Fill Out a Valid Pay Stub Form

Understanding your pay stub is crucial for both employees and employers. This document serves as a detailed summary of an employee's earnings for a specific pay period, providing clarity on gross pay, deductions, and net pay. Each pay stub typically includes essential information such as the employee's name, the pay period dates, and the employer's details. It breaks down earnings by hours worked, overtime, and any bonuses, ensuring transparency in compensation. Deductions for taxes, insurance, and retirement contributions are also clearly outlined, helping employees understand where their money goes. Additionally, many pay stubs feature year-to-date totals, allowing individuals to track their earnings and deductions over the course of the year. By familiarizing yourself with the components of a pay stub, you can better manage your finances and ensure that you are being compensated fairly for your work.

Common mistakes

-

Incorrect Personal Information: One of the most common mistakes is entering incorrect personal details. This can include misspelling names, providing the wrong Social Security number, or listing an incorrect address. Such errors can lead to complications in tax reporting and benefits eligibility.

-

Miscalculating Hours Worked: Employees often miscalculate their total hours worked, especially if they work irregular hours or have variable schedules. It’s essential to accurately track hours to ensure proper compensation. Failing to do so can result in underpayment or overpayment, both of which can create issues down the line.

-

Neglecting to Include Deductions: Some individuals forget to account for deductions such as health insurance premiums, retirement contributions, or taxes. These deductions are critical for calculating net pay. Omitting them can lead to an inflated view of take-home pay and potential financial issues later.

-

Not Reviewing for Errors: Finally, many people fail to review their pay stubs for errors after completing the form. It's important to double-check all entries for accuracy. A simple oversight can lead to significant problems, including discrepancies in pay and tax filings.

