Fill Out a Valid Letter To Purchase Land Form

The Letter to Purchase Land form serves as an essential tool for individuals or entities looking to initiate the process of acquiring real property. This document outlines the preliminary agreement between a buyer and a seller, setting the stage for a more detailed purchase agreement to follow. Within the form, key elements are presented, including the identities of the buyer and seller, a description of the property in question, and the proposed purchase price. It also specifies the timeline for negotiations, including the duration of the contract negotiation period, during which both parties aim to finalize the terms of sale. Additionally, the form addresses important aspects such as deposit requirements, feasibility periods for due diligence, and conditions that must be met before closing the escrow. By clearly defining the expectations and responsibilities of both parties, this letter not only facilitates communication but also helps to ensure that all necessary steps are taken before a formal agreement is executed. The Letter to Purchase Land is not just a formality; it is a crucial step that can help prevent misunderstandings and lay the groundwork for a successful real estate transaction.

Common mistakes

-

Incomplete Property Description: Failing to provide a complete and accurate description of the property can lead to confusion. It's essential to include the full address and any relevant identification numbers, such as the Assessor's Parcel Number (APN). Without this information, the intent to purchase may not be clear.

-

Missing Contact Information: Omitting contact details for both the buyer and seller is a common mistake. This information is crucial for communication throughout the negotiation process. Ensure that phone numbers and email addresses are clearly stated to avoid delays.

-

Vague Terms of Purchase: Providing unclear or overly broad terms can create misunderstandings later. Be specific about the purchase price, deposit amounts, and any contingencies. Clarity in these areas helps both parties understand their obligations and expectations.

-

Ignoring the Expiration Date: Not specifying an expiration date for the offer can lead to uncertainty. Clearly state the deadline for acceptance to ensure that both parties are on the same page. This helps avoid situations where one party believes the offer is still valid while the other does not.

