Printable Power of Attorney Form

The Power of Attorney form is a vital legal document that empowers an individual, known as the agent or attorney-in-fact, to act on behalf of another person, referred to as the principal. This form plays a crucial role in various situations, such as managing financial affairs, making healthcare decisions, or handling real estate transactions when the principal is unable to do so themselves. It can be tailored to be broad or limited in scope, depending on the specific needs and preferences of the principal. Additionally, the Power of Attorney can be effective immediately or set to activate upon a certain event, such as the principal's incapacitation. Understanding the implications of this form is essential, as it grants significant authority to the agent, making it imperative for individuals to choose someone they trust. Furthermore, the Power of Attorney can be revoked at any time by the principal, provided they are still mentally competent. Thus, the form serves not only as a tool for delegation but also as a means of ensuring that one’s wishes are respected and upheld during critical times.

State-specific Tips for Power of Attorney Templates

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the powers granted. Ambiguity can lead to confusion and disputes later on.

-

Choosing the Wrong Agent: Selecting an agent who may not have the best interests of the principal in mind can create problems. It’s crucial to choose someone trustworthy and reliable.

-

Not Signing the Document: A Power of Attorney is not valid unless it is signed. Forgetting this step can render the entire document useless.

-

Ignoring State Requirements: Each state has specific requirements for a Power of Attorney. Not adhering to these can invalidate the document.

-

Failing to Update the Document: Life changes, and so do circumstances. Not updating the Power of Attorney when necessary can lead to outdated or irrelevant powers.

-

Not Considering Alternate Agents: In case the primary agent is unavailable or unable to act, it’s wise to name an alternate. This can prevent delays in decision-making.

-

Overlooking Witness or Notary Requirements: Some states require the document to be witnessed or notarized. Skipping this step can affect the validity of the Power of Attorney.

-

Assuming All Powers Are Included: Not all powers are automatically granted. It’s important to specify any additional powers needed beyond the standard ones.

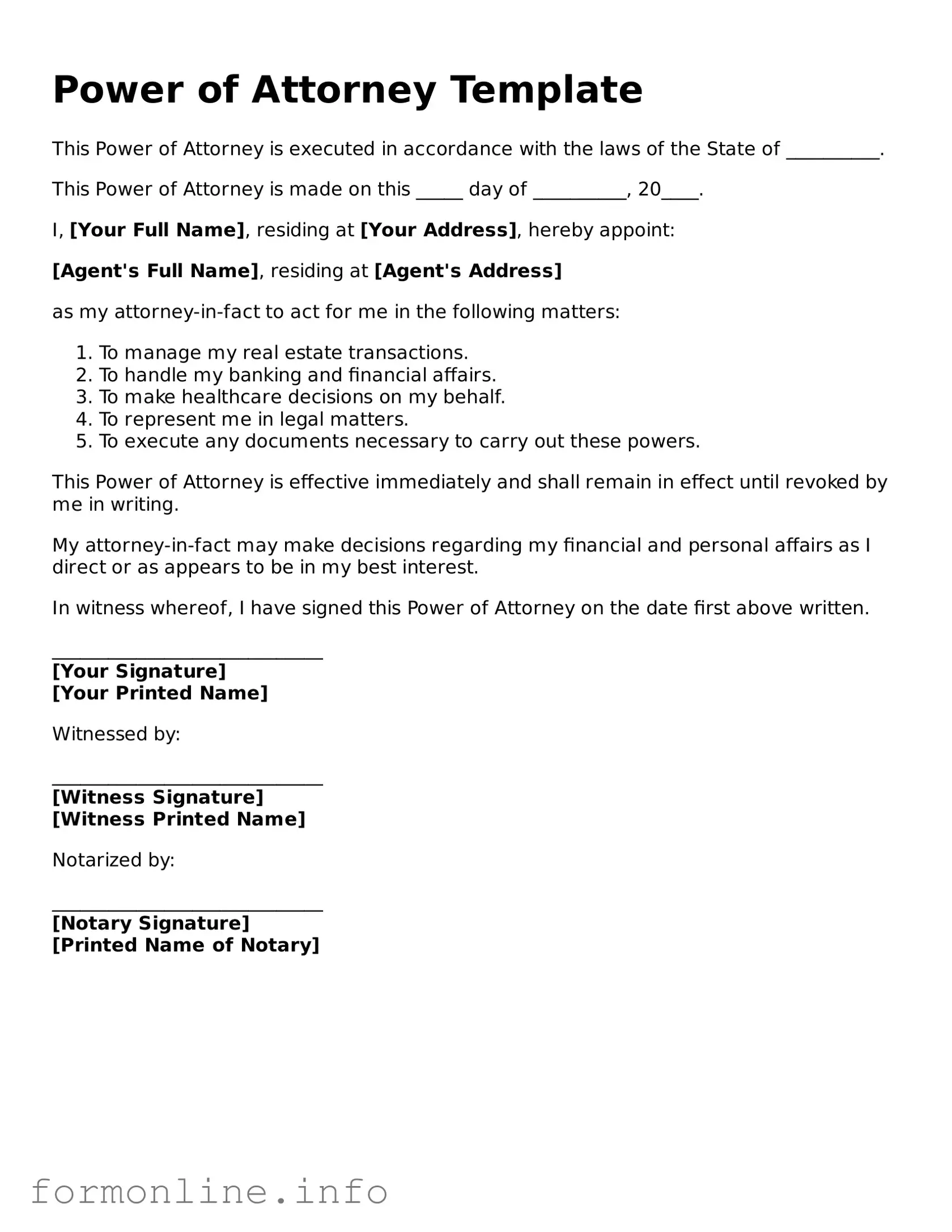

Preview - Power of Attorney Form

Power of Attorney Template

This Power of Attorney is executed in accordance with the laws of the State of __________.

