Printable Owner Financing Contract Form

When exploring options for purchasing a home, many buyers and sellers consider owner financing as a viable alternative to traditional mortgage methods. This arrangement allows the seller to finance the purchase directly, bypassing banks and lenders. The Owner Financing Contract form serves as a crucial document in this process, outlining the terms and conditions agreed upon by both parties. Key components of the form include the purchase price, down payment amount, interest rate, and repayment schedule. It also specifies the duration of the financing period and any penalties for late payments. Additionally, the contract addresses responsibilities for property maintenance and insurance, ensuring that both the buyer and seller understand their obligations. By clearly detailing these elements, the Owner Financing Contract form helps facilitate a smooth transaction while protecting the interests of both parties involved.

Common mistakes

-

Not Reading the Entire Contract: Many individuals rush through the contract without fully understanding its terms. This can lead to misunderstandings later.

-

Incorrectly Filling Out Personal Information: Errors in names, addresses, or contact information can create complications in communication and legal proceedings.

-

Failing to Specify Payment Terms: It's crucial to clearly outline the payment schedule, interest rate, and any penalties for late payments. Ambiguity can lead to disputes.

-

Ignoring the Importance of Signatures: Both parties must sign the contract. Failing to do so can render the agreement unenforceable.

-

Not Including a Default Clause: Without a clear plan for what happens in case of default, both parties may face unexpected challenges.

-

Overlooking Local Laws and Regulations: Each state has specific laws regarding owner financing. Ignoring these can lead to legal issues down the line.

-

Neglecting to Consult a Professional: Skipping legal or financial advice can result in costly mistakes. A professional can provide guidance tailored to your situation.

-

Not Keeping Copies of the Contract: Failing to retain a signed copy can lead to confusion or disputes in the future. Always ensure that both parties have access to the final document.

