Fill Out a Valid Michigan Property Transfer Affidavit 2766 Form

The Michigan Property Transfer Affidavit 2766 form plays a crucial role in the real estate transaction process within the state of Michigan. This form is required when property ownership changes hands, whether through sale, gift, or inheritance. It serves as a formal declaration of the property’s transfer, providing essential information about the property and the parties involved. Key details such as the property’s assessed value, the sale price, and the names of the buyer and seller must be included. The affidavit helps ensure that property taxes are accurately assessed based on the new ownership and any changes in property value. Moreover, it is important to file this form with the local assessor’s office within a specific timeframe to avoid potential penalties. Understanding the nuances of this form can significantly ease the transition of property ownership and help maintain compliance with local regulations.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details on the form. Missing information can lead to delays in processing and potential issues with property tax assessments.

-

Incorrect Property Description: Some people mistakenly enter the wrong legal description or address of the property. This error can create confusion and complicate future transactions.

-

Failure to Sign: A common oversight is neglecting to sign the affidavit. Without a signature, the form is considered invalid and cannot be processed.

-

Not Notifying the Assessor: After completing the form, individuals often forget to submit it to the local assessor's office. This step is crucial for updating property records and ensuring accurate tax assessments.

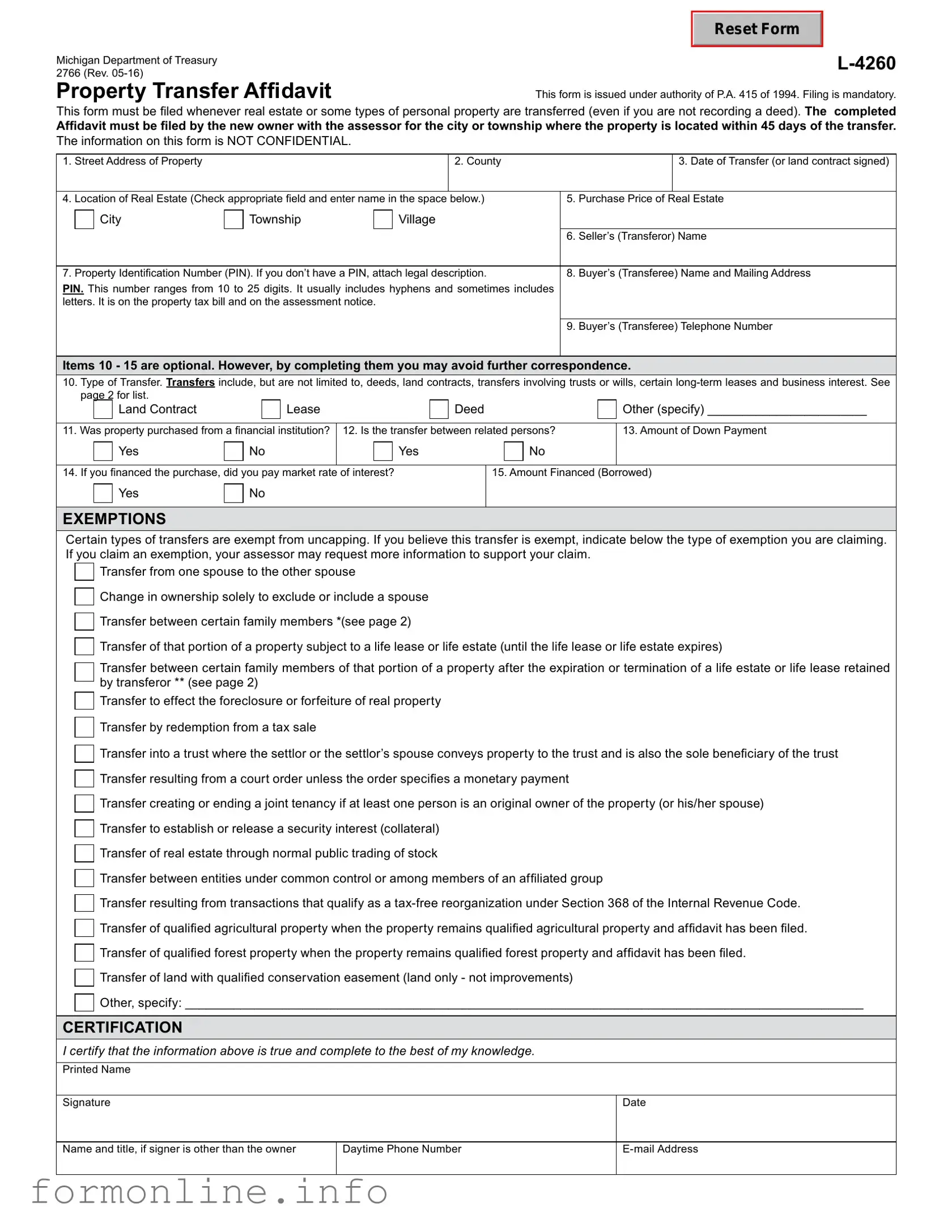

Preview - Michigan Property Transfer Affidavit 2766 Form

Reset Form

This form is issued under authority of P.A. 415 of 1994. Filing is mandatory.

This form must be filed whenever real estate or some types of personal property are transferred (even if you are not recording a deed). The completed

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

1. |

Street Address of Property |

|

|

|

|

2. County |

|

|

3. Date of Transfer (or land contract signed) |

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Location of Real Estate (Check appropriate field and enter name in the space |

below.) |

5. |

Purchase Price of |

Real Estate |

|||||

|

|

City |

|

Township |

|

Village |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

6. |

Seller’s (Transferor) Name |

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Property Identification Number (PIN). If you don’t have a PIN, attach legal description. |

8. |

Buyer’s (Transferee) Name and Mailing Address |

|||||||

PIN. This number ranges from 10 to 25 digits. It usually includes hyphens and sometimes includes |

