Printable Promissory Note for a Car Form

When purchasing a car, understanding the financial agreements involved is crucial. One key document often encountered in this process is the Promissory Note for a Car. This form serves as a written promise from the borrower to repay a specific amount of money to the lender, typically in exchange for financing the vehicle. It outlines essential details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. Additionally, it may specify the consequences of defaulting on the loan, ensuring that both parties are aware of their rights and responsibilities. By clearly defining the terms of the loan, the Promissory Note helps protect the interests of both the buyer and the lender, making it an essential component of any car financing agreement. Understanding this form can empower car buyers to make informed decisions, ensuring a smoother purchasing experience.

Common mistakes

-

Incorrect Personal Information: Many people forget to double-check their personal details. Names, addresses, and contact numbers should be accurate. A small typo can lead to confusion or even legal issues later on.

-

Missing Signatures: It’s crucial to sign the document. Sometimes, individuals neglect to sign or forget to have a co-signer sign if required. Without the necessary signatures, the note may not be valid.

-

Ambiguous Loan Terms: Clearly stating the loan amount, interest rate, and repayment schedule is essential. Vague terms can lead to misunderstandings. Always ensure these details are specific and easy to understand.

-

Ignoring State Regulations: Each state has its own laws regarding promissory notes. Failing to follow these regulations can invalidate the note. It’s important to be aware of local requirements before finalizing the document.

-

Not Keeping a Copy: After filling out the form, some forget to make a copy for their records. This can be problematic if disputes arise later. Always keep a signed copy of the promissory note for future reference.

