Fill Out a Valid Mortgage Statement Form

The Mortgage Statement form serves as a vital document for homeowners, providing essential details about their mortgage account. It includes the servicer's name and contact information, ensuring borrowers know where to seek assistance. Key elements of the form feature the borrower's name and address, along with critical dates such as the statement date, payment due date, and the total amount due. Homeowners will find a breakdown of their account information, including the outstanding principal, interest rate, and any applicable prepayment penalties. The explanation of the amount due clarifies how much is owed in principal, interest, and escrow for taxes and insurance, culminating in the total fees charged. Transaction activity is meticulously documented, offering insights into recent payments and any late fees incurred. Additionally, the form addresses partial payments and delinquency notices, alerting borrowers to the potential consequences of late payments, including fees and foreclosure risks. For those facing financial difficulties, the statement encourages seeking mortgage counseling or assistance, underscoring the servicer's commitment to helping borrowers navigate challenging times.

Common mistakes

-

Neglecting to Update Personal Information: Always ensure that your name and address are current. If there are any changes, update them before submitting the form.

-

Missing Important Dates: Double-check the statement date, payment due date, and any late fee dates. Missing these can lead to confusion and potential late fees.

-

Inaccurate Account Number: Make sure you enter the correct account number. An error here can delay processing and lead to misapplied payments.

-

Ignoring Late Fee Information: Pay attention to the late fee details. Knowing when fees apply can help you avoid unnecessary costs.

-

Overlooking Outstanding Principal and Interest Rate: Review these figures carefully. They affect your overall payment strategy.

-

Failing to Understand Escrow Amounts: Know how much you owe for taxes and insurance. This is part of your total payment.

-

Not Reviewing Transaction Activity: Check the transaction history for any discrepancies. This can help you catch errors early.

-

Ignoring Partial Payment Policies: Understand that partial payments do not apply to your mortgage. They are held in a suspense account until the full payment is made.

-

Disregarding Delinquency Notices: If you see a delinquency notice, take it seriously. Addressing it promptly can prevent foreclosure.