|

|

|

|||||||

letters. It is on the property tax bill and on the assessment notice. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Buyer’s (Transferee) Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

Items 10 - 15 are optional. However, by completing them you may avoid further correspondence.

10.Type of Transfer. Transfers include, but are not limited to, deeds, land contracts, transfers involving trusts or wills, certain

|

|

Land Contract |

|

|

|

Lease |

|

|

|

|

Deed |

|

Other (specify) _______________________ |

|||

|

|

|

|

|

||||||||||||

11. Was property purchased from a financial institution? |

12. Is the transfer between related persons? |

|

13. Amount of Down Payment |

|||||||||||||

|

|

Yes |

|

No |

|

|

Yes |

|

|

|

|

No |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||||||

14. If you financed the purchase, did you pay market rate |

of interest? |

|

|

15. Amount Financed (Borrowed) |

||||||||||||

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXEMPTIONS

Certain types of transfers are exempt from uncapping. If you believe this transfer is exempt, indicate below the type of exemption you are claiming. If you claim an exemption, your assessor may request more information to support your claim.

Transfer from one spouse to the other spouse

Change in ownership solely to exclude or include a spouse

Transfer between certain family members *(see page 2)

Transfer of that portion of a property subject to a life lease or life estate (until the life lease or life estate expires)

Transfer between certain family members of that portion of a property after the expiration or termination of a life estate or life lease retained by transferor ** (see page 2)

Transfer to effect the foreclosure or forfeiture of real property

Transfer by redemption from a tax sale

Transfer into a trust where the settlor or the settlor’s spouse conveys property to the trust and is also the sole beneficiary of the trust Transfer resulting from a court order unless the order specifies a monetary payment

Transfer creating or ending a joint tenancy if at least one person is an original owner of the property (or his/her spouse)

Transfer to establish or release a security interest (collateral)

Transfer of real estate through normal public trading of stock

Transfer between entities under common control or among members of an affiliated group

Transfer resulting from transactions that qualify as a

Transfer of land with qualified conservation easement (land only - not improvements)

Other, specify: __________________________________________________________________________________________________

CErTIfICaTION

I certify that the information above is true and complete to the best of my knowledge.

