Printable Letter of Intent to Purchase Business Form

When considering the purchase of a business, a Letter of Intent (LOI) to Purchase Business serves as a crucial first step in the negotiation process. This document outlines the preliminary agreement between the buyer and seller, signaling a mutual interest in moving forward. It typically includes essential elements such as the purchase price, payment terms, and key conditions that must be met before the deal can be finalized. Additionally, the LOI may address timelines for due diligence and closing, as well as any confidentiality agreements to protect sensitive information. While not legally binding, it sets the tone for the transaction and helps both parties clarify their intentions. Understanding the components of this form can streamline negotiations and pave the way for a successful business acquisition.

Common mistakes

-

Not Clearly Defining the Terms: One common mistake is failing to clearly outline the terms of the purchase. This includes the purchase price, payment structure, and any contingencies. Ambiguity can lead to misunderstandings later on.

-

Omitting Important Details: Some individuals forget to include essential details such as the business name, address, and the names of the parties involved. These details are crucial for identifying the transaction.

-

Ignoring Confidentiality Provisions: A lack of confidentiality clauses can expose sensitive business information. It’s important to protect proprietary information during negotiations.

-

Failing to Specify Due Diligence Requirements: Not stating what due diligence will be conducted can lead to surprises. Buyers should outline what information they need to review before finalizing the purchase.

-

Not Addressing Financing Arrangements: Some buyers neglect to mention how they plan to finance the purchase. This can create uncertainty and complicate negotiations.

-

Skipping Legal Review: Failing to have a lawyer review the letter can result in legal pitfalls. Legal expertise can help identify issues that may not be apparent to the buyer or seller.

-

Being Vague About Timelines: Not specifying timelines for the transaction can lead to delays. Clear deadlines help keep the process on track.

-

Neglecting to Include Contingencies: Some buyers overlook the importance of including contingencies, such as financing approval or regulatory approvals. These can protect the buyer if conditions aren’t met.

-

Using Inconsistent Language: Inconsistencies in language can create confusion. It’s important to use clear and consistent terminology throughout the document.

-

Not Considering Future Liabilities: Buyers may forget to address potential future liabilities, such as pending lawsuits or debts. A thorough review can help identify these risks before the purchase is made.

