Printable Mobile Home Purchase Agreement Form

The Mobile Home Purchase Agreement form serves as a crucial document in the process of buying or selling a mobile home. This agreement outlines the terms and conditions agreed upon by both the buyer and the seller. Key components typically include the purchase price, payment terms, and details about the mobile home itself, such as its make, model, and identification number. Additionally, the form often addresses contingencies, which are conditions that must be met for the sale to proceed. It may also specify the responsibilities of each party, including any repairs or inspections that need to be conducted before the sale is finalized. Understanding these elements can help ensure a smooth transaction and protect the interests of both parties involved.

Common mistakes

-

Incomplete Information: Many buyers fail to fill out all required fields. Missing details can lead to delays or even void the agreement.

-

Incorrect Property Description: It's crucial to accurately describe the mobile home. Errors in the address or model number can create legal issues down the line.

-

Neglecting to Include Contingencies: Buyers often forget to add contingencies, such as financing or inspection clauses. This oversight can leave them unprotected.

-

Not Reviewing Terms and Conditions: Some individuals skim through terms without understanding them. This can result in accepting unfavorable conditions.

-

Forgetting Signatures: It’s easy to overlook signatures from all parties involved. An unsigned agreement is not legally binding.

-

Ignoring Local Laws: Failing to consider local regulations regarding mobile home sales can lead to compliance issues. Always check local laws before finalizing the agreement.

-

Not Keeping Copies: After signing, some buyers do not make copies of the agreement. Keeping a record is essential for future reference.

