Printable Mortgage Lien Release Form

The Mortgage Lien Release form is a crucial document that signifies the conclusion of a mortgage agreement between a borrower and a lender. Once the borrower has fulfilled all financial obligations, including the repayment of the loan, this form serves as official proof that the lender relinquishes their claim on the property. It is essential for homeowners to obtain this release to clear the title of their property, allowing them to sell, refinance, or transfer ownership without any encumbrances. The form typically includes details such as the property address, loan number, and the names of both the borrower and lender. Additionally, it may require notarization to ensure authenticity. Understanding the importance of this document can empower homeowners to navigate their financial responsibilities confidently, ultimately leading to peace of mind and a clear path forward in their property ownership journey.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. This includes not filling out the borrower’s name, the lender’s name, or the property address. Each section must be completed accurately to avoid delays.

-

Incorrect Signatures: Signatures must match the names on the form. If a borrower or lender’s signature is missing or does not correspond with their legal name, the form may be rejected.

-

Not Notarizing the Form: Many states require that the Mortgage Lien Release form be notarized. Failing to have the document notarized can lead to complications in the release process.

-

Missing Dates: Dates are crucial in legal documents. Omitting the date of signing or the date of the mortgage release can create confusion and may invalidate the form.

-

Failure to Submit to the Correct Authority: After completing the form, it must be submitted to the appropriate county recorder's office. Sending it to the wrong office can result in delays or rejection.

-

Not Keeping Copies: After submission, individuals should retain copies of the completed form and any correspondence. This can provide proof of the lien release if any issues arise in the future.

