Printable Last Will and Testament Form

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. This legal document allows you to specify how your assets should be distributed, who will take care of any minor children, and even designate an executor to manage your estate. By outlining your preferences clearly, you can help prevent potential disputes among family members and provide peace of mind to your loved ones. A well-drafted will typically includes details about your assets, such as property, bank accounts, and personal belongings, along with instructions for their distribution. Additionally, it may address any specific bequests you wish to make, such as gifts to charities or particular items to friends or family. The form also requires signatures and witnesses to validate its authenticity, ensuring that it meets the legal requirements of your state. Understanding these components is crucial for anyone looking to create a will that accurately reflects their intentions and protects their legacy.

State-specific Tips for Last Will and Testament Templates

Common mistakes

-

Not being specific about assets: People often overlook the importance of clearly identifying their assets. Vague descriptions can lead to confusion or disputes among heirs.

-

Failing to update the will: Life changes, such as marriage, divorce, or the birth of children, necessitate updates to the will. Neglecting to revise it can result in unintended distributions.

-

Not appointing an executor: An executor is crucial for carrying out the terms of the will. Failing to name one can complicate the probate process and lead to delays.

-

Overlooking witnesses: Many states require witnesses to validate the will. Not having the necessary signatures can render the document invalid.

-

Ignoring state laws: Each state has its own rules regarding wills. Not adhering to these regulations can lead to legal challenges or invalidation of the will.

-

Using outdated forms: Laws change, and so do the requirements for wills. Utilizing an old form may lead to missing critical elements needed for a valid will.

-

Not considering tax implications: People often fail to think about how their estate may be taxed. This oversight can affect the amount heirs ultimately receive.

-

Neglecting to discuss the will with family: Open communication can prevent misunderstandings and disputes. Failing to discuss intentions may lead to conflict after one's passing.

-

Assuming a handwritten will is valid: While some states recognize handwritten wills, others do not. It’s essential to understand the legal requirements for such documents.

