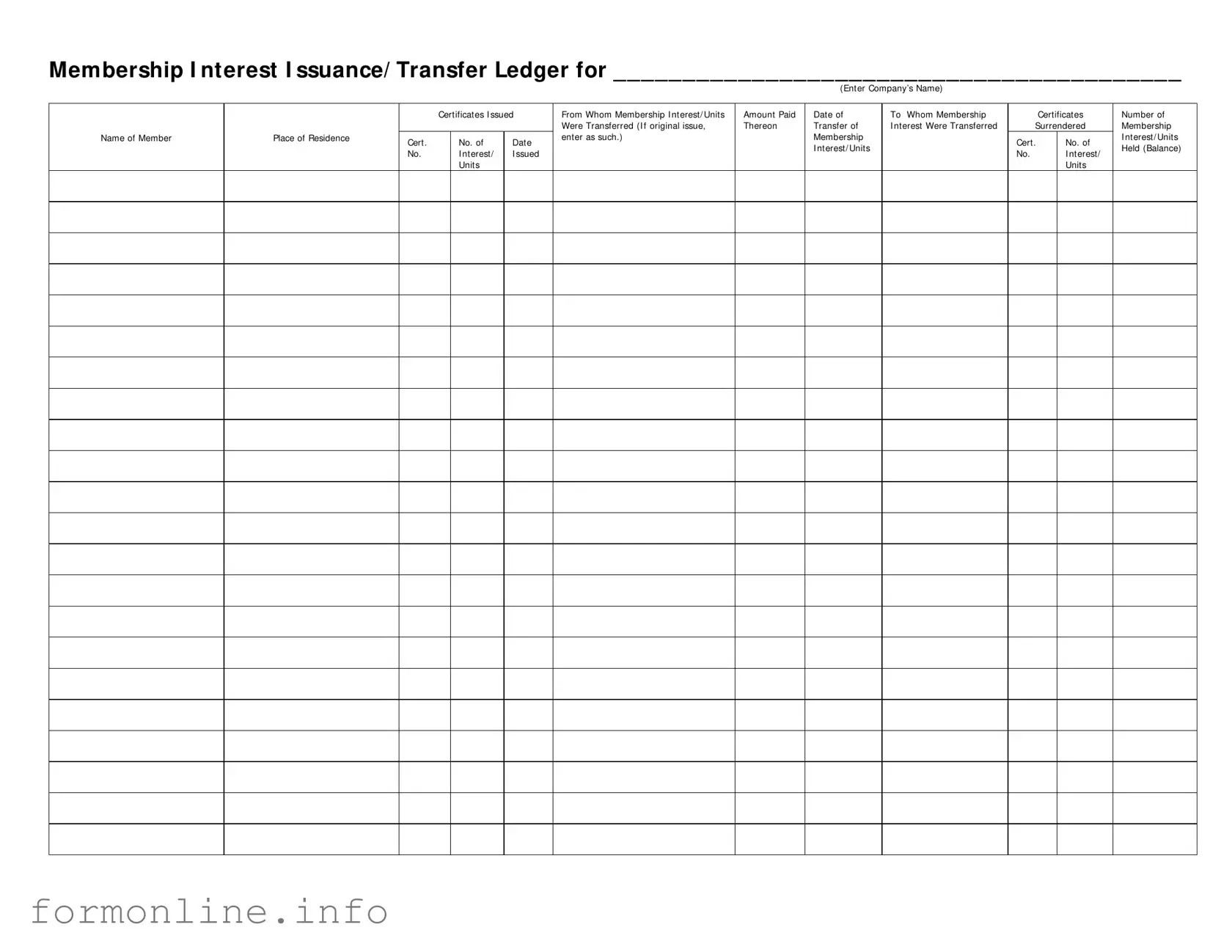

Fill Out a Valid Membership Ledger Form

The Membership Ledger form is a crucial document for tracking the issuance and transfer of membership interests within a company. It captures essential details such as the company’s name, the certificates issued, and the amount paid for each membership interest or unit. This form not only records the date of transfer but also identifies the parties involved—both the original issuer and the recipient of the membership interest. Accurate entries include the names of members, their places of residence, and the certificate numbers associated with each transaction. Furthermore, the ledger helps maintain clarity by documenting any certificates surrendered and the current balance of membership interests held. By ensuring this information is meticulously recorded, companies can uphold transparency and accountability in their membership transactions.

Common mistakes

-

Incomplete Company Name: Failing to provide the full name of the company can lead to confusion. Ensure that the company’s name is entered clearly in the designated space.

