Fill Out a Valid Profit And Loss Form

The Profit and Loss form, often referred to as the P&L statement, serves as a crucial financial document for businesses of all sizes. It provides a comprehensive overview of a company's revenues, costs, and expenses during a specific period, typically a quarter or a year. By detailing income generated from sales and subtracting the costs associated with producing goods or services, this form reveals the net profit or loss incurred. Understanding the P&L statement is vital for stakeholders, as it not only highlights operational efficiency but also aids in financial forecasting and budgeting. Moreover, the form typically includes sections for gross profit, operating expenses, and net income, each of which offers insights into different aspects of a company's financial health. Analyzing these components can help business owners and investors make informed decisions, ultimately guiding strategies for growth and sustainability.

Common mistakes

-

Inaccurate Income Reporting: Individuals often misreport their income. This can occur due to forgetting to include all sources of income or miscalculating totals. It is crucial to gather all financial documents to ensure accuracy.

-

Neglecting Expenses: Many overlook certain expenses, especially those that are less frequent. Regularly reviewing financial records can help capture all applicable costs. Missing expenses can lead to an inflated profit figure.

-

Failure to Categorize Properly: Some people do not categorize their income and expenses correctly. This can result in confusion and misinterpretation of financial health. A clear categorization system is essential for accurate reporting.

-

Not Keeping Documentation: Failing to maintain supporting documents for income and expenses is a common mistake. Documentation is vital for verification purposes and can prevent disputes later on. Keeping organized records can simplify this process.

-

Ignoring Changes Over Time: Individuals may not update their Profit and Loss form to reflect changes in their business. Regular updates are necessary to provide an accurate picture of financial performance. This helps in making informed decisions moving forward.

