Printable Letter of Intent to Lease Commercial Property Form

When considering a new commercial space for your business, a Letter of Intent to Lease Commercial Property can serve as an essential first step in the leasing process. This document outlines the preliminary terms and conditions that both the landlord and tenant are willing to agree upon before entering into a formal lease agreement. It typically includes important details such as the proposed rental rate, lease duration, and any specific conditions that may affect the tenancy, like tenant improvements or maintenance responsibilities. Additionally, it may cover aspects like security deposits, options for renewal, and contingencies related to zoning or financing. By clearly stating these intentions, both parties can establish a mutual understanding and avoid misunderstandings down the line. While this letter is generally non-binding, it sets the stage for negotiations and can help streamline the process of finalizing the lease, making it a valuable tool for anyone looking to secure a commercial property.

Common mistakes

-

Not Clearly Defining the Terms: One common mistake is failing to specify the key terms of the lease, such as the rental amount, lease duration, and renewal options. Without clarity, misunderstandings can arise later.

-

Ignoring Additional Costs: Many people overlook the inclusion of additional costs, like maintenance fees or property taxes. These expenses can significantly impact the overall cost of leasing a property.

-

Neglecting to Address Contingencies: Some individuals forget to include contingencies that might affect the lease, such as zoning approvals or financing conditions. Addressing these upfront can prevent complications down the road.

-

Not Consulting with Professionals: Skipping the advice of real estate professionals or legal experts can be a costly mistake. Their insights can help navigate complex terms and ensure the lease aligns with your business needs.

-

Overlooking the Importance of Signatures: Finally, failing to obtain the necessary signatures can render the Letter of Intent invalid. Ensuring all parties sign is crucial for the document to hold any legal weight.