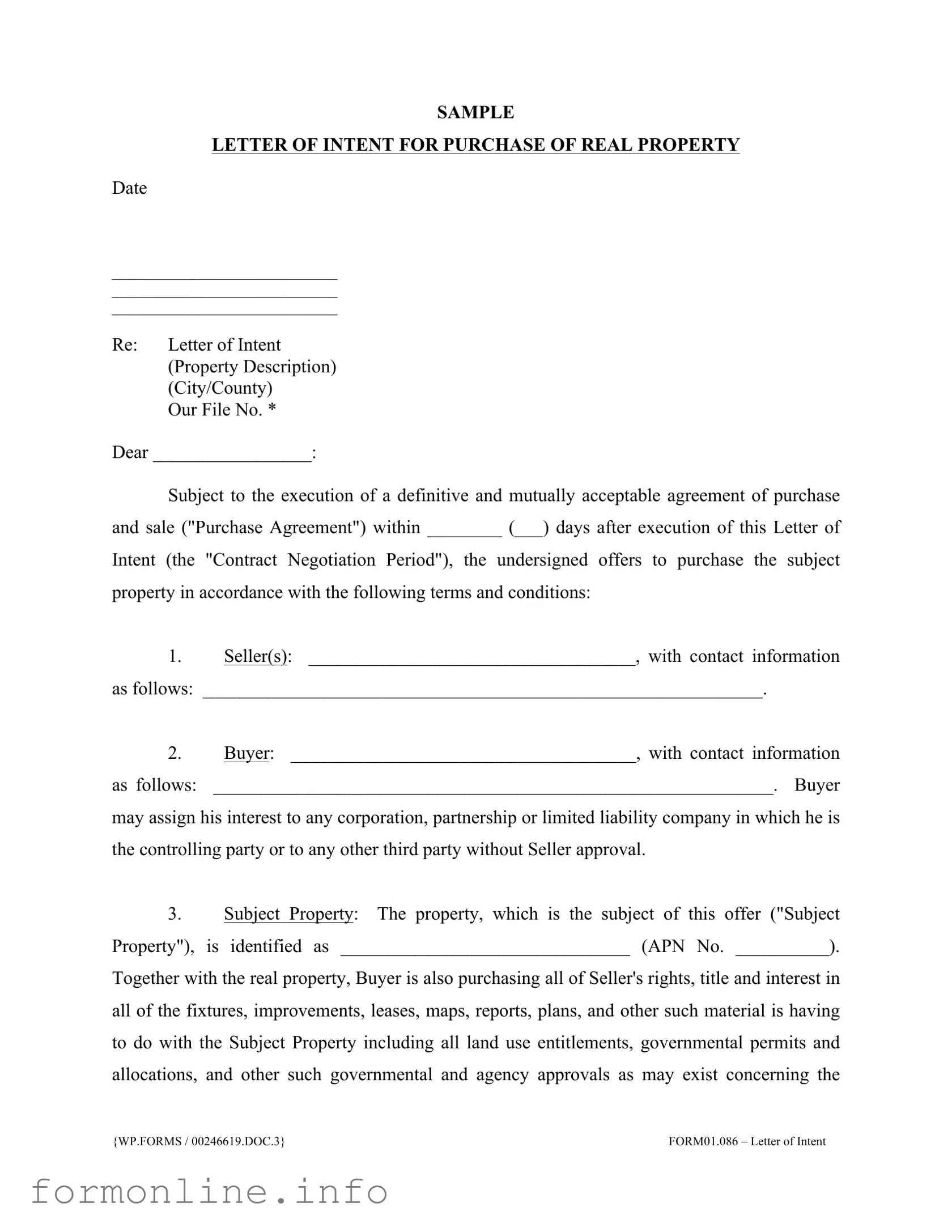

Preview - Letter To Purchase Land Form

SAMPLE

LETTER OF INTENT FOR PURCHASE OF REAL PROPERTY

Date

_____________________________

_____________________________

_____________________________

Re: Letter of Intent (Property Description) (City/County)

Our File No. *

Dear _________________:

Subject to the execution of a definitive and mutually acceptable agreement of purchase and sale ("Purchase Agreement") within ________ (___) days after execution of this Letter of

Intent (the "Contract Negotiation Period"), the undersigned offers to purchase the subject property in accordance with the following terms and conditions:

1.Seller(s): ___________________________________, with contact information

as follows: ____________________________________________________________.

2.Buyer: _____________________________________, with contact information

as follows: ____________________________________________________________. Buyer may assign his interest to any corporation, partnership or limited liability company in which he is the controlling party or to any other third party without Seller approval.

3.Subject Property: The property, which is the subject of this offer ("Subject Property"), is identified as _______________________________ (APN No. __________). Together with the real property, Buyer is also purchasing all of Seller's rights, title and interest in all of the fixtures, improvements, leases, maps, reports, plans, and other such material is having to do with the Subject Property including all land use entitlements, governmental permits and allocations, and other such governmental and agency approvals as may exist concerning the

{WP.FORMS / 00246619.DOC.3} |

FORM01.086 – Letter of Intent |

_____________________

_____________________

Page 2

property. In addition, this offer to purchase includes the following specific items: ___________

____________________________________________.

4.Purchase Price: ___________________ ($________).

5.Terms of Purchase: ________________________________________________

___________________________________________________.

6.Opening of Escrow: Escrow ("the Purchase Escrow") shall be opened at

______________ Title Company within three (3) business days from execution of this Letter of Intent. The Purchase Agreement and Mutual Escrow Instructions shall be mutually prepared and executed by Buyer and Seller within ________ (___) days of execution by both parties of this Letter of Intent to purchase (the "Contract Negotiation Period").

7.Deposit Toward Purchase Price:

A.Initial Deposit: Concurrently with the opening of escrow, Buyer shall place therein the sum of ___________________________ Dollars ($____________) as a refundable deposit toward and applicable to the Purchase Price ("the Initial Deposit"). Escrow Holder shall deposit such sum in an

B.Second Deposit: An additional

__________________________ Dollars ($____________) shall be applicable to the Purchase Price and upon approval of the feasibility shall be released to Seller, inclusive of the Initial Deposit.

8.Feasibility Period: Buyer shall have until ________________ to perform all feasibility and due diligence for subject property. Seller shall fully cooperate with Buyer in

_____________________

_____________________

Page 3

providing any and all information available regarding the development potential of the property. Buyer may terminate this Letter of Intent and/or the Purchase Agreement at any time prior to the end of the Feasibility Period for any reason or no reason at all upon written notification to Seller and Escrow Holder of the termination. Upon notice of termination, Escrow Holder shall be instructed to immediately release the Initial Deposit made by Buyer and return to Buyer within five (5) business days of termination.

9.Buyer's Condition Precedent to Closing: Following the expiration of the Feasibility Period, Buyer's obligation to close escrow shall be subject only to the following conditions:

A.Title Company shall be in position to issue a policy of title insurance to Buyer in the full amount of the Purchase Price showing good and marketable title vested in Buyer subject only to such exceptions to title as have been approved by Buyer during the Feasibility Period.

B.The

C.Seller to provide Buyer title to property free and clear of liens except for

10.Close of Escrow: Close of escrow to be on _______________________.

_____________________

_____________________

Page 4

11.Other Provisions:

A.The Purchase Agreement may contain other provisions such as, but not limited to, a liquidated damages clause, attorney's fees, notices, mutual indemnifications, broker's commission, and the like.

B.Any and all documentation provided by Seller to Buyer shall be returned to Seller upon cancellation of this transaction.

