Fill Out a Valid Loan Estimate Form

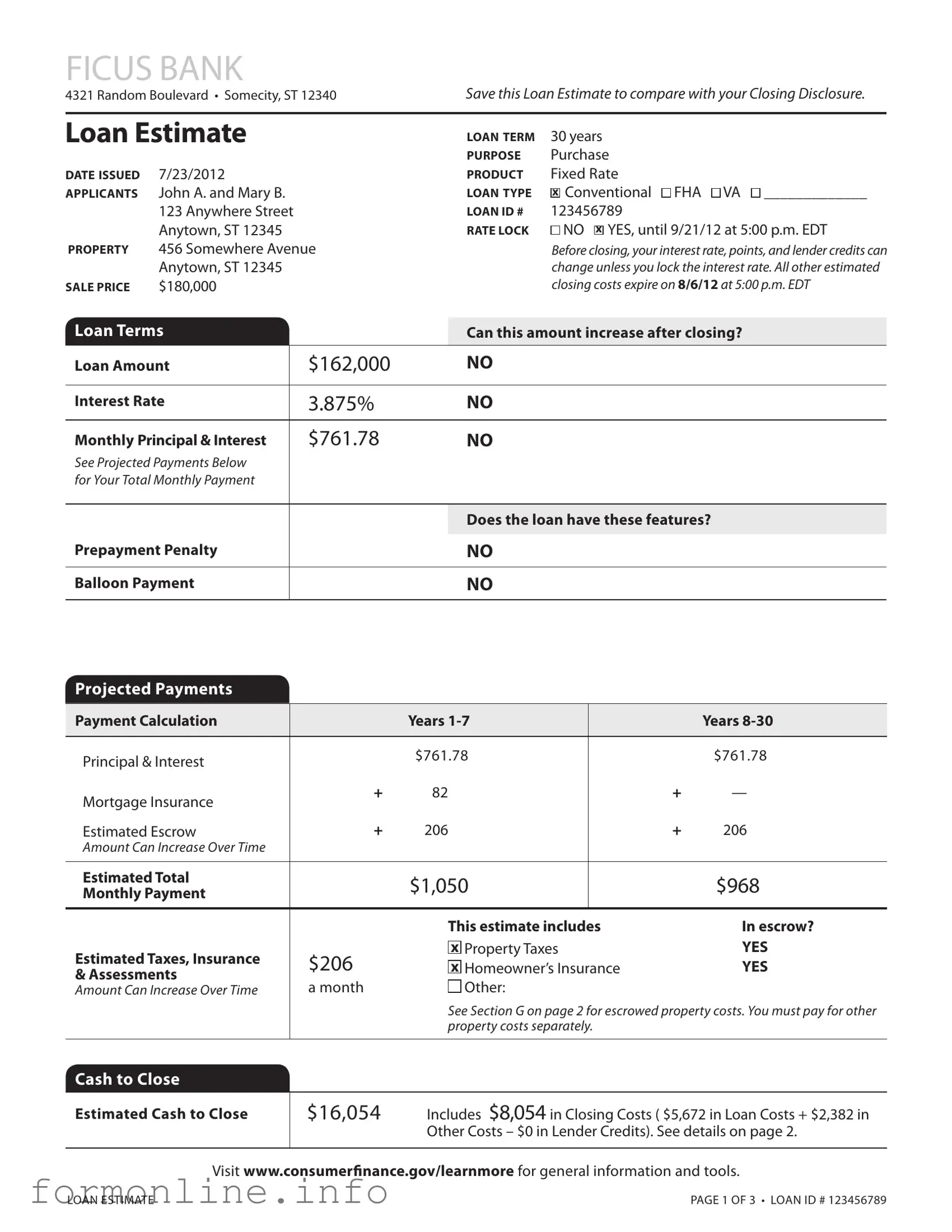

The Loan Estimate form is a crucial document for anyone considering a mortgage. It provides a clear overview of the loan terms, including the loan amount, interest rate, and monthly payments. For instance, the Loan Estimate specifies a 30-year fixed-rate mortgage with an interest rate of 3.875%. It also details the estimated closing costs, which total $8,054, and breaks down these costs into categories such as origination charges and other costs. Applicants can find important information regarding their projected payments, which include principal, interest, and property taxes. Additionally, the form highlights features like prepayment penalties and balloon payments, ensuring borrowers understand their obligations. The Loan Estimate serves as a valuable tool for comparing different loan offers, allowing borrowers to make informed decisions before finalizing their mortgage. Understanding this form can significantly impact a borrower’s financial future, making it essential to review it carefully.