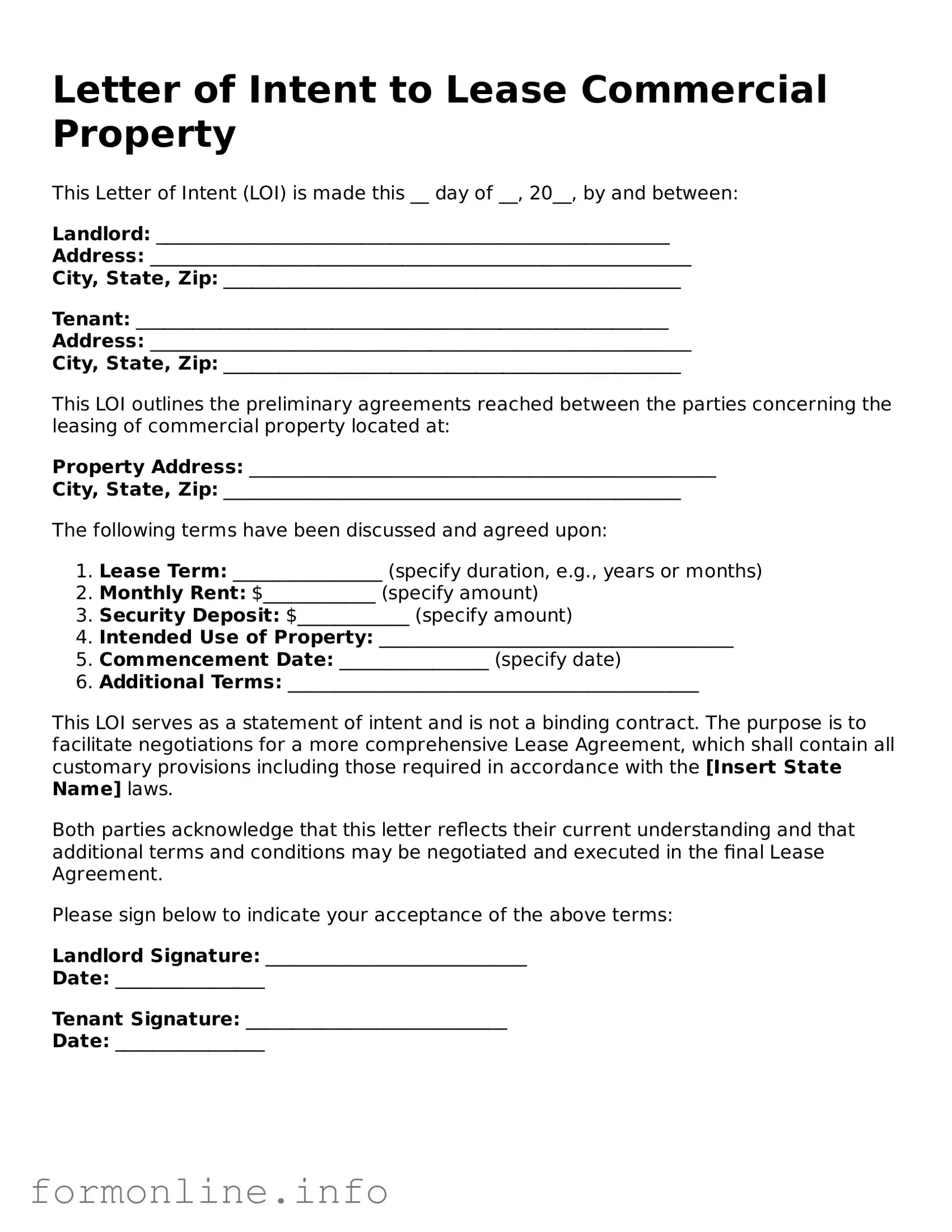

Preview - Letter of Intent to Lease Commercial Property Form

Letter of Intent to Lease Commercial Property

This Letter of Intent (LOI) is made this __ day of __, 20__, by and between:

Landlord: _______________________________________________________

Address: __________________________________________________________

City, State, Zip: _________________________________________________

Tenant: _________________________________________________________

Address: __________________________________________________________

City, State, Zip: _________________________________________________

This LOI outlines the preliminary agreements reached between the parties concerning the leasing of commercial property located at:

Property Address: __________________________________________________

City, State, Zip: _________________________________________________

The following terms have been discussed and agreed upon:

- Lease Term: ________________ (specify duration, e.g., years or months)

- Monthly Rent: $____________ (specify amount)

- Security Deposit: $____________ (specify amount)

- Intended Use of Property: ______________________________________

- Commencement Date: ________________ (specify date)

- Additional Terms: ____________________________________________

This LOI serves as a statement of intent and is not a binding contract. The purpose is to facilitate negotiations for a more comprehensive Lease Agreement, which shall contain all customary provisions including those required in accordance with the [Insert State Name] laws.

Both parties acknowledge that this letter reflects their current understanding and that additional terms and conditions may be negotiated and executed in the final Lease Agreement.

Please sign below to indicate your acceptance of the above terms:

Landlord Signature: ____________________________

Date: ________________

Tenant Signature: ____________________________

Date: ________________

More Types of Letter of Intent to Lease Commercial Property Templates:

Sample of Letter of Intent for Job - A transparent way to communicate potential employment plans.

For those looking to navigate business agreements, understanding the nuances of the invaluable Letter of Intent document can greatly simplify negotiations and clarify intentions before a formal agreement is reached.

Documents used along the form

A Letter of Intent to Lease Commercial Property is often accompanied by several other important documents. Each of these documents plays a crucial role in the leasing process, ensuring that both parties understand their rights and responsibilities. Below is a list of commonly used forms and documents that complement the Letter of Intent.

- Lease Agreement: This is the formal contract that outlines the terms and conditions of the lease, including rent, duration, and responsibilities of both the landlord and tenant.

- Homeschool Letter of Intent: This formal document notifies the state of a parent's decision to homeschool their children, serving as a vital step in complying with California's educational regulations. For additional information, you can visit hsintentletter.com/.

- Property Disclosure Statement: This document provides information about the condition of the property, including any known issues or defects that may affect its use or value.

- Personal Guaranty: If the tenant is a business entity, this form may be required to ensure that an individual guarantees the lease obligations personally.

- Financial Statements: These documents demonstrate the financial health of the tenant, often required by landlords to assess the tenant's ability to pay rent.

- Tenant Application: This form collects essential information about the tenant, including business history and references, helping the landlord make an informed decision.

- Security Deposit Agreement: This outlines the terms regarding the security deposit, including the amount, conditions for its return, and any deductions that may apply.

- Insurance Certificates: These documents provide proof of insurance coverage, ensuring that both parties are protected against potential liabilities during the lease term.

Understanding these documents is essential for both landlords and tenants. Each plays a vital role in establishing a clear and mutually beneficial leasing arrangement. Properly preparing and reviewing these forms can help prevent disputes and ensure a smooth leasing process.

Similar forms

The Letter of Intent (LOI) to Lease Commercial Property is similar to a Memorandum of Understanding (MOU). Both documents serve as preliminary agreements that outline the intentions of the parties involved. An MOU is often used in various contexts, not just real estate, to clarify the terms of a potential agreement. Like an LOI, it lays the groundwork for future negotiations and can help ensure that all parties are on the same page before moving forward. However, an MOU may not be as detailed as an LOI, often leaving more room for interpretation.

The Alabama Homeschool Letter of Intent is a formal document that parents must submit to notify their local school system of their decision to homeschool their children. This letter serves as an official declaration of intent and helps to ensure compliance with state regulations. Understanding how to properly complete and submit this form is essential for a smooth homeschooling experience in Alabama, and you can find the form here.

