Fill Out a Valid New Jersey Affidavit of Consideration RTF-1 Form

The New Jersey Affidavit of Consideration RTF-1 form plays a crucial role in real estate transactions within the state. This document serves as a declaration of the consideration paid for a property, which is essential for determining the appropriate transfer tax. When a property changes hands, the buyer and seller must accurately report the sale price, and the RTF-1 form facilitates this process. It requires the parties involved to provide specific information, including the names of the buyer and seller, the property address, and the agreed-upon purchase price. Additionally, the form may include details about any concessions or adjustments made during the transaction, which can influence the final tax calculation. Proper completion of the RTF-1 is not only a legal requirement but also helps ensure transparency and compliance with state regulations. As such, understanding the nuances of this form is vital for anyone engaged in New Jersey real estate transactions, whether they are buyers, sellers, or real estate professionals.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays. Ensure that every section is filled out accurately.

-

Incorrect Property Description: Misidentifying the property can create legal complications. Double-check the property address and lot number.

-

Wrong Consideration Amount: Listing an incorrect purchase price may raise questions during processing. Verify the amount aligns with the sales agreement.

-

Signature Issues: Omitting signatures or having them signed by the wrong party can invalidate the form. Ensure that all required parties sign where indicated.

-

Failure to Notarize: Not having the affidavit notarized can render it ineffective. Confirm that a notary public witnesses the signing.

-

Ignoring Submission Guidelines: Not following the specific instructions for submission can cause delays. Review the guidelines to ensure proper filing.