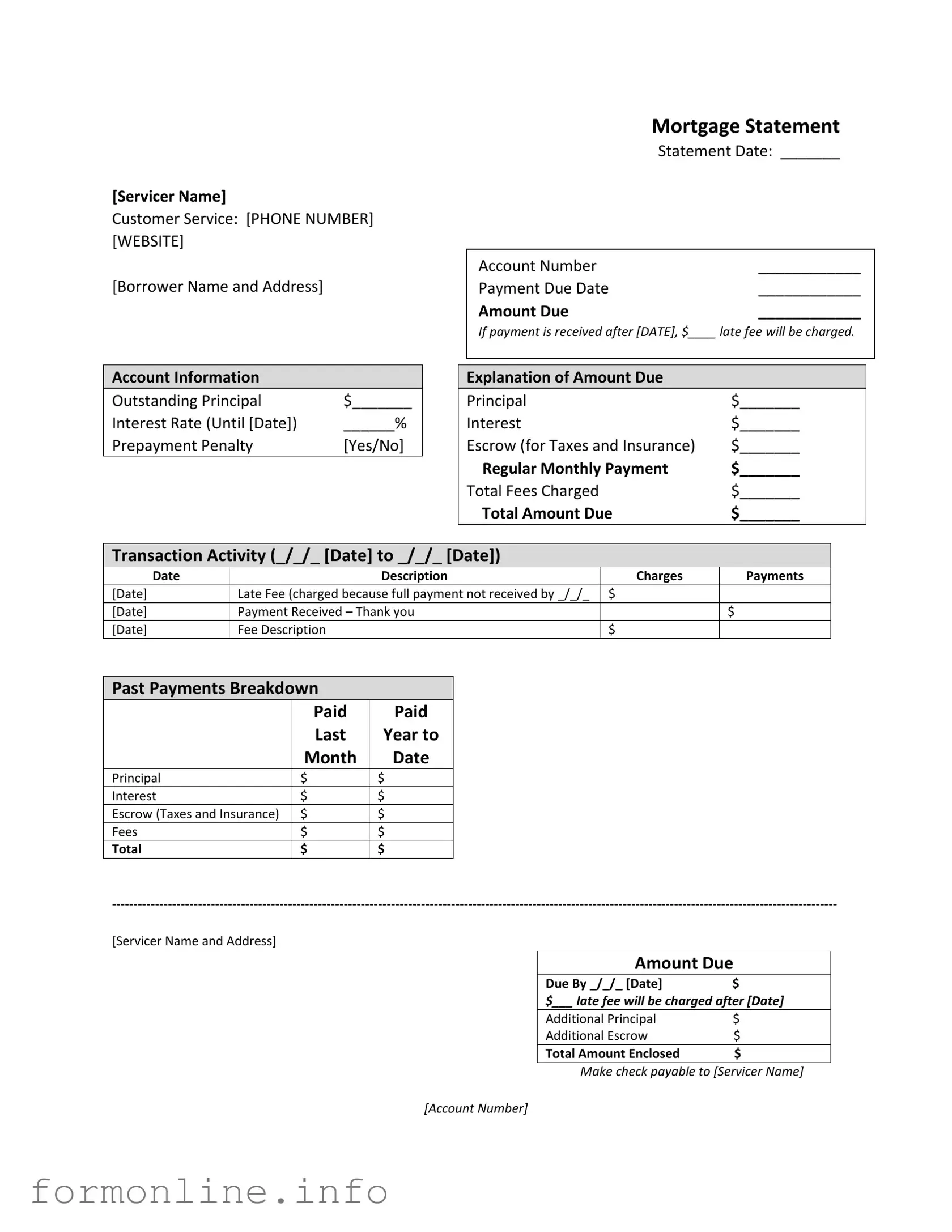

Preview - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.

Other PDF Templates

Florida Estate Tax Exemption 2023 - The affidavit must accurately reflect the decedent's domicile at the time of death.

Restroom Cleaning Sign Off Sheet - Ensure all essential items are regularly checked and replenished.

Having a properly filled out Trailer Bill of Sale form is essential for both the seller and buyer to ensure a smooth transaction. This form not only verifies the sale and transfer of ownership but also provides valuable details that can help in any future disputes. For additional information on this important document, you can visit https://autobillofsaleform.com/trailer-bill-of-sale-form/.

Purpose of Nda - Documented agreements aim to prevent misunderstandings that could lead to legal complications.

Documents used along the form

The Mortgage Statement form is a crucial document for homeowners, providing detailed information about their mortgage account. Several other forms and documents are commonly used alongside it, each serving a specific purpose in managing mortgage accounts. Below is a list of these documents, along with brief descriptions of their roles.

- Loan Agreement: This document outlines the terms and conditions of the mortgage loan, including the interest rate, repayment schedule, and obligations of both the borrower and lender.

- Power of Attorney Form: To ensure you can manage your affairs when needed, consider the complete Power of Attorney form guide that outlines the necessary steps and considerations.

- Payment History: A record of all payments made on the mortgage, including dates, amounts, and any late fees incurred. This document helps track the borrower’s payment behavior over time.

- Escrow Analysis Statement: This statement provides an annual review of the escrow account, detailing how much is collected for property taxes and insurance, and whether adjustments are needed.

- Delinquency Notice: A formal notification sent to the borrower when payments are late. It outlines the consequences of continued delinquency, including potential foreclosure.

- Foreclosure Notice: This document is issued when the lender initiates foreclosure proceedings. It informs the borrower of their rights and the steps they can take to avoid losing their home.

- Modification Agreement: If a borrower and lender agree to change the terms of the mortgage, this document outlines the new terms, such as a lower interest rate or extended repayment period.

- Property Tax Statement: This statement details the property taxes owed on the home. It is often included in the escrow analysis and is important for budgeting monthly payments.

- Insurance Declaration Page: This document provides proof of homeowner’s insurance coverage. It is crucial for ensuring that the property is protected against potential risks.

- Notice of Default: A formal notice indicating that the borrower has failed to meet the terms of the loan, typically sent after several missed payments. It serves as a warning before more serious actions are taken.

Understanding these documents can empower homeowners to manage their mortgage accounts effectively. Each form plays a vital role in maintaining transparency and ensuring that borrowers are informed of their rights and responsibilities.

Similar forms

The first document similar to a Mortgage Statement is a Billing Statement. A Billing Statement provides a summary of charges and payments for a specific period, much like a Mortgage Statement outlines the amounts due and payment history. Both documents list the total amount owed, due dates, and any fees associated with late payments. They serve as reminders for the recipient to make timely payments to avoid additional charges.

Another comparable document is the Loan Statement. A Loan Statement details the outstanding balance on a loan, including interest rates and payment history. Similar to a Mortgage Statement, it breaks down the amounts owed into principal and interest. Both documents provide essential information to borrowers, helping them track their financial obligations and plan for future payments.

A Credit Card Statement also shares similarities with a Mortgage Statement. It summarizes the charges made on a credit card during a billing cycle, including any interest and fees. Like a Mortgage Statement, it specifies the payment due date and total amount owed. Both statements help individuals manage their debts and avoid penalties for late payments.