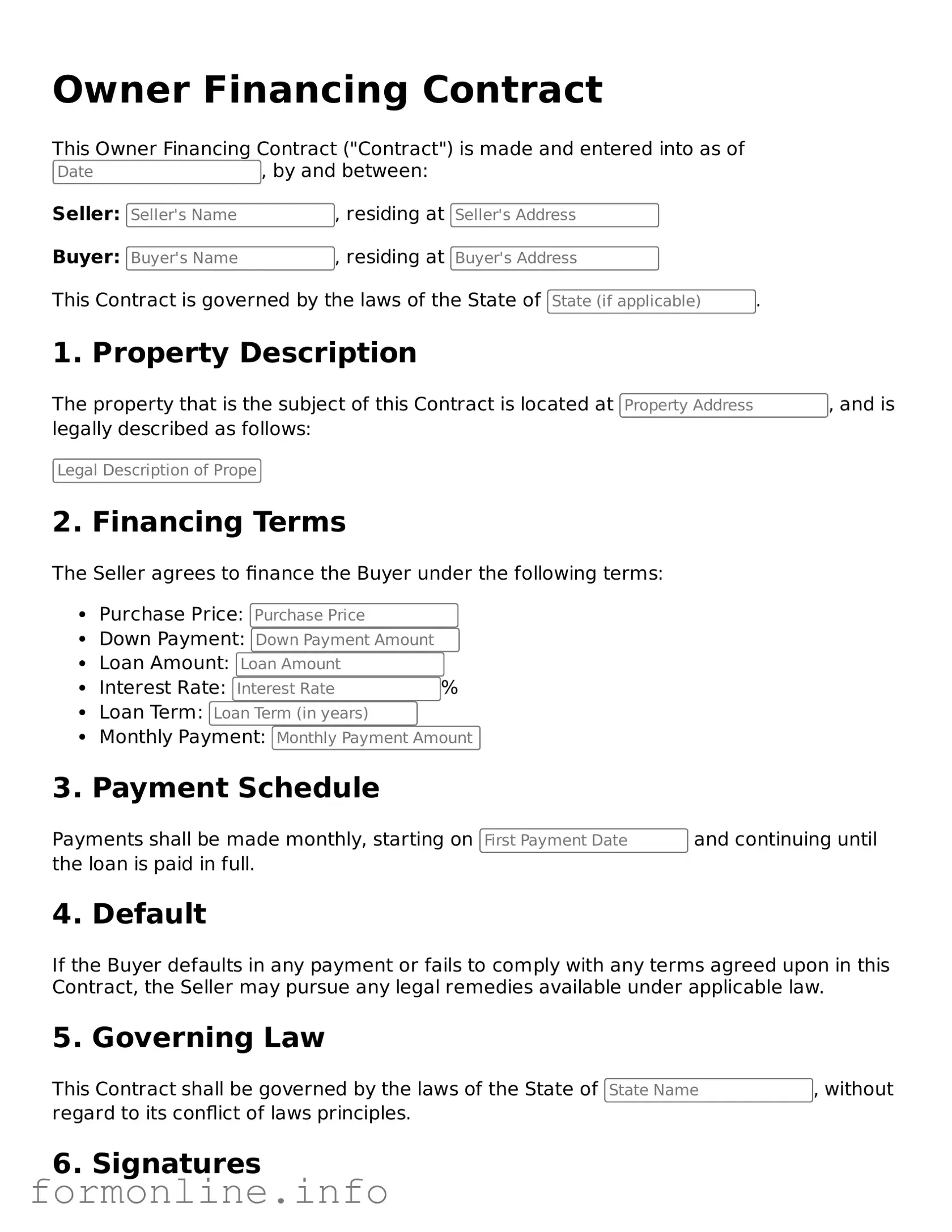

Preview - Owner Financing Contract Form

Owner Financing Contract

This Owner Financing Contract ("Contract") is made and entered into as of , by and between:

Seller: , residing at

Buyer: , residing at

This Contract is governed by the laws of the State of .

1. Property Description

The property that is the subject of this Contract is located at , and is legally described as follows:

2. Financing Terms

The Seller agrees to finance the Buyer under the following terms:

- Purchase Price:

- Down Payment:

- Loan Amount:

- Interest Rate: %

- Loan Term:

- Monthly Payment:

3. Payment Schedule

Payments shall be made monthly, starting on and continuing until the loan is paid in full.

4. Default

If the Buyer defaults in any payment or fails to comply with any terms agreed upon in this Contract, the Seller may pursue any legal remedies available under applicable law.

5. Governing Law

This Contract shall be governed by the laws of the State of , without regard to its conflict of laws principles.

6. Signatures

By signing below, both parties agree to the terms of this Owner Financing Contract:

- Seller's Signature: _________________________ Date: ______________

- Buyer's Signature: _________________________ Date: ______________

Witnesses (if required):

- Witness Signature: _________________________ Date: ______________

- Witness Signature: _________________________ Date: ______________

More Types of Owner Financing Contract Templates:

How to Fire a Realtor Example Letter - A document used to formally cancel a real estate purchase agreement.

Unlimited Guarantee - Potential guarantors should evaluate the borrowing entity's financial health before agreeing to the terms.

The Texas Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a real estate transaction in Texas. This form is essential for buyers and sellers to clearly define their rights and obligations throughout the sale process. To get started on your real estate journey, fill out the form by clicking the button below or visit https://texasdocuments.net/ for more information.

Purchase Agreement Addendum - Through this addendum, parties can specify deadlines or obligations that were not explicitly covered in the original agreement.

Documents used along the form

When entering into an owner financing agreement, several documents may accompany the Owner Financing Contract. Each document serves a specific purpose, ensuring that both parties are protected and that the transaction proceeds smoothly. Here’s a list of commonly used forms and documents:

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It details the amount borrowed, interest rate, repayment schedule, and any penalties for late payments.

- Deed of Trust: This serves as a security instrument, allowing the lender to hold a claim on the property until the borrower repays the loan. It includes the terms of the loan and the rights of both parties.

- Purchase Agreement: This is the initial agreement between the buyer and seller, detailing the sale terms, including price, closing date, and any contingencies.

- Disclosure Statements: These documents provide important information about the property, including any known defects or issues. They protect the buyer by ensuring transparency in the transaction.

- Title Search Report: This report confirms the property's legal ownership and identifies any liens or encumbrances. It is essential for ensuring that the seller has the right to sell the property.

- Real Estate Purchase Agreement: This essential document is used in the purchase process, detailing terms like purchase price and contingencies, ensuring both parties are aligned. For more information, visit All Nevada Forms.

- Closing Statement: This document summarizes all financial transactions involved in the sale. It outlines the costs associated with closing the deal, including fees, taxes, and adjustments.

- Insurance Policy: Proof of homeowner's insurance is often required. This document protects both parties by ensuring that the property is covered against potential damages.

- Amortization Schedule: This schedule shows the breakdown of each payment over time, detailing how much goes toward principal and interest. It helps the borrower understand their financial obligations.

- Escrow Agreement: If an escrow account is used, this agreement outlines how funds will be managed during the transaction. It ensures that both parties meet their obligations before the funds are released.

These documents work together to create a clear framework for the owner financing arrangement. Understanding each one can help both parties navigate the process with confidence, ensuring a successful transaction.

Similar forms

The first document that shares similarities with the Owner Financing Contract is the Purchase Agreement. This agreement outlines the terms under which a buyer will purchase a property from a seller. Both documents establish a clear understanding of the sale, including price and terms. However, while the Purchase Agreement typically involves traditional financing methods, the Owner Financing Contract specifically details the terms under which the seller provides financing directly to the buyer.