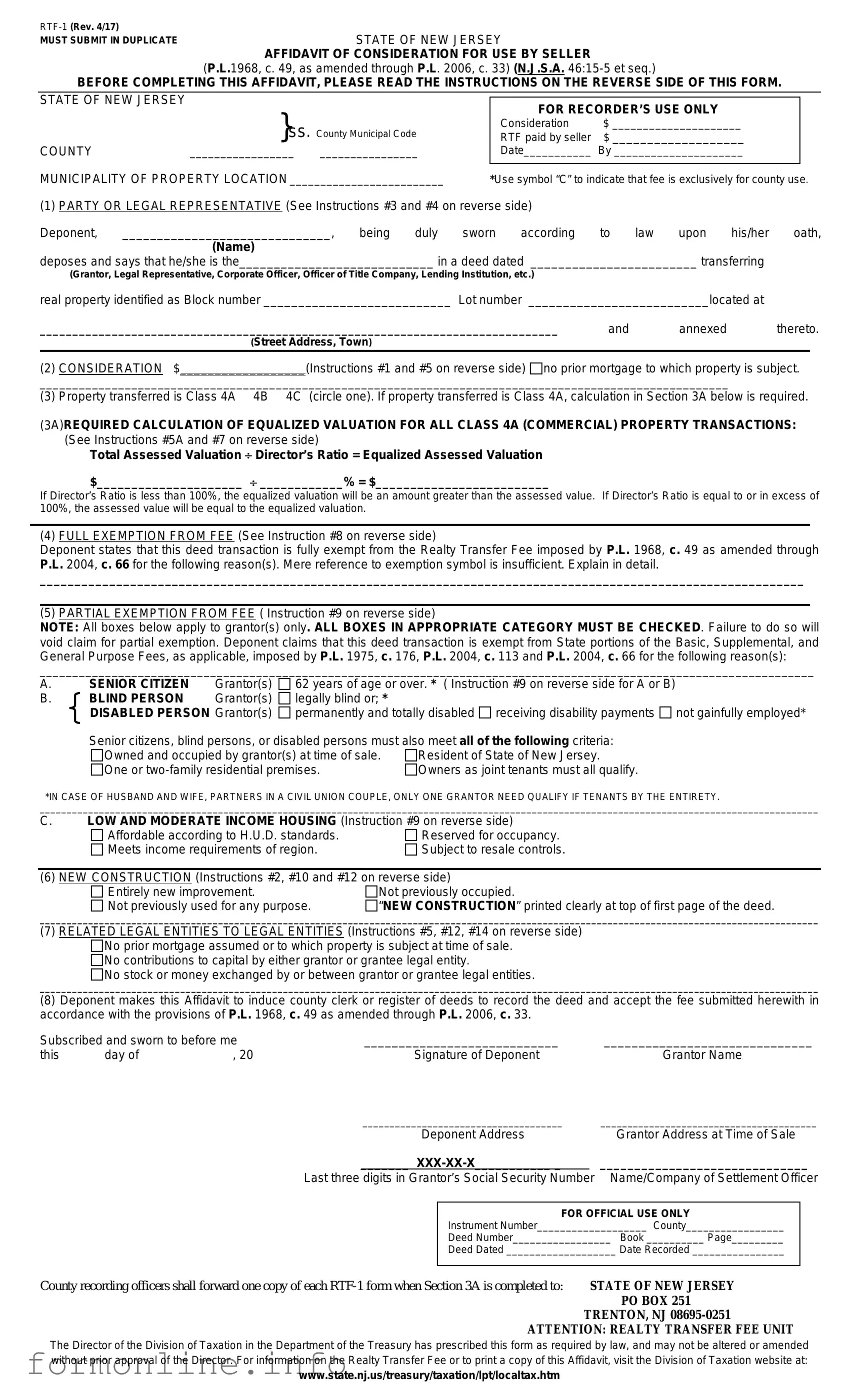

Preview - New Jersey Affidavit of Consideration RTF-1 Form

STATE OF NEW JERSEY

AFFIDAVIT OF CONSIDERATION FOR USE BY SELLER (P.L.1968, c. 49, as amended through P.L. 2006, c. 33) (N.J.S.A.

BEFORE COMPLETING THIS AFFIDAVIT, PLEASE READ THE INSTRUCTIONS ON THE REVERSE SIDE OF THIS FORM.

STATE OF NEW JERSEY |

|

|

|

|

}ss. County Municipal Code |

FOR RECORDER’S USE ONLY |

|

||

|

|

|||

|

Consideration |

$ _____________________ |

|

|

|

RTF paid by seller |

$ ___________________ |

|

|

COUNTY |

_________________ ________________ |

Date___________ By _____________________ |

|

|

MUNICIPALITY OF PROPERTY LOCATION _________________________ |

|

|

||

*Use symbol “C” to indicate that fee is exclusively for county use. |

||||

(1)PARTY OR LEGAL REPRESENTATIVE (See Instructions #3 and #4 on reverse side)

Deponent, ______________________________, being duly sworn according to law upon his/her oath,

(Name)

deposes and says that he/she is the____________________________ in a deed dated ________________________ transferring

(Grantor, Legal Representative, Corporate Officer, Officer of Title Company, Lending Institution, etc.)

real property identified as Block number ___________________________ Lot number __________________________located at

_______________________________________________________________________________ |

and |

annexed |

thereto. |

||

|

(Street Address, Town) |

|

|

|

|

(2) |

CONSIDERATION $__________________(Instructions #1 and #5 on reverse side) no prior mortgage to which property is subject. |

||||

_________________________________________________________________________________________________________ |

|

|

|||

(3) |

Property transferred is Class 4A 4B 4C (circle one). If property transferred is Class 4A, calculation in Section 3A below is required. |

||||

(3A)REQUIRED CALCULATION OF EQUALIZED VALUATION FOR ALL CLASS 4A (COMMERCIAL) PROPERTY TRANSACTIONS: (See Instructions #5A and #7 on reverse side)

Total Assessed Valuation ÷ Director’s Ratio = Equalized Assessed Valuation $_____________________ ÷ ____________% = $_________________________

If Director’s Ratio is less than 100%, the equalized valuation will be an amount greater than the assessed value. If Director’s Ratio is equal to or in excess of 100%, the assessed value will be equal to the equalized valuation.

(4)FULL EXEMPTION FROM FEE (See Instruction #8 on reverse side)

Deponent states that this deed transaction is fully exempt from the Realty Transfer Fee imposed by P.L. 1968, c. 49 as amended through P.L. 2004, c. 66 for the following reason(s). Mere reference to exemption symbol is insufficient. Explain in detail.

