Printable Loan Agreement Form

A Loan Agreement form is a crucial document that outlines the terms and conditions under which a borrower receives funds from a lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral required. It also specifies the rights and responsibilities of both parties, ensuring clarity and reducing the potential for disputes. Key provisions often address default scenarios, outlining the steps that may be taken if the borrower fails to meet repayment obligations. Additionally, the form may include clauses related to prepayment options, late fees, and governing law. By detailing these aspects, the Loan Agreement form serves as a binding contract that protects the interests of both the lender and the borrower, facilitating a transparent and structured lending process.

State-specific Tips for Loan Agreement Templates

Common mistakes

When filling out a Loan Agreement form, individuals often make several common mistakes. Below is a list of four mistakes to avoid:

-

Incomplete Information: Many people fail to fill in all required fields. This can lead to delays in processing the loan or even rejection of the application.

-

Incorrect Personal Details: Entering wrong names, addresses, or Social Security numbers is a frequent error. Such mistakes can cause issues with verification and communication.

-

Misunderstanding Loan Terms: Some applicants do not fully read or understand the terms of the loan. This can result in confusion about repayment schedules or interest rates.

-

Neglecting to Sign: Forgetting to sign the agreement is a simple yet critical mistake. Without a signature, the document is not valid, and the loan cannot be processed.

By being aware of these common mistakes, individuals can improve their chances of successfully completing the Loan Agreement form.