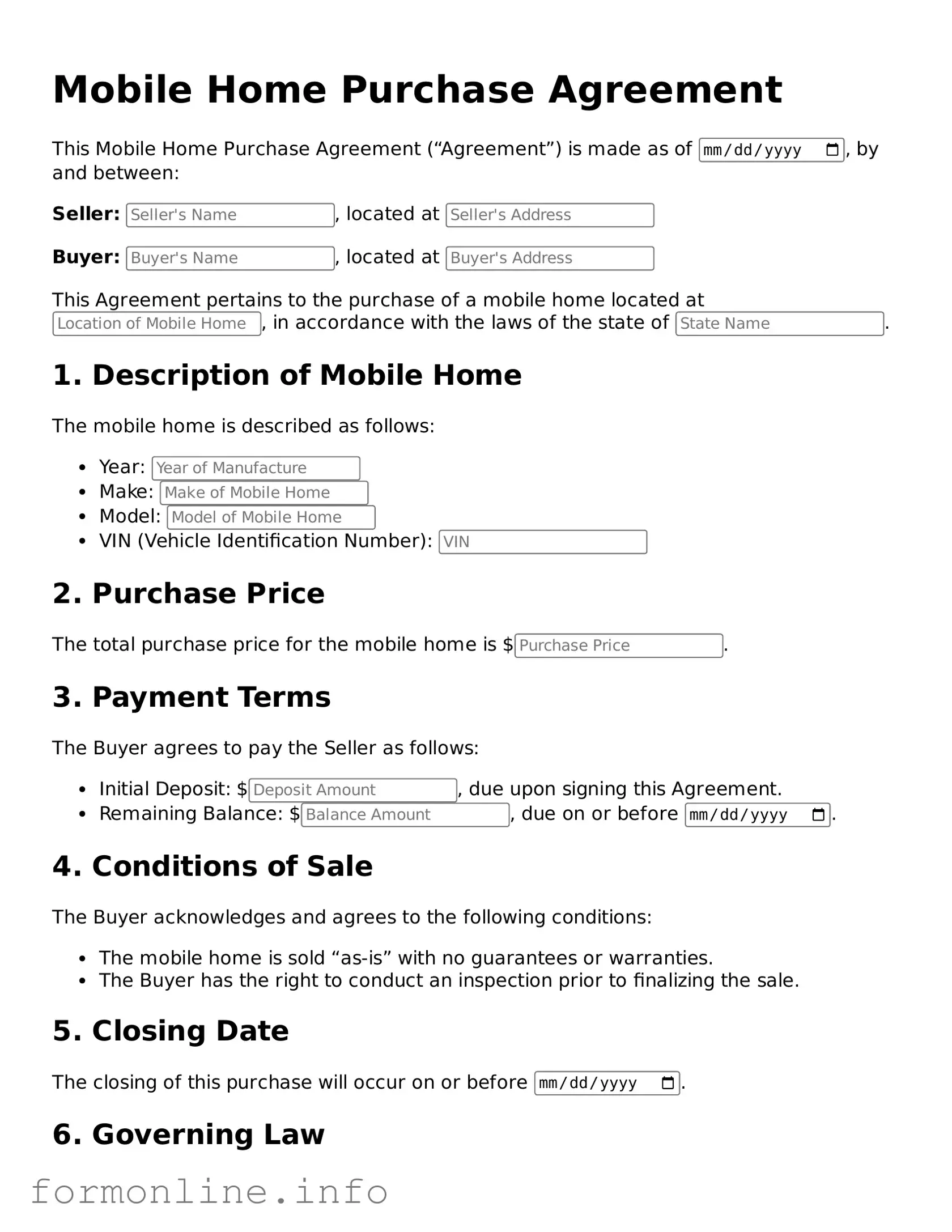

Preview - Mobile Home Purchase Agreement Form

Mobile Home Purchase Agreement

This Mobile Home Purchase Agreement (“Agreement”) is made as of , by and between:

Seller: , located at

Buyer: , located at

This Agreement pertains to the purchase of a mobile home located at , in accordance with the laws of the state of .

1. Description of Mobile Home

The mobile home is described as follows:

- Year:

- Make:

- Model:

- VIN (Vehicle Identification Number):

2. Purchase Price

The total purchase price for the mobile home is $.

3. Payment Terms

The Buyer agrees to pay the Seller as follows:

- Initial Deposit: $, due upon signing this Agreement.

- Remaining Balance: $, due on or before .

4. Conditions of Sale

The Buyer acknowledges and agrees to the following conditions:

- The mobile home is sold “as-is” with no guarantees or warranties.

- The Buyer has the right to conduct an inspection prior to finalizing the sale.

5. Closing Date

The closing of this purchase will occur on or before .

6. Governing Law

This Agreement shall be governed by the laws of the state of .

7. Signatures

Both parties sign below to confirm their agreement to the terms and conditions specified herein:

Seller's Signature: _____________________ Date:

Buyer's Signature: _____________________ Date:

Common Forms:

Dos 1246 - The form identifies mandatory training requirements that must be completed prior to renewal submission.

A General Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from a seller to a buyer. It acts as proof of purchase and indicates that the seller has transferred all rights to the property to the buyer. This form is crucial for both parties for documentation purposes and legal protections in the transaction. For those interested in using this form, you can download the document in pdf.

Hurt Feelings Report - This is for those who feel hurt easily.

Documents used along the form

The Mobile Home Purchase Agreement is a crucial document in the process of buying a mobile home. However, several other forms and documents are often utilized alongside it to ensure a smooth transaction and protect the interests of all parties involved. Below is a list of these additional documents.

- Bill of Sale: This document serves as proof of the transfer of ownership from the seller to the buyer. It includes details about the mobile home, such as the make, model, and identification number.

- Power of Attorney for a Child: In situations where parents need to temporarily delegate decision-making authority for their child, a Power of Attorney is essential. For more information, visit georgiapdf.com.

- Title Transfer Form: This form is necessary to officially transfer the title of the mobile home from the seller to the buyer. It must be filed with the appropriate state agency to update ownership records.

- Financing Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan, including interest rates, payment schedules, and any collateral involved.

- Disclosure Statement: This document provides important information about the condition of the mobile home. It may include details about repairs, past damages, or any known issues that could affect the buyer's decision.

These documents play a vital role in the mobile home purchasing process. They help clarify the responsibilities and rights of both the buyer and the seller, contributing to a more secure and informed transaction.

Similar forms

The Mobile Home Purchase Agreement is similar to a Residential Purchase Agreement. Both documents outline the terms and conditions under which a buyer agrees to purchase a property. They detail the purchase price, financing arrangements, and any contingencies that must be met before the sale can be finalized. Just as with mobile homes, residential agreements protect both the buyer and seller by clearly stating their rights and obligations throughout the transaction process.

When engaging in the purchase of a mobile home, it is essential to understand the various legal documents involved, including the Mobile Home Bill of Sale, which serves as a vital component in the transfer of ownership process. This document ensures that both the buyer and seller have a clear and mutual understanding of the sale, detailing important information such as the mobile home's identification, the agreed sale price, and the parties involved in the transaction.

Another document that shares similarities is the Lease Agreement. While primarily used for rental situations, a Lease Agreement can include terms for purchasing the property at a later date. Both documents address the duration of the agreement, payment terms, and maintenance responsibilities. They ensure that all parties understand their commitments, whether for a temporary lease or a long-term purchase.

