Printable LLC Share Purchase Agreement Form

When entering into a transaction involving the sale or purchase of shares in a Limited Liability Company (LLC), a well-structured LLC Share Purchase Agreement is essential. This document outlines the terms and conditions of the sale, ensuring that both parties are protected and clear on their obligations. Key aspects of the agreement include the identification of the buyer and seller, a detailed description of the shares being sold, and the purchase price. Additionally, the agreement often includes representations and warranties from both parties, addressing issues such as ownership rights and the financial status of the LLC. Provisions related to payment terms, closing conditions, and any post-closing obligations are also critical components. By clearly defining these elements, the LLC Share Purchase Agreement serves to minimize misunderstandings and disputes, creating a smoother transition of ownership and fostering a stronger business relationship.

Common mistakes

-

Inaccurate Information: One of the most common mistakes is providing incorrect or incomplete information. This can include misspelled names, wrong addresses, or incorrect percentages of ownership. Each detail matters, as inaccuracies can lead to disputes down the line.

-

Not Specifying Payment Terms: Failing to clearly outline payment terms can create confusion. It's crucial to detail how much is being paid, when the payment is due, and the method of payment. Ambiguities in this area can lead to misunderstandings between the parties involved.

-

Ignoring State-Specific Requirements: Each state may have unique regulations that affect LLC agreements. Not adhering to these specific requirements can invalidate the agreement. It's essential to research and understand the laws applicable in the state where the LLC operates.

-

Overlooking Signatures: A common oversight is neglecting to obtain the necessary signatures from all parties. Without signatures, the agreement holds no legal weight. Ensure that everyone involved reviews and signs the document to validate the agreement.