Common mistakes

-

Ignoring the Rate Lock Details: Many people overlook the importance of the rate lock. If you don’t lock in your interest rate, it can change before closing, potentially increasing your costs.

-

Not Comparing Closing Costs: Failing to save and compare the Loan Estimate with the Closing Disclosure can lead to surprises at closing. Keeping track of these documents is essential.

-

Misunderstanding Estimated Payments: Some individuals misinterpret the estimated monthly payments. It’s crucial to understand that these estimates can change based on various factors, including taxes and insurance.

-

Overlooking Other Costs: Many applicants focus solely on the loan amount and interest rate, neglecting other significant costs like taxes, insurance, and escrow payments.

-

Not Checking for Prepayment Penalties: Some loans may include prepayment penalties. Failing to check this detail can lead to unexpected fees if you decide to pay off your loan early.

-

Assuming All Fees Are Negotiable: While some fees can be negotiated, others are set by the lender or required by law. Understanding which fees are negotiable can help you better prepare.

-

Ignoring the Fine Print: Skimming through the details can lead to missed information about loan features, such as balloon payments or assumptions. Always read the fine print.

-

Failing to Ask Questions: Many individuals do not ask questions when they don’t understand something. It’s important to seek clarification from your lender to ensure you fully understand the terms.

-

Not Considering Future Financial Changes: Applicants often fail to consider how their financial situation might change over the life of the loan. Planning for potential changes can help you avoid future difficulties.

Preview - Loan Estimate Form

FICUS BANK

4321 Random Boulevard • Somecity, ST 12340Save this Loan Estimate to compare with your Closing Disclosure.

Loan estimate |

LOAN TeRM |

30 years |

|

|

|

PuRPOse |

Purchase |

DATe IssueD |

7/23/2012 |

PRODuCT |

Fixed Rate |

APPLICANTs |

John A. and Mary B. |

LOAN TyPe |

x Conventional FHA VA _____________ |

|

123 Anywhere Street |

LOAN ID # |

123456789 |

|

Anytown, ST 12345 |

RATe LOCK |

NO x YES, until 9/21/12 at 5:00 p.m. EDT |

PROPeRTy |

456 Somewhere Avenue |

|

Before closing, your interest rate, points, and lender credits can |

|

Anytown, ST 12345 |

|

change unless you lock the interest rate. All other estimated |

sALe PRICe |

$180,000 |

|

closing costs expire on 8/6/12 at 5:00 p.m. EDT |

Loan Terms |

|

Can this amount increase after closing? |

Loan Amount |

$162,000 |

NO |

|

|

|

Interest Rate |

3.875% |

NO |

|

|

|

Monthly Principal & Interest |

$761.78 |

NO |

See Projected Payments Below |

|

|

for Your Total Monthly Payment |

|

|

|

|

|

|

|

Does the loan have these features? |

Prepayment Penalty |

|

|

|

NO |

|

|

|

|

Balloon Payment |

|

NO |

|

|

|

Projected Payments

Payment Calculation |

|

years |

|

|

years |

|

|

|

|

|

|

Principal & Interest |

|

$761.78 |

|

|

$761.78 |

|

|

|

|

|

|

Mortgage Insurance |

+ |

82 |

|

+ |

— |

|

|

|

|

|

|

Estimated Escrow |

+ |

206 |

|

+ |

206 |

Amount Can Increase Over Time |

|

|

|

|

|

|

|

|

|

|

|

estimated Total |

|

$1,050 |

|

|

$968 |

Monthly Payment |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This estimate includes |

|

In escrow? |

|

estimated Taxes, Insurance |

$206 |

x Property Taxes |

|

yes |

|

x Homeowner’s Insurance |

|

yes |

|||

& Assessments |

|

||||

a month |

Other: |

|

|

||

Amount Can Increase Over Time |

|

|

|||

|

|

See Section G on page 2 for escrowed property costs. You must pay for other |

|||

|

|

property costs separately. |

|

|

|

|

|

|

|

|

|

Cash to Close |

|

|

|

|

|

|

|

|

|

||

estimated Cash to Close |

$16,054 |

Includes $8,054 in Closing Costs ( $5,672 in Loan Costs + $2,382 in |

|||

|

|

Other Costs – $0 in Lender Credits). See details on page 2. |

|||

|

|

|

|

|

|

Visit www.consumerinance.gov/learnmore for general information and tools.