-

Missing Transfer Details: Omitting information about the transfer of membership interest can create issues. It is essential to include details such as the name of the member and the date of transfer.

-

Incorrect Certificate Numbers: Entering incorrect certificate numbers can complicate record-keeping. Double-check the certificate numbers for accuracy before submission.

-

Failure to Record Amount Paid: Not documenting the amount paid for membership interest can lead to discrepancies. Ensure that this information is included for all transactions.

-

Neglecting Place of Residence: Leaving out the place of residence for members may hinder communication. Always provide this information for each member listed.

-

Not Updating Balance: Failing to update the number of membership interest or units held can result in outdated records. Regularly check and update this information to reflect current holdings.

Preview - Membership Ledger Form

Membership I nt erest I ssuance/ Transfer Ledger for _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

(Enter Company’s Name)

|

|

|

Certificates I ssued |

From Whom Membership I nterest/ Units |

Amount Paid |

Date of |

To Whom Membership |

||

|

|

|

|

|

|

Were Transferred (I f original issue, |

Thereon |

Transfer of |

I nterest Were Transferred |

Name of Member |

Place of Residence |

Cert . |

|

No. of |

Date |

enter as such.) |

|

Membership |

|

|

|

|

|

|

I nterest/ Units |

|

|||

|

|

No. |

|

I nterest/ |

I ssued |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certificates

Surrendered

Cert . |

No. of |

No. |

I nterest/ |

|

Units |

|

|

Number of Membership

I nterest/ Units Held (Balance)

Other PDF Templates

Aoa Forms - The apartment number and rental price are specified for which the lease is applied.

Biopsychosocial Assessment Example - The Biopsychosocial Assessment serves as a foundational tool in tailoring individualized therapy approaches for effective treatment.

The Texas Mobile Home Bill of Sale is a vital legal document that simplifies the process of transferring ownership of a mobile home. It provides a clear framework by detailing important information such as the buyer's and seller's names, the specifications of the mobile home, and the agreed sale price. To ensure a seamless transaction and safeguard the interests of both parties, it is essential to comprehend the significance of this document, often referred to as a Mobile Home Bill of Sale.

Hvac Job Application - Share your experience with parts and accessories related to HVAC/R systems.

Documents used along the form

The Membership Ledger form is an essential document for tracking membership interests and transfers. Alongside this form, several other documents are commonly used to ensure accurate record-keeping and compliance. Below is a list of these documents with brief descriptions of each.

- Membership Application Form: This form collects essential information from individuals seeking membership. It includes personal details, contact information, and any required qualifications.

- Transfer Request Form: Members use this form to request the transfer of their membership interests to another party. It includes details about the current member, the new member, and the interests being transferred.

- Certificate of Membership: This document serves as proof of membership. It contains the member's name, membership number, and the date of issue.

- Meeting Minutes: This record documents the discussions and decisions made during membership meetings. It includes approvals for transfers and other significant actions related to membership interests.

- Membership Interest Agreement: This agreement outlines the rights and responsibilities of members concerning their interests. It details how interests can be transferred and any restrictions that may apply.

- Financial Statements: These documents provide a summary of the organization’s financial status. They may include information relevant to members, such as profit distributions or assessments.

- Motor Vehicle Bill of Sale: This form is essential for validating the transfer of ownership of a motor vehicle from a seller to a buyer in Pennsylvania. It includes critical details about the vehicle and ensures a legal record of the transaction, similar to how the autobillofsaleform.com/pennsylvania-motor-vehicle-bill-of-sale-form facilitates proper documentation.

- Membership Termination Notice: This notice is used to formally inform a member of the termination of their membership. It outlines the reasons for termination and any relevant procedures.

- Annual Membership Renewal Form: Members complete this form to renew their membership each year. It typically includes updated personal information and payment details for renewal fees.

Each of these documents plays a vital role in managing membership interests effectively. Proper use and maintenance of these forms help ensure transparency and compliance within the organization.

Similar forms

The Membership Interest Issuance/Transfer Ledger is similar to a stock transfer ledger. Both documents track the ownership and transfer of interests or shares within a company. A stock transfer ledger records the names of shareholders, the number of shares they own, and any changes in ownership over time. This ensures accurate documentation of who holds what within the company, similar to how the Membership Ledger keeps track of membership interests and their transfers.

Another comparable document is the partnership interest ledger. This ledger serves a similar purpose for partnerships, detailing each partner's ownership percentage and any transfers of that interest. Like the Membership Ledger, it provides a clear record of who owns what and when changes occur, which is essential for maintaining transparency and accountability among partners.