Next, the Lease Purchase Agreement also bears resemblance to the Owner Financing Contract. This document allows a tenant to lease a property with the option to purchase it later. Like the Owner Financing Contract, it includes terms regarding payments and conditions for eventual ownership. However, the Lease Purchase Agreement often involves an initial rental period, while the Owner Financing Contract directly addresses the financing aspect of the sale.

The Promissory Note is another document that aligns closely with the Owner Financing Contract. A Promissory Note is a written promise to pay a specified amount of money at a particular time. In the context of owner financing, this document serves as a formal acknowledgment of the debt incurred by the buyer to the seller. Both documents detail the financial obligations, but the Promissory Note is more focused on the repayment terms rather than the overall sale agreement.

For those navigating the complexities of property transactions, utilizing a reliable comprehensive Real Estate Purchase Agreement template can streamline the process and ensure that all necessary terms are clearly defined. This template not only delineates the responsibilities of both parties but also safeguards their interests throughout the buying process.

The Deed of Trust is also similar to the Owner Financing Contract, as it secures the loan made by the seller to the buyer. This document establishes a legal claim against the property, ensuring that the seller can reclaim the property if the buyer defaults on payments. While the Owner Financing Contract outlines the terms of the sale and financing, the Deed of Trust provides a layer of security for the seller.

The Mortgage Agreement is another related document. In traditional financing scenarios, this agreement outlines the terms under which a lender provides funds to a borrower to purchase a property. While both documents involve financing, the key difference lies in the fact that the Mortgage Agreement typically involves a third-party lender, whereas the Owner Financing Contract is a direct agreement between the seller and buyer.

The Land Contract, also known as a Contract for Deed, is similar to the Owner Financing Contract in that it allows the buyer to make payments directly to the seller while gaining equitable interest in the property. Both documents facilitate a sale where the seller finances the purchase. However, the Land Contract often includes provisions that transfer title only after full payment, whereas the Owner Financing Contract may allow for immediate ownership under certain conditions.

The Seller Financing Addendum is another document that complements the Owner Financing Contract. This addendum is attached to a Purchase Agreement when the seller agrees to finance part of the purchase price. While both documents address seller financing, the addendum is often used in conjunction with a traditional sale, whereas the Owner Financing Contract serves as the primary agreement for the entire transaction.

The Assignment of Mortgage is also relevant, as it allows the seller to transfer the mortgage to another party. This document can come into play if the seller wishes to sell the note to an investor. Both the Assignment of Mortgage and the Owner Financing Contract deal with financial obligations related to property ownership, but the former focuses on transferring the debt, while the latter outlines the terms of the financing arrangement.

Lastly, the Closing Disclosure is a document that provides detailed information about the final terms of a mortgage loan. While it is typically used in traditional financing scenarios, it can also be relevant in owner financing situations. Both documents aim to ensure transparency in financial transactions, but the Closing Disclosure is more focused on the final costs and terms associated with the loan rather than the specific financing agreement itself.

Dos and Don'ts

When filling out the Owner Financing Contract form, it's important to be careful and thorough. Here are some dos and don'ts to keep in mind:

- Do read the entire contract before starting to fill it out.

- Do provide accurate and complete information about the buyer and seller.

- Do clearly outline the terms of the financing, including interest rates and payment schedules.

- Do have all parties sign and date the contract to make it legally binding.

- Do keep a copy of the completed contract for your records.

- Don't leave any blank spaces on the form; incomplete information can cause issues later.

- Don't use vague language; be specific about all terms and conditions.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to consult with a legal professional if you have questions.

Key takeaways

When considering the Owner Financing Contract form, there are several important points to keep in mind. Below are key takeaways that can help guide you through the process.

- Understand the Terms: It is crucial to clearly define the terms of the financing arrangement. This includes the purchase price, interest rate, and payment schedule.

- Legal Compliance: Ensure that the contract complies with local laws and regulations. This helps protect both the buyer and the seller.

- Clear Communication: Maintain open communication between both parties. Discuss any questions or concerns regarding the contract to avoid misunderstandings.

- Document Everything: Keep thorough records of all communications and transactions related to the contract. This documentation can be valuable in case of disputes.

How to Use Owner Financing Contract

Completing the Owner Financing Contract form is an important step in securing a financing agreement. Ensure that all information is accurate and clearly presented. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the names and contact information of both the buyer and the seller.

- Clearly describe the property being financed, including its address and any relevant details.

- Specify the total purchase price of the property.

- Indicate the amount of the down payment.

- Detail the financing terms, including the interest rate and repayment schedule.

- Include any additional terms or conditions that apply to the financing agreement.

- Both parties should sign and date the form at the designated areas.

Once the form is completed, review it carefully to ensure all information is accurate. This will help avoid any potential disputes in the future. After verification, make copies for both parties and keep the original in a secure location.