______________________________________________________________________________________________________________

(5)PARTIAL EXEMPTION FROM FEE ( Instruction #9 on reverse side)

NOTE: All boxes below apply to grantor(s) only. ALL BOXES IN APPROPRIATE CATEGORY MUST BE CHECKED. Failure to do so will

void claim for partial exemption. Deponent claims that this deed transaction is exempt from State portions of the Basic, Supplemental, and General Purpose Fees, as applicable, imposed by P.L. 1975, c. 176, P.L. 2004, c. 113 and P.L. 2004, c. 66 for the following reason(s):

______________________________________________________________________________________________________________________

A.SENIOR CITIZEN Grantor(s)

62 years of age or over. * ( Instruction #9 on reverse side for A or B)

62 years of age or over. * ( Instruction #9 on reverse side for A or B)

B.BLIND PERSON Grantor(s)  legally blind or; *

legally blind or; *

DISABLED PERSON Grantor(s)  permanently and totally disabled

permanently and totally disabled  receiving disability payments

receiving disability payments  not gainfully employed*

not gainfully employed*

Senior citizens, blind persons, or disabled persons must also meet all of the following criteria:

Owned and occupied by grantor(s) at time of sale. |

Resident of State of New Jersey. |

One or |

Owners as joint tenants must all qualify. |

*IN CASE OF HUSBAND AND WIFE, PARTNERS IN A CIVIL UNION COUPLE, ONLY ONE GRANTOR NEED QUALIFY IF TENANTS BY THE ENTIRETY.

________________________________________________________________________________________________________________________________________________

C.LOW AND MODERATE INCOME HOUSING (Instruction #9 on reverse side)

Affordable according to H.U.D. standards. |

Reserved for occupancy. |

Meets income requirements of region. |

Subject to resale controls. |

(6)NEW CONSTRUCTION (Instructions #2, #10 and #12 on reverse side)

Entirely new improvement. |

Not previously occupied. |

Not previously used for any purpose. |

“NEW CONSTRUCTION” printed clearly at top of first page of the deed. |

________________________________________________________________________________________________________________________________________________

(7)RELATED LEGAL ENTITIES TO LEGAL ENTITIES (Instructions #5, #12, #14 on reverse side)

No prior mortgage assumed or to which property is subject at time of sale.

No prior mortgage assumed or to which property is subject at time of sale.

No contributions to capital by either grantor or grantee legal entity.

No contributions to capital by either grantor or grantee legal entity.

No stock or money exchanged by or between grantor or grantee legal entities.

No stock or money exchanged by or between grantor or grantee legal entities.

________________________________________________________________________________________________________________________________________________

(8)Deponent makes this Affidavit to induce county clerk or register of deeds to record the deed and accept the fee submitted herewith in accordance with the provisions of P.L. 1968, c. 49 as amended through P.L. 2006, c. 33.

Subscribed and sworn to before me |

____________________________ |

______________________________ |

||

this |

day of |

, 20 |

Signature of Deponent |

Grantor Name |

_____________________________________ |

|

________________________________________ |

|

|

Deponent Address |

Grantor Address at Time of Sale |

|

|

_______ |

______________________________ |

|

Last three |

digits in Grantor’s Social Security Number |

|

Name/Company of Settlement Officer |

FOR OFFICIAL USE ONLY |

|

Instrument Number___________________ County_________________ |

|

Deed Number_________________ Book __________ Page_________ |

|

Deed Dated ___________________ Date Recorded ________________ |

|

County recording officers shall forward one copy of each |

STATE OF NEW JERSEY |

PO BOX 251

TRENTON, NJ

ATTENTION: REALTY TRANSFER FEE UNIT

The Director of the Division of Taxation in the Department of the Treasury has prescribed this form as required by law, and may not be altered or amended without prior approval of the Director. For information on the Realty Transfer Fee or to print a copy of this Affidavit, visit the Division of Taxation website at: www.state.nj.us/treasury/taxation/lpt/localtax.htm