12.Expiration of Offer: This Letter of Intent shall constitute an open offer until

____________, at which time it shall be automatically terminated if not executed by Seller.

If the above outline of terms and conditions are acceptable, please indicate by signing below. All parties to these transactions intend that this proposal be superseded by a the Purchase Agreement. In the meantime, all parties agree to proceed in accordance with terms and conditions outlined in this Letter of Intent. Seller understands the purpose of this Letter of Intent is to allow further investigation by both parties into the feasibility of entering into a formal agreement. This Letter of Intent is only binding on the parties during the Contract Negotiation period. If the Purchase Agreement is not mutually executed within the Contract Negotiation Period for any reason whatsoever or no reason at all, this Letter of Intent shall expire and no party shall have any further rights or duties hereunder. Seller shall not solicit other offers during the Contract Negotiation Period.

BUYER:

________________________________ |

Dated: _________________ |

SELLER:

________________________________ |

Dated: _________________ |

_____________________

_____________________

Page 5

Other PDF Templates

Air Force Award Form - Each section of the AF 1206 must be filled out thoroughly for effective evaluation.

This important legal tool can ensure that your child's needs are addressed promptly and effectively, which is why many parents turn to resources like georgiapdf.com for guidance and assistance in completing the necessary forms.

Rochdale Village Application - Access quality educational institutions within close proximity to your home.

Documents used along the form

When you're preparing to purchase land, several important documents often accompany the Letter To Purchase Land form. Each of these documents serves a unique purpose in facilitating the transaction and ensuring that both parties are protected. Here’s a brief overview of some commonly used forms.

- Purchase Agreement: This is a formal contract between the buyer and seller that outlines the specific terms and conditions of the sale. It includes details such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized.

- Escrow Instructions: These instructions guide the escrow agent in managing the funds and documents involved in the transaction. They detail how and when the funds will be disbursed, and what conditions must be met for the closing to occur.

- Motor Vehicle Bill of Sale: This form is essential for documenting the transfer of ownership of a vehicle, particularly in North Carolina. For more detailed information, visit https://autobillofsaleform.com/north-carolina-motor-vehicle-bill-of-sale-form/.

- Title Report: A title report provides information about the ownership history of the property and any liens or encumbrances that may affect the title. This document is crucial for ensuring that the buyer receives clear title to the property upon closing.

- Disclosure Statements: These statements require the seller to disclose any known issues with the property, such as zoning restrictions or environmental concerns. They help protect the buyer by ensuring they are fully informed before making a purchase.

Having these documents prepared and reviewed can significantly streamline the purchasing process. It’s essential to understand each document's role to ensure a smooth transaction and protect your interests as a buyer.

Similar forms

The Purchase Agreement is a formal contract that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. Similar to the Letter to Purchase Land, it includes essential details such as the purchase price, property description, and closing date. However, the Purchase Agreement is a legally binding document that becomes effective once both parties sign it, whereas the Letter of Intent serves primarily as a preliminary agreement to negotiate further.

A Memorandum of Understanding (MOU) is another document that shares similarities with the Letter to Purchase Land. An MOU outlines the intentions and mutual understanding of the parties involved in a potential agreement. Like the Letter of Intent, it is not legally binding but sets the stage for further negotiations. Both documents aim to clarify the expectations and responsibilities of each party before entering into a formal contract.

An Offer to Purchase is a document that a buyer submits to a seller, expressing their desire to buy a property under specific terms. This document is akin to the Letter to Purchase Land as it includes the purchase price and property details. However, the Offer to Purchase typically serves as a more formal proposal, often leading directly to a Purchase Agreement if accepted by the seller.

A Purchase and Sale Agreement is a legally binding contract that details the sale of real estate. It is similar to the Letter to Purchase Land in that it specifies terms such as price, contingencies, and closing dates. Unlike the Letter of Intent, the Purchase and Sale Agreement is enforceable in court and is the final step in the buying process once both parties have agreed to the terms.

An Option to Purchase is a document that grants a potential buyer the right to purchase a property at a predetermined price within a specified timeframe. This document is similar to the Letter to Purchase Land as it outlines the buyer's intentions and conditions. However, an Option to Purchase provides the buyer with exclusive rights to the property without the obligation to purchase, unlike the Letter of Intent, which expresses a commitment to negotiate a purchase.

In the context of mobile home transactions, it is essential to have a clear understanding of various legal documents, among which the Mobile Home Bill of Sale serves a critical role in confirming the transfer of ownership and protecting the rights of both the buyer and the seller. This document ensures that all pertinent details are properly documented, making the transaction process smoother and more reliable for all parties involved.

