Fill Out a Valid Payroll Check Form

The Payroll Check form is an essential document used by employers to compensate their employees for work performed during a specific pay period. This form typically includes vital information such as the employee's name, identification number, and the amount of wages earned. Additionally, it may outline deductions for taxes, benefits, and other withholdings, which are crucial for accurate payroll processing. Employers often use this form to maintain compliance with labor laws and tax regulations. The layout of the Payroll Check form is designed to ensure clarity and accuracy, allowing for easy verification of payments. Understanding the various components of this form can help employees track their earnings and deductions, while also enabling employers to manage their payroll systems effectively.

Common mistakes

-

Incorrect Employee Information: Many individuals fail to verify the accuracy of the employee's name, Social Security number, or address. This can lead to delays in processing and payment issues.

-

Missing Signatures: A common oversight is neglecting to obtain the necessary signatures. Without the required approvals, the payroll check cannot be processed.

-

Inaccurate Payment Amounts: Errors in calculating hours worked or overtime can result in incorrect payment amounts. Always double-check calculations to ensure accuracy.

-

Failure to Include Deductions: Not accounting for necessary deductions, such as taxes or benefits, can lead to complications. It is important to review all deductions before finalizing the form.

Preview - Payroll Check Form

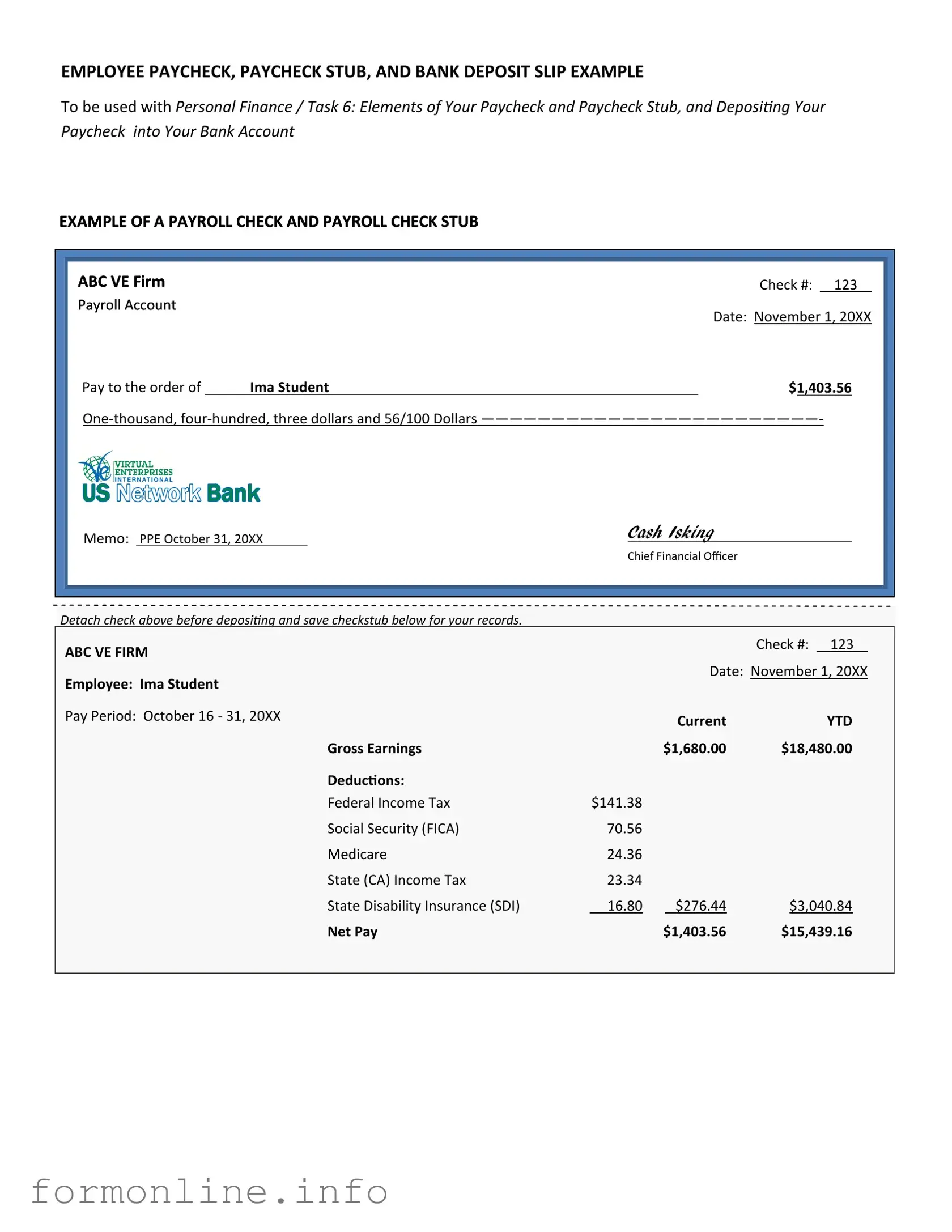

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Other PDF Templates

Family Group Sheets - Documenting life events helps in establishing vital historical context.

To understand the implications of a temporary Power of Attorney for a Child, it is important for parents and guardians to familiarize themselves with the legal responsibilities involved. This document can serve as a crucial tool, ensuring that someone can make necessary decisions for the child's wellbeing in the parent's absence.

Identity Verification Form - The form captures the specific date of notarization for official records.

Documents used along the form

When managing payroll, several forms and documents are essential to ensure compliance and accuracy. Each document serves a specific purpose in the payroll process, contributing to a smooth and efficient operation.

- W-4 Form: This form is completed by employees to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from an employee's paycheck.

- I-9 Form: Required for verifying an employee's identity and eligibility to work in the United States, this form must be completed by both the employer and the employee.

- Pay Stub: This document provides a detailed breakdown of an employee's earnings, deductions, and net pay for a specific pay period. It serves as a record for both the employee and employer.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their pay directly into their bank account, streamlining the payment process.