Printed Name

Signature

Date

Name and title, if signer is other than the owner

Daytime Phone Number

2766, Page 2

Instructions:

This form must be filed when there is a transfer of real property or one of the following types of personal property:

•Buildings on leased land.

•Leasehold improvements, as defined in MCL Section 211.8(h).

•Leasehold estates, as defined in MCL Section 211.8(i) and (j).

Transfer of ownership means the conveyance of title to or a present interest in property, including the beneficial use of the property. For complete descriptions of qualifying transfers, please refer to MCL Section

Excerpts from Michigan Compiled Laws (MCL), Chapter 211

**Section 211.27a(7)(d): Beginning December 31, 2014, a transfer of that portion of residential real property that had been subject to a life estate or life lease retained by the transferor resulting from expiration or termination of that life estate or life lease, if the transferee is the transferor’s or transferor’s spouse’s mother, father, brother, sister, son, daughter, adopted son, adopted daughter, grandson, or granddaughter and the residential real property is not used for any commercial purpose following the transfer. Upon request by the department of treasury or the assessor, the transferee shall furnish proof within 30 days that the transferee meets the requirements of this subdivision. If a transferee fails to comply with a request by the department of treasury or assessor under this subdivision, that transferee is subject to a fine of $200.00.

*Section 211.27a(7)(u): Beginning December 31, 2014, a transfer of residential real property if the transferee is the transferor’s or the transferor’s spouse’s mother, father, brother, sister, son, daughter, adopted son, adopted daughter, grandson, or granddaughter and the residential real property is not used for any commercial purpose following the conveyance. Upon request by the department of treasury or the assessor, the transferee shall furnish proof within 30 days that the transferee meets the requirements of this subparagraph. If a transferee fails to comply with a request by the department of treasury or assessor under this subparagraph, that transferee is subject to a fine of $200.00.

Section 211.27a(10): “... the buyer, grantee, or other transferee of the property shall notify the appropriate assessing office in the local unit of government in which the property is located of the transfer of ownership of the property within 45 days of the transfer of ownership, on a form prescribed by the state tax commission that states the parties to the transfer, the date of the transfer, the actual consideration for the transfer, and the property’s parcel identification number or legal description.”

Section 211.27(5): “Except as otherwise provided in subsection (6), the purchase price paid in a transfer of property is not the presumptive true cash value of the property transferred. In determining the true cash value of transferred property, an assessing officer shall assess that property using the same valuation method used to value all other property of that same classification in the assessing jurisdiction.”

Penalties:

Section 211.27b(1): “If the buyer, grantee, or other transferee in the immediately preceding transfer of ownership of property does not notify the appropriate assessing office as required by section 27a(10), the property’s taxable value shall be adjusted under section 27a(3) and all of the following shall be levied:

(a)Any additional taxes that would have been levied if the transfer of ownership had been recorded as required under this act from the date of transfer.

(b)Interest and penalty from the date the tax would have been originally levied.

(c)For property classified under section 34c as either industrial real property or commercial real property, a penalty in the following amount:

(i)Except as otherwise provided in subparagraph (ii), if the sale price of the property transferred is $100,000,000.00 or less, $20.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $1,000.00.

(ii)If the sale price of the property transferred is more than $100,000,000.00, $20,000.00 after the 45 days have elapsed.

(d)For real property other than real property classified under section 34c as industrial real property or commercial real property, a penalty of $5.00 per day for each separate failure beginning after the 45 days have elapsed, up to a maximum of $200.00.

Other PDF Templates

Social Security Pdf - The SSA SS-5 form is integral for tracking your earnings history.