A Real Estate Purchase Contract is a detailed document that outlines the terms of a real estate transaction. It is similar to the Letter to Purchase Land in that it includes critical information about the property, buyer, and seller. The key difference lies in the fact that the Real Estate Purchase Contract is a legally binding agreement, whereas the Letter of Intent is primarily a tool for negotiation and exploration of terms.

A Lease Agreement can also be compared to the Letter to Purchase Land. While a Lease Agreement allows a tenant to use a property for a specified period in exchange for rent, it often includes terms that can lead to a purchase option. Both documents outline the rights and responsibilities of the parties involved, but the Lease Agreement focuses on temporary use, while the Letter of Intent focuses on a potential purchase.

A Letter of Interest is a document that expresses a party's interest in pursuing a potential transaction. Similar to the Letter to Purchase Land, it serves as a preliminary communication that sets the tone for future negotiations. However, a Letter of Interest may not include as many specific terms or conditions as a Letter of Intent, making it less formal.

Finally, a Term Sheet is a document that summarizes the key points of a proposed agreement between parties. It is similar to the Letter to Purchase Land in that it outlines essential terms and conditions for a potential transaction. However, a Term Sheet is often used in business deals and may not specifically pertain to real estate, whereas the Letter to Purchase Land is focused on property transactions.

Dos and Don'ts

When filling out the Letter To Purchase Land form, it’s essential to approach the task with care and attention to detail. Here’s a list of things you should and shouldn't do:

- Do ensure all contact information is accurate. This includes names, addresses, and phone numbers for both the buyer and seller.

- Don't leave any sections blank. Every part of the form should be completed to avoid confusion later.

- Do clearly describe the subject property, including the APN number and any specific items included in the sale.

- Don't use vague language. Be specific about terms, conditions, and deadlines to minimize misunderstandings.

- Do include a reasonable feasibility period to allow for due diligence on the property.

- Don't forget to mention any deposits. Clearly state the amounts and conditions for both the initial and second deposits.

- Do sign and date the form to validate your intent and ensure it’s legally recognized.

Key takeaways

When filling out and using the Letter to Purchase Land form, consider the following key takeaways:

- Clearly Identify Parties: Make sure to include the full names and contact information for both the buyer and the seller. This ensures that all parties can communicate effectively.

- Define the Property: Accurately describe the property being purchased, including its address and any relevant identification numbers, such as the Assessor's Parcel Number (APN).

- Establish a Purchase Price: Clearly state the total purchase price in both words and numbers to avoid any confusion.

- Outline Terms of Purchase: Specify any conditions or terms related to the purchase. This may include financing arrangements or contingencies.

- Escrow Instructions: Indicate which title company will handle the escrow process and the timeline for opening escrow after signing the letter.

- Deposits: Detail the amounts and conditions of any deposits. This includes initial and second deposits, along with their refundable or non-refundable status.

- Feasibility Period: Allow time for the buyer to conduct due diligence on the property. Specify the duration of this period and the seller's obligations to provide necessary information.

- Conditions Precedent: List any conditions that must be met before closing the sale, such as title insurance and the absence of liens.

- Closing Timeline: Clearly state the expected date for closing escrow to ensure all parties are aligned on the schedule.

- Expiration of Offer: Specify the date by which the letter must be executed by the seller, or it will automatically terminate. This keeps the process moving forward.

By keeping these points in mind, both buyers and sellers can navigate the process of purchasing land more smoothly and with a clearer understanding of their responsibilities.

How to Use Letter To Purchase Land

Once you have gathered the necessary information, you can proceed to fill out the Letter to Purchase Land form. This document is essential for initiating the purchase process and outlines the terms of the proposed transaction. Follow the steps below to complete the form accurately.

- Date: Write the current date at the top of the form.

- Property Description: Fill in the description of the property, including the city or county.

- Seller's Information: Enter the seller's name and contact information in the designated section.

- Buyer's Information: Provide the buyer's name and contact information.

- Subject Property: Specify the property details, including the APN (Assessor's Parcel Number).

- Purchase Price: Clearly state the proposed purchase price in both words and numbers.

- Terms of Purchase: Outline any specific terms related to the purchase.

- Opening of Escrow: Indicate the title company where escrow will be opened and the timeline for this action.

- Deposit Toward Purchase Price: Detail the amounts for both the initial and second deposits.

- Feasibility Period: Specify the deadline for conducting feasibility and due diligence on the property.

- Buyer's Conditions Precedent to Closing: List the conditions that must be met before closing.

- Close of Escrow: Write the anticipated closing date.

- Other Provisions: Mention any additional provisions that may be included in the purchase agreement.

- Expiration of Offer: State the expiration date for the offer.

- Signatures: Ensure that both the buyer and seller sign and date the form at the bottom.