Printable Personal Guarantee Form

The Personal Guarantee form is a crucial document in the realm of business transactions, providing an extra layer of security for lenders and creditors. This form allows an individual, often a business owner or principal, to personally guarantee the debts or obligations of a business entity. By signing this document, the guarantor agrees to take responsibility for the repayment of loans or fulfillment of contracts if the business fails to meet its obligations. It typically includes essential details such as the names of the parties involved, the nature of the obligation, and the specific terms under which the guarantee is enforceable. Understanding the implications of signing a Personal Guarantee is vital, as it can significantly impact personal finances and credit. Additionally, the form may outline the conditions under which the guarantee can be released, making it essential for individuals to read and comprehend all terms thoroughly before committing. Whether for securing a loan, leasing property, or entering into contracts, the Personal Guarantee form plays a pivotal role in protecting the interests of creditors while also placing significant responsibility on the guarantor.

Common mistakes

-

Not reading the entire form carefully. It's important to understand what you are signing.

-

Failing to provide accurate personal information. Double-check your name, address, and contact details.

-

Overlooking the date. Make sure to sign and date the form correctly.

-

Leaving out required signatures. Ensure that all necessary parties have signed the document.

-

Not including a witness signature if required. Some agreements need a witness to be valid.

-

Using unclear language or abbreviations. Write clearly to avoid misunderstandings.

-

Ignoring the consequences of the guarantee. Understand what you are agreeing to and the potential risks involved.

-

Neglecting to keep a copy of the signed form. Always retain a copy for your records.

-

Not seeking advice if unsure. If you have questions, it’s wise to ask for help.