INSTRUCTIONS FOR FILING FORM

1.STATEMENT OF CONSIDERATION AND REALTY TRANSFER FEE PAYMENT ARE PREREQUISITES FOR DEED RECORDING

No county recording officer shall record any deed evidencing transfer of title to real property unless (a) the consideration is recited in the deed, or (b) an Affidavit by one or more of the parties named in the deed or by their legal representatives declaring the consideration is annexed for recording with the deed, and (c) for conveyances and transfers of property for which the total consideration recited in the deed is not in excess of $350,000, a fee is remitted at the rate of $2.00/$500 of consideration or fractional part thereof not in excess of $150,000; $3.35/$500 of consideration or fractional part thereof in excess of $150,000 but not in excess of $200,000; and $3.90/$500 of consideration or fractional part thereof in excess of $200,000. For transfers of property for which the total consideration recited in the deed is in excess of $350,000, a fee is remitted at the rate of $2.90/$500 of consideration or fractional part not in excess of $150,000; $4.25/$500 of consideration or fractional part thereof in excess of $150,000 but not in excess of $200,000; $4.80/$500 of consideration or fractional part thereof in excess of $200,000; $5.30/$500 of consideration or fractional part thereof in excess of $550,000 but not in excess of $850,000; $5.80/$500 of consideration or fractional part thereof in excess of $850,00 but not in $1,000,000; and $6.05/$500 of consideration or fractional part thereof in excess of $1,000,000, which fee shall be paid in addition to the recording fees imposed by, P.L. 1965 c. 123, Section 2 (C.

2.WHEN AFFIDAVIT MUST BE ANNEXED TO DEED

This Affidavit must be annexed to and recorded with all deeds when entire consideration is not recited in deed or the acknowledgement or proof of the execution, when the grantor claims a total or partial exemption from the fee, Class 4 property that includes commercial, industrial, or apartment property, and for transfers of “new construction.” (See Instructions #10 and #12 below.)

3.LEGAL REPRESENTATIVE

“Legal representative” is to be interpreted broadly to include any person actively and responsibly participating in the transaction, such as, but not limited to: an attorney representing one of the parties; a closing officer of a title company or lending institution participating in the transaction; a holder of power of attorney from grantor or grantee.

4.OFFICER OF CORPORATE GRANTOR/OFFICER OF TITLE COMPANY OR LENDING INSTITUTION

Where a deponent is an officer of corporate grantor, state the name of corporation and officer’s title or where a deponent is a closing officer of a title company or lending institution participating in the transaction, state the name of the company or institution and officer’s title.

5.CONSIDERATION

“Consideration” means in the case of any deed, the actual amount of money and the monetary value of any other thing of value constituting the entire compensation paid or to be paid for the transfer of title to the lands, tenements or other realty, including the remaining amount of any prior mortgage to which the transfer is subject or which is assumed and agreed to be paid by the grantee and any other lien or encumbrance not paid, satisfied or removed in connection with the transfer of title. (P.L. 1968, c. 49, Section 1, as amended.)

5A. CLASS 4A “COMMERCIAL PROPERTIES” DEFINED

Class 4A “Commercial properties” as defined in N.J.A.C.

6.DIRECTOR'S RATIO

“Director’s Ratio” means the average ratio of assessed to true value of real property for each taxing district as determined by the Director, Division of Taxation, in the Table of Equalized Valuations promulgated annually on or before October 1 in each year pursuant to N.J.S.A.

7.EQUALIZED VALUE

“Equalized Value” means the assessed value of the property in the year that the transfer is made, divided by the Director’s Ratio. The Table of Equalized Valuations is promulgated annually on or before October 1 in each year pursuant to N.J.S.A.

(Example: Assessed Value = $1,000,000; Director’s Ratio = 80%. $1,000,000 ÷ .80 = $1,250,000)

8.FULL EXEMPTION FROM THE REALTY TRANSFER FEE (GRANTOR/GRANTEE)

The fee imposed by this Act shall not apply to a deed:

(a)For consideration of less than $100; (b) By or to the United States of America, this State, or any instrumentality, agency or subdivision; (c) Solely in order to provide or release security for a debt or obligation; (d) Which confirms or corrects a deed previously recorded; (e) On a sale for delinquent taxes or assessments; (f) On partition; (g) By a receiver, trustee in bankruptcy or liquidation, or assignee for the benefit of creditors; (h) Eligible to be recorded as an “ancient deed” pursuant to N.J.S.A.