Preview - Letter of Intent to Purchase Business Form

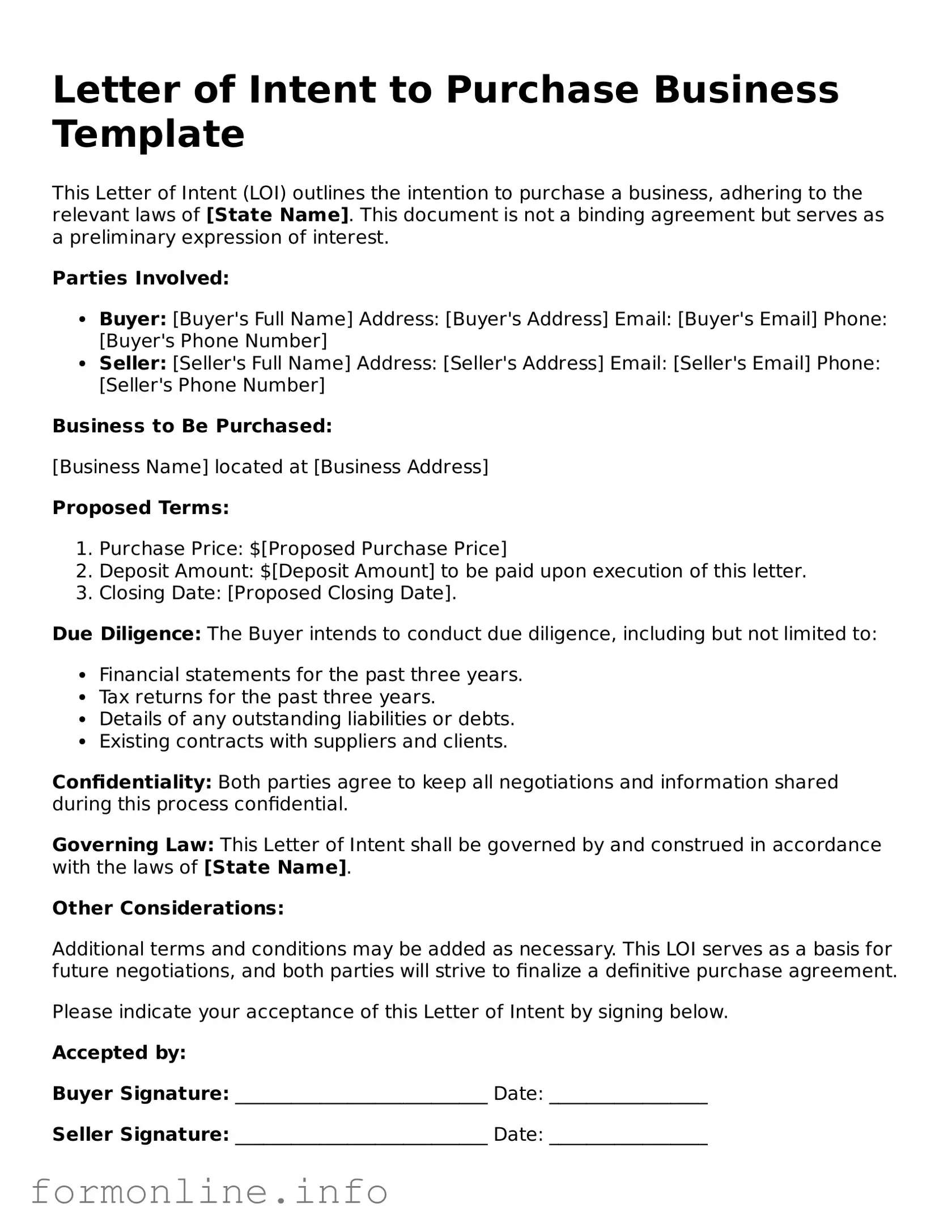

Letter of Intent to Purchase Business Template

This Letter of Intent (LOI) outlines the intention to purchase a business, adhering to the relevant laws of [State Name]. This document is not a binding agreement but serves as a preliminary expression of interest.

Parties Involved:

- Buyer: [Buyer's Full Name] Address: [Buyer's Address] Email: [Buyer's Email] Phone: [Buyer's Phone Number]

- Seller: [Seller's Full Name] Address: [Seller's Address] Email: [Seller's Email] Phone: [Seller's Phone Number]

Business to Be Purchased:

[Business Name] located at [Business Address]

Proposed Terms:

- Purchase Price: $[Proposed Purchase Price]

- Deposit Amount: $[Deposit Amount] to be paid upon execution of this letter.

- Closing Date: [Proposed Closing Date].

Due Diligence: The Buyer intends to conduct due diligence, including but not limited to:

- Financial statements for the past three years.

- Tax returns for the past three years.

- Details of any outstanding liabilities or debts.

- Existing contracts with suppliers and clients.

Confidentiality: Both parties agree to keep all negotiations and information shared during this process confidential.

Governing Law: This Letter of Intent shall be governed by and construed in accordance with the laws of [State Name].

Other Considerations:

Additional terms and conditions may be added as necessary. This LOI serves as a basis for future negotiations, and both parties will strive to finalize a definitive purchase agreement.

Please indicate your acceptance of this Letter of Intent by signing below.

Accepted by:

Buyer Signature: ___________________________ Date: _________________

Seller Signature: ___________________________ Date: _________________

More Types of Letter of Intent to Purchase Business Templates:

Sue Letter of Intent to Take Legal Action Template - The letter may also detail the potential damages or compensation you seek.

Additionally, utilizing resources such as the PDF Templates can further assist in creating a comprehensive Investment Letter of Intent form, ensuring that all critical aspects are covered and enhancing the overall investment process.

Sample of Letter of Intent for Job - Describes the preliminary terms and conditions of potential employment.

Documents used along the form

When individuals or entities express interest in purchasing a business, they often use a Letter of Intent (LOI) as a preliminary agreement. However, several other documents accompany the LOI to ensure clarity and protect the interests of both parties. Here are some key forms and documents commonly used alongside the LOI.

- Confidentiality Agreement: This document ensures that sensitive information shared during negotiations remains private. Both parties agree not to disclose proprietary information to outsiders.

- Purchase Agreement: Once the terms are finalized, this comprehensive contract outlines the specifics of the sale, including price, payment terms, and any conditions that must be met before the sale is completed.

- Due Diligence Checklist: This list helps the buyer evaluate the business thoroughly. It includes items like financial statements, legal documents, and operational details that the buyer needs to review before finalizing the purchase.

- Asset Purchase Agreement: If the buyer is purchasing specific assets rather than the entire business, this document details which assets are included in the sale, such as equipment, inventory, and intellectual property.

- California Homeschool Letter of Intent: For those considering homeschooling, this document is essential as it formally notifies the local school district of the decision to withdraw a child from public education and can be accessed at https://smarttemplates.net/fillable-california-homeschool-letter-of-intent.

- Non-Compete Agreement: This agreement prevents the seller from starting a competing business for a certain period after the sale. It protects the buyer’s investment by ensuring that the seller does not immediately compete with the business.

- Letter of Intent to Lease: If the business operates from a rented location, this letter outlines the terms under which the buyer intends to lease the premises after the purchase.

- Financing Agreement: If the buyer is seeking financing to complete the purchase, this document details the terms of the loan or investment, including repayment schedules and interest rates.

- Transition Plan: This document outlines how the transition of ownership will occur. It includes details about training for the new owner and how to maintain operations smoothly during the changeover.

Each of these documents plays a vital role in the process of buying a business. Together, they help ensure that both the buyer and seller are clear about their rights and responsibilities, facilitating a smoother transaction.