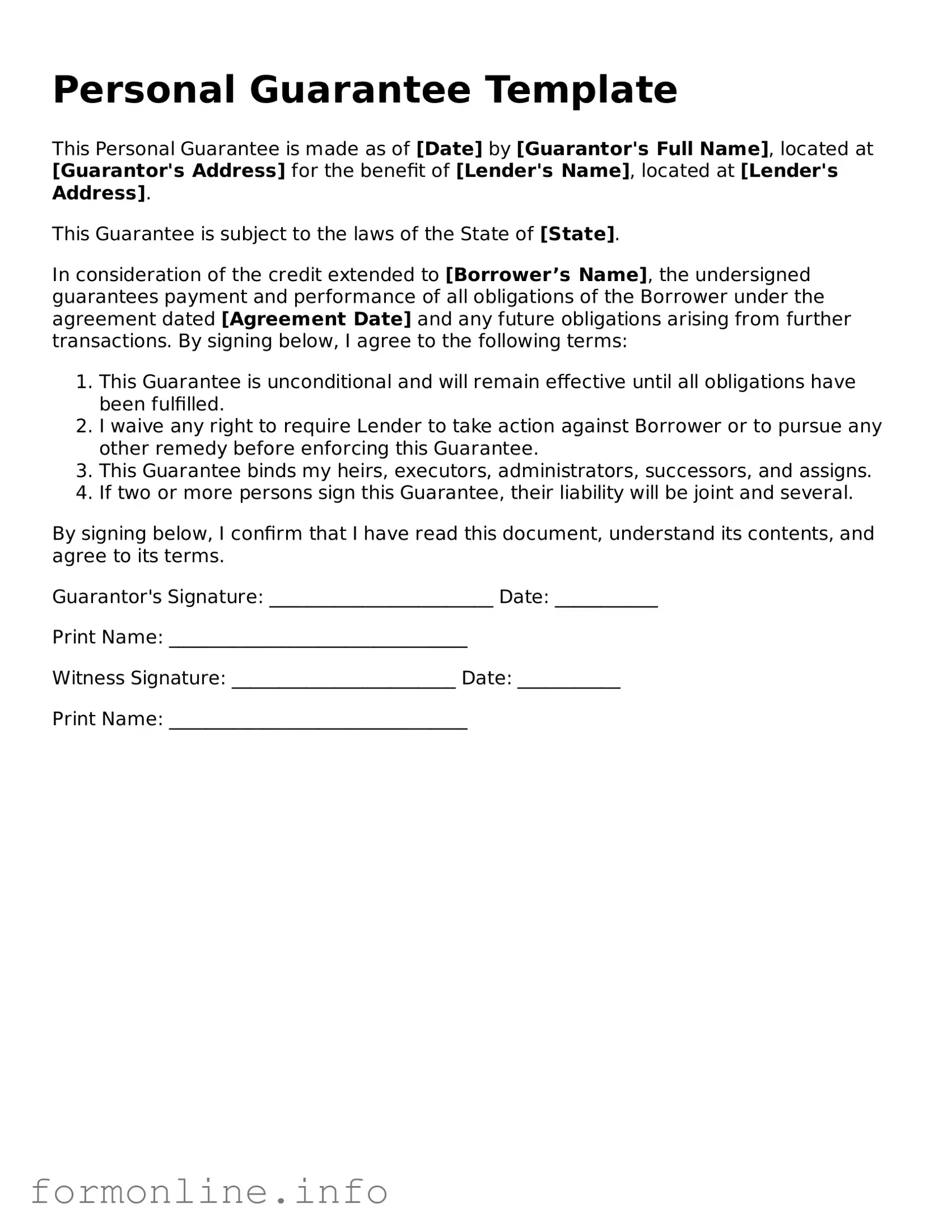

Preview - Personal Guarantee Form

Personal Guarantee Template

This Personal Guarantee is made as of [Date] by [Guarantor's Full Name], located at [Guarantor's Address] for the benefit of [Lender's Name], located at [Lender's Address].

This Guarantee is subject to the laws of the State of [State].

In consideration of the credit extended to [Borrower’s Name], the undersigned guarantees payment and performance of all obligations of the Borrower under the agreement dated [Agreement Date] and any future obligations arising from further transactions. By signing below, I agree to the following terms:

- This Guarantee is unconditional and will remain effective until all obligations have been fulfilled.

- I waive any right to require Lender to take action against Borrower or to pursue any other remedy before enforcing this Guarantee.

- This Guarantee binds my heirs, executors, administrators, successors, and assigns.

- If two or more persons sign this Guarantee, their liability will be joint and several.

By signing below, I confirm that I have read this document, understand its contents, and agree to its terms.

Guarantor's Signature: ________________________ Date: ___________

Print Name: ________________________________

Witness Signature: ________________________ Date: ___________

Print Name: ________________________________

More Types of Personal Guarantee Templates:

How to Fire a Realtor Example Letter - May be necessary if contractual deadlines are not met by either party.

The Texas Real Estate Purchase Agreement form plays a vital role in ensuring that both parties involved in the transaction are protected by clearly delineating the roles and responsibilities of the buyer and seller. This ensures a smoother transaction process and minimizes potential disputes. For further details, one may want to see the form, which offers the necessary guidance on this important document.

Purchase Agreement Addendum - Parties are encouraged to seek legal advice when drafting an addendum for better accuracy.

Seller Financing Contract - Buyers should be aware of whether or not the loan is assumable in the future.

Documents used along the form

The Personal Guarantee form is an important document often used in business transactions to ensure that an individual agrees to be personally responsible for a debt or obligation of a business. Alongside this form, several other documents may be required to provide a comprehensive understanding of the agreement and the parties involved. Below is a list of commonly associated forms and documents.

- Loan Agreement: This document outlines the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved.

- Business License: A legal authorization that permits a business to operate within a specific jurisdiction, often required to ensure compliance with local regulations.

- Real Estate Purchase Agreement: To navigate property transactions effectively, refer to our essential Real Estate Purchase Agreement guidelines for comprehensive terms and conditions.

- Articles of Incorporation: This document establishes a corporation's existence in the eyes of the state and includes essential details like the business name, purpose, and structure.

- Operating Agreement: Used primarily by LLCs, this document details the management structure and operational procedures of the business.

- Financial Statements: These documents, including balance sheets and income statements, provide a snapshot of the business's financial health, often required by lenders.

- Credit Application: A form that potential borrowers fill out to provide information about their credit history and financial status, helping lenders assess risk.

- Security Agreement: This document outlines the collateral pledged by the borrower to secure a loan, detailing the rights of the lender in the event of default.

- Personal Financial Statement: A summary of an individual's financial position, including assets and liabilities, often required to evaluate personal creditworthiness.

- Disclosure Statement: This document provides important information about the terms and conditions of the agreement, ensuring that all parties are fully informed.

These documents collectively support the Personal Guarantee form, providing necessary context and legal backing for the obligations being undertaken. Each plays a vital role in clarifying the responsibilities and expectations of all parties involved in the agreement.

Similar forms

A Personal Guarantee form shares similarities with a Lease Agreement, which outlines the terms under which a tenant rents a property from a landlord. Like a Personal Guarantee, a Lease Agreement often requires a signature from a party who agrees to be responsible for fulfilling the terms of the lease, including payment of rent. This ensures that the landlord has recourse if the tenant fails to meet their obligations, much like how a Personal Guarantee secures a lender's interests by holding an individual accountable for a borrower's debt.

