Fill Out a Valid Non Borrower Credit Authorization Form

The Non Borrower Credit Authorization form plays a crucial role in the mortgage loan modification process, particularly when a borrower discloses income from a household member who is not listed on the promissory note. This form is necessary for individuals who live in the borrower's home and contribute to the household income but are not legally responsible for the mortgage. By completing this form, the non-borrower grants permission for the lender to access their consumer credit report, which helps in assessing the overall financial situation of the household. The form requires the non-borrower to provide basic information, including their relationship to the borrower and their social security number, ensuring that the lender can accurately evaluate the application for a loan modification. Additionally, if there are multiple non-borrowers contributing to the household income, copies of the form can be used to gather the necessary authorizations from each individual. This process not only facilitates transparency but also aids in making informed decisions regarding loan modifications.

Common mistakes

-

Incomplete Property Address: Failing to provide the full property address can lead to confusion and delays. Ensure that the complete address is filled in accurately.

-

Missing Signature: The non-borrower must sign the form. Without a signature, the authorization is not valid, and the process may halt.

-

Incorrect Relationship to Borrower: Specifying the wrong relationship can cause misunderstandings. Clearly state how you are related to the borrower.

-

Omitting Social Security Number: Not providing a Social Security number can delay the credit report retrieval. Make sure to fill this in accurately.

-

Not Understanding the Authorization: It's important to read and understand what you are authorizing. Misunderstandings can lead to issues down the line.

-

Using Multiple Forms Incorrectly: If there are several non-borrowers, ensure each one completes their own form. Using a single form for multiple non-borrowers can lead to complications.