Another document that shares similarities with the LOI is a Purchase Agreement. While the LOI is focused on leasing, a Purchase Agreement outlines the terms for buying property. Both documents specify key terms such as price, duration, and responsibilities of each party. They serve as a roadmap for the transaction, ensuring that everyone understands their commitments. However, a Purchase Agreement is legally binding, whereas an LOI is typically non-binding, allowing for more flexibility during negotiations.

A Term Sheet also resembles the Letter of Intent. Term Sheets are often used in various business transactions, including leases. They summarize the key points of a deal, such as rent, lease duration, and any special conditions. Both documents aim to facilitate discussions and provide a framework for the final agreement. However, a Term Sheet may cover more financial details and conditions than an LOI, which is often broader in scope.

The Lease Agreement itself is another document closely related to the LOI. After negotiations based on the LOI, a Lease Agreement is drafted to formalize the terms of the lease. While the LOI outlines intentions and preliminary terms, the Lease Agreement provides detailed obligations and rights of both parties. It is a legally binding document that finalizes the agreement and includes specifics that the LOI may only touch upon.

A Letter of Intent to Purchase is also akin to the LOI to Lease Commercial Property. This document expresses a buyer’s interest in acquiring a property and outlines the basic terms of the sale. Both letters serve as initial steps in the transaction process, helping to clarify intentions and expectations. The primary difference lies in the nature of the transaction—one focuses on leasing while the other is about purchasing.

Lastly, a Non-Disclosure Agreement (NDA) can be compared to the LOI. While an NDA primarily protects confidential information during negotiations, it often accompanies an LOI to ensure that sensitive information shared during the leasing discussions remains private. Both documents help create a secure environment for negotiations, allowing parties to feel more comfortable sharing important details without fear of misuse.

Dos and Don'ts

When filling out the Letter of Intent to Lease Commercial Property form, careful attention to detail can make a significant difference in the leasing process. Here are ten essential tips to guide you through this important task.

- Do: Clearly state your intentions. Outline the purpose of the lease and what you hope to achieve.

- Do: Provide accurate contact information. Ensure that all parties can be reached easily for follow-up discussions.

- Do: Specify the desired lease term. Include the start date and duration to avoid confusion later.

- Do: Include any contingencies. Mention any conditions that must be met before the lease can be finalized.

- Do: Be concise and clear. Use straightforward language to convey your points effectively.

- Don't: Leave out important details. Omitting key information can lead to misunderstandings.

- Don't: Use vague language. Ambiguities can create complications in negotiations.

- Don't: Rush the process. Take your time to review and ensure accuracy in your submission.

- Don't: Ignore the importance of signatures. Ensure that all necessary parties sign the document to validate it.

- Don't: Forget to follow up. After submission, check in with the other party to confirm receipt and discuss next steps.

Key takeaways

When it comes to leasing commercial property, a Letter of Intent (LOI) serves as an important first step. Here are some key takeaways to keep in mind while filling out and using this form:

- Clarity is Crucial: Clearly outline the terms you wish to negotiate, including rent, lease duration, and any special conditions. This will help both parties understand expectations from the outset.

- Be Comprehensive: Include all relevant details in the LOI. This might encompass the property address, square footage, and any specific needs you have for the space.

- Non-Binding Nature: Remember that an LOI is typically non-binding. While it expresses your intent, it does not create a legally enforceable agreement. This allows for flexibility during negotiations.

- Professional Tone: Maintain a professional and respectful tone throughout the document. This sets a positive tone for future negotiations and interactions with the landlord.

- Seek Legal Guidance: Before finalizing your LOI, consider consulting with a lawyer. They can help ensure that your interests are protected and that the document accurately reflects your intentions.

How to Use Letter of Intent to Lease Commercial Property

Once you have the Letter of Intent to Lease Commercial Property form in hand, it's time to fill it out carefully. This form is essential for outlining the key terms of the lease agreement you intend to propose. After completing the form, you will be ready to present your offer to the property owner or their representative.

- Start by entering the date at the top of the form.

- Fill in your name and contact information in the designated section.

- Provide the name and contact information of the property owner or their representative.

- Clearly state the address of the commercial property you wish to lease.

- Indicate the proposed lease term, including start and end dates.

- Specify the rental amount you are proposing, along with any other financial terms.

- Outline any additional terms you wish to include, such as maintenance responsibilities or options to renew.

- Sign and date the form at the bottom.

After completing these steps, review the form for accuracy. Ensure all information is correct before submitting it to the property owner. This will help facilitate a smooth negotiation process.