- Vehicle Sales Documentation: When selling or purchasing a vehicle, it's essential to use the Texas Motor Vehicle Bill of Sale form to formalize the transaction. For more information, visit autobillofsaleform.com/texas-motor-vehicle-bill-of-sale-form/.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state tax withholding. Employees complete it to indicate their state tax preferences based on their residence.

- Employee Handbook: While not a payroll form per se, this document outlines company policies, including those related to payroll, benefits, and employee rights. It helps ensure that employees understand their entitlements and responsibilities.

- Payroll Register: This is a comprehensive report that summarizes all payroll transactions for a specific period. It includes details such as employee names, hours worked, gross pay, and deductions.

Utilizing these forms and documents can help streamline payroll processes and maintain compliance with legal requirements. Each plays a crucial role in ensuring both employers and employees understand their rights and responsibilities within the payroll system.

Similar forms

The Payroll Check form is closely related to the Direct Deposit Authorization form. Both documents serve the purpose of facilitating employee compensation. While the Payroll Check form is used for issuing physical checks, the Direct Deposit Authorization form allows employees to receive their pay directly into their bank accounts. This modern approach not only streamlines the payment process but also enhances security by reducing the risk of lost or stolen checks. Employees appreciate the convenience of having their funds readily available, while employers benefit from reduced administrative tasks associated with issuing paper checks.

Another document that shares similarities with the Payroll Check form is the Employee Pay Stub. This document provides a detailed breakdown of an employee's earnings for a specific pay period. Like the Payroll Check form, it is essential for transparency in payroll processing. The pay stub outlines gross pay, deductions, and net pay, ensuring that employees understand how their compensation is calculated. Both documents are critical for maintaining accurate financial records and help employees track their earnings over time.

The W-2 form is another important document related to payroll. It summarizes an employee's annual earnings and the taxes withheld throughout the year. While the Payroll Check form focuses on individual pay periods, the W-2 provides a comprehensive overview of an employee's financial history with a company. Both documents are vital for tax reporting purposes, ensuring that employees can accurately report their income to the IRS. The W-2 form also serves as a reminder of the importance of payroll accuracy and compliance with tax regulations.

The timesheet is another document that bears a resemblance to the Payroll Check form. Timesheets record the hours worked by employees, serving as the foundation for calculating wages. Both documents are integral to the payroll process, as accurate timesheets ensure that employees are paid correctly for their labor. Employers rely on these records to verify attendance and productivity, making them essential for maintaining fair compensation practices. Without accurate timesheets, discrepancies in payroll could arise, leading to employee dissatisfaction.