9.PARTIAL EXEMPTION FROM THE REALTY TRANSFER FEE (P.L. 1975, c. 176; P.L. 2003, c. 113; P.L. 2004, c. 66)

The following transfers of title to real property shall be exempt from State portions of the Basic Fee, Supplemental Fee, and General Purpose Fee, as applicable: 1. The sale of any one or

For the purposes of this Act, the following definitions shall apply:

“Blind person” means a person whose vision in his better eye with proper correction does not exceed 20/200 as measured by the Snellen chart or a person who has a field defect in his better eye with proper correction in which the peripheral field has contracted to such an extent that the widest diameter of visual field subtends an angular distance no greater than 20º.

“Disabled person” means any resident of this State who is permanently and totally disabled, unable to engage in gainful employment, and receiving disability benefits or any other compensation under any federal or State law.

“Senior citizen” means any resident of this State of the age of 62 or over.

“Low and Moderate Income Housing” means any residential premises, or part thereof, affordable according to Federal Department of Housing and Urban Development or other recognized standards for home ownership and rental costs occupied or reserved for occupancy by households with a gross income equal to 80% or less of the median gross household income for households of the same size within the housing region in which the housing is located, but shall include only those residential premises subject to resale controls pursuant to contractual guarantees.

“Resident of the State of New Jersey” means any claimant who is legally domiciled in this State when the transfer of the subject property is made. Domicile is what the claimant regards as the permanent home to which he intends to return after a period of absence. Proofs of domicile include a New Jersey voter registration, motor vehicle registration and driver’s license, and resident tax return filing.

10. TRANSFERS OF NEW CONSTRUCTION

“New construction” means any conveyance or transfer of property upon which there is an entirely new improvement not previously occupied or used for any purpose. On transfers of new construction, the words “NEW CONSTRUCTION” shall be printed clearly at the top of the first page of the deed, and an Affidavit by the grantor stating that the transfer is of property upon which there is new construction shall be appended to the deed.

11.REALTY TRANSFER FEE IS A FEE IN ADDITION TO OTHER RECORDING FEES

The county recording officer is required to collect the Realty Transfer Fee at the time the deed is offered for recording/transfer.

12.PENALTY FOR WILLFUL FALSIFICATION OF CONSIDERATION AND TRANSFERS OF NEW CONSTRUCTION

Any person who knowingly falsifies the consideration recited in a deed or in the proof or acknowledgement of the execution of a deed or in an affidavit annexed to a deed declaring the consideration therefor or a declaration in an affidavit that a transfer is exempt from recording fee is guilty of a crime of the fourth degree (P.L. 1991, c. 308, effective June 1, 1992). Grantors conveying title of new construction who fail to subscribe and append to the deed an affidavit to that effect in accordance with the provisions of subsection c. of section 2 of P.L. 1968, c. 49

13.COUNTY/MUNICIPAL CODES

County/Municipal codes may be found at http://www.state.nj.us/treasury/taxation/pdf/lpt/cntycode.pdf.

14.LEGAL ENTITIES TRANSFERRING NEW JEREY REAL ESTATE TO RELATED LEGAL ENTITIES

Legal entities transferring New Jersey real estate to related legal entities are not exempt from the Realty Transfer Fee if the consideration, as defined in the law, is $100 or more. Such consideration includes the actual amount of money and/or the monetary value of any other thing of value constituting the entire compensation paid, such as the dollar value of stock included in the transaction or any enhancement to or contribution to the capital or either legal entity resulting from the transfer, or remaining balances of any prior mortgage to which the property is subject or which is assumed and agreed to be paid by the grantee and any other lien or encumbrance not paid, satisfied or removed in connection with the transfer of title.