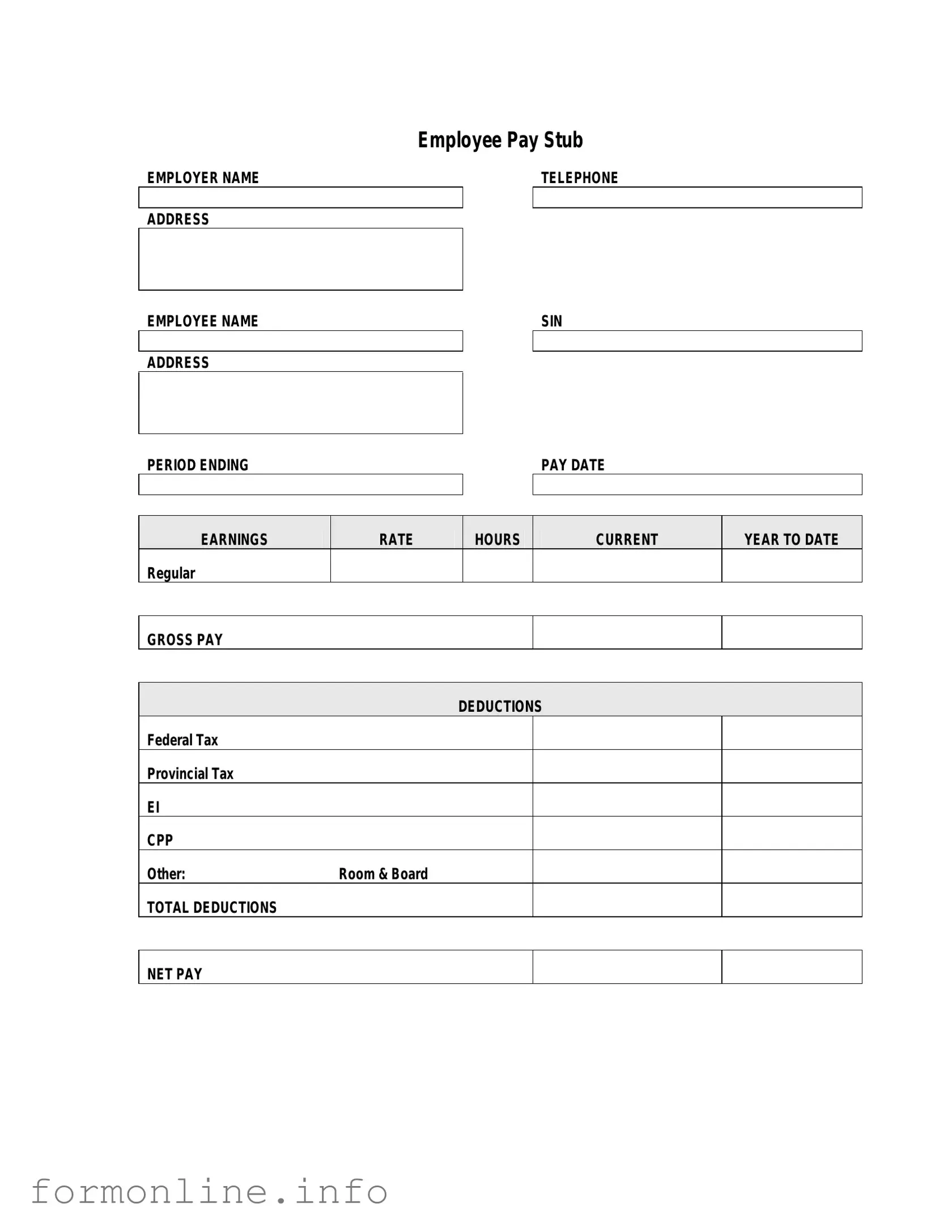

Preview - Pay Stub Form

Employee Pay Stub

EMPLOYER NAME |

|

TELEPHONE |

|

|

|

ADDRESS

EMPLOYEE NAME |

|

SIN |

|

|

|

ADDRESS

PERIOD ENDING |

|

|

PAY DATE |

|

|

|

|

|

|

|

|

|

|

|

EARNINGS |

RATE |

HOURS |

CURRENT |

YEAR TO DATE |

Regular |

|

|

|

|

GROSS PAY

DEDUCTIONS

Federal Tax

Provincial Tax

EI

CPP

Other:Room & Board

TOTAL DEDUCTIONS

NET PAY

Other PDF Templates

Michigan Divorce Forms Pdf - The duration of residency in the county where the complaint is filed is required.

In addition to understanding the basics of the FedEx Bill of Lading, it is also beneficial to explore resources that facilitate the shipping process; for instance, Top Forms Online offers templates and guidance that can help streamline your shipping documentation.

Dd Form 2870 Download - This form is often required for dental referrals or specialist visits.

Invoice Maker - Ideal for freelancers and small businesses needing an invoice solution.

Documents used along the form

When it comes to managing your finances and understanding your earnings, the Pay Stub form is a vital document. However, it often works in conjunction with several other forms and documents that provide a complete picture of your employment and financial situation. Here’s a look at some of these important documents.

- W-2 Form: This form is issued by your employer at the end of the year. It summarizes your total earnings and the taxes withheld throughout the year. You’ll need it when filing your income tax return.

- Direct Deposit Authorization Form: This document allows your employer to deposit your paycheck directly into your bank account. It streamlines the payment process and ensures you receive your funds quickly.

- Employment Contract: This agreement outlines the terms of your employment, including salary, benefits, and job responsibilities. It serves as a reference point for both you and your employer.

- Last Will and Testament: Before finalizing your estate planning, consider our comprehensive guide to the Last Will and Testament to ensure your wishes are clearly documented and legally binding.

- Tax Withholding Certificate (W-4): This form helps your employer determine how much federal income tax to withhold from your paycheck. You can adjust your withholding based on your personal financial situation.

- Benefits Enrollment Form: If you’re enrolling in health insurance or other benefits, this document outlines your choices and coverage options. It’s essential for understanding your benefits package.

- Time Sheet: This document records the hours you’ve worked, including regular hours and overtime. It’s crucial for accurate payroll processing and ensuring you’re compensated fairly for your time.

Understanding these documents can empower you to take control of your finances and ensure you’re receiving the correct compensation and benefits. Keeping track of them alongside your Pay Stub can help you stay organized and informed about your employment status.

Similar forms

The first document that shares similarities with a Pay Stub is the W-2 form. The W-2 is an annual statement provided by employers to report an employee's wages and the taxes withheld throughout the year. Like a pay stub, it details the amount earned, but it covers a longer period, summarizing the entire year rather than a single pay period. Both documents are essential for employees to understand their earnings and tax obligations.

Another document akin to a Pay Stub is the paycheck itself. A paycheck serves as a direct payment for work performed, detailing the gross pay, deductions, and net pay. While a pay stub provides a breakdown of earnings and deductions in a more comprehensive format, the paycheck represents the actual payment received. Both documents are crucial for employees to track their income and understand how deductions affect their take-home pay.