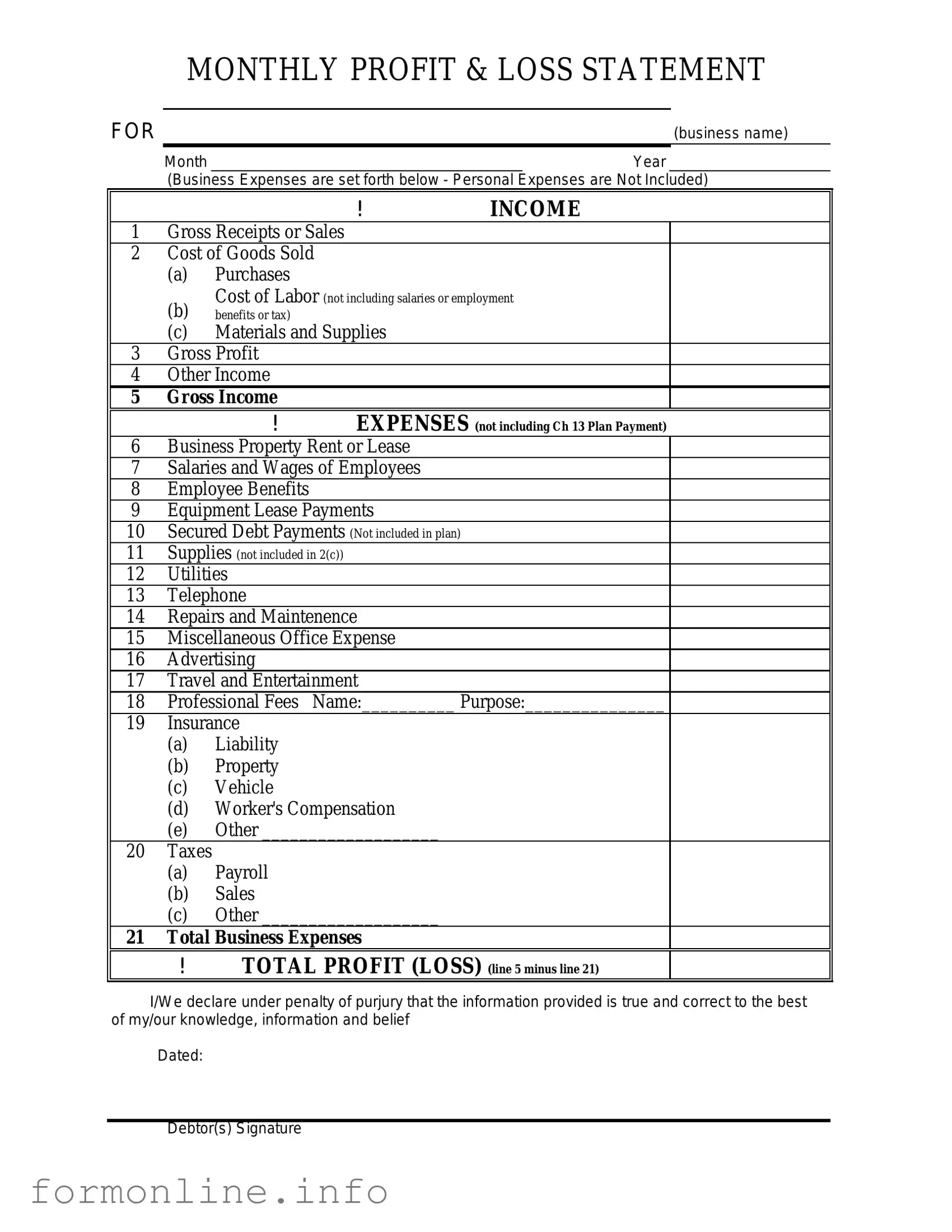

Preview - Profit And Loss Form

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Other PDF Templates

Cuddle Buddy Application Meme - Find peace and relaxation through the warmth of another's presence.

Utilizing a tailored template for your Last Will and Testament preparation can significantly simplify the process and ensure that all necessary details are captured accurately. This form is crucial for anyone looking to clarify their wishes regarding asset distribution and guardianship arrangements for dependents.

Free Printable Gift Certificate - Let recipients enjoy the excitement of choosing their perfect gift.

Documents used along the form

The Profit and Loss form is a crucial document for any business, providing a snapshot of financial performance over a specific period. However, it often works in conjunction with other forms and documents that provide a more comprehensive view of a company's financial health. Here are some commonly used documents that complement the Profit and Loss form.

- Balance Sheet: This document outlines a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand what the business owns and owes, offering a clear picture of its financial stability.

- Cash Flow Statement: This statement tracks the flow of cash in and out of a business over a designated period. It highlights how well the company manages its cash, showing whether it can meet its obligations and invest in growth.

- Budget: A budget serves as a financial plan that outlines expected revenues and expenses for a future period. It helps businesses set financial goals and measure performance against those targets.

- Tax Returns: These documents report income, expenses, and other tax-related information to the government. They are essential for ensuring compliance with tax laws and can provide insights into a company's financial performance.

- Illinois Bill of Sale: Essential for documenting the transfer of ownership during transactions, it serves as legal proof; download the Bill of Sale form for your needs.

- Accounts Receivable Aging Report: This report details outstanding invoices and how long they have been unpaid. It helps businesses manage their cash flow and assess the effectiveness of their credit policies.

Understanding these documents can enhance a business's financial analysis and decision-making. Each plays a vital role in providing a complete picture of the company's financial landscape, enabling better strategic planning and operational efficiency.

Similar forms

The Profit and Loss form, often referred to as an income statement, shares similarities with the Balance Sheet. Both documents provide a snapshot of a business's financial health, but they do so from different angles. While the Profit and Loss form focuses on revenues and expenses over a specific period, the Balance Sheet presents a company's assets, liabilities, and equity at a particular point in time. This complementary relationship allows stakeholders to assess not only how much money a business made or lost during a period but also what it owns and owes at that moment.

Another document closely related to the Profit and Loss form is the Cash Flow Statement. This statement tracks the flow of cash in and out of a business, highlighting how cash is generated and spent over a specific timeframe. Unlike the Profit and Loss form, which can include non-cash items like depreciation, the Cash Flow Statement provides a clearer picture of actual cash transactions. Together, these documents help business owners and investors understand both profitability and liquidity, two critical components of financial stability.