Other PDF Templates

Alabama High School Physical Form - This form helps facilitate communication between medical professionals, schools, and families.

When purchasing an RV in Arizona, it's essential to have a properly completed form to document the sale. The Arizona RV Bill of Sale form can be found online, providing an official record of the transaction between the buyer and seller. For more details on this form, you can visit https://autobillofsaleform.com/rv-bill-of-sale-form/arizona-rv-bill-of-sale-form/, ensuring a smooth and legal transfer of ownership.

Sample Lease Form - Landlords may not be held liable for delays in occupancy when possession is not delivered on time.

Documents used along the form

The New Jersey Affidavit of Consideration RTF-1 form is an important document used in real estate transactions, particularly to declare the consideration or payment made for a property. However, it is often accompanied by other forms and documents that help provide a comprehensive view of the transaction. Below is a list of five commonly used documents that work in conjunction with the RTF-1 form.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It includes details such as the names of the parties involved, a description of the property, and is typically signed in the presence of a notary public.

- Motor Vehicle Power of Attorney Form: For those needing to authorize representation in vehicle matters, the specific Motor Vehicle Power of Attorney document streamlines the process for handling transactions and signings.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes. It provides information about the sale price and other relevant details necessary for tax assessment.

- Title Report: A title report outlines the legal status of the property. It identifies any liens, easements, or other encumbrances that may affect ownership and ensures that the buyer receives clear title to the property.

- Settlement Statement (HUD-1): This document provides a detailed account of the financial transactions involved in the sale. It lists all costs and fees associated with the closing of the sale, helping both parties understand their financial obligations.

- Buyer’s or Seller’s Affidavit: This affidavit may be required to affirm certain facts related to the transaction, such as the buyer’s or seller’s identity and their authority to enter into the agreement. It serves to protect all parties involved by providing a sworn statement of key facts.

These documents work together to ensure a smooth and legally compliant real estate transaction. Having them prepared and reviewed can prevent misunderstandings and protect the interests of all parties involved.

Similar forms

The New Jersey Affidavit of Consideration RTF-1 form is similar to the New Jersey Quitclaim Deed. Both documents serve to transfer property ownership. The Quitclaim Deed specifically conveys whatever interest the grantor has in the property without guaranteeing that the title is clear. This means that if there are any claims against the property, the grantee may inherit those issues. The RTF-1 form, on the other hand, is used to disclose the consideration or payment made for the property, which is essential for tax purposes.

Another document similar to the RTF-1 form is the New Jersey Warranty Deed. While both documents facilitate the transfer of property, the Warranty Deed offers a guarantee that the title is clear and free of liens or encumbrances. The Warranty Deed protects the buyer by ensuring that the seller is legally entitled to sell the property. In contrast, the RTF-1 form focuses on the financial aspect of the transaction, detailing the consideration involved.

The New Jersey Bargain and Sale Deed is also comparable to the RTF-1 form. This deed transfers property without warranties against encumbrances. It is often used in transactions where the seller may not want to guarantee the title. The RTF-1 form complements this by providing a record of the consideration exchanged, which is crucial for tax assessment and recording purposes.

The New Jersey Deed of Trust shares similarities with the RTF-1 form in that both are involved in property transactions. A Deed of Trust secures a loan by placing a lien on the property, while the RTF-1 form documents the sale price or consideration for the property. Both documents are essential in real estate transactions, ensuring that all parties are aware of their financial obligations.

In addition to the various documents discussed, the Washington Mobile Home Bill of Sale serves as a critical form for the transfer of ownership specifically in mobile home transactions. It is important to ensure that both the buyer and seller complete this form accurately to avoid any ambiguities and protect their interests. For further details on the required information and process, you can refer to the Mobile Home Bill of Sale.

The New Jersey Bill of Sale can be likened to the RTF-1 form as both documents serve to confirm a transfer of ownership. While a Bill of Sale is typically used for personal property, it outlines the terms of the sale and the consideration exchanged. The RTF-1 form does this for real estate, providing essential information for tax records and ensuring transparency in the transaction.