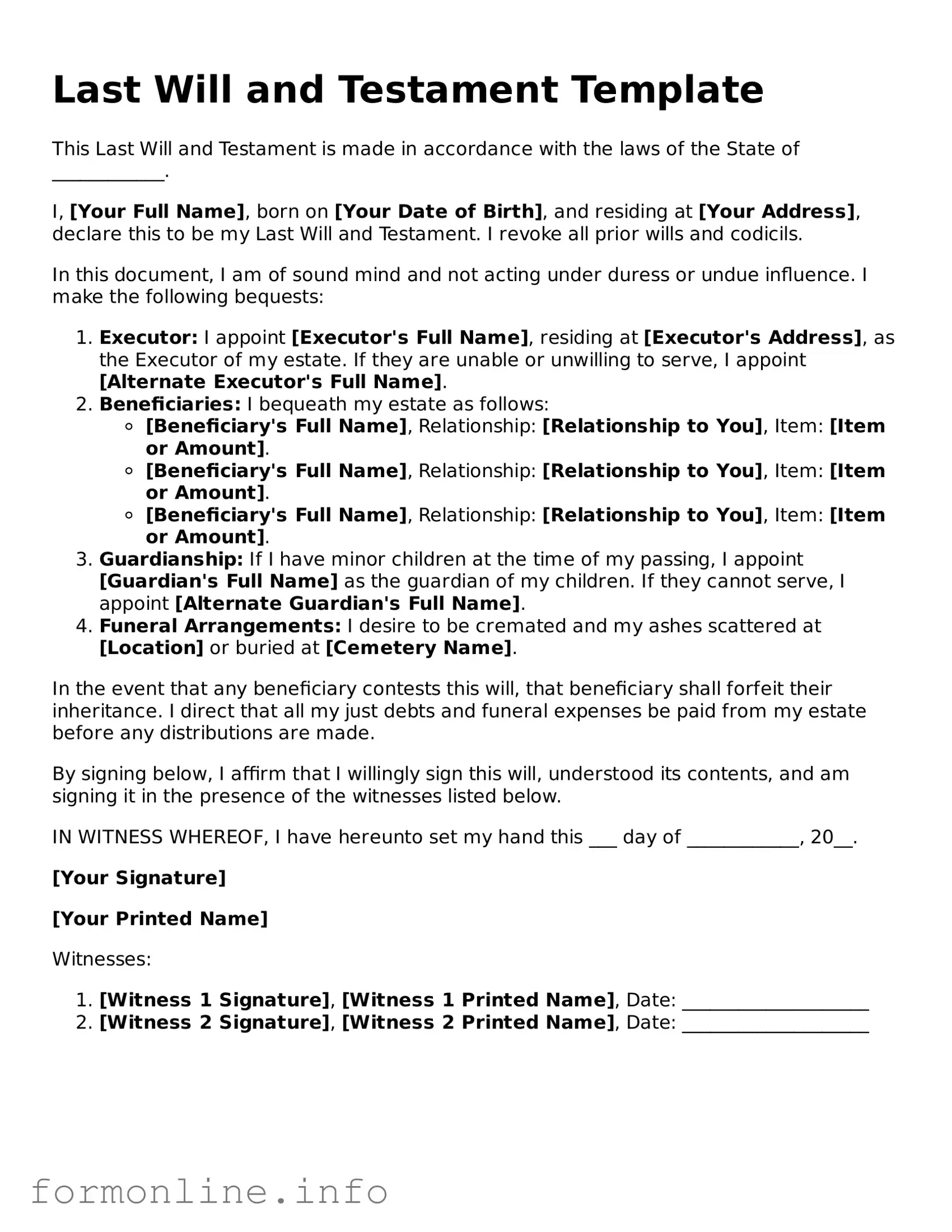

Preview - Last Will and Testament Form

Last Will and Testament Template

This Last Will and Testament is made in accordance with the laws of the State of ____________.

I, [Your Full Name], born on [Your Date of Birth], and residing at [Your Address], declare this to be my Last Will and Testament. I revoke all prior wills and codicils.

In this document, I am of sound mind and not acting under duress or undue influence. I make the following bequests:

- Executor: I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of my estate. If they are unable or unwilling to serve, I appoint [Alternate Executor's Full Name].

-

Beneficiaries: I bequeath my estate as follows:

- [Beneficiary's Full Name], Relationship: [Relationship to You], Item: [Item or Amount].

- [Beneficiary's Full Name], Relationship: [Relationship to You], Item: [Item or Amount].

- [Beneficiary's Full Name], Relationship: [Relationship to You], Item: [Item or Amount].

- Guardianship: If I have minor children at the time of my passing, I appoint [Guardian's Full Name] as the guardian of my children. If they cannot serve, I appoint [Alternate Guardian's Full Name].

- Funeral Arrangements: I desire to be cremated and my ashes scattered at [Location] or buried at [Cemetery Name].

In the event that any beneficiary contests this will, that beneficiary shall forfeit their inheritance. I direct that all my just debts and funeral expenses be paid from my estate before any distributions are made.

By signing below, I affirm that I willingly sign this will, understood its contents, and am signing it in the presence of the witnesses listed below.

IN WITNESS WHEREOF, I have hereunto set my hand this ___ day of ____________, 20__.

[Your Signature]

[Your Printed Name]

Witnesses:

- [Witness 1 Signature], [Witness 1 Printed Name], Date: ____________________

- [Witness 2 Signature], [Witness 2 Printed Name], Date: ____________________

Common Forms:

Test Drive Agreement - It emphasizes the need for drivers to have valid insurance while operating the dealership’s vehicle.

The Employment Verification Form is a document used to confirm an individual's employment history and status with a particular employer. This form often serves as an essential tool for prospective employers, landlords, and financial institutions to assess a person's qualifications and reliability. For those interested, additional resources, such as Top Forms Online, can provide valuable insights into understanding this form's importance and assist both employees and employers in navigating the employment verification process effectively.

Section 8 Gold Street - Respond promptly to any follow-up communication from the Housing Authority regarding your request.

Last Will and Testament Form Subtypes

Documents used along the form

When preparing a Last Will and Testament, it's essential to consider other documents that can complement or enhance your estate planning. Each of these forms serves a unique purpose, helping to ensure that your wishes are respected and that your loved ones are taken care of after your passing. Below is a list of common forms and documents that often accompany a Last Will and Testament.

- Living Trust: A legal arrangement that allows you to place your assets into a trust during your lifetime. It can help avoid probate and provide for the management of your assets if you become incapacitated.

- Durable Power of Attorney: This document grants someone the authority to make financial and legal decisions on your behalf if you are unable to do so. It is effective immediately or upon your incapacitation, depending on how it is structured.

- Employment Verification Form: For effective confirmation of an employee's work history, consult the important Employment Verification process and guidelines for employers and job seekers.

- Healthcare Proxy: Also known as a medical power of attorney, this document designates an individual to make healthcare decisions for you if you are unable to communicate your wishes due to illness or injury.

- Living Will: This legal document outlines your preferences regarding medical treatment and end-of-life care. It provides guidance to your healthcare providers and loved ones about your wishes in critical situations.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. These designations can override your will, so it’s crucial to keep them updated.

- Letter of Intent: While not a legal document, this letter can accompany your will. It provides guidance to your executor and loved ones about your wishes, including funeral arrangements and personal messages.

- Pet Trust: If you have pets, a pet trust ensures that they are cared for according to your wishes after your death. It specifies the care and financial resources necessary for their well-being.

Understanding these additional documents can greatly enhance your estate planning strategy. By considering them alongside your Last Will and Testament, you can create a comprehensive plan that protects your assets and provides peace of mind for both you and your loved ones.

Similar forms

A Living Will is a document that outlines a person's wishes regarding medical treatment in case they become unable to communicate their preferences. Like a Last Will and Testament, it reflects individual choices and intentions. However, while a Last Will takes effect after death, a Living Will is activated during a person’s lifetime, specifically when they face a medical crisis. Both documents serve to ensure that a person’s wishes are respected, but they address different aspects of life and death decisions.