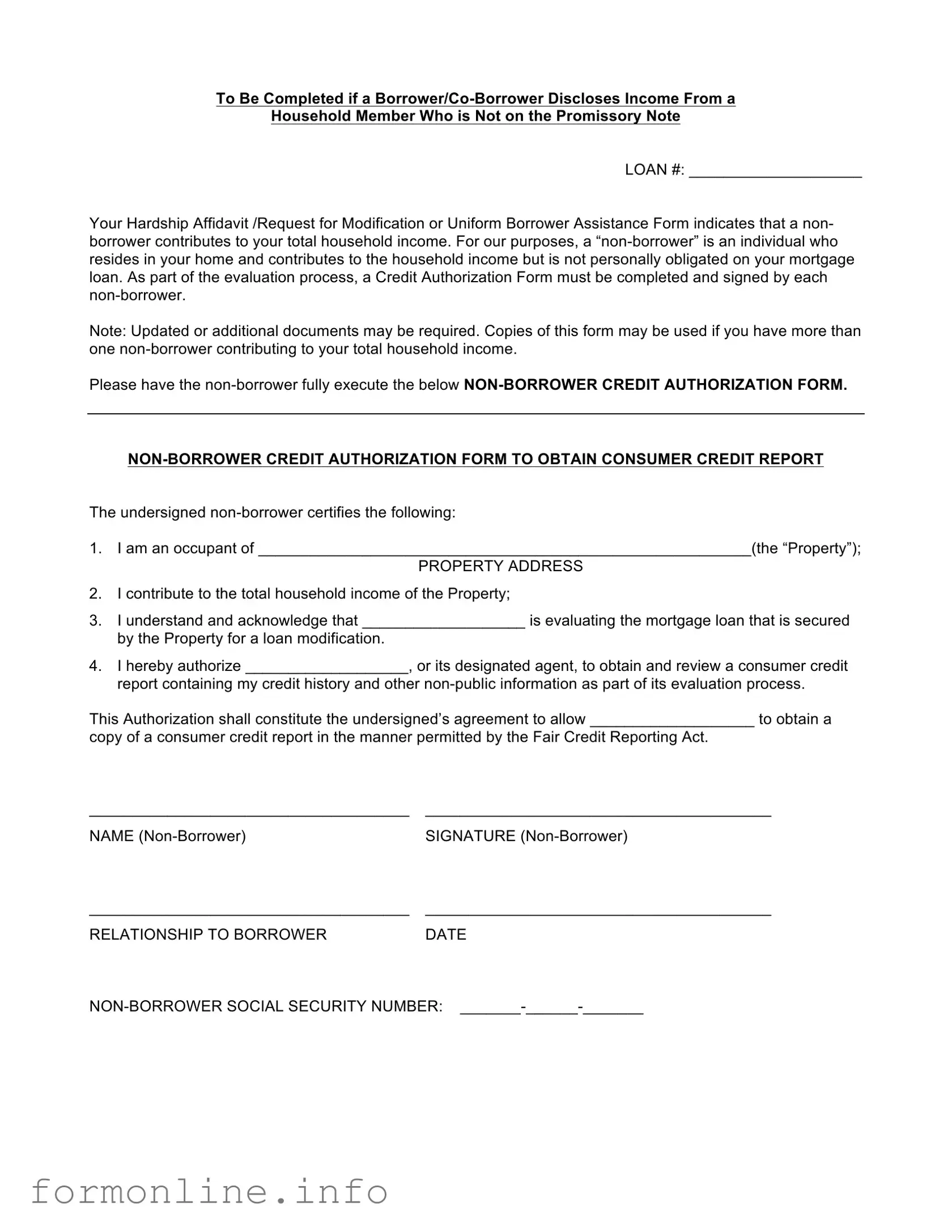

Preview - Non Borrower Credit Authorization Form

To Be Completed if a

Household Member Who is Not on the Promissory Note

LOAN #: ____________________

Your Hardship Affidavit /Request for Modification or Uniform Borrower Assistance Form indicates that a non- borrower contributes to your total household income. For our purposes, a

Note: Updated or additional documents may be required. Copies of this form may be used if you have more than one

Please have the

The undersigned

1.I am an occupant of _________________________________________________________(the “Property”);

PROPERTY ADDRESS

2.I contribute to the total household income of the Property;

3.I understand and acknowledge that ___________________ is evaluating the mortgage loan that is secured by the Property for a loan modification.

4.I hereby authorize ___________________, or its designated agent, to obtain and review a consumer credit report containing my credit history and other

This Authorization shall constitute the undersigned’s agreement to allow ___________________ to obtain a

copy of a consumer credit report in the manner permitted by the Fair Credit Reporting Act.

_____________________________________ |

________________________________________ |

NAME |

SIGNATURE |

_____________________________________ |

________________________________________ |

RELATIONSHIP TO BORROWER |

DATE |

Other PDF Templates

How to Make a Gift Card - Completing the Gift Letter accurately is critical to avoid delays.

A Florida Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. This form outlines essential details such as the buyer, seller, and the mobile home's specifications. Understanding this document is crucial for ensuring a smooth transaction and protecting the rights of both parties involved. For further guidance, you may refer to a detailed example of a Mobile Home Bill of Sale.

Certapet Letter - Emotional Support Animals provide comfort and support to individuals experiencing anxiety, depression, or other emotional challenges.

Documents used along the form

The Non Borrower Credit Authorization form is an important document when evaluating household income contributions from individuals not listed on the mortgage. To ensure a smooth process, several other forms and documents may be required alongside this authorization. Below is a list of commonly used documents that often accompany the Non Borrower Credit Authorization form.

- Hardship Affidavit: This document outlines the financial difficulties faced by the borrower. It provides context for the request for loan modification and explains why assistance is needed.

- Request for Modification: This form is used to formally request changes to the terms of a mortgage. It details the specific modifications being sought, such as lower payments or extended loan terms.

- Uniform Borrower Assistance Form: This standardized form collects information about the borrower’s financial situation. It helps lenders assess the overall ability to repay the loan and determine eligibility for assistance programs.

- Income Verification Documents: These may include pay stubs, tax returns, or bank statements. They serve to confirm the income contributions of both the borrower and non-borrowers in the household.

- Georgia WC-14 Form: Essential for notifying the Georgia State Board of Workers' Compensation about workplace injury claims, this form can be modified to include additional employers or insurers as necessary. For more information, visit georgiapdf.com.

- Authorization to Release Information: This form allows lenders to obtain information from third parties, such as employers or financial institutions. It ensures that the lender can verify the information provided by the borrower and non-borrowers.

Gathering these documents can feel overwhelming, but they are crucial for a thorough evaluation of your situation. Having everything ready can help streamline the process and increase the chances of a favorable outcome.

Similar forms

The Non-Borrower Credit Authorization form shares similarities with the Authorization to Release Information form. This document allows individuals to grant permission for specific information to be shared with lenders or other financial institutions. Just like the Non-Borrower Credit Authorization, this form requires a signature and personal details from the individual authorizing the release. Both documents aim to facilitate the evaluation process by ensuring that necessary financial information can be obtained and reviewed by the relevant parties.

Another document akin to the Non-Borrower Credit Authorization is the Credit Report Authorization form. This form specifically permits a lender to access an individual's credit report. Similar to the Non-Borrower Credit Authorization, it requires the individual’s consent and personal information. The purpose of both forms is to provide lenders with the necessary credit history to assess financial eligibility, ensuring a smooth evaluation process.

When engaging in the purchase or sale of a motorcycle in Texas, it's vital to accurately document the transaction using the Texas Motorcycle Bill of Sale. This form not only serves as a proof of purchase but also safeguards both the buyer and seller by outlining key details such as the motorcycle’s condition and sale price. For those looking for a reliable template to facilitate this process, you can find a comprehensive form at https://autobillofsaleform.com/motorcycle-bill-of-sale-form/texas-motorcycle-bill-of-sale-form.

The Household Income Verification form is also comparable to the Non-Borrower Credit Authorization. This document is used to confirm the total income of all household members, including non-borrowers. Like the Non-Borrower Credit Authorization, it seeks to gather essential information that can impact the loan modification process. Both forms emphasize the importance of accurately reporting income sources to facilitate a fair assessment.

