Fill Out a Valid Louisiana act of donation Form

The Louisiana act of donation form serves as a crucial legal document that enables individuals to transfer ownership of property or assets to another person, typically without any expectation of payment. This form is particularly significant in Louisiana, where civil law principles govern property transfers. Key aspects of the form include the identification of the donor and the recipient, a clear description of the property being donated, and the intention behind the donation. Additionally, the form often requires notarization to ensure its validity and may include specific provisions about the conditions of the donation. Understanding the nuances of this form is essential for anyone looking to make a generous gift, as it helps to clarify the rights and responsibilities of both parties involved. Whether it’s real estate, personal property, or financial assets, the act of donation is a meaningful way to support loved ones or charitable causes, and completing the form correctly is the first step in that process.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required details. This includes the names and addresses of both the donor and the recipient. Missing information can lead to delays or even rejection of the form.

-

Incorrect Signatures: The form must be signed by the donor. Sometimes, individuals forget to sign or mistakenly have someone else sign on their behalf. This oversight can invalidate the donation.

-

Not Notarizing the Document: In Louisiana, the Act of Donation often requires notarization. Failing to have the document notarized can result in legal complications down the line.

-

Ignoring Legal Descriptions: When transferring property, a precise legal description is essential. Some individuals may use vague terms instead of the exact legal description, which can create confusion or disputes later.

-

Neglecting to Include Witnesses: Depending on the nature of the donation, witnesses may be required. Not having the necessary witnesses can lead to challenges regarding the validity of the donation.

-

Failure to Review Before Submission: Rushing through the form can lead to mistakes. Taking the time to review all entries can prevent errors that might complicate the donation process.

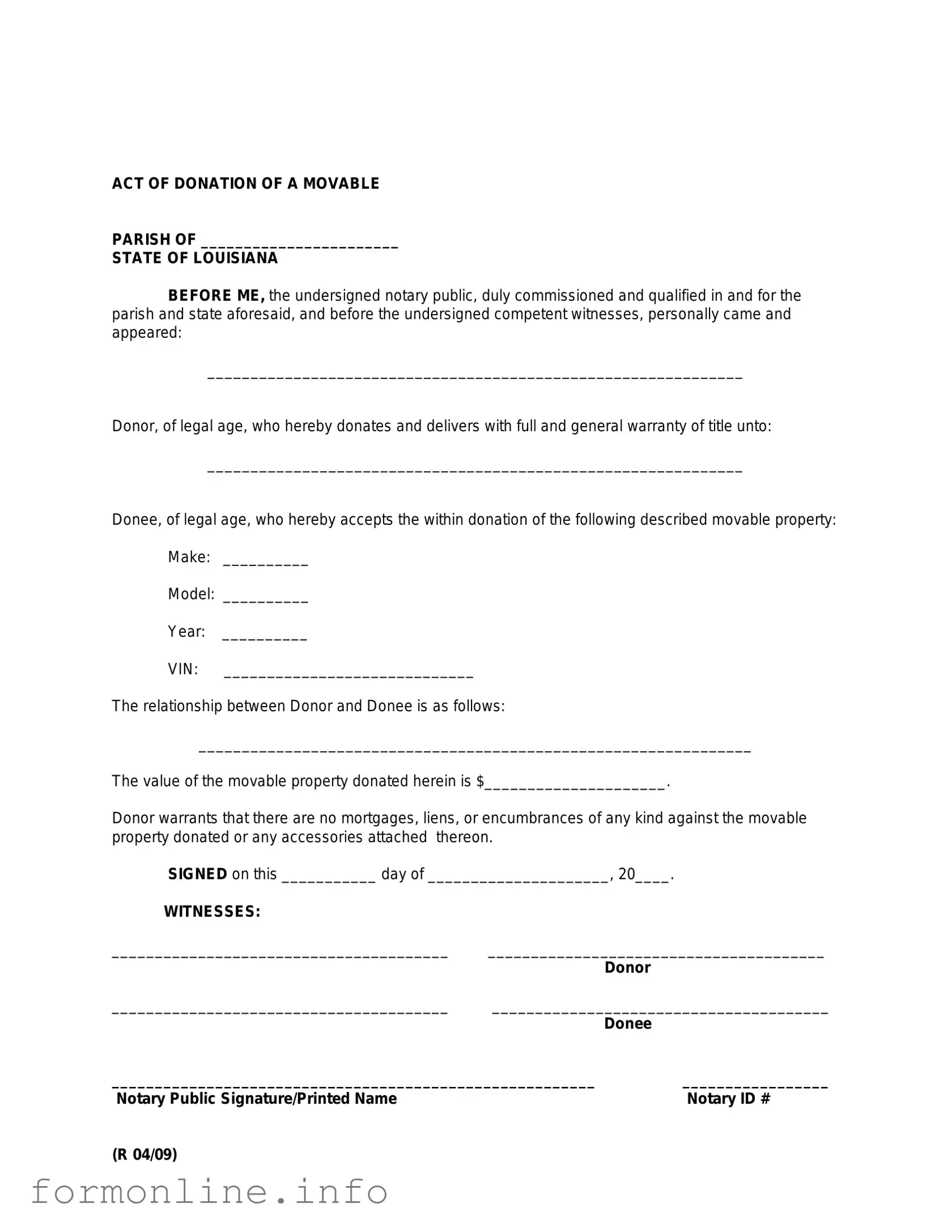

Preview - Louisiana act of donation Form

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Other PDF Templates

3613a - The form assists in identifying any allegations of abuse, neglect, or other incidents.