The Purchase and Sale Agreement is also akin to the Mobile Home Purchase Agreement. This document is used in various real estate transactions and contains similar elements, including the identification of the buyer and seller, property description, and the agreed-upon price. It serves as a legally binding contract that facilitates the transfer of ownership, much like the mobile home agreement.

A Real Estate Option Agreement is another related document. This agreement gives a buyer the exclusive right to purchase a property within a specified timeframe. Like the Mobile Home Purchase Agreement, it outlines the purchase price and any terms related to the sale. Both documents protect the interests of the buyer while providing sellers with a clear understanding of their obligations.

The Land Contract, or Contract for Deed, is similar as well. This document allows a buyer to purchase a property by making installment payments over time while the seller retains legal title until the full purchase price is paid. Both agreements detail payment terms, interest rates, and responsibilities for property maintenance, ensuring clarity for both parties involved.

The Bill of Sale is another document that shares common features. While it is typically used for personal property transactions, it can also be relevant in mobile home purchases. A Bill of Sale provides proof of the transfer of ownership and outlines the details of the transaction, such as the purchase price and description of the item. Both documents serve to formalize the sale and protect the interests of the buyer and seller.

The Closing Disclosure is also related to the Mobile Home Purchase Agreement. This document provides a detailed account of the final terms of the loan and closing costs. While it is more focused on financing, it complements the Mobile Home Purchase Agreement by ensuring that buyers are fully informed about the financial aspects of their purchase. Both documents aim to promote transparency and understanding in the transaction process.

Lastly, the Financing Agreement is akin to the Mobile Home Purchase Agreement. This document outlines the terms of any loans or financing arrangements made to facilitate the purchase. It includes details about interest rates, payment schedules, and consequences of default. Like the Mobile Home Purchase Agreement, it is designed to protect the interests of both the buyer and the lender, ensuring that all parties are aware of their financial commitments.

Dos and Don'ts

When filling out a Mobile Home Purchase Agreement form, it's crucial to approach the task with care. Here are some essential dos and don'ts to consider:

- Do: Read the entire agreement thoroughly before signing to ensure you understand all terms and conditions.

- Do: Provide accurate and complete information about the mobile home, including its make, model, and serial number.

- Do: Keep a copy of the signed agreement for your records, as it serves as a legal document of the transaction.

- Do: Consult with a legal expert if you have any questions or concerns about the agreement.

- Don't: Rush through the form. Take your time to avoid mistakes that could lead to complications later.

- Don't: Leave any sections blank. Incomplete forms may lead to misunderstandings or disputes.

- Don't: Ignore any contingencies or special conditions that may be included in the agreement.

- Don't: Sign the agreement without ensuring that all parties involved have agreed to the terms.

Key takeaways

When filling out and using the Mobile Home Purchase Agreement form, keep these key takeaways in mind:

- Understand the Basics: Familiarize yourself with the main components of the agreement, including buyer and seller information, property details, and purchase price.

- Accurate Information: Ensure all information is accurate. Mistakes can lead to complications during the sale.

- Contingencies: Include any contingencies, such as financing or inspections, that must be met before the sale is finalized.

- Signatures Required: Both the buyer and seller must sign the agreement for it to be legally binding.

- Review Local Laws: Check local regulations regarding mobile home sales, as they can vary by state.

- Keep Copies: After signing, both parties should keep a copy of the agreement for their records.

- Seek Legal Advice: If unsure about any part of the agreement, consider consulting a legal expert to avoid potential issues.

- Use Clear Language: Write in clear and straightforward language to prevent misunderstandings about the terms of the sale.

How to Use Mobile Home Purchase Agreement

After obtaining the Mobile Home Purchase Agreement form, you will need to complete it accurately to ensure a smooth transaction. Follow the steps below to fill out the form correctly.

- Read the form carefully. Familiarize yourself with all sections before filling it out.

- Enter the date. Write the current date at the top of the form.

- Provide seller information. Fill in the seller’s full name, address, and contact information.

- Provide buyer information. Enter the buyer’s full name, address, and contact information.

- Describe the mobile home. Include details such as make, model, year, and VIN (Vehicle Identification Number).

- State the purchase price. Clearly write the agreed-upon price for the mobile home.

- Outline payment terms. Specify how the payment will be made, including any deposit and financing details.

- Include contingencies. If applicable, list any conditions that must be met before the sale is finalized.

- Sign the agreement. Both the buyer and seller should sign and date the document at the bottom.

Once you have completed the form, ensure that both parties retain a copy for their records. This agreement serves as a crucial document in the mobile home purchasing process.