LOAN ESTIMATE |

page 1 of 3 • Loan ID # 123456789 |

Closing Cost Details

Loan Costs

A. Origination Charges |

$1,802 |

.25 % of Loan Amount (Points) |

$405 |

Application Fee |

$300 |

Underwriting Fee |

$1,097 |

Other Costs

e. Taxes and Other Government Fees |

$85 |

||||||

Recording Fees and Other Taxes |

|

|

$85 |

||||

Transfer Taxes |

|

|

$0 |

||||

|

|

|

|

|

|

|

|

F. Prepaids |

|

|

$867 |

||||

Homeowner’s Insurance Premium ( |

6 months) |

$605 |

|||||

|

|

|

|

|

|

|

|

Mortgage Insurance Premium ( 0 |

months) |

$0 |

|||||

|

|

|

|

|

|

||

Prepaid Interest ( $17.44 per day for 15 days @ 3.875%) |

$262 |

||||||

Property Taxes ( 0 months) |

|

|

$0 |

||||

|

|

|

|

|

|

|

|

B. services you Cannot shop For |

$672 |

Appraisal Fee |

$405 |

Credit Report Fee |

$30 |

Flood Determination Fee |

$20 |

Flood Monitoring Fee |

$32 |

Tax Monitoring Fee |

$75 |

Tax Status Research Fee |

$110 |

G. Initial escrow Payment at Closing |

|

|

$413 |

|

Homeowner’s Insurance |

$100.83 per month for |

23mo. $202 |

||

Mortgage Insurance |

per month for |

0 |

mo. |

|

Property Taxes |

$105.30 per month for |

2 |

mo. |

$211 |

H. Other |

$1,017 |

Title – Owner’s Title Policy (optional) |

$1,017 |

C. services you Can shop For |

$3,198 |

Pest Inspection Fee |

$135 |

Survey Fee |

$65 |

Title – Insurance Binder |

$700 |

Title – Lender’s Title Policy |

$535 |

Title – Title Search |

$1,261 |

Title – Settlement Agent Fee |

$502 |

D. TOTAL LOAN COsTs (A + B + C) |

$5,672 |

I. TOTAL OTHeR COsTs (e + F + G + H) |

$2,382 |

|

|

J. TOTAL CLOsING COsTs |

$8,054 |

|

|

D + I |

$8,054 |

Lender Credits |

$0 |

Calculating Cash to Close |

|

|

|

Total Closing Costs (J) |

$8,054 |

Closing Costs Financed (Included in Loan Amount) |

$0 |

Down Payment/Funds from Borrower |

$18,000 |

Deposit |

– $10,000 |

Funds for Borrower |

$0 |

Seller Credits |

$0 |

Adjustments and Other Credits |

$0 |

estimated Cash to Close |

$16,054 |

|

|

LOAN ESTIMATE |

page 2 of 3 • Loan ID # 123456789 |

Additional Information About This Loan

LeNDeR NMLs/LICeNse ID

LOAN OFFICeR

NMLs ID

PHONe

Ficus Bank

Joe Smith 12345 joesmith@icusbank.com

MORTGAGe BROKeR NMLs/LICeNse ID LOAN OFFICeR NMLs ID

eMAIL PHONe

Comparisons |

use these measures to compare this loan with other loans. |

||

|

|

|

|

In 5 years |

$56,582 |

Total you will have paid in principal, interest, mortgage insurance, and loan costs. |

|

$15,773 |

Principal you will have paid of. |

||

|

|||

|

|

|

|

Annual Percentage Rate (APR) |

4.494% |

Your costs over the loan term expressed as a rate. This is not your interest rate. |

|

|

|

|

|

Total Interest Percentage (TIP) |

69.447% |

The total amount of interest that you will pay over the loan term as a |

|

|

|

percentage of your loan amount. |

|

|

|

|

|

Other Considerations

Appraisal |

We may order an appraisal to determine the property’s value and charge you for this |

|

appraisal. We will promptly give you a copy of any appraisal, even if your loan does not close. |

|

You can pay for an additional appraisal for your own use at your own cost. |

Assumption |

If you sell or transfer this property to another person, we |

|

will allow, under certain conditions, this person to assume this loan on the original terms. |

|

x will not allow this person to assume this loan on the original terms. |

Homeowner’s |

This loan requires homeowner’s insurance on the property, which you may obtain from a |