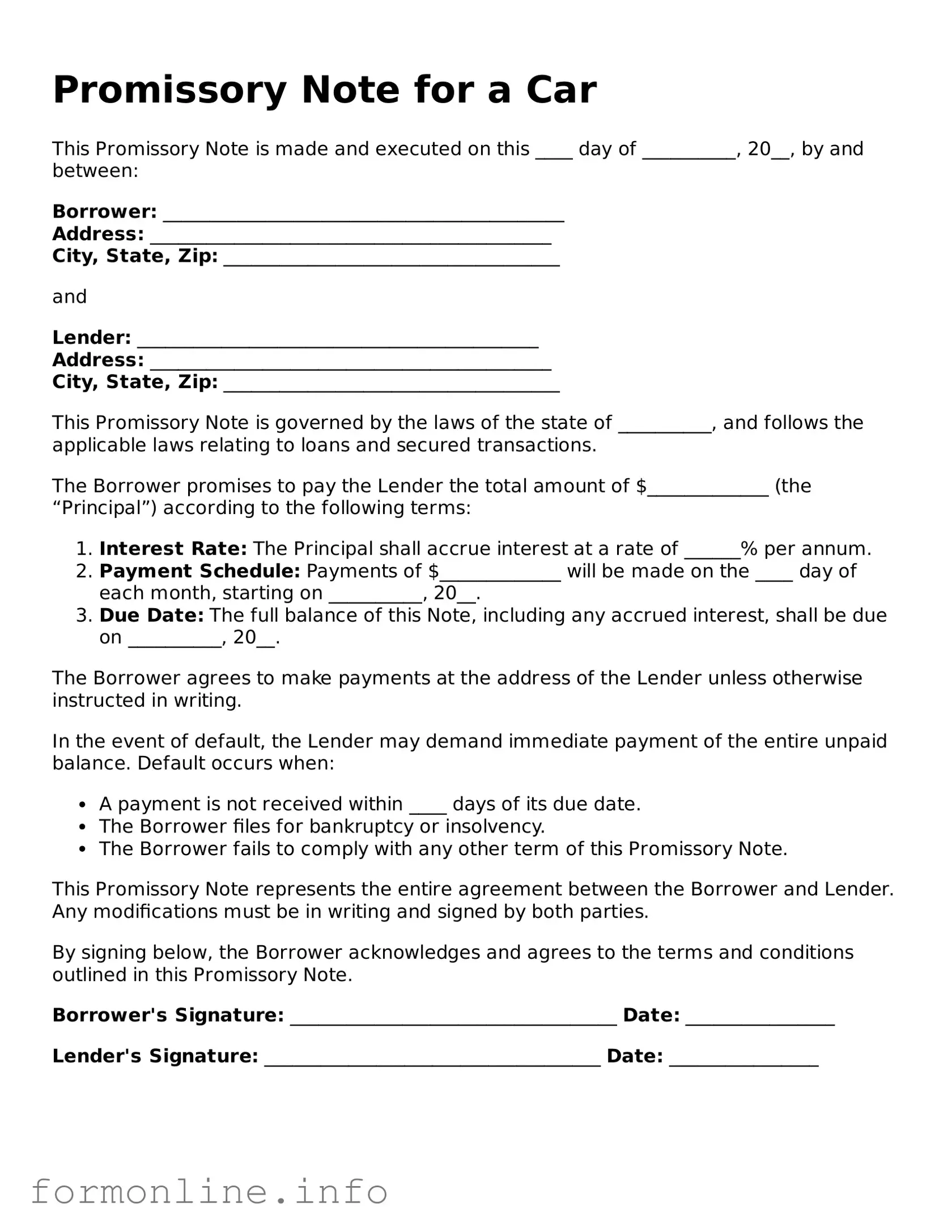

Preview - Promissory Note for a Car Form

Promissory Note for a Car

This Promissory Note is made and executed on this ____ day of __________, 20__, by and between:

Borrower: ___________________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

and

Lender: ___________________________________________

Address: ___________________________________________

City, State, Zip: ____________________________________

This Promissory Note is governed by the laws of the state of __________, and follows the applicable laws relating to loans and secured transactions.

The Borrower promises to pay the Lender the total amount of $_____________ (the “Principal”) according to the following terms:

- Interest Rate: The Principal shall accrue interest at a rate of ______% per annum.

- Payment Schedule: Payments of $_____________ will be made on the ____ day of each month, starting on __________, 20__.

- Due Date: The full balance of this Note, including any accrued interest, shall be due on __________, 20__.

The Borrower agrees to make payments at the address of the Lender unless otherwise instructed in writing.

In the event of default, the Lender may demand immediate payment of the entire unpaid balance. Default occurs when:

- A payment is not received within ____ days of its due date.

- The Borrower files for bankruptcy or insolvency.

- The Borrower fails to comply with any other term of this Promissory Note.

This Promissory Note represents the entire agreement between the Borrower and Lender. Any modifications must be in writing and signed by both parties.

By signing below, the Borrower acknowledges and agrees to the terms and conditions outlined in this Promissory Note.

Borrower's Signature: ___________________________________ Date: ________________

Lender's Signature: ____________________________________ Date: ________________

More Types of Promissory Note for a Car Templates:

Release and Satisfaction of Promissory Note - Legitimizes the end of the financial relationship between lender and borrower.

In order to create a legally binding agreement, individuals in New Jersey often utilize a New Jersey Promissory Note form, which signifies the mutual understanding between the lender and borrower regarding the repayment of a specific amount. This document includes all necessary details such as loan amount, interest rate, and repayment terms. For those seeking assistance in drafting such agreements, various resources are available, including NJ PDF Forms, which provide editable templates to streamline the process.

Documents used along the form

A Promissory Note for a car is a crucial document in the financing process of purchasing a vehicle. However, several other forms and documents often accompany it to ensure a smooth transaction and legal compliance. Below is a list of common documents that may be used alongside the Promissory Note.

- Bill of Sale: This document serves as proof of the transaction between the buyer and seller. It includes details such as the vehicle's make, model, year, and VIN, along with the sale price.

- Title Transfer Form: This form is necessary to transfer ownership of the vehicle from the seller to the buyer. It typically requires signatures from both parties and may need to be filed with the state’s Department of Motor Vehicles (DMV).

- Loan Agreement: If financing is involved, this document outlines the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan.

- Vehicle Registration: This form registers the vehicle in the buyer's name with the DMV. It usually requires proof of insurance and payment of registration fees.

- Insurance Policy: Proof of insurance is often required before a vehicle can be registered. This document outlines the coverage details and ensures that the vehicle is protected against potential risks.

- Credit Application: If financing is sought through a lender, this application collects personal and financial information to assess creditworthiness and determine loan eligibility.

- Odometer Disclosure Statement: This document certifies the vehicle's mileage at the time of sale. It helps prevent fraud related to odometer tampering.

- Promissory Note: A critical component in the financing process, this document formalizes the agreement between the lender and the borrower, detailing loan terms including repayment expectations and interest rates. For additional resources, refer to All Maryland Forms.

- Power of Attorney: In some cases, a buyer may grant a third party the authority to handle the title transfer or registration process on their behalf. This document outlines that authority.

- Sales Contract: This comprehensive agreement details the terms of the sale, including the price, payment method, and any warranties or guarantees provided by the seller.