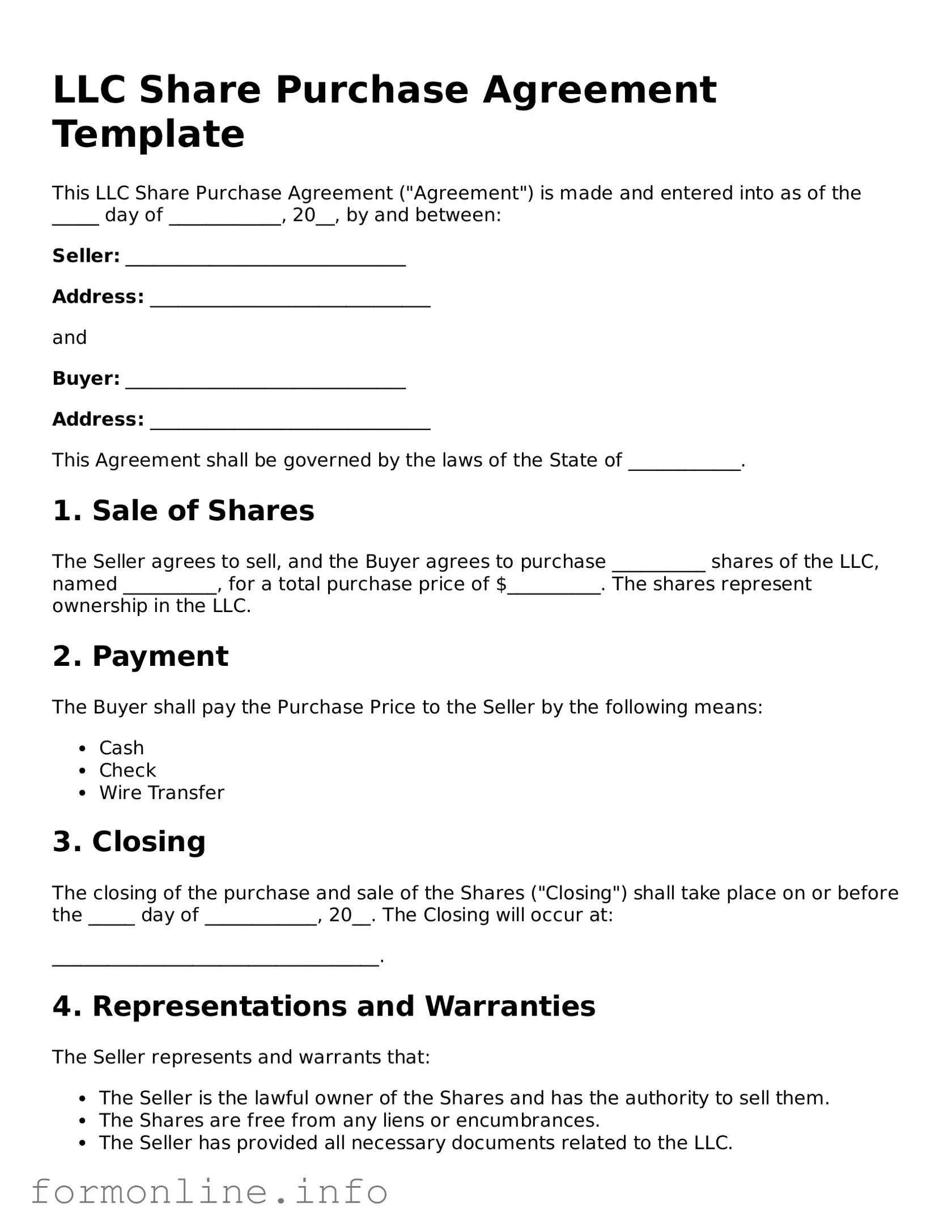

Preview - LLC Share Purchase Agreement Form

LLC Share Purchase Agreement Template

This LLC Share Purchase Agreement ("Agreement") is made and entered into as of the _____ day of ____________, 20__, by and between:

Seller: ______________________________

Address: ______________________________

and

Buyer: ______________________________

Address: ______________________________

This Agreement shall be governed by the laws of the State of ____________.

1. Sale of Shares

The Seller agrees to sell, and the Buyer agrees to purchase __________ shares of the LLC, named __________, for a total purchase price of $__________. The shares represent ownership in the LLC.

2. Payment

The Buyer shall pay the Purchase Price to the Seller by the following means:

- Cash

- Check

- Wire Transfer

3. Closing

The closing of the purchase and sale of the Shares ("Closing") shall take place on or before the _____ day of ____________, 20__. The Closing will occur at:

___________________________________.

4. Representations and Warranties

The Seller represents and warrants that:

- The Seller is the lawful owner of the Shares and has the authority to sell them.

- The Shares are free from any liens or encumbrances.

- The Seller has provided all necessary documents related to the LLC.

5. Conditions Precedent

Completion of the sale is subject to the following conditions:

- Buyer's satisfactory review of the LLC's financial statements.

- Approval of the transaction by the members of the LLC.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ____________.

7. Entire Agreement

This Agreement constitutes the entire agreement between the parties, superseding all prior agreements or understandings, whether written or oral.

8. Signatures

The parties have executed this Agreement as of the date first above written.

______________________________

Seller

______________________________

Buyer

Common Forms:

How Long Asylum Process Take in Usa - There is no filing fee for the I-589 form, making it accessible for many.

Fee Statement - Includes an estimate for additional settlement charges that may apply.

The Investment Letter of Intent plays a vital role in the investment process, acting as an initial document that establishes key terms between parties. For a better understanding of this form, consider reviewing this guide on an effective Investment Letter of Intent strategy to navigate the complexities of investment agreements.

Aaa International Drivers Permit - Your journey starts here with the Aaa International Driving Permit Application form.

Documents used along the form

The LLC Share Purchase Agreement is a critical document for the sale and purchase of shares in a Limited Liability Company. It outlines the terms and conditions of the transaction, ensuring that both parties understand their rights and obligations. Along with this agreement, several other forms and documents are often utilized to facilitate the process and protect the interests of both the buyer and seller.

- Operating Agreement: This document outlines the management structure and operating procedures of the LLC. It details the roles and responsibilities of members, as well as the distribution of profits and losses.

- Mobile Home Bill of Sale: This document serves as a crucial legal form for transferring ownership of a mobile home and can be accessed here: Mobile Home Bill of Sale.

- Membership Interest Transfer Agreement: This agreement formalizes the transfer of membership interests from one member to another. It includes details such as the number of interests being transferred and the consideration paid.

- Disclosure Schedule: This schedule accompanies the purchase agreement and provides important information about the LLC, including financial statements, pending litigation, and any liabilities that could affect the sale.

- Bill of Sale: This document serves as proof of the transfer of ownership of the shares from the seller to the buyer. It typically includes a description of the shares and the purchase price.

- Consent of Members: This document may be required to obtain approval from other members of the LLC for the sale of shares. It demonstrates that the transaction has been agreed upon by the necessary parties.

Each of these documents plays a significant role in the overall transaction, ensuring clarity and legal compliance. Properly preparing and executing these forms can help prevent disputes and facilitate a smooth transfer of ownership in the LLC.

Similar forms

The LLC Operating Agreement is similar to the LLC Share Purchase Agreement in that both documents govern the internal workings of a limited liability company. The Operating Agreement outlines the management structure, member roles, and procedures for decision-making. It serves as a foundational document that dictates how the company operates, while the Share Purchase Agreement specifically focuses on the transfer of ownership interests. Together, they ensure clarity in ownership and management expectations.