Insurance |

company of your choice that we ind acceptable. |

Late Payment |

If your payment is more than 15 days late, we will charge a late fee of 5% of the monthly |

|

principal and interest payment. |

Reinance |

Reinancing this loan will depend on your future inancial situation, the property value, and |

|

market conditions. You may not be able to reinance this loan. |

servicing |

We intend |

|

to service your loan. If so, you will make your payments to us. |

|

x to transfer servicing of your loan. |

Conirm Receipt

By signing, you are only conirming that you have received this form. You do not have to accept this loan because you have signed or received this form.

Applicant Signature |

Date |

Date |

LOAN ESTIMATE |

page 3 of 3 • Loan ID #123456789 |

Other PDF Templates

How Do I Change My Address - Users can provide detailed accounts of service failures in this form.

The proper handling of the Florida Mobile Home Bill of Sale is vital to ensure clarity in ownership transfer, and those involved in the transaction can find guidance through resources such as the Mobile Home Bill of Sale. This form encapsulates the necessary details of the sale, providing a framework that both parties can rely on.

Ucc 308 Without Prejudice - By using this form, you aim to clarify your legal position effectively.

Documents used along the form

The Loan Estimate form is a crucial document in the mortgage process, providing borrowers with essential information about their loan terms and costs. Alongside this form, several other documents are commonly used to facilitate the loan process. Each of these documents serves a specific purpose, helping borrowers understand their obligations and the overall transaction.

- Closing Disclosure: This document outlines the final terms and costs of the loan. It is provided to the borrower three days before closing and must match the Loan Estimate closely.

- Loan Application (Form 1003): This is the official application form for a mortgage. It collects personal, financial, and property information from the borrower.

- Non-disclosure Agreement: For protecting sensitive information, utilize a comprehensive Non-disclosure Agreement form to ensure confidentiality in your business dealings.

- Credit Report: Lenders review the borrower’s credit report to assess their creditworthiness. This report includes the borrower’s credit history and scores.

- Title Insurance Policy: This document protects against potential disputes over property ownership. It ensures that the title to the property is clear and free of liens.

- Appraisal Report: An appraisal is conducted to determine the property's market value. This report helps the lender ensure that the loan amount does not exceed the property's worth.

- Homeowners Insurance Policy: Lenders typically require borrowers to obtain homeowners insurance to protect the property against damage or loss. Proof of this insurance is often needed at closing.

- Good Faith Estimate (GFE): Although largely replaced by the Loan Estimate, some lenders may still provide a GFE, which outlines the estimated costs associated with the loan.

Understanding these documents can empower borrowers to make informed decisions throughout the mortgage process. Each form plays a vital role in ensuring clarity and transparency, ultimately contributing to a smoother closing experience.

Similar forms

The Loan Estimate form is similar to the Closing Disclosure. Both documents provide essential information about the terms and costs of a mortgage. The Loan Estimate is issued early in the loan process, giving borrowers a clear picture of what to expect. In contrast, the Closing Disclosure is provided before the closing date, detailing the final terms and costs. While the Loan Estimate outlines estimated costs, the Closing Disclosure presents the actual costs, ensuring transparency as the borrower approaches the closing stage.

Another document that resembles the Loan Estimate is the Good Faith Estimate (GFE). The GFE was commonly used prior to the implementation of the Loan Estimate form. Like the Loan Estimate, the GFE provides borrowers with an estimate of the loan terms and closing costs. However, the GFE does not include the same level of detail regarding loan features and potential changes in costs, making the Loan Estimate a more comprehensive tool for understanding mortgage obligations.

The Texas RV Bill of Sale form is essential for ensuring a smooth transaction between buyers and sellers of recreational vehicles. This legal document captures vital information such as the vehicle's details and the terms of the sale, providing a clear record of ownership transfer. It is important for both parties to have this documentation for registration and tax purposes, ensuring compliance with state regulations. For those looking to access a template, the autobillofsaleform.com/rv-bill-of-sale-form/texas-rv-bill-of-sale-form offers an easy solution.