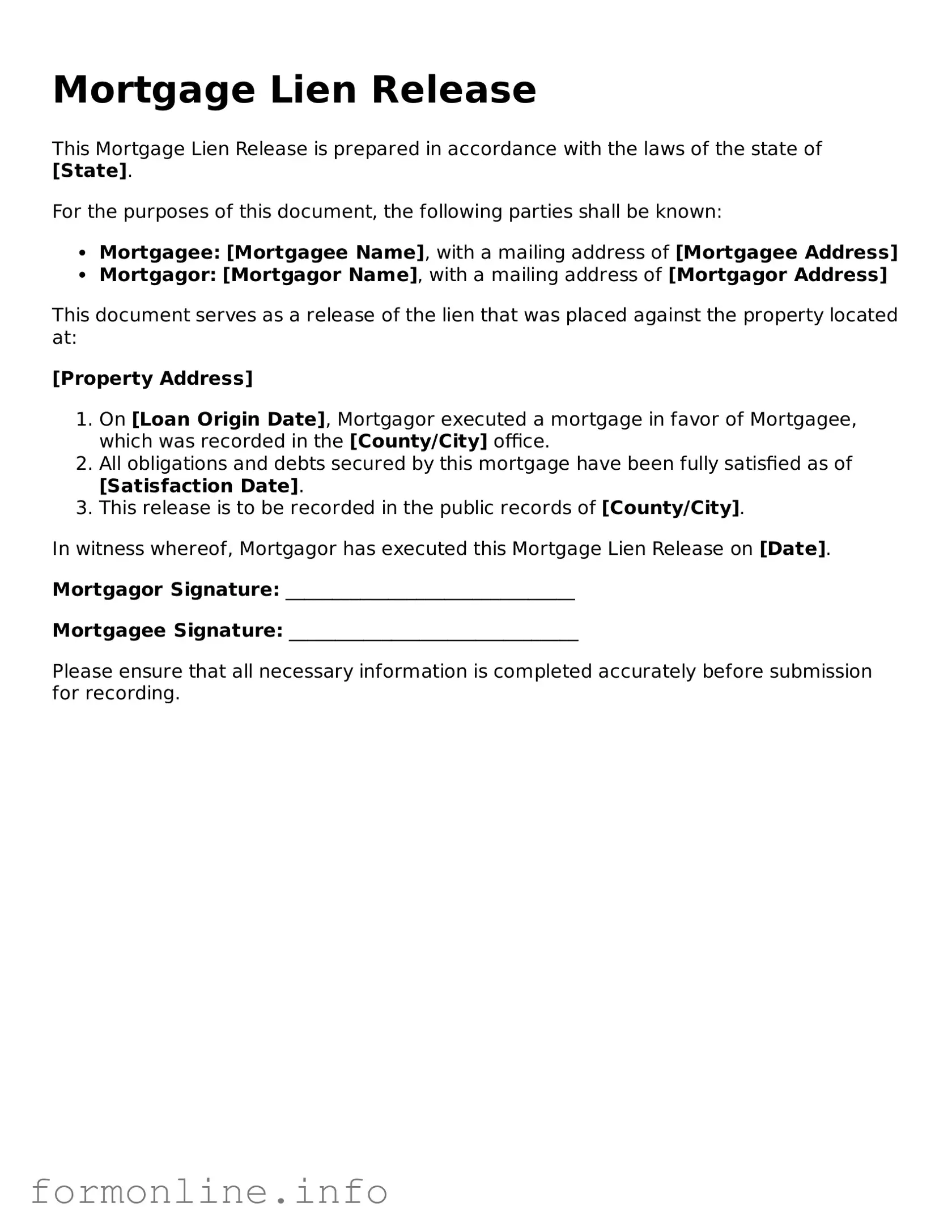

Preview - Mortgage Lien Release Form

Mortgage Lien Release

This Mortgage Lien Release is prepared in accordance with the laws of the state of [State].

For the purposes of this document, the following parties shall be known:

- Mortgagee: [Mortgagee Name], with a mailing address of [Mortgagee Address]

- Mortgagor: [Mortgagor Name], with a mailing address of [Mortgagor Address]

This document serves as a release of the lien that was placed against the property located at:

[Property Address]

- On [Loan Origin Date], Mortgagor executed a mortgage in favor of Mortgagee, which was recorded in the [County/City] office.

- All obligations and debts secured by this mortgage have been fully satisfied as of [Satisfaction Date].

- This release is to be recorded in the public records of [County/City].

In witness whereof, Mortgagor has executed this Mortgage Lien Release on [Date].

Mortgagor Signature: _______________________________

Mortgagee Signature: _______________________________

Please ensure that all necessary information is completed accurately before submission for recording.

More Types of Mortgage Lien Release Templates:

Partial Lien Release Template - Completing this form ensures all parties are informed about the status of the lien on the property.

Understanding the importance of a Release of Liability form is essential for both organizers and participants, as it clearly outlines expectations and responsibilities, helping to mitigate potential legal issues. For more detailed information on how such a form operates and to view a sample template, visit topformsonline.com/release-of-liability.

Conditional Lien Waiver Template - A tool for formalizing conditional agreements regarding lien releases.

Documents used along the form

The Mortgage Lien Release form is a crucial document that signifies the release of a lender's claim on a property after the mortgage has been paid in full. However, there are several other forms and documents that often accompany this release. Each plays a vital role in ensuring that all legal and financial obligations are clearly documented and understood by all parties involved. Below is a list of common forms and documents associated with the Mortgage Lien Release.

- Mortgage Agreement: This is the original document that outlines the terms of the loan between the borrower and the lender. It includes details about the loan amount, interest rate, payment schedule, and the consequences of default.

- Promissory Note: This document serves as a written promise from the borrower to repay the loan. It details the amount borrowed, the interest rate, and the repayment terms, providing legal evidence of the debt.

- Deed of Trust: In some states, this document is used instead of a mortgage. It involves three parties: the borrower, the lender, and a trustee who holds the property title until the loan is paid off.

- Payoff Statement: This statement is issued by the lender and details the exact amount needed to pay off the mortgage. It includes any outstanding interest, fees, and other charges that must be settled.

- Affidavit of Payment: This sworn statement confirms that the borrower has fulfilled all payment obligations under the mortgage agreement. It can help clarify the borrower's status in case of disputes.

- Title Insurance Policy: This document protects the lender and the borrower from potential issues related to the property title. It ensures that the title is clear of any liens or encumbrances before the mortgage is released.

- Release of Liability Form: This document allows one party to waive their right to hold another party responsible for certain risks or injuries that may occur during an activity, as stated by California Documents Online.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage once the lien is released. It provides peace of mind by confirming that the borrower is no longer responsible for the loan.

Understanding these documents is essential for both borrowers and lenders. Each plays a specific role in the mortgage process, ensuring that all parties are protected and informed throughout the transaction. Being familiar with these forms can help facilitate a smoother release of the mortgage lien and promote a clear understanding of one’s rights and responsibilities in the process.

Similar forms

The Mortgage Satisfaction form serves a similar purpose to the Mortgage Lien Release form. Both documents indicate that a borrower has fulfilled their obligations under a mortgage agreement. Once the mortgage is paid off, the lender issues a Mortgage Satisfaction form, which formally acknowledges that the borrower no longer owes any money. This release clears the title and allows the property owner to sell or refinance without any encumbrances from the previous mortgage.