This Power of Attorney is made on this _____ day of __________, 20____.

I, [Your Full Name], residing at [Your Address], hereby appoint:

[Agent's Full Name], residing at [Agent's Address]

as my attorney-in-fact to act for me in the following matters:

- To manage my real estate transactions.

- To handle my banking and financial affairs.

- To make healthcare decisions on my behalf.

- To represent me in legal matters.

- To execute any documents necessary to carry out these powers.

This Power of Attorney is effective immediately and shall remain in effect until revoked by me in writing.

My attorney-in-fact may make decisions regarding my financial and personal affairs as I direct or as appears to be in my best interest.

In witness whereof, I have signed this Power of Attorney on the date first above written.

_____________________________

[Your Signature]

[Your Printed Name]

Witnessed by:

_____________________________

[Witness Signature]

[Witness Printed Name]

Notarized by:

_____________________________

[Notary Signature]

[Printed Name of Notary]

Common Forms:

Puppy Health Record - Set reminders for vaccinations every three weeks to ensure compliance.

The Asurion F-017-08 MEN form is a document that plays a crucial role in protecting consumers' rights regarding electronic device warranties. This form enables individuals to initiate a claim or service request for their devices under Asurion's warranty program. For more detailed information, users can refer to the Asurion F-017-08 MEN form, which outlines the necessary steps to simplify the process of receiving support for your electronics.

Section 8 Housing Requirements - Eligibility is contingent upon verification of financial and personal data through federal agencies.

Bill of Sale Cattle - Sets the agreed sale price for the livestock.

Power of Attorney Form Subtypes

Documents used along the form

When considering a Power of Attorney (POA), it's important to understand that this document often works in tandem with other forms. Each document serves a specific purpose and can enhance the effectiveness of your POA. Here are four common forms that you might encounter alongside a Power of Attorney.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and care in case you become unable to communicate your wishes. It ensures that your healthcare decisions are respected and followed by your loved ones and medical professionals.

- Living Will: A living will specifies the types of medical interventions you do or do not want in situations where you are unable to express your wishes. This document is particularly important in end-of-life scenarios, guiding your family and healthcare providers in making decisions that align with your values.

- HIPAA Authorization: The Health Insurance Portability and Accountability Act (HIPAA) authorization allows designated individuals to access your medical records and health information. This form is crucial for ensuring that your agent under the POA can make informed decisions about your care.

- Employment Verification Form: To enhance your hiring process, consider utilizing our essential Employment Verification form resources to ensure accuracy and compliance.

- Financial Power of Attorney: While a general POA may cover various aspects of your life, a financial power of attorney specifically focuses on financial matters. This document grants someone the authority to manage your finances, pay bills, and handle investments on your behalf.

Understanding these documents can help you create a comprehensive plan for your future. By having the right forms in place, you ensure that your wishes are honored and that your loved ones have clear guidance during challenging times.

Similar forms

A Living Will is a document that allows individuals to express their wishes regarding medical treatment in the event they become unable to communicate those wishes themselves. Like a Power of Attorney, a Living Will empowers someone to make decisions on your behalf, but it specifically focuses on health care choices. This document outlines what types of medical interventions you do or do not want, such as life support or resuscitation, ensuring that your preferences are honored even when you cannot voice them.

A Health Care Proxy is similar to a Power of Attorney in that it designates someone to make health care decisions for you if you are unable to do so. While a Power of Attorney can cover a broad range of financial and legal matters, a Health Care Proxy is focused solely on medical decisions. This document allows you to choose a trusted person to advocate for your health care preferences, ensuring that your values and wishes are respected in medical settings.

A Durable Power of Attorney is closely related to the standard Power of Attorney but includes a crucial distinction: it remains effective even if you become incapacitated. This means that if you are unable to manage your affairs due to illness or injury, the person you designate can continue to act on your behalf. This type of document is essential for long-term planning, providing peace of mind that your financial and legal matters will be handled according to your wishes, regardless of your health status.

A Financial Power of Attorney is another variant that specifically grants someone the authority to manage your financial affairs. This document allows your designated agent to handle tasks such as paying bills, managing investments, and filing taxes. Like a general Power of Attorney, it can be tailored to your specific needs, but it is focused solely on financial matters, making it easier for your agent to navigate your financial landscape without ambiguity.