The New Jersey Lease Agreement is another document that bears resemblance to the RTF-1 form. Although primarily used for rental agreements, it includes terms regarding the consideration (rent) paid for the use of the property. Both documents are crucial in establishing the financial relationship between parties, although the RTF-1 form focuses on outright sales rather than rental arrangements.

The New Jersey Property Transfer Tax form is closely related to the RTF-1 form. This form specifically addresses the tax implications of transferring property. It requires information about the consideration involved in the sale, similar to the RTF-1. Both documents aim to ensure compliance with state tax laws and provide a clear record of the transaction.

The New Jersey Real Estate Transfer Declaration is another document that aligns with the RTF-1 form. This declaration provides details about the property being transferred, including its sale price. Like the RTF-1, it is used for tax assessment purposes. Both documents help local authorities track property transactions and ensure accurate tax collection.

Lastly, the New Jersey Affidavit of Title is similar in that it provides a sworn statement about the status of the property title. While the RTF-1 focuses on the financial consideration of the sale, the Affidavit of Title assures the buyer that the seller has the right to transfer ownership. Both documents are essential in the real estate process, ensuring that buyers and sellers understand their rights and obligations.

Dos and Don'ts

When filling out the New Jersey Affidavit of Consideration RTF-1 form, it’s important to be thorough and accurate. Here are some key do's and don'ts to keep in mind:

- Do ensure that all information is complete and accurate. Double-check names, addresses, and other details.

- Do sign and date the form where required. An unsigned form may be considered invalid.

- Do use clear and legible handwriting or type the information. This helps prevent misunderstandings.

- Do keep a copy of the completed form for your records. It’s useful for future reference.

- Don't leave any required fields blank. Omitting information can delay processing.

- Don't use correction fluid or tape on the form. If you make a mistake, it’s better to start over with a new form.

- Don't rush through the form. Take your time to ensure everything is filled out correctly.

- Don't forget to check for any additional documents that may need to be submitted with the form.

Key takeaways

When filling out and using the New Jersey Affidavit of Consideration RTF-1 form, keep these key takeaways in mind:

- Accurate Information is Essential: Ensure that all details provided on the form are accurate and complete. This includes names, addresses, and the consideration amount. Mistakes can lead to delays or complications.

- Signature Requirements: The form must be signed by the seller or the seller's representative. Make sure that the signature is notarized, as this adds legitimacy and is often a requirement for acceptance.

- Submission Process: After completing the form, it should be submitted to the appropriate county office. Check the specific submission guidelines for your county to avoid any issues.

- Keep Copies: Always retain a copy of the completed affidavit for your records. This can be helpful in case of future inquiries or if any issues arise regarding the transaction.

By following these guidelines, you can ensure a smoother experience when using the New Jersey Affidavit of Consideration RTF-1 form.

How to Use New Jersey Affidavit of Consideration RTF-1

Completing the New Jersey Affidavit of Consideration RTF-1 form is a straightforward process that requires careful attention to detail. Once the form is filled out accurately, it will be ready for submission, allowing for the next steps in your transaction to proceed smoothly.

- Begin by downloading the New Jersey Affidavit of Consideration RTF-1 form from the appropriate state website or obtaining a physical copy.

- At the top of the form, fill in the name of the seller and the buyer. Ensure that both names are spelled correctly and match the legal documents.

- Provide the property address in the designated section. Include the street address, city, and zip code.

- Next, indicate the date of the transaction. This is typically the date on which the sale is finalized.

- In the section for consideration amount, clearly state the total amount paid for the property. This should reflect the agreed-upon price.

- If applicable, check the box that corresponds to the type of consideration (e.g., cash, mortgage, or other). Be specific about the nature of the payment.

- Complete the section regarding any exemptions, if relevant. This may involve providing additional details about the nature of the transaction.

- Both the buyer and seller must sign the form in the designated areas. Ensure that signatures are legible and match the names provided earlier.

- Include the date of signing next to each signature to confirm when the agreement was finalized.

- Review the entire form for accuracy and completeness. Any missing information could delay processing.

- Once reviewed, submit the completed form to the appropriate county office or as directed. Keep a copy for your records.