The ST-12B Georgia form serves as a valuable tool in ensuring that individuals and businesses can efficiently reclaim overpaid sales tax, much like the Membership Ledger that documents ownership stakes. Accurate completion of the ST-12B requires detailed information about the purchaser, the dealer, and the transaction, paralleling the meticulous records maintained in the Membership Ledger. For those interested in learning more, additional resources are available at georgiapdf.com/.

The membership register is also akin to the Membership Ledger. This document contains a list of all current members of an organization, along with details about their membership status. It records when members join, leave, or transfer their interests, making it a crucial tool for managing membership and ensuring that all information is up to date, just as the Membership Ledger does for membership interests.

A capital contributions ledger shares similarities with the Membership Ledger as well. It tracks the financial contributions made by members or shareholders in exchange for their interests. This document is essential for understanding the financial commitment of each member, paralleling how the Membership Ledger documents the amount paid for membership interests and any changes in ownership.

The certificate of membership is another document that relates closely to the Membership Ledger. This certificate serves as proof of membership in an organization, often including details such as the member's name and the number of interests held. While the Membership Ledger tracks the transfers and balances, the certificate provides tangible evidence of membership, reinforcing the ownership recorded in the ledger.

A shareholder agreement can also be seen as similar to the Membership Ledger. This agreement outlines the rights and responsibilities of members or shareholders, including how interests can be transferred. While the Membership Ledger documents these transfers, the shareholder agreement sets the rules and conditions under which they can occur, ensuring that all parties are aware of their obligations.

Lastly, a company’s bylaws can be compared to the Membership Ledger. Bylaws establish the rules governing the management of a company, including how membership interests are issued and transferred. While the Membership Ledger records specific transactions, the bylaws provide the framework within which those transactions take place, ensuring that all actions are compliant with the organization's established policies.

Dos and Don'ts

When filling out the Membership Ledger form, it's important to follow certain guidelines to ensure accuracy and clarity. Here are seven things to do and avoid:

- Do enter the company's name clearly at the top of the form.

- Do provide complete details for each membership interest or unit being issued or transferred.

- Do include the correct amount paid for each membership interest or unit.

- Do date each entry accurately to maintain a clear record.

- Don't leave any sections blank; every part of the form needs to be filled out.

- Don't use abbreviations or shorthand that could lead to confusion.

- Don't forget to check for typos or errors before submitting the form.

By adhering to these guidelines, you can help ensure that the Membership Ledger is filled out correctly and efficiently. This attention to detail will benefit all parties involved.

Key takeaways

When filling out and utilizing the Membership Ledger form, several key points should be kept in mind to ensure accuracy and compliance.

- The form requires the company's name to be clearly entered at the top, ensuring proper identification of the entity involved.

- Each certificate issued must be documented with the name of the member receiving the membership interest or units.

- It is essential to record the amount paid for each membership interest or unit issued, as this reflects the financial transaction.

- The date of issuance should be noted, providing a timeline for membership interests.

- For transfers, clearly indicate the name of the member to whom the membership interest or units are being transferred.

- In cases of original issues, specify that the interests were transferred by entering "original issue" in the appropriate section.

- Keep track of the certificates surrendered when memberships are transferred, as this is crucial for maintaining accurate records.

- Finally, always update the balance of membership interests or units held, ensuring that records reflect the current status.

How to Use Membership Ledger

Filling out the Membership Ledger form is a straightforward process. This form helps keep track of membership interests and transfers. Make sure to have all necessary information ready before you start.

- At the top of the form, enter the Company’s Name in the designated space.

- In the first section, list the Certificates Issued. Write down the details of the membership interest or units that have been issued.

- Next, fill in the From Whom field. This is where you note the name of the person or entity that originally issued the membership interest.

- In the Amount Paid section, indicate the total amount that was paid for the membership interest or units.

- Record the Date of Transfer in the appropriate field. This is the date when the transfer occurred.

- In the To Whom section, write the name of the person or entity to whom the membership interest was transferred.

- If applicable, indicate the Name of Member in the next field.

- Fill in the Place of Residence for the member.

- In the Cert. No. field, write the certificate number of the membership interest that was issued.

- Continue to the section regarding Membership Interest/Units Surrendered. List any certificates that have been surrendered.

- In the Cert. No. field for surrendered units, write the corresponding certificate numbers.

- Finally, indicate the Number of Membership Interest/Units Held to show the balance after all transactions.