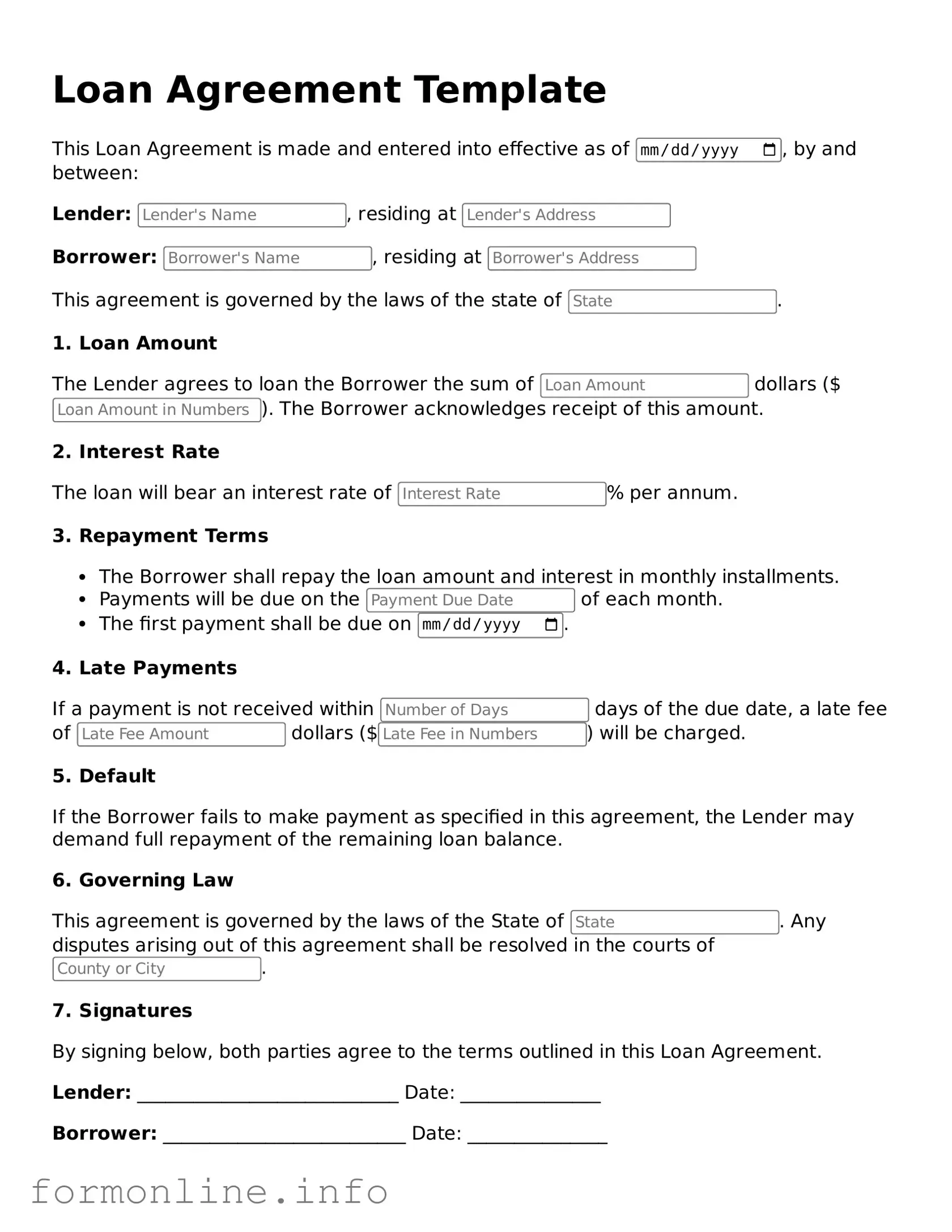

Preview - Loan Agreement Form

Loan Agreement Template

This Loan Agreement is made and entered into effective as of , by and between:

Lender: , residing at

Borrower: , residing at

This agreement is governed by the laws of the state of .

1. Loan Amount

The Lender agrees to loan the Borrower the sum of dollars ($). The Borrower acknowledges receipt of this amount.

2. Interest Rate

The loan will bear an interest rate of % per annum.

3. Repayment Terms

- The Borrower shall repay the loan amount and interest in monthly installments.

- Payments will be due on the of each month.

- The first payment shall be due on .

4. Late Payments

If a payment is not received within days of the due date, a late fee of dollars ($) will be charged.

5. Default

If the Borrower fails to make payment as specified in this agreement, the Lender may demand full repayment of the remaining loan balance.

6. Governing Law

This agreement is governed by the laws of the State of . Any disputes arising out of this agreement shall be resolved in the courts of .

7. Signatures

By signing below, both parties agree to the terms outlined in this Loan Agreement.

Lender: ____________________________ Date: _______________

Borrower: __________________________ Date: _______________

This template is provided for informational purposes only and does not constitute legal advice. It is recommended that both parties seek independent legal advice prior to signing any agreements.

Common Forms:

Certapet Letter - The letter typically includes the professional's qualifications and a statement regarding the necessity of the animal.

When engaging in the sale or purchase of a motorcycle, it is crucial to have a formal record of the transaction, which can be effectively accomplished with a Bill of Sale for Motorcycles. This document not only confirms the sale but also provides both buyer and seller with protection by detailing the price, motorcycle specifics, and the relevant details of both parties involved.

Printable Sports Physical Form - Specific inquiries about the athlete's history of concussions help safeguard against further head injuries.

Loan Agreement Form Subtypes

Documents used along the form

A Loan Agreement is an essential document that outlines the terms and conditions of a loan between a borrower and a lender. However, several other forms and documents often accompany it to ensure clarity and legal protection for both parties involved. Here is a list of related documents that may be necessary.

- Promissory Note: This is a written promise from the borrower to repay the loan amount, detailing the repayment schedule and interest rate.

- Loan Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and terms, ensuring transparency for the borrower.

- Personal Guarantee: A personal guarantee is a document where an individual agrees to be responsible for the loan if the borrower defaults, adding an extra layer of security for the lender.

- Collateral Agreement: If the loan is secured, this document outlines the collateral being used to back the loan, protecting the lender's interests.

- Credit Application: This form collects financial information from the borrower, helping the lender assess creditworthiness before approving the loan.

- Loan Modification Agreement: If the terms of the loan need to be changed, this document outlines the new terms and conditions agreed upon by both parties.

- ATV Bill of Sale Form: To ensure a smooth transaction for all-terrain vehicles, refer to our essential ATV Bill of Sale documentation to accurately record ownership transfers.

- Default Notice: This is a formal notice sent to the borrower if they fail to meet the terms of the loan, informing them of the default and potential consequences.

- Release of Lien: Once the loan is paid off, this document is issued to confirm that the lender no longer has a claim on the collateral used for the loan.

- Payment Schedule: This document outlines the specific dates and amounts due for loan repayments, helping both parties keep track of payment obligations.

Understanding these documents can help both borrowers and lenders navigate the lending process more effectively. Each document plays a crucial role in ensuring that both parties are protected and informed throughout the duration of the loan agreement.

Similar forms

A promissory note is a written promise to pay a specified amount of money to a designated person or entity. Like a loan agreement, it outlines the terms of repayment, including interest rates and due dates. However, a promissory note is typically simpler and focuses solely on the borrower's commitment to repay the loan, while a loan agreement may include additional terms and conditions.