Another document that parallels the Personal Guarantee is a Co-Signer Agreement. This agreement is commonly used when an individual applies for a loan or rental property but may not meet the necessary credit requirements. The co-signer agrees to take responsibility for the loan or lease if the primary applicant defaults. Similar to a Personal Guarantee, the co-signer's financial standing is assessed to provide assurance to the lender or landlord, thereby mitigating risk.

A Credit Application also bears resemblance to a Personal Guarantee. When individuals or businesses apply for credit, they often provide personal information and financial history to demonstrate their creditworthiness. In some cases, the lender may require a Personal Guarantee alongside the application to further secure the loan. Both documents aim to evaluate risk and ensure that there is a responsible party accountable for repayment.

The Business Loan Agreement is another document akin to a Personal Guarantee. This agreement outlines the terms and conditions under which a lender provides funds to a business. Often, lenders will require a Personal Guarantee from the business owner, ensuring that they are personally liable for the loan. This adds a layer of security for the lender, as they can pursue the owner's personal assets if the business defaults.

Similar to a Personal Guarantee, a Partnership Agreement outlines the responsibilities and liabilities of each partner in a business venture. When partners enter into an agreement, they often agree to share profits and losses, as well as any debts incurred by the partnership. If one partner fails to fulfill their financial obligations, the others may be held accountable, mirroring the accountability established in a Personal Guarantee.

When navigating the complexities of real estate transactions, it is vital for buyers and sellers to have clear agreements in place, such as the California Real Estate Purchase Agreement form, which ensures all terms are outlined transparently. Similar to other financial agreements, utilizing resources like All California Forms can help streamline the process, providing essential legal frameworks that protect both parties involved.

A Security Agreement can also be compared to a Personal Guarantee. This document is used when a borrower pledges collateral to secure a loan. In essence, the borrower guarantees that if they default on the loan, the lender can seize the collateral. Both documents aim to protect the lender's interests, ensuring that there is a means of recovery should the borrower fail to meet their obligations.

The Indemnity Agreement is another document that shares characteristics with a Personal Guarantee. This agreement protects one party from losses or damages incurred by another party's actions. When someone signs an Indemnity Agreement, they are essentially promising to cover any potential liabilities. This is similar to a Personal Guarantee, where the signer agrees to take on financial responsibility if the primary borrower defaults.

Finally, a Loan Agreement is closely related to a Personal Guarantee. This document details the terms of a loan, including repayment schedules and interest rates. Often, lenders will require a Personal Guarantee to ensure that an individual is liable for the loan, providing additional security. Both documents serve to outline the obligations of the borrower while protecting the lender’s interests.

Dos and Don'ts

When filling out the Personal Guarantee form, it's important to follow certain guidelines to ensure accuracy and effectiveness. Here are seven things to keep in mind:

- Do read the entire form carefully before you start filling it out.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Do provide accurate and truthful information to the best of your ability.

- Don't use abbreviations or informal language; clarity is key.

- Do double-check your entries for spelling and numerical accuracy.

- Don't sign the form until you have reviewed all the information.

- Do keep a copy of the completed form for your records.

By following these guidelines, you can help ensure that your Personal Guarantee form is processed smoothly and effectively.

Key takeaways

Here are some important points to keep in mind when filling out and using the Personal Guarantee form:

- Understand the purpose of the Personal Guarantee. It holds you personally responsible for a debt or obligation.

- Read the entire form carefully before signing. Ensure you understand all terms and conditions.

- Provide accurate personal information. This includes your full name, address, and contact details.

- Be clear about the obligations you are guaranteeing. Know what debts or agreements you are backing.

- Consider the financial implications. You may be liable for the full amount if the primary borrower defaults.

- Seek legal advice if you have questions. A lawyer can help clarify your responsibilities.

- Keep a copy of the signed form for your records. This is important for future reference.

- Be aware of the duration of the guarantee. Know when it starts and when it ends.

- Check if there are any conditions that could release you from the guarantee. This might vary by agreement.

- Use the form responsibly. Only sign if you are comfortable with the risks involved.

How to Use Personal Guarantee

Filling out the Personal Guarantee form is an important step in your application process. Once you complete this form, it will be reviewed to ensure all necessary information is provided. Follow these steps carefully to ensure accuracy.

- Begin with your personal information. Write your full name, address, and contact details at the top of the form.

- Provide your Social Security Number. This is essential for identification purposes.

- Indicate your relationship to the business. Clearly state if you are an owner, partner, or have another role.

- Fill in the business details. Include the business name, address, and any relevant identification numbers.

- Read through the guarantee statement carefully. Ensure you understand what you are agreeing to.

- Sign and date the form at the bottom. Your signature confirms your commitment to the guarantee.

- Review the completed form for any errors or missing information before submission.