When engaging in the sale of a mobile home, it is crucial to utilize a formal agreement, such as the Connecticut Mobile Home Bill of Sale, which serves to clearly define the transaction and protect the interests of both parties involved. For more information on how to obtain this important document, you can visit the Mobile Home Bill of Sale page.

Basic Direct Deposit Form - Use this form to manage your income and payments efficiently.

Documents used along the form

The Louisiana Act of Donation form is a crucial document for transferring ownership of property without compensation. When engaging in this process, several other forms and documents may also be required to ensure a smooth transaction. Below are four commonly used documents that complement the Act of Donation.

- Property Deed: This document officially records the transfer of property ownership. It includes details such as the names of the parties involved, a description of the property, and any conditions attached to the transfer.

- Affidavit of Identity: This affidavit serves to verify the identities of the parties involved in the donation. It is often required to prevent fraud and ensure that the donor has the legal authority to make the donation.

- Gift Tax Return (Form 709): If the value of the donated property exceeds a certain threshold, the donor may need to file a gift tax return. This form helps report the donation to the IRS and ensures compliance with federal tax laws.

- Motor Vehicle Bill of Sale: This essential document records the transfer of ownership of a vehicle in North Carolina and is vital for registering and titling the vehicle. More information can be found at https://autobillofsaleform.com/north-carolina-motor-vehicle-bill-of-sale-form/.

- Notarized Statement of Intent: This document expresses the donor's intent to make the donation. It may be required to affirm the donor's wishes and clarify the terms of the donation, providing additional legal protection for both parties.

Understanding these documents is essential for anyone involved in the donation process in Louisiana. Proper documentation not only facilitates a smooth transfer but also helps prevent potential legal disputes in the future.

Similar forms

The Louisiana act of donation form shares similarities with a will. Both documents facilitate the transfer of property from one party to another. A will outlines how a person's assets should be distributed upon their death, while the act of donation allows for the immediate transfer of ownership during the donor's lifetime. Each document requires specific formalities to ensure validity, such as being in writing and, in some cases, notarized. Both serve to clearly express the donor's or testator's intentions regarding their property.

In the realm of property ownership transfer, it is essential to understand various legal documents similar to the act of donation, such as the Mobile Home Bill of Sale. This document serves to officially record the sale and transfer of ownership for mobile homes, ensuring that all necessary details are accurately exchanged between the buyer and seller. Proper use of such forms helps protect the rights of both parties involved in the transaction.

Dos and Don'ts

When filling out the Louisiana Act of Donation form, it is essential to approach the process with care. Here are some key dos and don'ts to keep in mind:

- Do ensure that all personal information is accurate and up-to-date.

- Do clearly describe the property being donated, including any relevant details.

- Do sign and date the form in the appropriate sections.

- Do consult with a legal professional if you have any questions about the process.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't forget to keep a copy of the completed form for your records.

Following these guidelines can help ensure that the donation process goes smoothly and that all legal requirements are met.

Key takeaways

When filling out and using the Louisiana Act of Donation form, there are several important points to keep in mind. Below is a list of key takeaways to ensure a smooth process.

- Understand the Purpose: The Act of Donation is a legal document used to transfer ownership of property from one person to another without any exchange of money.

- Eligibility: Anyone who owns property can use this form to donate it to another individual or entity.

- Property Types: The form can be used for various types of property, including real estate, personal belongings, and financial assets.

- Complete Information: Ensure all required fields are filled out accurately, including the names of both the donor and the recipient.

- Signatures Required: Both the donor and recipient must sign the form. Witness signatures may also be required, depending on the type of property being donated.

- Notarization: Some donations may require notarization to be legally binding. Check local requirements.

- Tax Implications: Donors should be aware of potential tax implications associated with the donation. Consulting a tax professional is advisable.

- Record Keeping: Keep a copy of the completed form for personal records. This is essential for future reference.

- Legal Advice: If there are any uncertainties about the process, seeking legal advice can provide clarity and ensure compliance with state laws.

- Consult Local Laws: Each state may have specific regulations regarding donations. Familiarize yourself with Louisiana's laws to avoid any issues.

By following these key takeaways, individuals can effectively navigate the process of completing and utilizing the Louisiana Act of Donation form.

How to Use Louisiana act of donation

Completing the Louisiana Act of Donation form is an important step in transferring ownership of property or assets. Once you have the form ready, ensure you have all necessary information and documentation at hand. This will help streamline the process and ensure accuracy.

- Begin by downloading the Louisiana Act of Donation form from the appropriate state website or obtaining a physical copy from a local office.

- Carefully read through the instructions provided with the form to familiarize yourself with the requirements.

- Fill in the date at the top of the form. This is the date you are completing the donation.

- Provide the full name and address of the donor (the person giving the gift). Ensure all details are accurate.

- Next, enter the full name and address of the donee (the person receiving the gift). Double-check for any spelling errors.

- Describe the property or asset being donated. Include any relevant details, such as location, type, and value, if applicable.

- If there are any conditions or restrictions on the donation, clearly outline them in the designated section.

- Both the donor and donee should sign the form. Make sure that the signatures are dated as well.

- Consider having the form notarized, as this may add an extra layer of validation to the document.

- Once completed, make copies of the signed form for both the donor and donee for their records.

After filling out the form, it is advisable to keep a copy for your records. If notarization was performed, ensure that the notary's seal is visible and legible. You may need to file the form with the appropriate local government office, depending on the type of property being donated. Be sure to check local regulations for any additional steps that may be required.