A Power of Attorney (POA) is another important legal document that shares similarities with a Last Will and Testament. A POA allows an individual to designate someone to make decisions on their behalf, particularly in financial or medical matters. While a Last Will comes into play after death, a POA is effective during a person’s life, providing guidance on how to manage affairs if one becomes incapacitated. Both documents empower individuals to control their future, ensuring their preferences are honored.

A Trust is a legal arrangement that holds assets for the benefit of a designated beneficiary. Similar to a Last Will, a Trust outlines how a person’s assets should be distributed after their death. However, a Trust can also be used during a person’s lifetime to manage assets and provide for beneficiaries without going through the probate process. This can offer privacy and efficiency in asset distribution, making Trusts a popular alternative or complement to Wills.

In addition to financial and legal documents, it's also important to understand employment-related forms like the Adp Pay Stub form, which details an employee's earnings and deductions for a specific pay period. This form plays a crucial role in maintaining transparency in payroll and helps employees verify their compensation while tracking financial information effectively.

A Codicil is a legal document that serves as an amendment to an existing Last Will and Testament. It allows individuals to make changes to their Will without having to rewrite the entire document. Like a Last Will, a Codicil must meet specific legal requirements to be valid. This document is particularly useful for those who want to update their wishes, whether due to changes in relationships, financial status, or personal preferences, ensuring that their estate plan remains current.

An Advance Healthcare Directive combines a Living Will and a Power of Attorney for healthcare decisions. This document allows individuals to specify their medical treatment preferences and appoint someone to make healthcare decisions on their behalf if they are unable to do so. Similar to a Last Will, it reflects personal wishes and provides guidance to loved ones and medical professionals, ensuring that one's healthcare choices are honored even when they cannot communicate them.

A Declaration of Guardian is a document that allows an individual to designate a guardian for their minor children in the event of their death or incapacitation. This is similar to a Last Will in that it outlines specific wishes regarding the care and upbringing of children. Both documents are essential for ensuring that a person’s preferences are known and respected, providing peace of mind regarding the future of loved ones.

Lastly, a Beneficiary Designation form is often used for financial accounts, insurance policies, and retirement plans. This document allows individuals to specify who will receive their assets upon their death. Like a Last Will, it directs the distribution of assets, but it typically bypasses the probate process. This makes it a straightforward way to ensure that loved ones receive what they are entitled to without the delays that can accompany a Will, highlighting the importance of keeping such designations up to date.

Dos and Don'ts

When filling out a Last Will and Testament form, it's essential to approach the task with care. Here are ten important dos and don'ts to consider:

- Do clearly state your intentions regarding your assets.

- Do choose an executor you trust to carry out your wishes.

- Do sign the document in front of witnesses, if required by your state.

- Do keep your will in a safe place and inform your executor of its location.

- Do review and update your will regularly, especially after major life changes.

- Don't use vague language that could lead to confusion.

- Don't forget to date the document.

- Don't rely on oral agreements; put everything in writing.

- Don't leave out important details about specific bequests.

- Don't assume that a will made in another state is valid in your state without checking local laws.

Key takeaways

Creating a Last Will and Testament is an important step in planning for the future. Here are some key takeaways to keep in mind when filling out and using this form:

- Clarity is essential. Be specific about your wishes regarding the distribution of your assets. Vague language can lead to confusion and disputes among your beneficiaries.

- Choose your executor wisely. This person will be responsible for ensuring that your wishes are carried out. Select someone you trust and who is capable of handling the responsibilities involved.

- Regular updates are necessary. Life circumstances change, such as marriage, divorce, or the birth of children. Review and update your will periodically to reflect your current situation.

- Consider legal requirements. Each state has its own laws regarding wills. Ensure that your will meets these requirements to be considered valid and enforceable.

How to Use Last Will and Testament

After gathering all necessary information, you are ready to fill out the Last Will and Testament form. This document will guide your wishes regarding the distribution of your assets and other important matters after your passing. Following these steps will help ensure that your will is completed accurately and effectively.

- Title the Document: Begin by writing "Last Will and Testament" at the top of the page.

- Identify Yourself: Clearly state your full name and address. Include a statement declaring that you are of sound mind and over the age of 18.

- Revocation of Previous Wills: If you have made any previous wills, include a statement revoking them to avoid confusion.

- Appoint an Executor: Choose a trusted person to manage your estate. Clearly state their name and relationship to you.

- List Your Beneficiaries: Identify the individuals or organizations that will inherit your assets. Be specific about what each person will receive.

- Detail Your Assets: Provide a comprehensive list of your assets, such as property, bank accounts, and personal belongings.

- Include Guardianship Provisions: If you have minor children, designate a guardian for them in case of your passing.

- Sign and Date the Document: Sign your will at the bottom and include the date. This is a crucial step for the validity of the document.

- Witness Requirements: Depending on your state, you may need to have your will witnessed by two individuals who are not beneficiaries. Ensure they sign and date the document as well.

Once the form is completed, keep it in a safe place and inform your executor and family members where it can be found. Regularly review and update your will as needed to reflect any changes in your circumstances or wishes.