Fill Out a Valid Netspend Dispute Form

The Netspend Dispute Notification Form is a crucial tool for cardholders facing unauthorized credit or debit transactions. Designed for efficiency, this form allows users to formally initiate a dispute regarding transactions they did not authorize. Timeliness is key; it must be completed and submitted to Netspend within 60 days of the disputed transaction. Once received, Netspend commits to making a decision about crediting the disputed funds within 10 business days. The form requires essential details such as the cardholder's name, contact information, and specifics about each transaction being disputed, including the amount, date, time, and merchant name. Additionally, cardholders must indicate if they have contacted the merchant regarding the dispute and whether a refund is expected. If the card was lost or stolen, it is vital to note this on the form, as it can affect liability for unauthorized use. Supporting documentation, such as police reports and receipts, can strengthen the case. Completing this form accurately and promptly is essential for a smooth dispute process.

Common mistakes

-

Failing to Submit the Form on Time: One of the most critical mistakes is not submitting the Dispute Notification Form within the 60-day timeframe after the unauthorized transaction. Delays can lead to the inability to dispute the transaction.

-

Incomplete Information: Leaving out essential details, such as the cardholder's name, phone number, or address, can hinder the processing of the dispute. Each section of the form must be filled out completely to ensure a smooth review.

-

Not Providing Sufficient Documentation: Failing to attach supporting documents, such as a police report or transaction receipts, can weaken your case. These documents are crucial for substantiating your claim and can expedite the decision-making process.

-

Ignoring Merchant Contact: Not indicating whether you have contacted the merchant regarding the disputed transaction is a common oversight. This information is important for Netspend to understand the steps you’ve already taken to resolve the issue.

-

Incorrect Transaction Details: Providing wrong information about the disputed transactions, such as the amount or date, can complicate the dispute process. Double-checking these details can save time and prevent delays.

-

Not Noting Card Loss or Theft: If your card was lost or stolen, it is essential to indicate this clearly on the form. This step is vital for blocking any further unauthorized activity and protecting your account.

-

Failure to Explain the Situation: Skipping the section that asks for a detailed explanation of what happened can be detrimental. Providing a clear and concise account of the circumstances surrounding the dispute helps Netspend assess your claim more effectively.