Understanding the necessary documentation is crucial for anyone looking to navigate the various agreements involved in business transactions, including nursing licensure. For individuals looking to obtain their nursing license in Arizona, the AZ Forms Online offers a streamlined process for accessing the required forms and information to ensure compliance with state regulations.

The Membership Interest Purchase Agreement is another document that parallels the LLC Share Purchase Agreement. This agreement specifically deals with the sale and purchase of membership interests in an LLC. It details the terms of the transaction, including the purchase price and any conditions that must be met. Like the Share Purchase Agreement, it formalizes the transfer of ownership but focuses more on the interests rather than shares, which is particularly relevant for LLCs.

A Stock Purchase Agreement shares similarities with the LLC Share Purchase Agreement, particularly in the context of corporations. This document governs the sale of stock between parties and outlines the terms of the transaction. Both agreements aim to protect the interests of the buyer and seller, ensuring that the terms are clearly defined and legally binding. While one pertains to LLCs and the other to corporations, the fundamental purpose of transferring ownership is consistent across both documents.

The Asset Purchase Agreement also bears resemblance to the LLC Share Purchase Agreement. This document facilitates the sale of specific assets of a business rather than ownership interests or shares. Both agreements require detailed descriptions of what is being sold and the terms of the transaction. They ensure that all parties understand their rights and obligations, although the Asset Purchase Agreement focuses on tangible and intangible assets rather than ownership stakes.

The Partnership Agreement is akin to the LLC Share Purchase Agreement in that it outlines the terms under which partners operate a business together. While the Share Purchase Agreement focuses on the sale of ownership interests, the Partnership Agreement establishes the roles, responsibilities, and profit-sharing arrangements among partners. Both documents are essential for defining relationships and expectations among parties involved in a business venture.

Finally, the Buy-Sell Agreement is another document that aligns with the LLC Share Purchase Agreement. This agreement establishes the terms under which owners can sell their interests in the company, often triggered by specific events like death or disability. Both agreements facilitate the transfer of ownership and protect the remaining owners by outlining the process and conditions for such transactions. This ensures that ownership transitions smoothly and in accordance with pre-agreed terms.

Dos and Don'ts

When filling out the LLC Share Purchase Agreement form, it is crucial to approach the task with care and attention to detail. Here are some essential dos and don’ts to keep in mind:

- Do read the entire agreement thoroughly before starting to fill it out.

- Do ensure that all names and addresses are accurate and up to date.

- Do provide all required information, including the number of shares being purchased.

- Do consult with a legal advisor if you have any questions or uncertainties.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any fields blank unless specifically instructed to do so.

- Don't ignore any terms or conditions outlined in the agreement.

- Don't forget to sign and date the agreement once completed.

Key takeaways

When dealing with an LLC Share Purchase Agreement, there are several important points to keep in mind. Understanding these can help ensure a smooth transaction and protect the interests of all parties involved.

- Clarity of Terms: Ensure that all terms of the agreement are clearly defined. This includes the purchase price, payment terms, and any conditions that must be met before the sale is finalized.

- Member Approval: Depending on the LLC's operating agreement, member approval may be required before shares can be sold. Verify the rules to avoid complications.

- Transfer Restrictions: Be aware of any restrictions on transferring shares. Some LLCs may have specific rules about who can buy shares or how many can be sold.

- Legal Compliance: Ensure that the agreement complies with state laws and regulations. This is crucial to avoid legal issues down the line.

By keeping these key takeaways in mind, individuals can navigate the process of filling out and utilizing the LLC Share Purchase Agreement more effectively.

How to Use LLC Share Purchase Agreement

Filling out the LLC Share Purchase Agreement form is an important step in transferring ownership of shares within a limited liability company. Ensure that you have all necessary information at hand before you begin. This will help streamline the process and avoid any errors.

- Start with the title of the document. Write "LLC Share Purchase Agreement" at the top of the form.

- Identify the parties involved. Fill in the names and addresses of the seller and the buyer. Make sure to include any relevant titles or roles within the LLC.

- Specify the date of the agreement. Write the date when the agreement is being executed.

- Detail the shares being sold. Indicate the number of shares and their class or type, if applicable.

- State the purchase price. Clearly write the total amount the buyer agrees to pay for the shares.

- Include payment terms. Specify how and when the payment will be made, such as a lump sum or installments.

- Outline any conditions for the sale. If there are specific conditions that must be met before the sale can proceed, list them here.

- Provide representations and warranties. Both parties should affirm their authority to enter into the agreement and disclose any relevant information.

- Include any additional provisions. If there are specific clauses or terms that need to be included, write them down here.

- Sign and date the agreement. Both the seller and buyer must sign the document and date it to make it legally binding.

Once you have completed the form, review it carefully for any errors. It’s advisable to keep a copy for your records and provide a copy to the other party involved in the transaction.