Each of these documents plays a vital role in the car purchasing process. Together, they help protect the interests of both the buyer and seller while ensuring compliance with legal requirements. It is essential to review and understand each document before finalizing the transaction.

Similar forms

A Loan Agreement is similar to a Promissory Note for a Car because it outlines the terms under which money is borrowed. Both documents specify the amount borrowed, the interest rate, and the repayment schedule. However, a Loan Agreement may include additional details such as collateral and conditions for default, making it more comprehensive than a simple promissory note.

A Sales Agreement for a Vehicle also shares similarities with a Promissory Note for a Car. This document details the terms of the sale, including the purchase price and payment method. While a Sales Agreement focuses on the transaction between buyer and seller, the Promissory Note emphasizes the borrower's commitment to repay the loan used to finance the purchase.

A Lease Agreement is another document that bears resemblance to a Promissory Note for a Car. Both documents involve a financial commitment and outline payment terms. However, a Lease Agreement typically pertains to renting a vehicle for a specified period, while a Promissory Note involves borrowing money to buy a vehicle outright.

When considering financing options, understanding the role of a Promissory Note is vital. For more information, explore our guide on how to create a proper Promissory Note form that meets your needs and ensures lawful compliance.

A Credit Agreement is also comparable to a Promissory Note for a Car. It defines the terms of borrowing and repayment, similar to a promissory note. However, a Credit Agreement often encompasses a broader range of financial products and may include terms related to credit limits, fees, and conditions for borrowing additional funds.

An Installment Sale Agreement is akin to a Promissory Note for a Car in that it outlines a payment plan for purchasing a vehicle. Both documents specify the total amount owed and the payment schedule. However, an Installment Sale Agreement typically transfers ownership to the buyer after the final payment, while a Promissory Note primarily serves as a promise to repay the loan.

Lastly, a Mortgage Note can be compared to a Promissory Note for a Car, as both are binding agreements to repay borrowed money. A Mortgage Note specifically relates to real estate transactions, detailing the loan amount, interest rate, and payment terms. In contrast, a Promissory Note for a Car focuses on the financing of an automobile purchase, highlighting the different contexts in which these notes are utilized.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it's important to follow certain guidelines to ensure accuracy and clarity. Here are some dos and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and the lender.

- Do clearly state the loan amount and interest rate.

- Do include the payment schedule and due dates.

- Don't leave any sections blank; fill out all required fields.

- Don't use vague language; be specific about the terms of the loan.

Key takeaways

When filling out and using a Promissory Note for a Car, there are several important points to keep in mind. Here are four key takeaways:

- Clearly Define the Terms: Specify the loan amount, interest rate, repayment schedule, and any penalties for late payments. Clarity helps prevent misunderstandings.

- Include Identification Information: Both the borrower and lender should provide their full names, addresses, and contact information. This ensures that both parties are easily identifiable.

- Signatures Matter: Ensure that both parties sign the document. Without signatures, the note may not hold up in a dispute.

- Keep Copies: After the note is completed and signed, make copies for both parties. This provides a record of the agreement and can be useful if any issues arise.

By following these guidelines, you can create a solid foundation for your car loan agreement, helping to protect both parties involved.

How to Use Promissory Note for a Car

Filling out a Promissory Note for a car is a straightforward process that requires careful attention to detail. Once completed, this document serves as a formal agreement between the borrower and the lender regarding the terms of the loan for the vehicle. Ensuring that all information is accurate will help protect the interests of both parties involved.

- Gather Necessary Information: Collect details such as the names and addresses of both the borrower and the lender, the vehicle's make, model, and year, and the loan amount.

- Title the Document: At the top of the form, write "Promissory Note for a Car" to clearly identify the purpose of the document.

- Fill in Borrower Information: Write the full name and address of the borrower in the designated section.

- Fill in Lender Information: Provide the full name and address of the lender in the appropriate area.

- Detail Loan Amount: Clearly state the total amount being borrowed for the purchase of the vehicle.

- Specify Interest Rate: Indicate the interest rate applicable to the loan, if any, and whether it is fixed or variable.

- Outline Payment Terms: Describe how and when payments will be made, including the frequency (monthly, bi-weekly, etc.) and the due date for the first payment.

- Include Maturity Date: Specify the date by which the loan must be fully repaid.

- Sign and Date: Both the borrower and lender should sign and date the document to validate the agreement.

- Keep Copies: Make sure both parties retain a signed copy of the Promissory Note for their records.