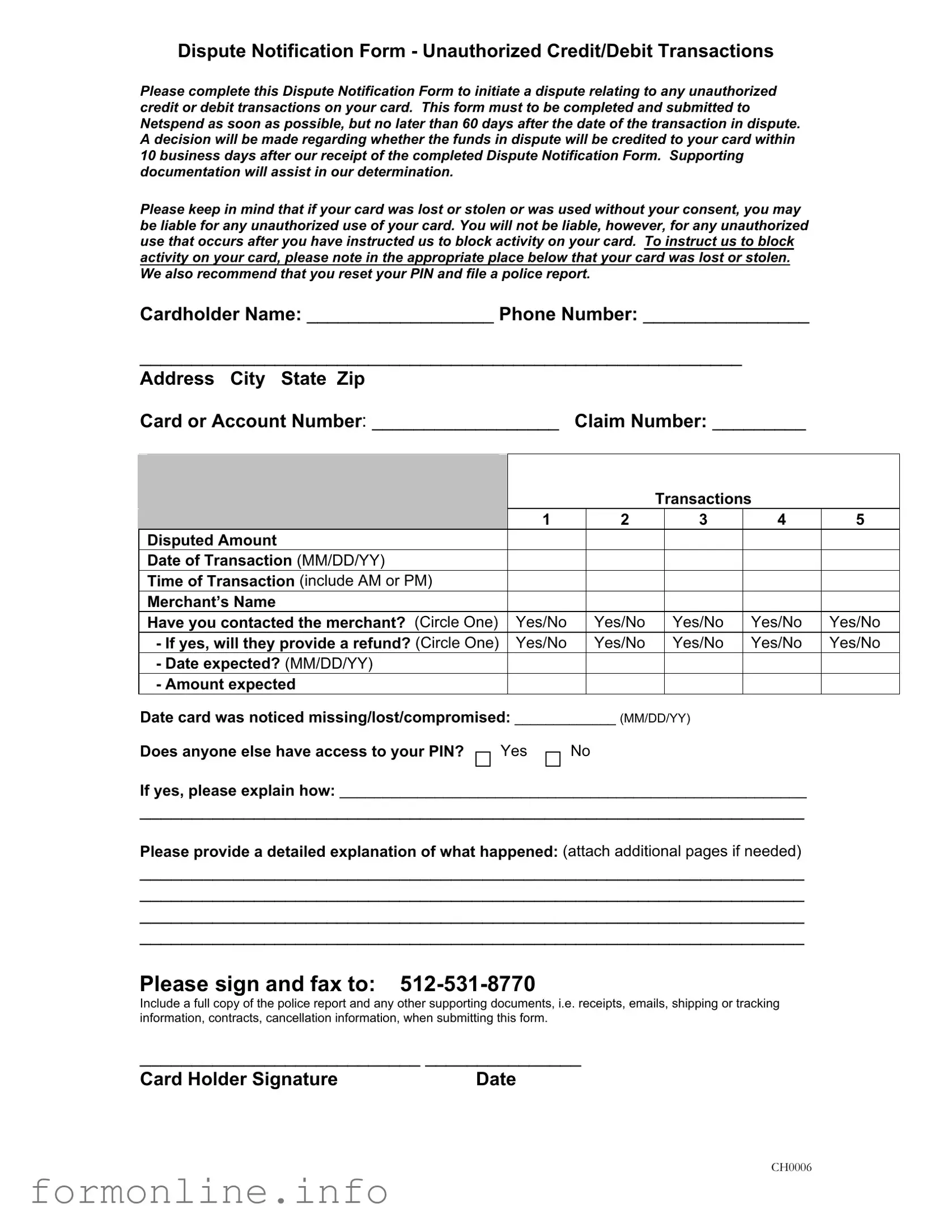

Preview - Netspend Dispute Form

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006

Other PDF Templates

Texas Driver License Renewal Form - Submitting the DL-43 form efficiently facilitates the licensing process in case of loss.

The completion of the ownership transfer process requires careful attention to details, making the use of the Washington Mobile Home Bill of Sale critical. This legal document not only serves as proof of the transaction but also outlines pertinent information relating to the buyer and seller, along with the unique specifications of the mobile home. For those looking to facilitate a smooth transition, resources like the Mobile Home Bill of Sale can provide essential guidance and templates.

Phone Insurance Claim - The Asurion F-017-08 MEN form is designed for customer claims.

Florida Realtors Forms - The lease may contain specific information about rent prorating based on start dates.

Documents used along the form

When disputing unauthorized transactions on your Netspend card, it is essential to gather the necessary documentation to support your claim. Along with the Netspend Dispute form, several other forms and documents may be required to facilitate the dispute process effectively. Below is a list of commonly used documents that can assist in your case.

- Police Report: If your card was lost or stolen, filing a police report is crucial. This document serves as official proof of the theft or loss and can strengthen your dispute by showing that you took immediate action to report the incident.

- Motorcycle Bill of Sale: For those involved in the sale of motorcycles, having a formal document is vital. The Bill of Sale for Motorcycles serves as proof of ownership transfer and provides essential transaction details.

- Transaction Receipts: Collecting receipts for the transactions you are disputing can provide evidence of unauthorized charges. These documents help demonstrate that the transactions in question were not authorized by you.

- Email Correspondence: Any emails exchanged with the merchant regarding the disputed transaction can be valuable. This documentation may show that you attempted to resolve the issue directly with the merchant before escalating it to Netspend.

- Cancellation Confirmation: If you canceled a service or product that led to a disputed charge, keeping a copy of the cancellation confirmation is important. This document can help establish that you took steps to prevent the charge from occurring.

Having these documents ready will not only streamline the dispute process but also increase the likelihood of a favorable outcome. Each piece of information contributes to building a stronger case for your claim, ensuring that you are adequately protected against unauthorized transactions.

Similar forms

The Netspend Dispute form shares similarities with the Chargeback Request form used by credit card companies. Both documents serve the purpose of contesting unauthorized transactions. In each case, the individual must provide specific details about the disputed charges, including transaction amounts, dates, and merchant names. Additionally, both forms require the submission of supporting documentation to strengthen the claim. Timeliness is critical, as both forms typically must be submitted within a specific time frame after the transaction in question.

Another comparable document is the Fraudulent Transaction Report, often utilized by banks and financial institutions. This report allows account holders to report transactions that they did not authorize. Like the Netspend Dispute form, it requires detailed information about the transaction and may also ask for a description of the circumstances surrounding the fraud. Both forms emphasize the importance of acting quickly to limit potential liability for unauthorized transactions.

The Identity Theft Affidavit is another document that bears resemblance to the Netspend Dispute form. This affidavit is used when an individual’s personal information has been compromised, leading to unauthorized transactions. Similar to the Netspend form, it requires a detailed account of the fraudulent activity and supporting evidence. Both documents aim to provide a clear narrative to assist in the investigation and resolution of the dispute.