Similar forms

The Letter of Intent (LOI) is often compared to a Memorandum of Understanding (MOU). Both documents serve as preliminary agreements that outline the intentions of the parties involved. An MOU typically details the framework of the agreement and can be less formal than an LOI. While an LOI may focus on the specifics of a business transaction, an MOU might cover broader aspects of collaboration or partnership, making it a flexible tool for various negotiations.

A Term Sheet is another document similar to the LOI. It provides a summary of the key terms and conditions of a potential deal. A Term Sheet is commonly used in investment or financing scenarios. Like an LOI, it serves as a starting point for drafting a more detailed agreement. However, it tends to be less formal and may not require the same level of commitment as an LOI.

The Purchase Agreement is a more formal document that follows the LOI. Once the parties agree on the terms outlined in the LOI, they typically draft a Purchase Agreement to finalize the transaction. This document includes detailed provisions regarding the sale, such as price, payment terms, and warranties. While the LOI indicates intent, the Purchase Agreement solidifies the commitment.

For those considering homeschooling in Arizona, obtaining the necessary forms is crucial, and understanding resources available can make the process smoother; one helpful tool is the Arizona Homeschool Letter of Intent, which can be accessed at legalpdfdocs.com.

An Asset Purchase Agreement (APA) is specifically focused on the purchase of a business's assets rather than its stock or equity. Similar to a Purchase Agreement, it outlines the terms of the transaction but is tailored for situations where only certain assets are being acquired. This document is essential when the buyer wants to avoid taking on liabilities associated with the seller's business.

A Non-Disclosure Agreement (NDA) often accompanies the LOI in business transactions. This document protects confidential information shared during negotiations. While the LOI outlines the intent to negotiate, the NDA ensures that sensitive information remains private. Both documents work together to facilitate open discussions without the risk of information leaks.

A Confidentiality Agreement is similar to an NDA but may have slightly different terms or applications. It serves to protect proprietary information during negotiations. Like the NDA, a Confidentiality Agreement helps create a safe environment for both parties to share information. This is particularly important in business deals where trade secrets or sensitive data are involved.

Finally, a Letter of Intent to Lease is akin to the LOI but pertains specifically to leasing agreements. This document outlines the basic terms and conditions for leasing a property. It reflects the parties' intentions to enter into a lease agreement, similar to how an LOI signals the intent to purchase a business. Both documents serve as a foundation for more detailed contracts that follow.

Dos and Don'ts

When filling out the Letter of Intent to Purchase Business form, it's essential to approach the task with care and attention. Here are five things you should and shouldn't do:

- Do: Clearly state your intentions. Make sure your goals and objectives are expressed in a straightforward manner.

- Do: Include all necessary details. Provide complete information about the business you wish to purchase, including its name and address.

- Do: Be honest and transparent. Disclose any relevant information that may affect the transaction.

- Don't: Rush through the process. Take your time to ensure all information is accurate and complete.

- Don't: Use vague language. Avoid ambiguous terms that could lead to misunderstandings later on.

Key takeaways

Filling out a Letter of Intent (LOI) to Purchase a Business is an important step in the acquisition process. Here are some key takeaways to keep in mind:

- Clarity is Key: Clearly outline your intentions and the terms of the purchase. This will help prevent misunderstandings later.

- Include Essential Details: Make sure to include the names of the parties involved, the business being purchased, and any relevant deadlines.

- Express Your Intent: Use direct language to convey your desire to purchase the business, which sets a positive tone for negotiations.

- Confidentiality Matters: If sensitive information will be shared, consider including a confidentiality clause to protect both parties.

- Non-Binding Nature: Remember that an LOI is typically non-binding, meaning it outlines intentions but does not create a legal obligation to complete the sale.

- Consider Contingencies: Address any conditions that must be met before the sale can proceed, such as financing or due diligence.

- Review and Revise: Take the time to review the LOI carefully. It’s advisable to revise it as necessary to ensure it reflects your goals accurately.

- Seek Professional Advice: Consult with legal and financial advisors to ensure that your LOI is comprehensive and aligns with your objectives.

By keeping these points in mind, you can create a strong foundation for your business purchase negotiations.

How to Use Letter of Intent to Purchase Business

Once you have the Letter of Intent to Purchase Business form, you will need to fill it out carefully. This form is essential for outlining your intentions regarding the purchase of a business. Follow the steps below to ensure you complete it correctly.

- Start by entering the date at the top of the form.

- Provide your name and contact information in the designated fields.

- Fill in the name and address of the business you intend to purchase.

- Clearly state the proposed purchase price for the business.

- Outline any conditions that must be met before the purchase can proceed, such as financing or inspections.

- Include a timeline for the completion of the purchase.

- Sign and date the form at the bottom.

After completing the form, review it for accuracy and clarity. Once satisfied, you can present it to the seller for consideration. This step is crucial in moving forward with the purchase process.