used effectively and in accordance with your wishes.

How to Use Lady Bird Deed

Filling out a Lady Bird Deed form is an important step in ensuring that your property is transferred according to your wishes. Once completed, the form will need to be signed and notarized before it can be recorded with the appropriate county office. The following steps will guide you through the process of filling out the form accurately.

- Begin by entering the date at the top of the form.

- Provide the full names of the current property owners as they appear on the title.

- Clearly state the property address, including the city, state, and zip code.

- Identify the beneficiaries by listing their full names. These are the individuals who will inherit the property.

- Include a legal description of the property. This can often be found on the current deed or property tax documents.

- Specify any conditions or limitations regarding the transfer of the property.

- Sign the form where indicated, ensuring that all current owners are present to sign.

- Have the document notarized. This step is crucial for validating the deed.

- Make copies of the completed and notarized form for your records.

- Finally, file the original deed with the county clerk's office where the property is located.