The third document is the direct deposit notification. This notification informs employees when their wages have been deposited into their bank accounts. Similar to a pay stub, it typically outlines the amount deposited and any deductions that were taken. Employees can use both documents to verify that their payments are accurate and to ensure that their financial records are in order.

Another related document is the earnings statement. This statement is often provided alongside a pay stub and contains similar information regarding an employee's earnings, deductions, and benefits. While a pay stub may be more focused on a specific pay period, an earnings statement can sometimes include year-to-date totals. Both documents help employees keep track of their financial progress over time.

The timecard is another document that bears resemblance to a Pay Stub. A timecard records the hours worked by an employee during a specific pay period. While a pay stub summarizes earnings based on the hours worked and the corresponding pay rate, the timecard serves as the foundational record that informs the pay stub. Together, they provide a complete picture of an employee's work and compensation.

Understanding the documentation associated with financial transactions is crucial for both employees and independent workers. For those under mobile device protection plans, for example, knowing how to complete the Asurion F-017-08 MEN form can greatly enhance the claims process, allowing for smoother resolutions when issues with devices arise. This form, like others in financial documentation, plays an essential role in ensuring timely support and effective management of one's financial interests.

Next is the payroll summary report. This report is typically generated by the payroll department and provides an overview of all employee earnings, deductions, and taxes for a specific pay period. While a pay stub is individualized for each employee, the payroll summary report aggregates data for all employees. Both documents are essential for understanding compensation and ensuring accuracy in payroll processing.

The benefits statement is another document that can be compared to a Pay Stub. This statement outlines the various benefits an employee is entitled to, such as health insurance, retirement contributions, and paid time off. While a pay stub focuses on monetary compensation, the benefits statement highlights the non-monetary components of an employee's overall compensation package. Both documents are important for employees to assess the full value of their employment.

Lastly, the tax withholding statement is similar to a Pay Stub in that it provides information regarding the taxes withheld from an employee's pay. This document specifies the amounts withheld for federal, state, and local taxes, much like a pay stub does. Understanding this information is crucial for employees as it helps them plan for tax season and ensures they are aware of their tax obligations throughout the year.

Dos and Don'ts

When filling out the Pay Stub form, attention to detail is crucial. Here are some guidelines to ensure accuracy and compliance.

- Do: Double-check your personal information for accuracy, including your name, address, and Social Security number.

- Do: Ensure that all earnings and deductions are accurately reflected. Review your pay rate and hours worked.

- Do: Keep a copy of your completed Pay Stub form for your records. This can help resolve any discrepancies in the future.

- Do: Submit the form by the specified deadline to avoid any delays in processing your pay.

- Don't: Leave any sections blank. Incomplete information can lead to processing errors.

- Don't: Use incorrect or outdated forms. Always use the most current version of the Pay Stub form.

- Don't: Ignore instructions provided with the form. They are there to guide you through the process.

- Don't: Share sensitive information, such as your Social Security number, without ensuring the recipient is authorized to receive it.

Key takeaways

When filling out and using the Pay Stub form, there are several important points to keep in mind. These takeaways can help ensure accuracy and clarity in your financial records.

- Accuracy is Key: Always double-check the information entered on the Pay Stub form. Mistakes in figures or personal details can lead to complications in payroll processing.

- Understand Your Deductions: Familiarize yourself with the various deductions listed on the pay stub. Knowing what each deduction represents helps you manage your finances better.

- Keep Records: Save copies of your pay stubs for future reference. They serve as essential documentation for tax purposes and can be useful when applying for loans or other financial services.

- Review Regularly: Regularly reviewing your pay stubs can help you spot any discrepancies in your pay. If something seems off, address it with your employer promptly.

How to Use Pay Stub

Completing the Pay Stub form is a straightforward process that ensures accurate record-keeping for your earnings. After filling out this form, you will have a clear understanding of your income details and deductions, which can be helpful for budgeting or tax purposes.

- Begin by entering your personal information at the top of the form. This typically includes your name, address, and employee ID.

- Next, locate the section for pay period dates. Fill in the start and end dates of the pay period for which you are documenting your earnings.

- In the earnings section, list your gross pay. This is the total amount you earned before any deductions.

- Move on to the deductions section. Here, you will input any amounts that have been deducted from your gross pay, such as taxes, health insurance, or retirement contributions.

- After filling in the deductions, calculate your net pay by subtracting the total deductions from your gross pay. Write this amount in the designated space.

- Finally, review all the information you entered for accuracy. Make sure everything is correct before submitting the form.