The FedEx Bill of Lading form is an essential shipping document that facilitates the transportation of goods and provides clarity on the responsibilities of the carrier. It captures vital details about the shipment, ensuring that both shippers and recipients are aligned on the terms of service. For those interested in accessing this form and learning more about its utility, Top Forms Online is a valuable resource.

A Guardianship Agreement is a legal arrangement where an individual is appointed to care for another person, often a minor or someone unable to care for themselves. While a Power of Attorney designates someone to act on your behalf, a Guardianship Agreement involves a court process to appoint a guardian. This document is critical when there is no one available to make decisions for an individual, ensuring that their best interests are protected by a responsible party.

A Trust Agreement is a legal document that allows a person to place assets into a trust for the benefit of others. While it serves a different primary purpose than a Power of Attorney, both documents involve designating someone to manage your affairs. A Trust Agreement can provide a structured way to distribute your assets according to your wishes, whereas a Power of Attorney focuses on decision-making authority during your lifetime.

An Advance Directive combines elements of a Living Will and a Health Care Proxy. It allows individuals to outline their preferences for medical treatment while also appointing someone to make decisions on their behalf. This document is similar to a Power of Attorney in that it empowers a designated individual to act according to your wishes, ensuring that your health care choices are respected even when you cannot communicate them yourself.

A Will is a legal document that outlines how your assets should be distributed upon your death. While a Power of Attorney is effective during your lifetime and ceases upon your death, a Will comes into play after you pass away. Both documents are essential for estate planning, allowing you to express your wishes and ensure that your desires are followed, but they serve different purposes in managing your affairs.

A Bill of Sale is a document that transfers ownership of personal property from one party to another. While it may seem unrelated to a Power of Attorney, both documents involve the transfer of authority or ownership. A Bill of Sale provides proof of the transaction, while a Power of Attorney grants someone the authority to act on your behalf in various matters, including the sale of property.

A Release of Liability is a document that protects one party from legal claims by another. Similar to a Power of Attorney, which allows someone to act on your behalf, a Release of Liability requires you to give up certain rights. While the contexts are different, both documents involve the delegation of authority and the acceptance of certain responsibilities, highlighting the importance of clear communication and understanding in legal matters.

Dos and Don'ts

When filling out a Power of Attorney form, it is crucial to ensure that the document accurately reflects your intentions and complies with legal requirements. Here are some important do's and don'ts to keep in mind:

- Do clearly identify the person you are granting power to, known as the agent or attorney-in-fact.

- Do specify the powers you are granting. Be as detailed as possible to avoid confusion.

- Do sign the document in the presence of a notary public, if required by your state.

- Do keep a copy of the signed document for your records.

- Don't rush through the form. Take your time to ensure all information is accurate.

- Don't forget to discuss your decision with the person you are appointing to ensure they are willing to accept the responsibility.

Key takeaways

Filling out and using a Power of Attorney (POA) form is an important step in ensuring that your financial and medical decisions can be managed by someone you trust when you are unable to do so yourself. Here are some key takeaways to keep in mind:

- Understand the types of POA: There are different types of Power of Attorney, including general, durable, and medical. Each serves a different purpose, so choose the one that fits your needs.

- Choose your agent wisely: The person you designate as your agent should be trustworthy and capable of making decisions on your behalf. This could be a family member, friend, or professional.

- Be clear about your wishes: Clearly outline your preferences and instructions in the form. This helps your agent understand your values and make decisions aligned with your wishes.

- Check state requirements: Each state has its own rules regarding POA forms. Make sure to review your state’s requirements to ensure the document is valid.

- Consider including specific powers: You can specify what powers you want to grant your agent, such as managing bank accounts, selling property, or making healthcare decisions.

- Sign and date the document: Proper execution of the POA is crucial. Sign and date the form in the presence of a notary or witnesses, if required by your state.

- Keep copies accessible: After completing the form, keep copies in a safe place and provide copies to your agent, family members, and relevant institutions, like banks or healthcare providers.

By keeping these points in mind, you can ensure that your Power of Attorney is effective and serves your needs when it matters most.

How to Use Power of Attorney

After obtaining the Power of Attorney form, you will need to complete it accurately to ensure that your intentions are clearly expressed. This process involves filling out various sections of the form, which requires careful attention to detail. Follow these steps to fill out the form properly.

- Read the instructions: Before starting, review any instructions provided with the form to understand what information is needed.

- Identify the principal: Write your full name and address in the designated section. This is the person granting the authority.

- Choose the agent: Clearly state the name and address of the person you are appointing as your agent. This individual will act on your behalf.

- Specify powers: Indicate the specific powers you are granting to your agent. This may include financial decisions, healthcare choices, or other legal matters.

- Set limitations: If there are any limitations on the powers granted, clearly outline them in the appropriate section.

- Include effective date: Specify when the Power of Attorney will take effect. You can choose to make it effective immediately or upon a certain event.

- Sign the form: As the principal, sign and date the form in the designated area. Ensure that your signature is clear and legible.

- Witness or notarize: Depending on your state’s requirements, have the form witnessed or notarized to validate it.

- Distribute copies: Once completed, make copies of the signed form for your records and provide copies to your agent and any relevant institutions.