The Unauthorized Payment Claim form is also akin to the Netspend Dispute form. This document is often used by consumers to report unauthorized withdrawals from their accounts. Both forms require the individual to specify the nature of the unauthorized transaction and provide relevant transaction details. They also encourage the inclusion of any supporting documents that can substantiate the claim.

The Billing Dispute Letter is another similar document. Consumers use this letter to contest charges on their bills, whether they are for services or products. Like the Netspend Dispute form, it necessitates clear communication of the disputed amounts and the reasons for the dispute. Both documents may also require follow-up actions, such as contacting the service provider or merchant involved.

When dealing with personal property transactions in Georgia, it's essential to utilize the appropriate documentation to ensure a smooth process. One important document is the Bill of Sale form, which facilitates the transfer of ownership and protects both parties involved. Understanding the nuances of such forms can help avoid complications during the transfer process.

The Report of Lost or Stolen Card form is closely related to the Netspend Dispute form. This document is essential for notifying a financial institution about a lost or stolen card, which can lead to unauthorized transactions. Both forms require the cardholder to provide personal information and details about the card. Additionally, they stress the importance of reporting the incident promptly to mitigate potential financial loss.

Lastly, the Consumer Complaint Form often used by regulatory agencies has similarities with the Netspend Dispute form. This form allows consumers to report issues with financial products or services, including unauthorized transactions. Both forms require detailed descriptions of the issues faced and may necessitate supporting documentation. They aim to facilitate the resolution of consumer disputes while ensuring that the necessary information is collected for proper investigation.

Dos and Don'ts

When filling out the Netspend Dispute form, it is essential to follow certain guidelines to ensure a smooth process. Below is a list of things you should and shouldn't do.

- Do complete the form as soon as possible, ideally within 60 days of the transaction.

- Do provide accurate and detailed information for each disputed transaction.

- Do include your contact information, including your phone number and address.

- Do attach any supporting documentation, such as receipts or police reports.

- Do indicate if your card was lost or stolen to block further activity.

- Don't delay submitting the form, as late submissions may complicate the dispute process.

- Don't provide incomplete or vague explanations of the disputed transactions.

- Don't forget to check if anyone else has access to your PIN, as this may affect your liability.

- Don't submit the form without a signature, as an unsigned form may be rejected.

- Don't assume that your dispute will be resolved without proper documentation; thoroughness is key.

Key takeaways

Key Takeaways for Filling Out the Netspend Dispute Form:

- Complete the form promptly, ensuring submission within 60 days of the disputed transaction date to ensure your claim is processed.

- Provide accurate and detailed information for each disputed transaction, including the merchant’s name, date, and amount.

- Attach supporting documents such as receipts, emails, or a police report to strengthen your case and assist in the decision-making process.

- If your card was lost or stolen, indicate this on the form to prevent further unauthorized use and consider resetting your PIN.

How to Use Netspend Dispute

Once you’ve gathered all the necessary information, you’re ready to fill out the Netspend Dispute Notification Form. Completing this form accurately is essential for initiating your dispute regarding unauthorized transactions. Remember, it’s important to submit the form within 60 days of the transaction date to ensure a timely response.

- Cardholder Name: Write your full name in the designated space.

- Phone Number: Enter your contact number.

- Address: Fill in your complete address, including city, state, and zip code.

- Card or Account Number: Provide the number associated with your Netspend card or account.

- Claim Number: If applicable, write your claim number here.

- Transaction Details: For each transaction you are disputing (up to five), fill out the following:

- Disputed Amount: Write the amount for each transaction.

- Date of Transaction: Enter the date in MM/DD/YY format.

- Time of Transaction: Specify the time, including AM or PM.

- Merchant’s Name: Indicate the name of the merchant involved.

- Contacted Merchant: Circle Yes or No to indicate if you’ve reached out to the merchant.

- Refund Status: If you contacted the merchant, circle Yes or No to indicate if they will provide a refund.

- Date Expected: If applicable, write the expected refund date in MM/DD/YY format.

- Date Card Noticed Missing/Lost/Compromised: Provide the date in MM/DD/YY format.

- PIN Access: Indicate whether anyone else has access to your PIN by circling Yes or No. If Yes, explain how in the space provided.

- Detailed Explanation: Write a detailed account of what happened. Attach additional pages if necessary.

- Signature: Sign the form and write the date next to your signature.

- Submission: Fax the completed form to 512-531-8770, along with a full copy of the police report and any supporting documents like receipts or emails.