The Truth in Lending (TIL) statement also shares similarities with the Loan Estimate. This document focuses on the costs of borrowing and provides important information such as the annual percentage rate (APR) and total interest paid over the life of the loan. While the Loan Estimate covers a broader range of information, including estimated closing costs and monthly payments, the TIL statement emphasizes the cost of credit, helping borrowers make informed comparisons between loan offers.

The Uniform Residential Loan Application (URLA) is another document related to the Loan Estimate. The URLA collects essential information about the borrower and the property, which lenders use to assess eligibility for a loan. While the Loan Estimate provides details about loan terms and costs, the URLA focuses on the borrower’s financial situation and the specifics of the property being financed. Both documents play crucial roles in the mortgage application process.

Lastly, the Mortgage Loan Originator (MLO) Disclosure is comparable to the Loan Estimate. This disclosure informs borrowers about the mortgage loan originator's role and compensation in the loan process. While the Loan Estimate centers on the financial aspects of the loan, the MLO Disclosure provides context regarding who is facilitating the loan and any potential conflicts of interest. Together, these documents help borrowers understand both the financial and procedural aspects of obtaining a mortgage.

Dos and Don'ts

When filling out the Loan Estimate form, it’s important to be thorough and accurate. Here are some key dos and don'ts to keep in mind:

- Do double-check all personal information for accuracy.

- Do review the loan terms carefully, including interest rates and monthly payments.

- Do ask questions if you don’t understand any part of the estimate.

- Do save a copy of the Loan Estimate for future reference.

- Don't rush through the form; take your time to ensure everything is correct.

- Don't ignore any fees or costs listed; they can significantly affect your total payment.

- Don't hesitate to seek help from a financial advisor if needed.

- Don't forget to compare this estimate with your Closing Disclosure later on.

Key takeaways

Understanding the Loan Estimate form is crucial for making informed decisions about your mortgage. Here are some key takeaways to keep in mind:

- Always save your Loan Estimate. It’s essential for comparing with your Closing Disclosure later.

- Review the loan terms carefully. This includes the loan amount, interest rate, and monthly payments.

- Check if your interest rate is locked. A locked rate can protect you from changes before closing.

- Understand your projected payments. This includes principal, interest, mortgage insurance, and estimated taxes.

- Be aware of closing costs. Know what they include and how they affect your cash to close.

- Consider the total interest percentage (TIP). This shows the total amount of interest paid over the loan term.

- Look for any prepayment penalties or balloon payments. These features can impact your financial flexibility.

- Know that you can shop for certain services, which can save you money on closing costs.

- Remember that signing the Loan Estimate does not obligate you to accept the loan. It simply confirms receipt.

Acting on these takeaways can help ensure a smoother mortgage process. Stay informed and make decisions that align with your financial goals.

How to Use Loan Estimate

Filling out the Loan Estimate form is an important step in understanding your mortgage options. This form provides key details about your loan, including terms, costs, and projected payments. Completing it accurately will help you make informed decisions as you move forward in the home buying process.

- Start by entering the lender's name and address at the top of the form. For example, Ficus Bank, 4321 Random Boulevard, Somecity, ST 12340.

- Fill in the loan term, which is typically 30 years for a fixed-rate mortgage.

- Specify the purpose of the loan (e.g., purchase).

- Input the date issued for the Loan Estimate.

- Indicate the loan product type (e.g., fixed rate).

- List the applicants' names (e.g., John A. and Mary B.).

- Choose the loan type (e.g., conventional, FHA, VA).

- Provide the property address where the loan will be used.

- Enter the loan ID number assigned to your application.

- Specify if you have a rate lock and the expiration date.

- Fill in the sale price of the property.

- Input the loan amount you are requesting.

- Provide the interest rate for the loan.

- Calculate and enter the monthly principal and interest payment.

- Indicate if there are any features like prepayment penalties or balloon payments.

- Complete the projected payments section, including estimated monthly payments for the first and subsequent years.

- Detail the estimated cash to close, including any closing costs and down payment.

- Fill out the closing cost details, including origination charges and other costs.

- Review the additional information

- Finally, confirm receipt by having the applicants sign and date the form.