How to Get Employment Verification Letter - This form must be handled confidentially due to sensitive information involved.

When purchasing a motorcycle, it is crucial to have a proper record of the transaction to avoid any disputes in the future. The New York Motorcycle Bill of Sale form fulfills this need by capturing vital information such as the buyer and seller details along with the motorcycle's specifics. For those looking to obtain a reliable and legally recognized document, more information can be found at autobillofsaleform.com/motorcycle-bill-of-sale-form/new-york-motorcycle-bill-of-sale-form/, ensuring a smooth transfer of ownership that protects both parties involved.

How to Count Down a Register - Provides a snapshot of available cash for operations.

Documents used along the form

When transferring property in Michigan, the Property Transfer Affidavit 2766 form is a crucial document. However, it is often accompanied by other forms and documents that help facilitate a smooth transaction. Here are four commonly used documents that may accompany the Property Transfer Affidavit.

- Deed: This legal document officially conveys ownership of the property from the seller to the buyer. It includes details such as the names of the parties involved, a description of the property, and any conditions of the transfer.

- General Power of Attorney: This document allows an individual to act on behalf of another party regarding various decisions, including financial and legal matters. For more information on this form, visit https://georgiapdf.com/.

- Title Insurance Policy: This document protects the buyer and lender from potential disputes over property ownership. It ensures that the title is clear of any liens or claims that could affect ownership rights.

- Property Survey: A survey outlines the boundaries of the property and identifies any easements or encroachments. This document is essential for confirming the exact dimensions and layout of the property being transferred.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document details all financial aspects of the transaction. It includes the purchase price, closing costs, and any adjustments made between the buyer and seller.

Understanding these documents can significantly simplify the property transfer process. Each plays a vital role in ensuring that the transaction is clear, fair, and legally binding. Being prepared with the right paperwork can make all the difference in a smooth property transfer experience.

Similar forms

The Michigan Property Transfer Affidavit 2766 form is similar to the IRS Form 1099-S, which is used to report the sale or exchange of real estate. Both documents serve to provide important information regarding property transactions. While the Michigan Property Transfer Affidavit focuses on the transfer of ownership and the details surrounding it, the 1099-S is concerned with reporting the proceeds from the sale to the IRS. This ensures that the federal government is informed about any capital gains that may arise from the transaction, thus establishing a clear link between state and federal reporting requirements.

In addition to the various property-related documents, parents considering homeschooling in Virginia need to be aware of the Homeschool Letter of Intent, which acts as a formal notification to the local school division regarding their intention to provide education outside traditional schools. This document is crucial in ensuring a smooth transition into the homeschooling framework, similar to how property transfer documents facilitate clarity and transparency in real estate transactions.

Another document that shares similarities with the Michigan Property Transfer Affidavit is the Quit Claim Deed. This deed is often utilized in property transfers to convey ownership from one party to another without guaranteeing the title. While the Quit Claim Deed itself is a legal instrument that affects the title, it must be accompanied by the Michigan Property Transfer Affidavit to comply with state regulations. Both documents are essential for a seamless transfer of property ownership, ensuring that all parties are aware of their rights and responsibilities.

The Certificate of Title is another document that parallels the Michigan Property Transfer Affidavit. This certificate serves as evidence of a person's legal ownership of a property. While the Property Transfer Affidavit provides details about the transfer process, the Certificate of Title confirms that the property has been legally conveyed. Both documents work together to protect the interests of buyers and sellers, ensuring that ownership is clearly established and documented.

The Warranty Deed also shares characteristics with the Michigan Property Transfer Affidavit. This type of deed guarantees that the seller holds clear title to the property and has the right to sell it. When a Warranty Deed is executed, it typically accompanies the Property Transfer Affidavit to provide a complete picture of the transaction. Both documents help to ensure that the transfer is legitimate and that the buyer is receiving a property free from undisclosed encumbrances.