For individuals considering modifying their legal documents, a helpful resource is the comprehensive guide to the Affidavit of Correction, which can be found at https://texaspdftemplates.com/fillable-affidavit-of-correction/. This form is crucial for correcting recorded errors, ensuring accurate public records and avoiding future disputes.

A mortgage agreement is similar to a loan agreement in that it secures a loan with real property. It details the terms under which a borrower can obtain a loan to purchase real estate. Both documents specify repayment terms, interest rates, and the consequences of default. The key difference is that a mortgage agreement involves the property as collateral, while a general loan agreement may not.

An installment agreement outlines the terms under which a borrower repays a loan in fixed payments over time. Like a loan agreement, it specifies the amount borrowed, interest rates, and payment schedule. However, an installment agreement typically applies to consumer loans, such as for vehicles or appliances, rather than general loans, which can cover a broader range of purposes.

A credit agreement governs the terms under which a lender provides a line of credit to a borrower. It includes details about the credit limit, interest rates, and repayment terms. Similar to a loan agreement, it establishes the relationship between the lender and borrower, but a credit agreement often allows for flexible borrowing and repayment, unlike a traditional loan agreement.

A lease agreement is similar to a loan agreement in that it establishes terms for the use of property in exchange for payment. It outlines the responsibilities of both parties, including payment amounts and duration. While a loan agreement typically involves cash transactions, a lease agreement focuses on the rental of property, making it a different type of financial arrangement.

A personal guarantee is a document where an individual agrees to be responsible for the debt of another party. It is similar to a loan agreement because it establishes the obligations of the guarantor and the borrower. Both documents outline the terms of repayment, but a personal guarantee adds an additional layer of security for the lender by holding an individual accountable for the debt.

A business loan agreement is specifically tailored for business financing. It includes terms related to the loan amount, interest rates, and repayment schedules, similar to a personal loan agreement. However, it often contains additional clauses related to business operations, collateral, and financial reporting, reflecting the unique needs of business borrowers.

A debt settlement agreement outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. It shares similarities with a loan agreement in that it specifies payment terms and conditions. However, a debt settlement agreement typically arises when a borrower is unable to pay the full amount owed, whereas a loan agreement is established before the borrowing occurs.

An assignment agreement allows a borrower to transfer their rights and obligations under a loan agreement to another party. This document is similar in that it maintains the original loan terms while changing the responsible party. Both agreements ensure that the lender's interests are protected, but an assignment agreement modifies the borrower’s obligations rather than creating new ones.

Dos and Don'ts

When filling out a Loan Agreement form, attention to detail is crucial. Here are five important dos and don'ts to consider:

- Do read the entire agreement carefully before signing.

- Do ensure all personal information is accurate and up-to-date.

- Do understand the terms and conditions, including interest rates and repayment schedules.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank; if something doesn’t apply, indicate that clearly.

Key takeaways

When filling out and using a Loan Agreement form, keep these key takeaways in mind:

- Clearly state the loan amount. Specify the exact figure to avoid confusion.

- Define the interest rate. Indicate whether it is fixed or variable, and provide the percentage.

- Include the loan term. Specify the duration for repayment, whether it’s in months or years.

- Outline the repayment schedule. Detail when payments are due and the frequency of payments.

- Identify the borrower and lender. Full names and contact information must be included for both parties.

- Clarify the purpose of the loan. State why the funds are being borrowed.

- Address default conditions. Specify what happens if payments are missed or if the borrower defaults.

- Include any collateral details. If the loan is secured, describe the assets involved.

- Ensure all parties sign and date the agreement. This confirms acceptance of the terms.

- Consult a legal expert if necessary. They can provide guidance on specific terms and conditions.

How to Use Loan Agreement

Filling out the Loan Agreement form is an important step in securing your loan. Make sure you have all the necessary information ready before you start. This will help streamline the process and ensure accuracy.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Fill in your phone number and email address for communication purposes.

- Specify the loan amount you are requesting.

- Indicate the purpose of the loan in the appropriate section.

- Enter the repayment term you prefer, whether it’s monthly, quarterly, or annually.

- Review the interest rate section and fill in the agreed-upon rate.

- Include any collateral details if required.

- Sign and date the form at the bottom to confirm your agreement.

After completing the form, double-check all entries for accuracy. This will help avoid delays in processing your loan. Once verified, submit the form as instructed to move forward with your loan application.