The Budget is another document that parallels the Profit and Loss form. A budget is a financial plan that outlines expected revenues and expenses for a future period. While the Profit and Loss form reflects actual financial performance, the budget serves as a benchmark against which that performance can be measured. By comparing actual results with budgeted figures, businesses can identify variances and make informed decisions to steer their financial strategy moving forward.

For businesses looking to streamline their hiring processes, the Employment Verification form is not just beneficial but essential. It serves as a primary tool for employers to confirm candidates' job histories and qualifications, ensuring accuracy and efficiency in recruitment. By utilizing resources such as Top Forms Online, employers can better understand how to effectively manage this critical document, which aids in making sound hiring decisions and promotes a smoother onboarding experience.

Lastly, the Statement of Changes in Equity complements the Profit and Loss form by detailing how a company’s equity changes over time. This document captures the effects of profits or losses, dividends paid, and any additional investments made by owners. While the Profit and Loss form summarizes earnings, the Statement of Changes in Equity shows how those earnings impact the ownership stake in the business. Together, these documents provide a comprehensive view of a company's financial journey, from income generation to equity adjustments.

Dos and Don'ts

When filling out the Profit and Loss form, it is important to be careful and thorough. Here are some guidelines to help you navigate the process.

- Do: Review your financial records before starting.

- Do: Use accurate and up-to-date figures.

- Do: Keep your calculations clear and organized.

- Do: Double-check all entries for accuracy.

- Do: Seek help if you’re unsure about any section.

- Don't: Rush through the form without checking details.

- Don't: Use estimates instead of actual numbers.

- Don't: Ignore any sections that seem confusing.

- Don't: Forget to save your progress if filling it out online.

By following these guidelines, you can ensure that your Profit and Loss form is completed accurately and efficiently. Taking the time to do it right can make a significant difference in your financial reporting.

Key takeaways

Understanding how to fill out and use the Profit and Loss (P&L) form is essential for managing your business finances effectively. Here are some key takeaways to guide you:

- Know Your Categories: Familiarize yourself with the different sections of the P&L form, such as revenue, expenses, and net profit. Each category plays a crucial role in understanding your financial health.

- Accurate Revenue Reporting: Ensure that you report all sources of income accurately. This includes sales, service income, and any other revenue streams.

- Track Expenses Closely: List all business expenses, including fixed costs like rent and variable costs like supplies. This will give you a clearer picture of your spending habits.

- Use Consistent Time Frames: Fill out the P&L form for consistent periods, such as monthly, quarterly, or annually. This consistency helps in making accurate comparisons over time.

- Calculate Net Profit: Subtract total expenses from total revenue to find your net profit. This figure is vital for assessing the profitability of your business.

- Analyze Trends: Regularly review your P&L statements to identify trends in income and expenses. This analysis can inform future business decisions.

- Seek Professional Help: If you're unsure about filling out the P&L form, consider consulting with an accountant. Their expertise can save you time and ensure accuracy.

- Use Software Tools: Leverage accounting software to simplify the process of filling out your P&L. Many programs offer templates and automated calculations.

- Keep It Up to Date: Regularly update your P&L form to reflect the most current financial data. An up-to-date form is essential for effective financial management.

By keeping these key takeaways in mind, you can make the most of your Profit and Loss form, leading to better financial insights and informed decision-making for your business.

How to Use Profit And Loss

Completing the Profit and Loss form is an essential task for tracking financial performance. By following these steps, you will ensure that all necessary information is accurately recorded, allowing for a clear overview of income and expenses.

- Begin by gathering all relevant financial documents, such as bank statements, receipts, and invoices.

- Open the Profit and Loss form on your computer or print a hard copy if needed.

- In the designated section, enter the reporting period for which you are filling out the form.

- List all sources of income in the income section. Include details such as sales revenue, service income, and any other earnings.

- Calculate the total income by summing all entries in the income section.

- Move to the expenses section. Document all business-related expenses, including rent, utilities, salaries, and other costs.

- Calculate the total expenses by adding up all the entries in the expenses section.

- Subtract the total expenses from the total income to determine your net profit or loss.

- Review all entries for accuracy and completeness before finalizing the form.

- Save the completed form digitally or file it away if you have a hard copy.