The Payroll Register is also similar to the Payroll Check form, as it provides a summary of all payroll transactions for a specific period. This document lists each employee's gross pay, deductions, and net pay, similar to what is found on individual payroll checks. The Payroll Register helps employers track total payroll expenses and ensures that all payments are accounted for. It serves as a valuable tool for financial reporting and budget management, making it essential for organizations of all sizes.

In the context of mobile home transactions, the New York Mobile Home Bill of Sale serves as a crucial document that details the transfer of ownership. Similar to the importance of the Payroll Check form in employment transactions, this bill of sale outlines essential details such as the buyer and seller's information, the mobile home's identification, and the agreed-upon sale price. Completing this document accurately not only provides clarity for both parties involved but also serves as necessary proof of ownership transfer, distinguishing it from other financial documents. For a more comprehensive understanding, you can refer to this Mobile Home Bill of Sale.

Lastly, the Employment Agreement can be viewed as related to the Payroll Check form. This document outlines the terms of employment, including salary, benefits, and payment frequency. While the Payroll Check form is a tool for executing payment, the Employment Agreement establishes the expectations surrounding that payment. Both documents are crucial for fostering a clear understanding between employers and employees regarding compensation. They help create a transparent work environment where employees feel valued and informed about their financial agreements.

Dos and Don'ts

When filling out the Payroll Check form, attention to detail is crucial. Here’s a list of things to keep in mind:

- Do: Double-check all employee information for accuracy.

- Do: Ensure that the correct pay period is indicated.

- Do: Calculate the total hours worked carefully.

- Do: Include any deductions or withholdings as required.

- Do: Sign the form before submission.

- Don't: Forget to use the correct payroll codes.

- Don't: Leave any fields blank unless specified.

- Don't: Use outdated forms; always use the latest version.

- Don't: Ignore company policies regarding payroll submissions.

- Don't: Submit the form without a thorough review.

By following these guidelines, you can help ensure a smooth payroll process and avoid common pitfalls.

Key takeaways

Filling out and using a Payroll Check form is a crucial task for any business that pays employees. Here are some key takeaways to keep in mind:

- Accurate Information is Essential: Always ensure that the employee's name, address, and Social Security number are correctly entered. Mistakes can lead to tax issues and payment delays.

- Specify the Payment Period: Clearly indicate the pay period for which the check is being issued. This helps both the employer and employee keep track of earnings.

- Include Hours Worked: If applicable, list the total hours worked during the pay period. This transparency aids in verifying that the employee is paid correctly.

- Deduct Taxes and Other Withholdings: Make sure to calculate and subtract federal, state, and local taxes, as well as any other deductions such as health insurance or retirement contributions.

- Double-Check Calculations: Always review the total amount being paid to ensure that all calculations are accurate. Errors can lead to financial discrepancies.

- Use Clear Language: Write in a straightforward manner. Avoid using abbreviations or terms that may confuse the employee receiving the check.

- Maintain Confidentiality: Keep the Payroll Check form secure. This document contains sensitive personal information that should be protected.

- Provide Copies: Offer a copy of the Payroll Check form to the employee. This serves as a record for both parties and can help in resolving any future disputes.

- Follow Company Policies: Adhere to your organization’s specific guidelines regarding payroll processing. Each company may have unique requirements.

- Stay Updated on Regulations: Regularly review federal and state laws related to payroll. Changes in legislation can impact how payroll is processed.

By keeping these takeaways in mind, you can ensure a smoother payroll process and foster a positive relationship with employees regarding their compensation.

How to Use Payroll Check

Filling out the Payroll Check form is an important step in ensuring that employees receive their compensation accurately and on time. This process requires careful attention to detail to avoid any errors that could lead to delays or misunderstandings. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, fill in the employee's name in the designated field. Ensure that the name matches the name on the employee's identification.

- In the following section, write the employee's identification number or Social Security number. This helps to verify the employee’s identity.

- Specify the pay period by indicating the start and end dates. This shows the timeframe for which the employee is being compensated.

- Enter the total amount to be paid to the employee in the payment amount box. Double-check this figure for accuracy.

- If applicable, include any deductions or bonuses in the specified sections. Clearly label each deduction or bonus for transparency.

- Sign the form in the designated signature area. This confirms the authorization of the payment.

- Finally, provide any additional notes or information if required in the comments section at the bottom of the form.