The Texas Mobile Home Bill of Sale form is essential for facilitating the transfer of ownership of a mobile home, clearly detailing the identities of the buyer and seller, as well as specifics about the mobile home. To avoid any ambiguities during this process, it is important to utilize the Mobile Home Bill of Sale, ensuring that all parties involved understand the conditions and legalities governing the transaction.

The Utility Bill is another document that resembles a Mortgage Statement. It outlines the usage of services like water, electricity, or gas, along with the total amount due for the billing period. Both documents include payment due dates and any late fees that may apply. They serve to inform customers of their financial responsibilities regarding essential services.

A Property Tax Statement is similar in that it provides detailed information about taxes owed on a property. Like a Mortgage Statement, it lists the total amount due, payment deadlines, and any penalties for late payments. Both documents are crucial for homeowners to maintain good standing and avoid potential legal issues related to property ownership.

The Insurance Premium Statement also shares key features with a Mortgage Statement. It outlines the premium amounts due for insurance coverage, including payment due dates and any applicable fees. Both documents are essential for ensuring that individuals remain compliant with their financial commitments and avoid lapses in coverage or additional charges.

A Pay Stub is another document that has similarities to a Mortgage Statement. It provides a summary of an employee's earnings and deductions for a specific pay period. While it focuses on income rather than payments owed, both documents include important financial information that helps individuals manage their budgets and understand their financial situations better.

Finally, a Loan Payoff Statement is akin to a Mortgage Statement in that it provides a detailed breakdown of the total amount needed to pay off a loan. This document includes outstanding principal, interest, and any fees that may apply. Like a Mortgage Statement, it serves to inform borrowers about their financial obligations and helps them make informed decisions about their loans.

Dos and Don'ts

When filling out the Mortgage Statement form, there are specific actions to take and avoid. Here is a list to guide you:

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information about your account.

- Do double-check the payment due date to avoid late fees.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't ignore the instructions regarding partial payments.

- Don't forget to include your account number on your payment.

- Don't submit the form without reviewing it for errors.

Key takeaways

When filling out and using the Mortgage Statement form, it’s important to keep several key points in mind:

- Accurate Information: Ensure that all personal details, including the borrower’s name and address, are correctly filled out. This prevents any confusion regarding your account.

- Payment Details: Take note of the payment due date and the amount due. Missing this date may incur a late fee.

- Understand Fees: Be aware of the potential late fee that will be charged if payment is not received by the specified date.

- Account Information: Review the outstanding principal, interest rate, and any prepayment penalties. This helps you understand your financial obligations.

- Transaction Activity: Keep track of recent transactions, including payments and any fees charged. This section provides a clear history of your account activity.

- Partial Payments: Remember that partial payments do not apply to your mortgage. They are held in a suspense account until the full amount is paid.

- Delinquency Notice: Take the delinquency notice seriously. If you are behind on payments, it is crucial to address this immediately to avoid potential foreclosure.

By following these guidelines, you can effectively manage your mortgage statement and maintain clear communication with your loan servicer.

How to Use Mortgage Statement

Completing the Mortgage Statement form is essential for managing your mortgage account effectively. This form provides important information about your mortgage, including payment details and account status. Follow the steps below to fill out the form accurately.

- Servicer Information: Begin by entering the name of the mortgage servicer at the top of the form. Include their customer service phone number and website for reference.

- Borrower Information: Fill in your name and address in the designated section.

- Statement Date: Write the date of the statement in the space provided.

- Account Number: Enter your mortgage account number accurately.

- Payment Due Date: Specify the date by which your next payment is due.

- Amount Due: Indicate the total amount due for this payment period.

- Late Fee Information: Note the date after which a late fee will be charged and write the amount of the late fee.

- Account Information: Fill in the outstanding principal amount and the interest rate applicable until the specified date.

- Prepayment Penalty: Indicate whether there is a prepayment penalty by selecting "Yes" or "No."

- Explanation of Amount Due: Break down the amount due into principal, interest, escrow for taxes and insurance, regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: Document the date range for transaction activity. List any charges, payments, and late fees that occurred during this period.

- Past Payments Breakdown: Provide a summary of past payments made, including principal, interest, escrow, and total amounts for the last year.

- Additional Information: Write the total amount due and the due date. Include any additional principal or escrow amounts, if applicable.

- Payment Instructions: Indicate the total amount enclosed and make sure to note that checks should be made payable to the servicer name, including your account number.

- Important Messages: Review the important messages section for information on partial payments and delinquency notices.