The Deed of Reconveyance is another document closely related to the Mortgage Lien Release. This form is used primarily in states that follow a deed of trust system. When a borrower pays off their loan, the lender executes a Deed of Reconveyance to transfer the title back to the borrower. Like the Mortgage Lien Release, it serves to clear the lien from the property, ensuring that the borrower has full ownership rights once again.

A Certificate of Satisfaction is also akin to the Mortgage Lien Release. This document is issued by the lender upon the full repayment of a mortgage. It serves as proof that the mortgage has been satisfied. While it is often used interchangeably with the Mortgage Lien Release, it may be more common in certain jurisdictions. Both documents ensure that the borrower’s credit report accurately reflects the status of their mortgage.

The Quitclaim Deed can be compared to the Mortgage Lien Release in that it transfers ownership rights. However, it is typically used to transfer property between parties without a sale. If a mortgage is paid off and the title is held by multiple parties, a Quitclaim Deed may be used to remove one party from the title. This document does not provide the same lien release but serves to clarify ownership after a mortgage has been satisfied.

For those navigating the complexities of property transactions, understanding the significance of a Release of Liability form is crucial. This document not only protects your interests but ensures all parties involved are on the same page, preventing future legal disputes. To begin the process, visit missouriform.com/ to fill out the necessary documentation that primes you for clear ownership and peace of mind.

An Affidavit of Payment is another relevant document. This sworn statement confirms that a borrower has completed all payments on their mortgage. While it does not serve as an official release, it can be used in conjunction with a Mortgage Lien Release to provide additional proof of payment. It may help resolve disputes or clarify the status of the mortgage for future transactions.

The Release of Lien form is also similar to the Mortgage Lien Release. This document is used when a lender formally relinquishes their claim to a property after a debt has been paid. It can apply to various types of liens, not just mortgages. Like the Mortgage Lien Release, it ensures that the property is free from encumbrances, allowing the owner to proceed with selling or refinancing.

Finally, the Loan Payoff Statement shares similarities with the Mortgage Lien Release. This document details the total amount required to pay off a mortgage, including any fees or interest. Once the borrower pays this amount, a Mortgage Lien Release is typically issued. The Loan Payoff Statement serves as a crucial step in the process, providing clarity on the borrower’s obligations and the lender’s confirmation of satisfaction.

Dos and Don'ts

When filling out the Mortgage Lien Release form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are some do's and don'ts to keep in mind:

- Do double-check all personal information for accuracy.

- Do ensure that the form is signed by all necessary parties.

- Do keep a copy of the completed form for your records.

- Do submit the form to the appropriate authority in a timely manner.

- Don't leave any required fields blank.

- Don't use white-out or alterations on the form.

- Don't forget to include any supporting documents if required.

- Don't assume the form is processed without confirmation.

Key takeaways

When dealing with a Mortgage Lien Release form, understanding its purpose and proper execution is crucial. Here are some key takeaways to keep in mind:

- Purpose: The Mortgage Lien Release form is used to formally remove a lien from a property once the mortgage has been paid in full.

- Documentation: Ensure you have all necessary documents, including proof of payment, before initiating the release process.

- Filing Requirements: Check local regulations, as requirements for filing the form may vary by state or county.

- Signature: The form must be signed by the lender or their authorized representative to be valid.

- Recording: After completion, the release should be recorded with the appropriate local government office to update public records.

- Timeframe: Be aware that processing times for the release may vary; it’s wise to follow up with the relevant office.

- Copy Retention: Keep a copy of the completed form for your records, as it serves as proof of the lien's release.

- Legal Advice: Consider consulting with a legal professional if you have questions or face complexities in the process.

By adhering to these guidelines, you can navigate the Mortgage Lien Release process more effectively, ensuring that your property records accurately reflect your ownership status.

How to Use Mortgage Lien Release

After obtaining the Mortgage Lien Release form, it is important to complete it accurately. This ensures that the lien on the property is officially released. Follow the steps below to fill out the form correctly.

- Begin by entering the name of the borrower or property owner at the top of the form.

- Next, provide the address of the property associated with the mortgage lien.

- Fill in the lender's name and contact information in the designated section.

- Include the loan number or account number related to the mortgage.

- Indicate the date of the release, which is typically the date you are completing the form.

- Sign the form where indicated. If applicable, have a witness or notary sign as well.

- Review the completed form for accuracy and completeness.

- Make copies of the signed form for your records.

- Submit the original form to the appropriate county or state office for recording.