In addition, the Affidavit of Value is a document that complements the Michigan Property Transfer Affidavit. This affidavit is often required to accompany property transfers to disclose the value of the property being transferred. Similar to the Property Transfer Affidavit, the Affidavit of Value helps to establish a fair market value for tax purposes. By providing this information, both documents contribute to accurate property assessments and ensure compliance with local regulations.

Finally, the Deed of Trust is akin to the Michigan Property Transfer Affidavit in that it involves the transfer of property rights. This document is used primarily in financing transactions, where the property serves as collateral for a loan. While the Deed of Trust outlines the lender's rights, the Property Transfer Affidavit focuses on the ownership transfer. Both documents are crucial in real estate transactions, ensuring that all parties understand their obligations and rights in the context of property ownership and financing.

Dos and Don'ts

When filling out the Michigan Property Transfer Affidavit 2766 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do read the instructions carefully before starting the form.

- Do provide accurate information about the property and the transfer.

- Do sign and date the affidavit where required.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use white-out or erase any mistakes on the form.

- Don't submit the form after the deadline.

- Don't forget to check for any local requirements that may apply.

Key takeaways

When dealing with property transactions in Michigan, understanding the Property Transfer Affidavit 2766 form is essential. Here are some key takeaways to keep in mind:

- Purpose of the Form: The Michigan Property Transfer Affidavit 2766 is used to report the transfer of property ownership and is crucial for assessing property taxes.

- Who Must File: The seller or transferor of the property is typically responsible for completing and filing this form.

- Filing Timeline: It’s important to file the affidavit within 45 days of the property transfer to ensure compliance with state regulations.

- Information Required: The form requires details such as the property’s address, the names of the buyer and seller, and the sale price.

- Signature Requirement: Both the buyer and seller must sign the affidavit to validate the information provided.

- Impact on Taxes: Filing the affidavit can affect the property tax assessment, potentially leading to a reassessment based on the sale price.

- Accessibility: The form can be obtained online or from local government offices, making it relatively easy to access.

- Record Keeping: Keep a copy of the completed form for your records, as it may be needed for future reference or disputes.

- Local Variations: Some municipalities may have additional requirements, so it’s wise to check local regulations.

- Seek Assistance: If you have questions or need help, consider consulting a real estate professional or legal advisor.

Understanding these key points can simplify the process of filling out and using the Michigan Property Transfer Affidavit 2766 form, ensuring a smoother property transfer experience.

How to Use Michigan Property Transfer Affidavit 2766

Filling out the Michigan Property Transfer Affidavit 2766 form is an important step in the property transfer process. Once completed, this form helps ensure that the property records are accurate and up to date. You will need to provide specific information about the property and the parties involved in the transfer. Below are the steps to guide you through the process of filling out the form.

- Obtain a copy of the Michigan Property Transfer Affidavit 2766 form. You can download it from the Michigan Department of Treasury website or request a physical copy from your local government office.

- Begin with the property information section. Fill in the property address, including the city, state, and zip code. Make sure this information is accurate, as it identifies the property in question.

- Provide the parcel number. This is a unique identifier for the property, which can usually be found on your property tax statement or local tax records.

- Enter the names of the parties involved in the transfer. This includes both the seller and the buyer. Make sure to include full legal names as they appear on official documents.

- Indicate the type of transfer. Check the appropriate box that describes the nature of the transfer, such as a sale, gift, or inheritance.

- Complete the section detailing the consideration. This refers to the amount of money or value exchanged for the property. If the transfer is a gift, indicate that accordingly.

- Fill out the section on exemptions, if applicable. If the transfer qualifies for any exemptions from property transfer taxes, provide the necessary details.

- Sign and date the form. Both parties involved in the transaction must sign, confirming that the information provided is accurate and complete.

- Submit the completed form to your local county register of deeds office. This is typically done in person or by mail. Be sure to keep a copy for your records.