In addition, the Non-Borrower Credit Authorization is similar to the Non-Borrower Affidavit. This affidavit serves as a sworn statement confirming the non-borrower’s contribution to household income. Both documents require the non-borrower to attest to their financial involvement, thereby providing lenders with a clearer picture of the household’s financial situation during the evaluation process.

The Authorization for Release of Medical Records can also be compared to the Non-Borrower Credit Authorization. While it pertains to health information, both documents require explicit consent from the individual for information to be shared. They are both designed to ensure that relevant data is accessible for decision-making, whether in financial or medical contexts.

Another similar document is the Employment Verification form. This form is used to confirm an individual’s employment status and income, similar to how the Non-Borrower Credit Authorization verifies a non-borrower’s contribution to household income. Both documents serve to provide lenders with a comprehensive view of the household’s financial stability, which is crucial during the loan modification evaluation.

The Authorization for Background Check is yet another document that bears resemblance to the Non-Borrower Credit Authorization. This form allows an organization to conduct a background check on an individual, which may include credit history. Both documents require consent from the individual and are aimed at gathering necessary information for evaluation purposes, whether for lending or employment decisions.

In addition, the Personal Financial Statement can be compared to the Non-Borrower Credit Authorization. A personal financial statement provides a detailed overview of an individual’s financial situation, including income and expenses. Similar to the Non-Borrower Credit Authorization, it is used to assess financial eligibility and stability, helping lenders make informed decisions regarding loans or modifications.

The Consent to Obtain Credit Information form is another document similar to the Non-Borrower Credit Authorization. This form explicitly allows a lender to obtain credit information about an individual. Both documents require a signature and personal details, ensuring that the lender can access the necessary information to evaluate the financial standing of all parties involved.

Lastly, the Loan Application form is akin to the Non-Borrower Credit Authorization. While the loan application gathers comprehensive financial information from the borrower, it often requires information about non-borrowers as well. Both documents are integral to the loan process, as they provide lenders with the necessary details to assess the overall financial situation of the household.

Dos and Don'ts

When filling out the Non Borrower Credit Authorization form, it's essential to follow specific guidelines to ensure accuracy and compliance. Here are six things to consider:

- Do ensure all information is accurate. Double-check the property address and the non-borrower’s details.

- Do have the non-borrower sign the form. Their signature is crucial for authorization.

- Do include the relationship to the borrower. Clearly state how the non-borrower is related to the borrower.

- Do keep a copy of the completed form. This can be useful for your records and future reference.

- Don’t leave any fields blank. Ensure all required information is filled out completely.

- Don’t submit without a date. The form must be dated to be valid.

Key takeaways

When filling out and using the Non Borrower Credit Authorization form, several important points should be considered to ensure compliance and accuracy.

- Purpose of the Form: This form is specifically designed for non-borrowers who contribute to the household income but are not obligated on the mortgage loan.

- Loan Identification: Clearly indicate the loan number at the top of the form to ensure proper identification and processing.

- Property Address: Provide the complete address of the property where the non-borrower resides, as this is crucial for the evaluation process.

- Multiple Non-Borrowers: If there are several non-borrowers contributing to the income, copies of the form may be used for each individual.

- Signature Requirement: Each non-borrower must sign the form to authorize the evaluation of their credit history.

- Understanding of Evaluation: The non-borrower should acknowledge that their credit report will be used in the mortgage loan evaluation process.

- Compliance with Regulations: The authorization allows the lender to obtain a consumer credit report in accordance with the Fair Credit Reporting Act.

- Personal Information: Ensure the non-borrower provides their Social Security number, as this is necessary for credit report retrieval.

By following these key takeaways, individuals can effectively navigate the process of completing the Non Borrower Credit Authorization form.

How to Use Non Borrower Credit Authorization

After gathering the necessary information, you can proceed to fill out the Non Borrower Credit Authorization form. This form is essential for evaluating household income contributions from individuals who are not on the mortgage loan. Follow these steps to complete the form accurately.

- Write the loan number at the top of the form where indicated.

- Fill in the property address in the space provided.

- Confirm that the non-borrower is an occupant of the property by checking the appropriate box or writing "yes."

- Indicate that the non-borrower contributes to the total household income.

- In the designated area, write the name of the entity evaluating the mortgage loan.

- Authorize the evaluation by filling in the name of the entity or its designated agent that will obtain the credit report.

- Have the non-borrower sign the form in the designated signature area.

- Fill in the relationship of the non-borrower to the borrower.

- Enter the date the form is completed.

- Provide the non-borrower’s Social Security number in the space provided, ensuring accuracy.

Once the form is completed, ensure that all required signatures are in place. Additional documents may be needed as part of the evaluation process, so keep an eye out for any requests for further information.